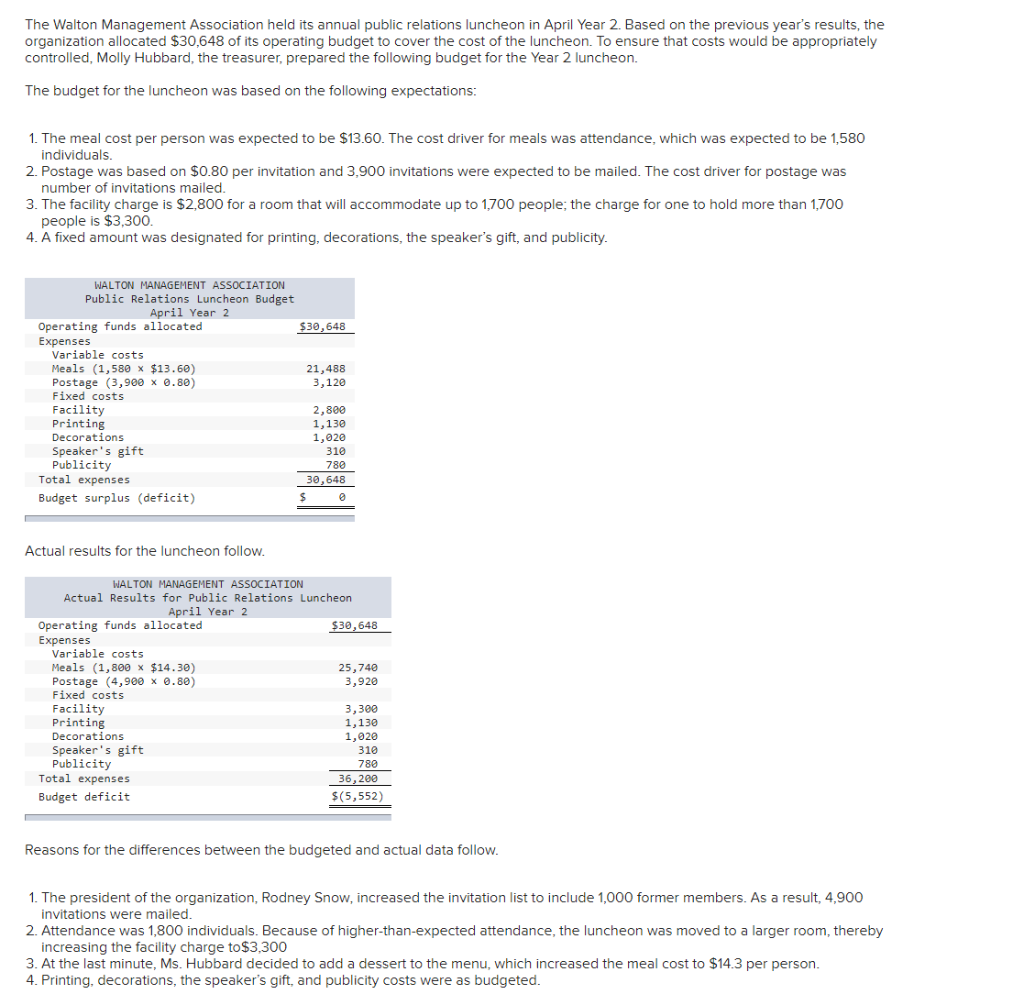

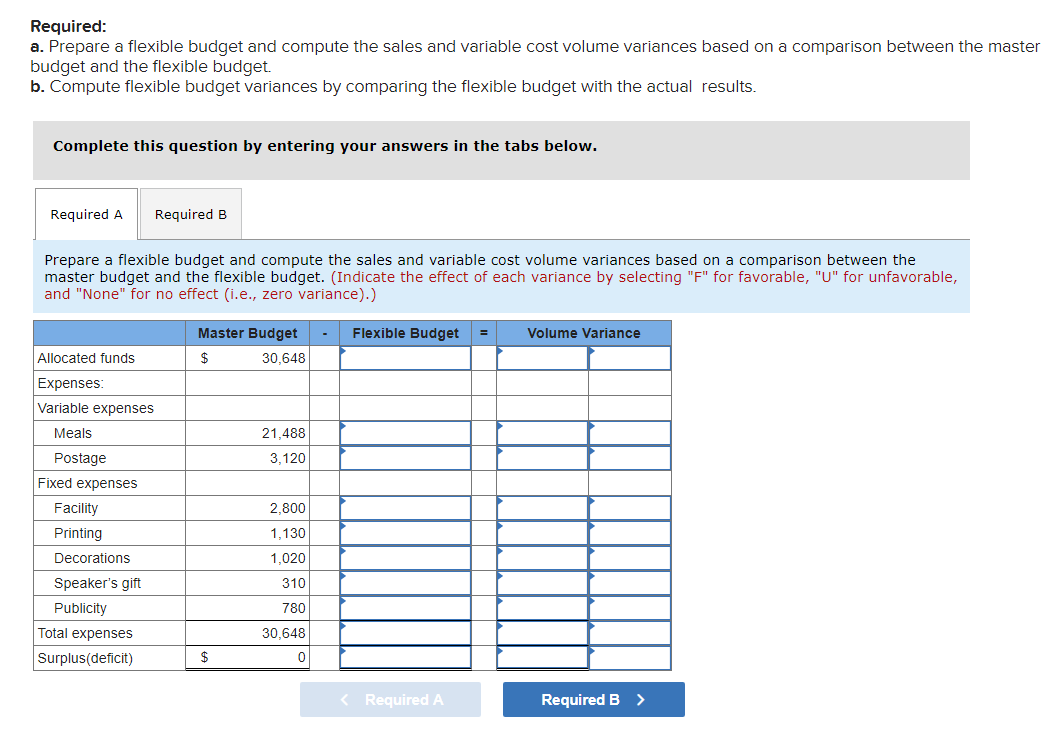

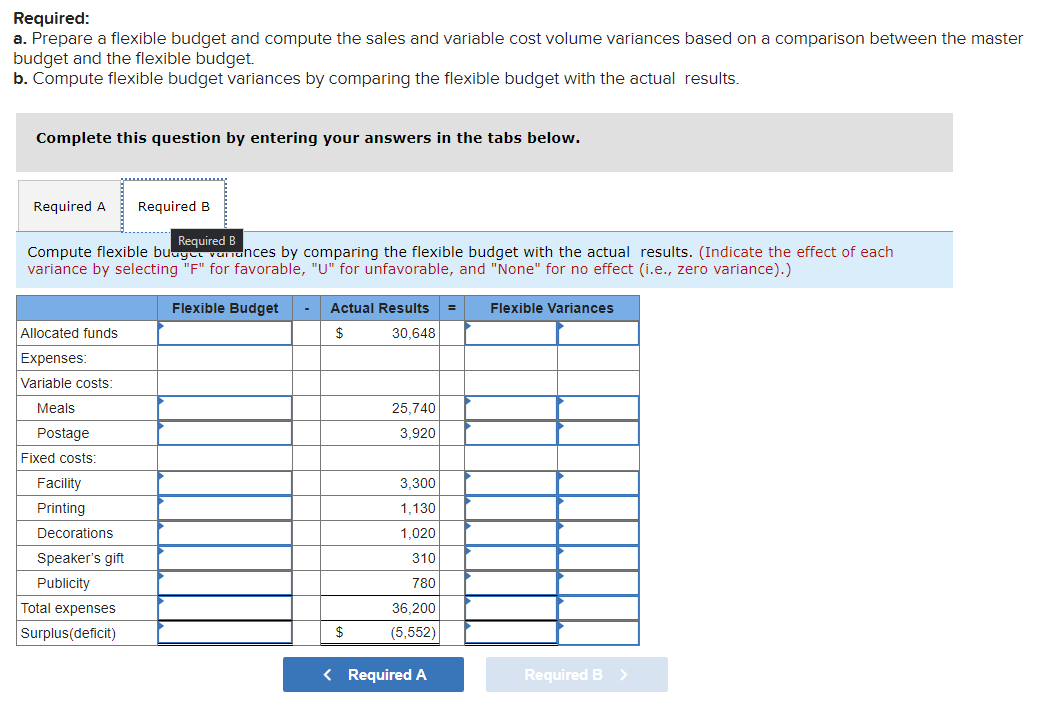

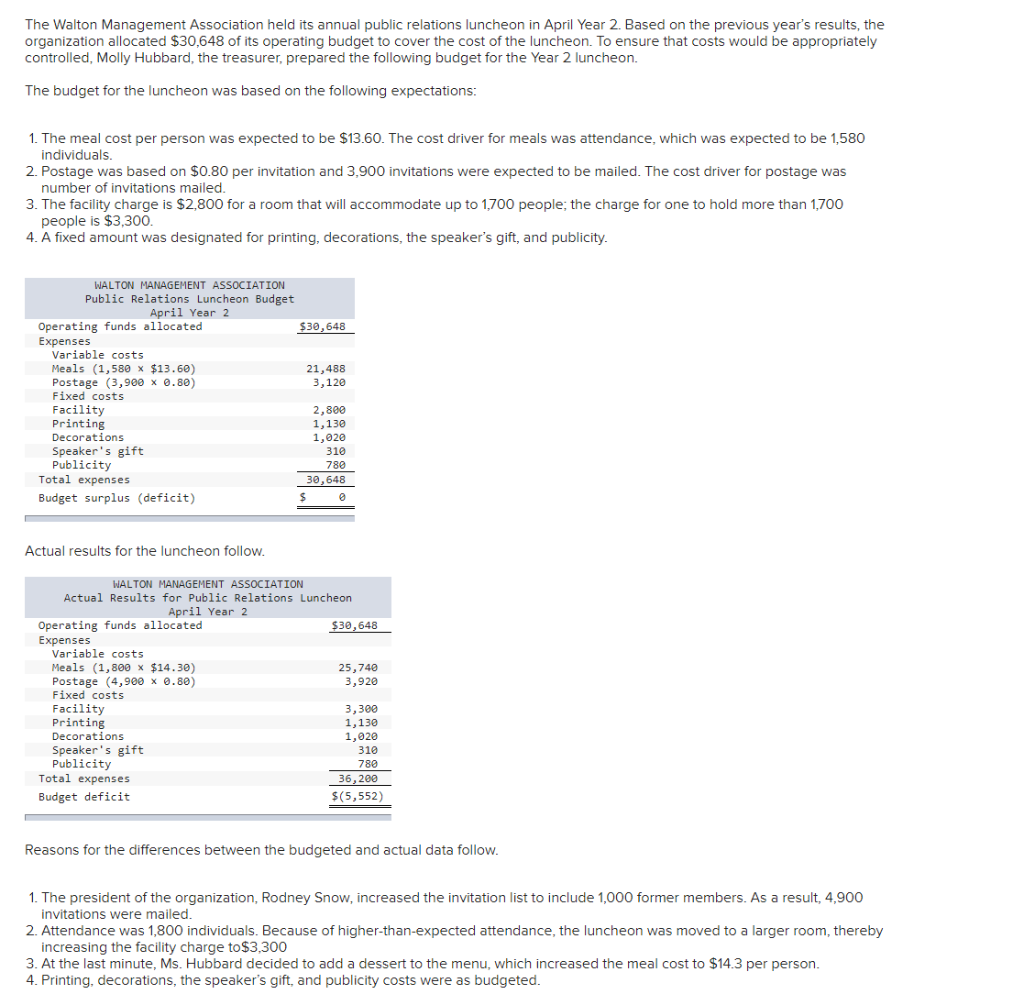

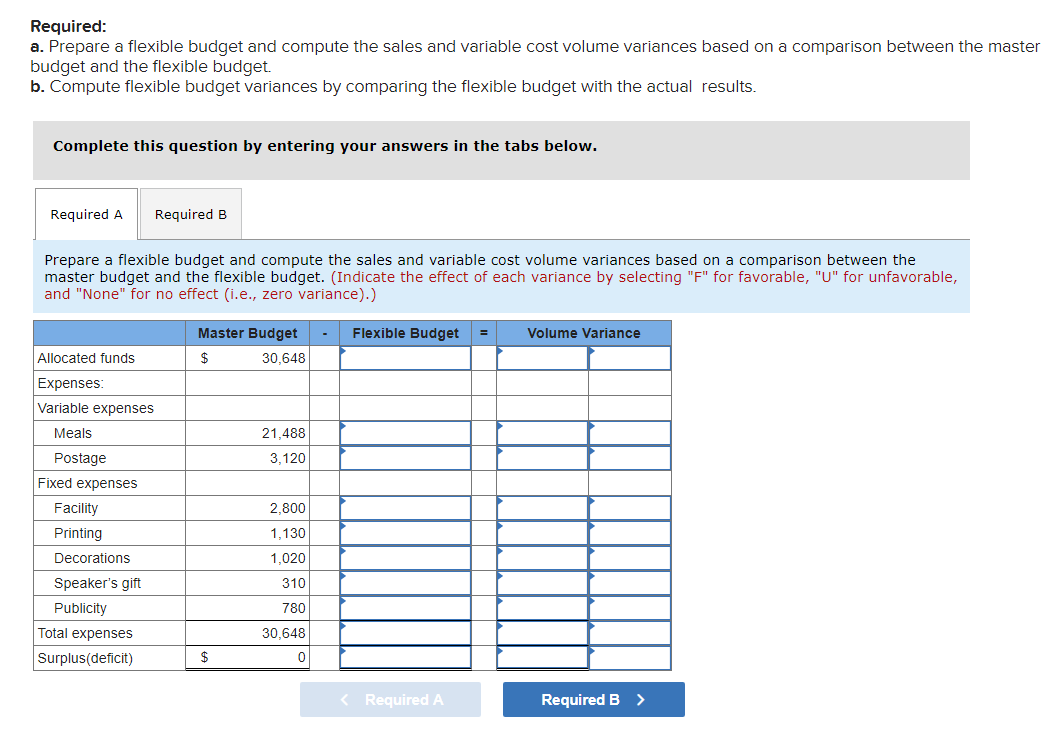

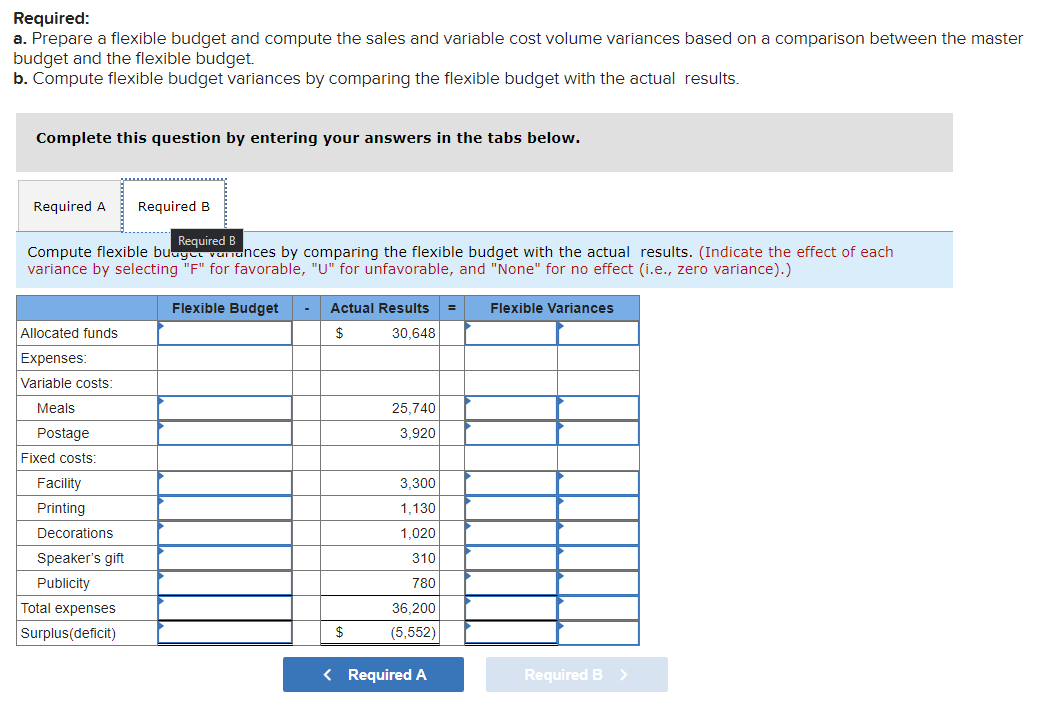

The Walton Management Association held its annual public relations luncheon in April Year 2. Based on the previous year's results, the organization allocated $30,648 of its operating budget to cover the cost of the luncheon. To ensure that costs would be appropriately controlled, Molly Hubbard, the treasurer, prepared the following budget for the Year 2 luncheon. The budget for the luncheon was based on the following expectations: 1. The meal cost per person was expected to be $13.60. The cost driver for meals was attendance, which was expected to be 1,580 individuals. 2. Postage was based on $0.80 per invitation and 3,900 invitations were expected to be mailed. The cost driver for postage was number of invitations mailed. 