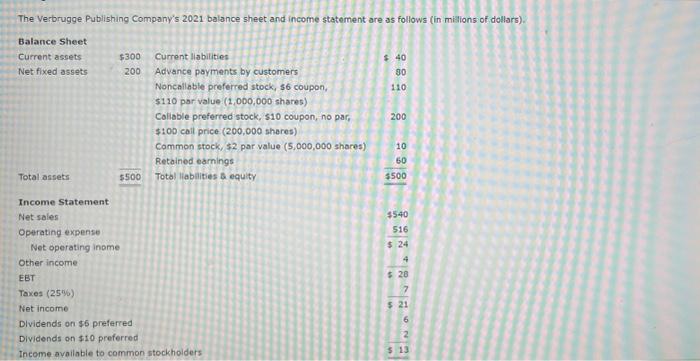

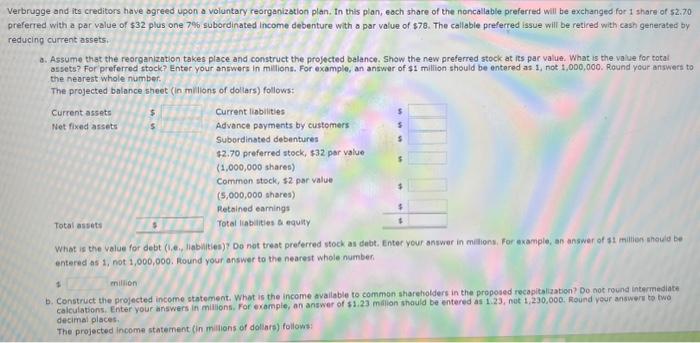

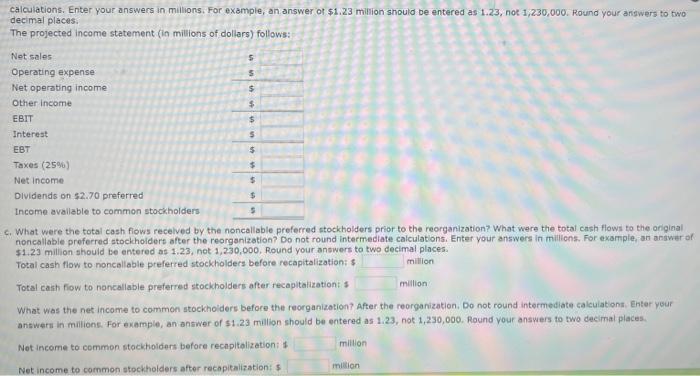

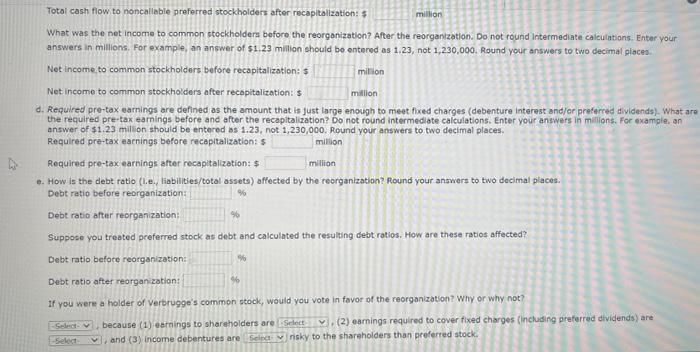

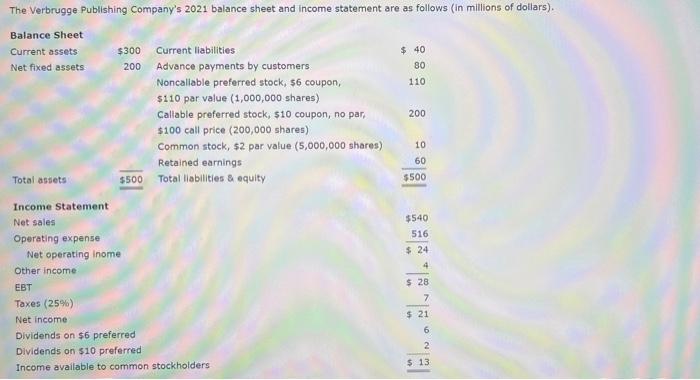

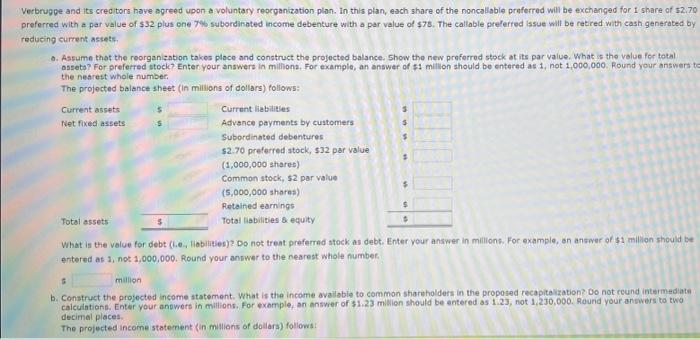

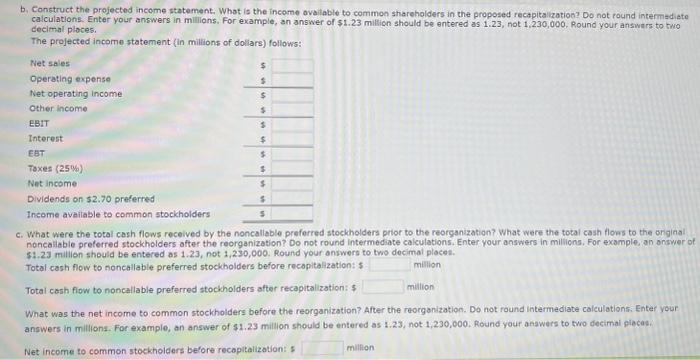

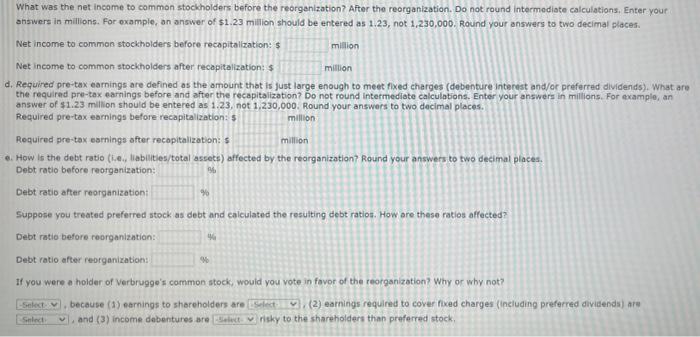

The Verbrugge Publishing Company's 2021 balance sheet and income statement are as follows (in milions of dollars). erbrugge and its creditors have bgreed upon a voluntary reorganization plan, In this plan, each share of the noncallable preferred will be exchanged for 1 share of s2.70 referred with a par value of $32 plus one 7% subordinated income debenture with o por value of $78. The callable preferred issue will be retired with cash generated by educing current assets. a. Assume that the reorganization takes place and construct the projected balance. Show the new preferred stock at its par value. What is the value for cotal assets? For preferred stock? Enter your answers in milions. For example, an answer of $1 million should be ontered as 1 , not t, 000, 000. Round your answers to the nearest whole number. The projected balance sheet (in milions of doliars) follows: What is the value for debt (1,e., liabuities)? Do not treat preferred stock as debt, Enter your answer in millions, For example, an answer of st milion shauld be entered as 1, not 1,000,000. Hound your answer to the nearest whole number b. Construct the projected income statement. Whot is the income Available to common shareholders in the proposed recapitaliation? Do noc round intermediate decimal places. The projected income staternent (in milions of dolints) followi: calculations. Enter your answers in millions. For example, an answer of $1.23 million should be entered as 1.23 , not 1,230,000. Round your aniswers to two decimal places: The projected income statement (in milions of doliars) follows: c. What were the total cash flows recelved by the noncallable preferred stockholders prior to the reorganization? What were the total cnsh flowi to the origieal noncallable proferred stockholders after the reorganization? Do not round intermedate calculations. Enter your answers in militens. For example, an ansier of $1.23 million should be entered as 1.23, not 1,230,000. Round your answers to two decimal places. Total cash flow to noncaliable preferred stockholders before recapitalization: $ milion Total caih fiow to noncallable preferred stockholders after recapitalizationi s million What was the net income to common stockholders before the reorganization? After the reorganization, Do not round intermediate calcuiations, Enter your antwert in milione. For example, an answer of 51.23 million should be entered as 1.23 , not 1,230,000. Round your answers to two decimal places. Not income to common stocktiolidens before recapitalizetion 1 Net income to common stockholders after recapitalization: 5 Total cash flow to noncallable preferred stockholders after recapitalization: $ What was the net income to common stockholders before the reorganization? After the reorganization. Do not round intermediate