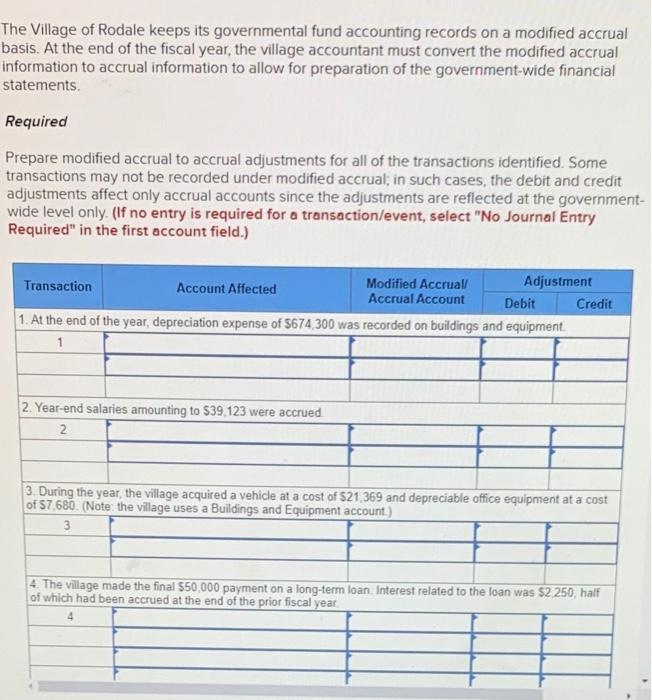

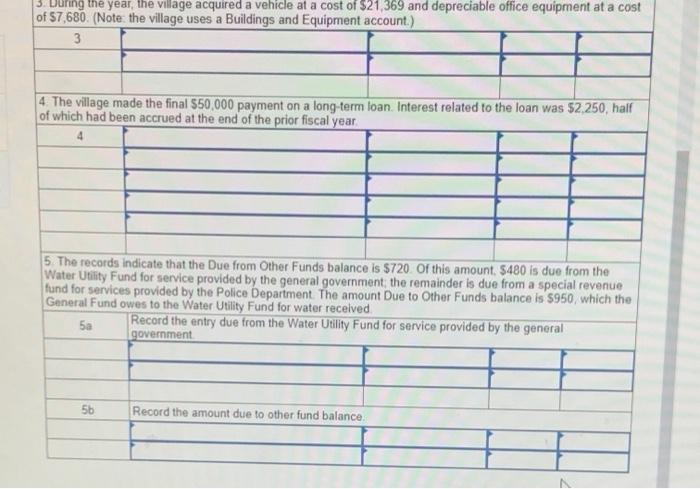

The Village of Rodale keeps its governmental fund accounting records on a modified accrual basis. At the end of the fiscal year, the village accountant must convert the modified accrual information to accrual information to allow for preparation of the government-wide financial statements. Required Prepare modified accrual to accrual adjustments for all of the transactions identified. Some transactions may not be recorded under modified accrual; in such cases, the debit and credit adjustments affect only accrual accounts since the adjustments are reflected at the government- wide level only. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Transaction Account Affected Modified Accrual/ Adjustment Accrual Account Debit Credit 1. At the end of the year, depreciation expense of S674,300 was recorded on buildings and equipment 1 2. Year-end salaries amounting to $39,123 were accrued 2 3. During the year, the village acquired a vehicle at a cost of $21.369 and depreciable office equipment at a cost of $7.680. (Note: the village uses a Buildings and Equipment account) 3 4. The village made the final $50,000 payment on a long-term loan Interest related to the loan was $2.250, half of which had been accrued at the end of the prior fiscal year - During the year, the village acquired a vehicle at a cost of $21.369 and depreciable office equipment at a cost of 57,680. (Note: the village uses a Buildings and Equipment account.) 3 4 The village made the final 550,000 payment on a long term loan. Interest related to the loan was $2,250, half of which had been accrued at the end of the prior fiscal year 5 The records indicate that the Due from Other Funds balance is $720. Of this amount, $480 is due from the Water Utility Fund for service provided by the general government, the remainder is due from a special revenue fund for services provided by the Police Department. The amount Due to Other Funds balance is 5950, which the General Fund owes to the Water Utility Fund for water received 5a Record the entry due from the Water Utility Fund for service provided by the general government 5b Record the amount due to other fund balance