3. The facility charge is $2,800 for a room that will accommodate up to 1,700 people; the charge for one to hold more than 1,700 people is $3,300. 4. A fixed amount was designated for printing, decorations, the speaker's gift, and publicity. WALTON MANAGEMENT ASSOCIATION Public Relations Luncheon Budget April Year 2 Operating funds allocated $30,648 Expenses Variable costs Meals (1,580 x $13.60) 21,488 Postage (3,900 x 0.80) 3,120 Fixed costs Facility 2,800 Printing Decorations 1,20 Speaker's gift 310 Publicity 780 Total expenses 30,648 Budget surplus (deficit) $ 1,130 Actual results for the luncheon follow WALTON MANAGEMENT ASSOCIATION Actual Results for Public Relations Luncheon April Year 2 Operating funds allocated $30,648 Expenses Variable costs Meals (1,800 x $14.30) 25,740 Postage (4,900 X 0.80) 3,920 Fixed costs Facility 3,300 Printing 1,130 Decorations 1,020 Speaker's gift 310 Publicity 780 Total expenses 36,200 Budget deficit $(5,552) Reasons for the differences between the budgeted and actual data follow. 1. The president of the organization, Rodney Snow, increased the invitation list to include 1,000 former members. As a result, 4,900 invitations were mailed. 2. Attendance was 1,800 individuals. Because of higher-than-expected attendance, the luncheon was moved to a larger room, thereby increasing the facility charge to $3,300 3. At the last minute, Ms. Hubbard decided to add a dessert to the menu, which increased the meal cost to $14.3 per person. 4. Printing, decorations, the speaker's gift, and publicity costs were as budgeted. Required: a. Prepare a flexible budget and compute the sales and variable cost volume variances based on a comparison between the master budget and the flexible budget. b. Compute flexible budget variances by comparing the flexible budget with the actual results. Complete this question by entering your answers in the tabs below. Required A Required B Prepare a flexible budget and compute the sales and variable cost volume variances based on a comparison between the master budget and the flexible budget. