Question

The Watts Company is a publicly traded corporation that produces different types of commercial food processors. My name is Alan Smith and I have worked

The Watts Company is a publicly traded corporation that produces different types of commercial food processors. My name is Alan Smith and I have worked for this company for the last ten years in the controllers office. I was both an accounting and finance major in university. The company currently produces 300 products and does not anticipate any new products coming out over the next three years.

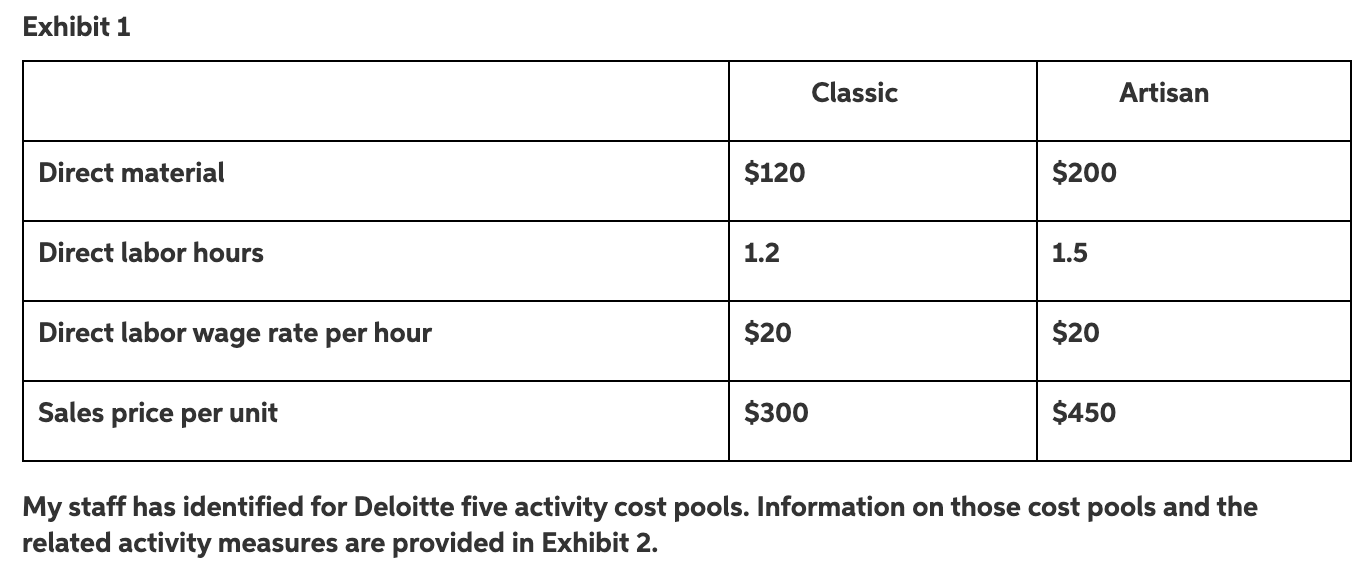

Exhibit 1

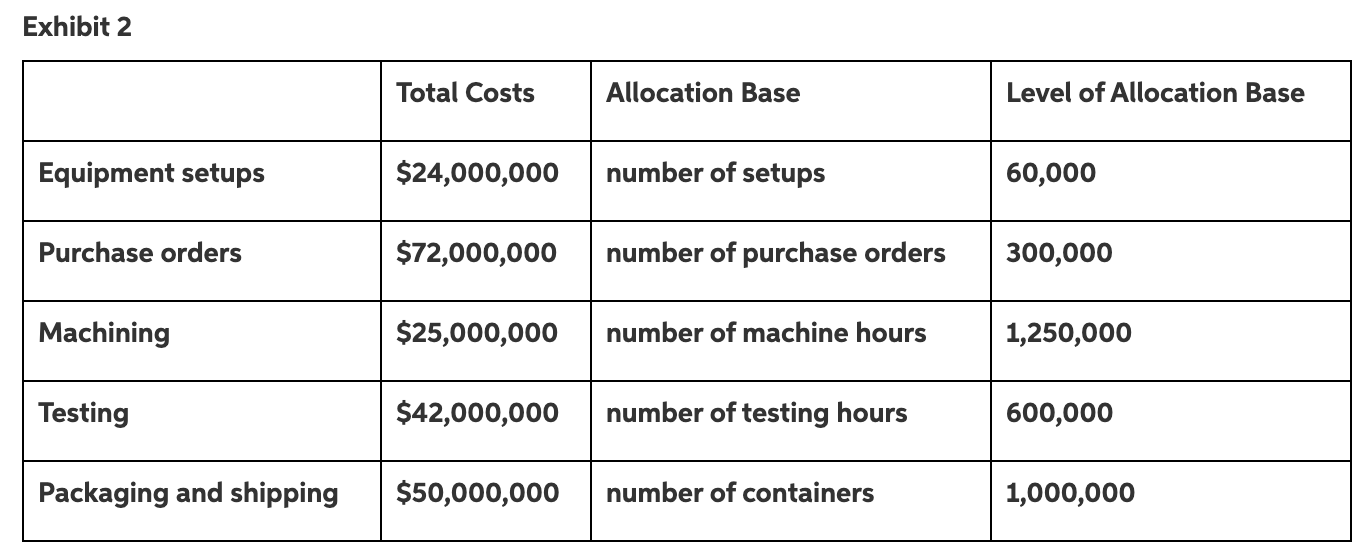

Although fixed costs are lumped in with variable costs across the five different cost pools, I am aware that machining related costs consists almost exclusively of depreciation costs. Hence, with respect to all questions asked in this case, machining costs will be treated as entirely fixed with respect to machine hours. Each machine is used in the production of multiple product lines. The resale value of machines is only affected by the passage of time and not by how much they are used in a given year.

In all questions asked in this case, the firm will assume that costs associated with equipment setups, purchase orders, testing, and packaging & shipping are variable with respect to their respective activity measures. Currently, we believe our assumptions on cost behavior patterns are quite reasonable.

