Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Vision Company is evaluating the acquisition of an asset that it requires for a period of 6 years. The following information relates to

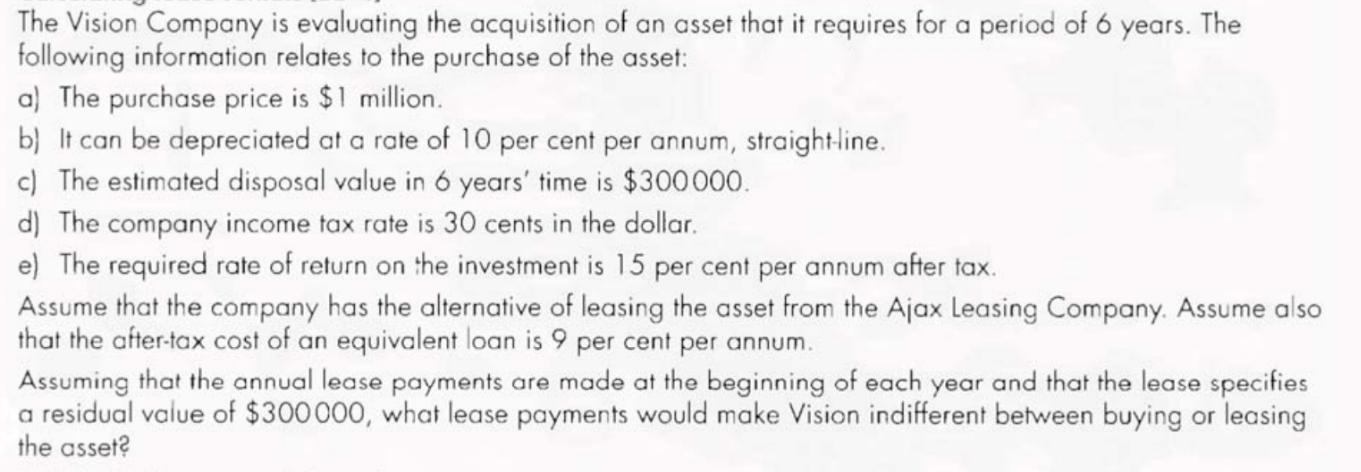

The Vision Company is evaluating the acquisition of an asset that it requires for a period of 6 years. The following information relates to the purchase of the asset: a) The purchase price is $1 million. b) It can be depreciated at a rate of 10 per cent per annum, straight-line. c) The estimated disposal value in 6 years' time is $300 000. d) The company income tax rate is 30 cents in the dollar. e) The required rate of return on the investment is 15 per cent per annum after tax. Assume that the company has the alternative of leasing the asset from the Ajax Leasing Company. Assume also that the after-tax cost of an equivalent loan is 9 per cent per annum. Assuming that the annual lease payments are made at the beginning of each year and that the lease specifies a residual value of $300 000, what lease payments would make Vision indifferent between buying or leasing the asset?

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine the lease payments that would make Vision indifferent between buying or leasing the asset we need to compare the present value of buying the asset to the present value of leasing ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started