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).) Master Budget Flexible Budget Volume Variance $ 30,648 21.488 3,120 Allocated funds Expenses Variable expenses Meals Postage Fixed expenses Facility Printing Decorations Speaker's gift Publicity Total expenses Surplus(deficit) 2.800 1,130 1,020 310 780 30,648 $ 0 Required: a. Prepare a flexible budget and compute the sales and variable cost volume variances based on a comparison between the master budget and the flexible budget. b. Compute flexible budget variances by comparing the flexible budget with the actual results. Complete this question by entering your answers in the tabs below. Required A Required B Required B Compute flexible buuyt vurances by comparing the flexible budget with the actual results. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).) Flexible Budget Actual Results = Flexible Variances Allocated funds $ 30,648 Expenses: Variable costs: 25,740 3,920 3,300 Meals Postage Fixed costs Facility Printing Decorations Speaker's gift Publicity Total expenses Surplus(deficit) 1,130 1,020 310 780 36,200 (5,552) $ Required: a. Prepare a flexible budget and compute the sales and variable cost volume variances based on a comparison between the master budget and the flexible budget. b. Compute flexible budget variances by comparing the flexible budget with the actual results. Complete this question by entering your answers in the tabs below. Required A Required B Required B Compute flexible buuyt vurances by comparing the flexible budget with the actual results. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance).) Flexible Budget Actual Results = Flexible Variances Allocated funds $ 30,648 Expenses: Variable costs: 25,740 3,920 3,300 Meals Postage Fixed costs Facility Printing Decorations Speaker's gift Publicity Total expenses Surplus(deficit) 1,130 1,020 310 780 36,200 (5,552) $