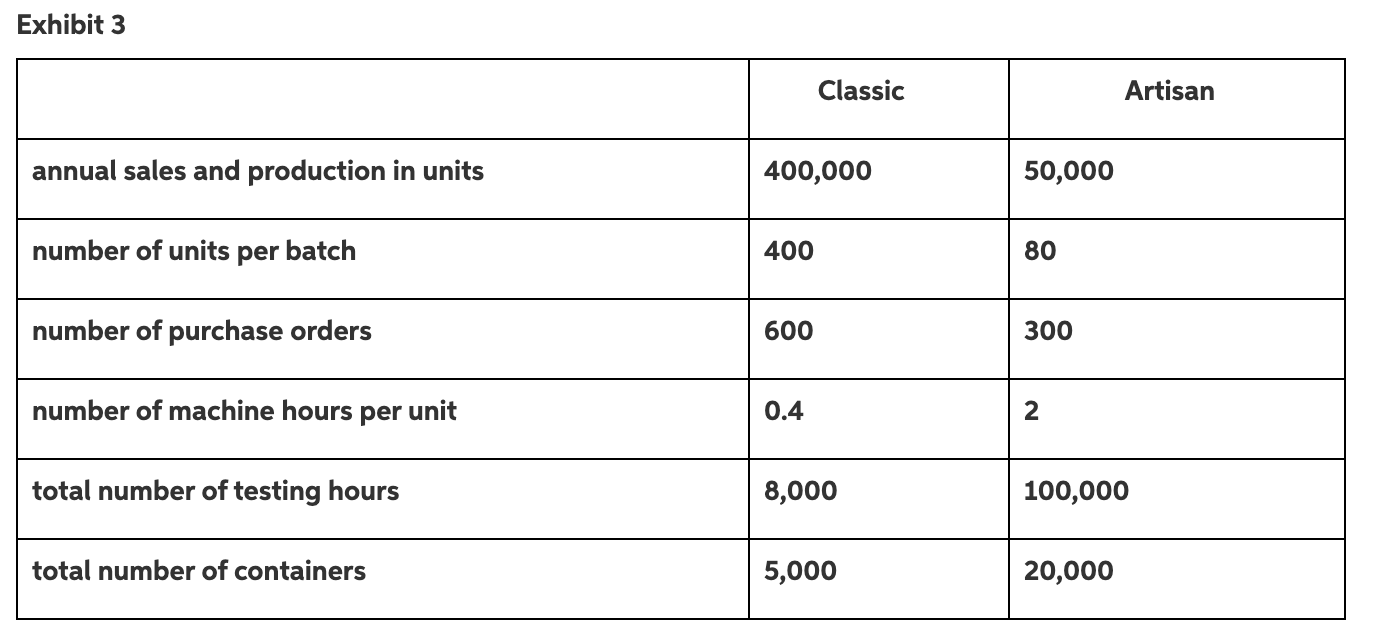

All products are produced in batches, where the size of a batch differs across products. For example, if we produce 80 units of a product in batch sizes of 40, then the product will be produced in two batches. An equipment setup must be performed before producing each batch of a product. Hence, in the example above, two equipment setups would be performed. Units of product are packaged in containers and sent to distributors.

Production volumes are set equal to sales volumes since the company only produces products that they have orders for. Consequently, the firm never has a beginning or ending work in process inventory, and it does not have a beginning or ending finished goods inventory.

Further information on our two products is provided in Exhibit 3

Exhibit 3

1. (20 Points) Prepare an income statement for Classic and an income statement for Artisan using the traditional accounting system where overhead is applied at a rate of $100 per direct labor hour. (For simplicity, SG&A expenses for the firm are not included in the income statement for the two products.) The income statements should be prepared on a total basis and then show the average net operating income per unit using the following template for guidance:

Classic Artisan

Sales $$$ $$$

Direct materials $$$ $$$

Direct labor $$$ $$$

Manufacturing overhead $$$ $$$

Total Costs $$$ $$$

Net operating income $$$ $$$

Average net operating income

per unit $$$ $$$

Exhibit 1 Classic Artisan Direct material $120 $200 Direct labor hours 1.2 1.5 Direct labor wage rate per hour $20 $20 Sales price per unit $300 $450 My staff has identified for Deloitte five activity cost pools. Information on those cost pools and the related activity measures are provided in Exhibit 2. Exhibit 2 Total Costs Allocation Base Level of Allocation Base Equipment setups $24,000,000 number of setups 60,000 Purchase orders $72,000,000 number of purchase orders 300,000 Machining $25,000,000 number of machine hours 1,250,000 Testing $42,000,000 number of testing hours 600,000 Packaging and shipping $50,000,000 number of containers 1,000,000 Exhibit 3 Classic Artisan annual sales and production in units 400,000 50,000 number of units per batch 400 80 number of purchase orders 600 300 number of machine hours per unit 0.4 total number of testing hours 8,000 100,000 total number of containers 5,000 20,000 Exhibit 1 Classic Artisan Direct material $120 $200 Direct labor hours 1.2 1.5 Direct labor wage rate per hour $20 $20 Sales price per unit $300 $450 My staff has identified for Deloitte five activity cost pools. Information on those cost pools and the related activity measures are provided in Exhibit 2. Exhibit 2 Total Costs Allocation Base Level of Allocation Base Equipment setups $24,000,000 number of setups 60,000 Purchase orders $72,000,000 number of purchase orders 300,000 Machining $25,000,000 number of machine hours 1,250,000 Testing $42,000,000 number of testing hours 600,000 Packaging and shipping $50,000,000 number of containers 1,000,000 Exhibit 3 Classic Artisan annual sales and production in units 400,000 50,000 number of units per batch 400 80 number of purchase orders 600 300 number of machine hours per unit 0.4 total number of testing hours 8,000 100,000 total number of containers 5,000 20,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started