caiculations. Enter your answers in millions. For example, an answer of $1,23 milion should be entored as 1,23, not 1,230,000. Round your answers to two decimal glaces. Net income to common stockholders before recapitalization: $ mikion Net income to common stockholders after recopitalization: $ d. Required pre-tax earnings are defined as the amount that is just large enough to meet fixed charges (debenture interest and/ar preferred dividends). What are the required pre-tax earmings before and after the recapitalization? Do not round intermediate calculations. Enter your answers in malilons. For example. an answer of $1.23 milion should be entered as 1.23, not 1,230,000. Round your answers to two decimal places. Required pre-tax eacnings before recapitalization: $ milion Required pre-tax earnings after recapitalization: $ e. How is the debt ratio (l.e. liabilitiesitotal assets) affected by the reorganization? Round your answers to two docimal places. Debt ratio before reorganization: Debt ratio after reorganization: Suppose you treated preferred stock as debt and calculated the resuling debt rotios. How are these ratios affected? Debt ratio before reorganization: Debt ratio after reorganization: If you were a holder of verbrugge's common stock, would you vote in favor of the reorganization? Why or why not? because (1) earaings to shareholders are (2) eamings required to cover fixed charges (inchusing preferred dividends) are and (3) income debentures are risky to the shareholders than preferred stock. The Verbrugge Publishing Company's 2021 balance sheet and income statement are as follows (in millions of dollars). Balance Sheet Income Statement Net sales Operating expense Net operating inome Other income EBT Taxes (25\%) Net income Dividends on $5 preferred Dividends on $10 preferred Income available to common stockholders rerbrugge and its crecitors have agreed upon a voluntary repcganization plon. in this plan, each share of the noncallable praferred will be exchanged for. I share of s2.70 referred with a par value of $32 plus one 7% subordinated income debenture with a par value of s78. The callable prelerred issue will be retired with cash generated by edicing current assets. 0. Assume that the reorganization takes place and construct the projected balance. Show the new preforred stock at its par value. What is the velue fer total ossete? For preferred stock? Enter your answerd in milliona. For exampie, an answer of s1 million should be entered as 1 , not 1,000,000. Round your answers t the nestest whole number. The projected balance sheet (in mililions of dollars) follows: What is the volue for debt (1.e. liobiities)? Do not treat preferred stock as debt. Enter your ansiwer in milions. For example, on answar of st million should be entered af 1,n0t1,000,000. Round your ancwer to the nearest whole number. if mullion b. Construct the projected income statement. What is the income availabie to common shareholders in the proposed recapitelzation? Do not ccund intermediate calculations. Enter your angwers in millions, For exomple, an answer of $1.23ml ion should be antered as 1.23 , not 1,250,000. Round your answers to two decimal places. The projected income statement (in mullions of dollars) followst b. Construct the projected income statement. Whot is the income ovailable to common stiareholders in the proposed recapitalizationz Do not round intermadiete calculatlons. Enter your answers in mililons. For example, an answer of $1.23 million should be entered as 1.23 , not 1,230,000. Round your answers to two decimal ploces. The projected income statement (in millions of dollars) follows: c. What were the total cash flows recelved by the noncaliable preferred stockholders prior to the reorganization? What were the total cash flows to the ongina. noncaliable preferred stockholders after the reorganization? Do not round intermediate calculations. Enter your answers in millicns. For example, an onswer of 51.23 million should be entered as 1.23, not 1,230,000. Round your answers to two decimal ploces. Total cash flow to noncallable preferred stockholders before recopitalization: $ mililion Total cash fiow to noncallable preferred stockholders after recapitalizotion: 5 What was the net income to common stockholders before the reorganization? After the reorganization. Do not raund intermediate calculations. Enter your answers in millions. For example, an answer of $1.23 million should be entered as 1.23, not 1,230,000, Round your anawers to two decimal piecat. Net income to common stockholders before recopitalizotion: : miltion What was the net incame to common stockholders before the reorgenization? After the reorganization. Do not round intermodiate calculations, Enter your answers in milions. For oxample, an answer of $1.23 milion should be entered as 1.23, not 1,230,000. Round your answers to two decimal places. Net income to common stockholders before recopitalization: $ milion Net income to common stockholders after recapitalization: $ milition d. Required pre-tax earnings are defined os the omount that is just large enough to meet fixed charges (debenture interest and/or preferred dividends). What are the required pre-tax earnings before and after the recapitalizationt Do not round intermediate calculations. Enter your answers in millions. For example, an answer of $1.23 million should be entered as 1.23. not 1.230.000. Round your answers to two decimal places. Required pre-tax earnings before recapitalization: 5 milision Required pre-tax earnings after recopitalization: 5 e. How is the debt ratio (i.e., liabilities/total assets) affected by the reorganization? Round your answers to two decimal places. Debt ratio before reorganization: Debt ratio after reorganization: Suppose you treated preferred stock as debt and calculated the resulting debt ratios. How are these ratios affected? Debt ratio before reorganization: Debt ratio after reorganization: If you were a holder of Verbrugge's common stock, would you vote in favor of the reorganization? Why or why not? because (1) earnings to shareholders are (2) earnings required to cover fixed charges (including preferred divitends) are , and (3) income debentures are risky to the shareholders than preferred stock