Answered step by step

Verified Expert Solution

Question

1 Approved Answer

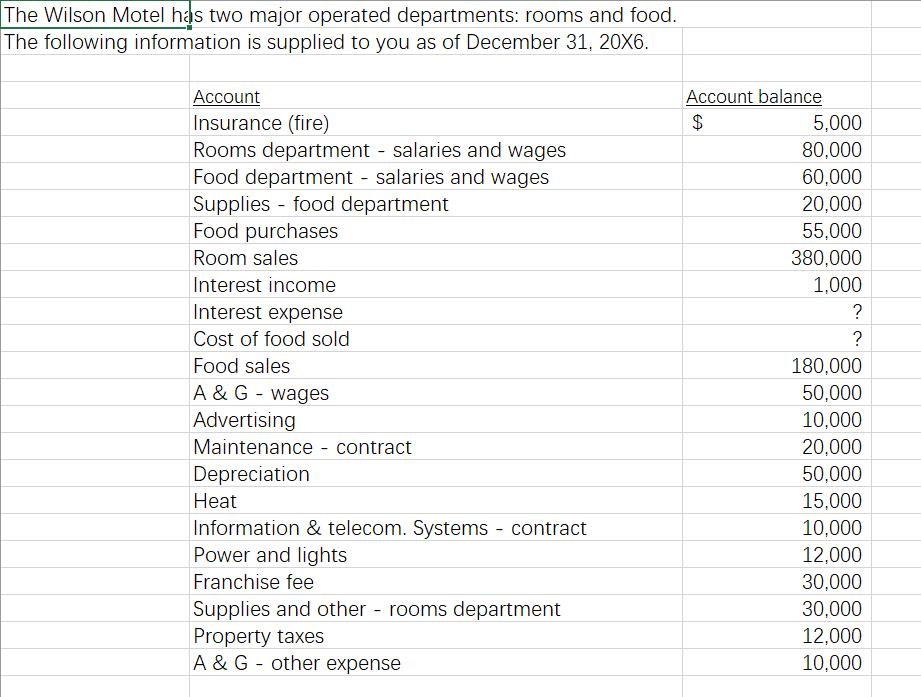

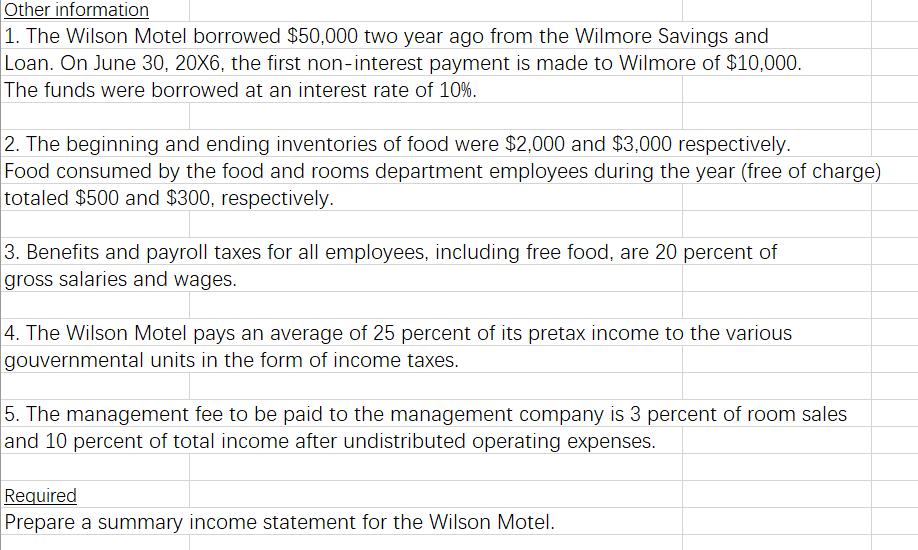

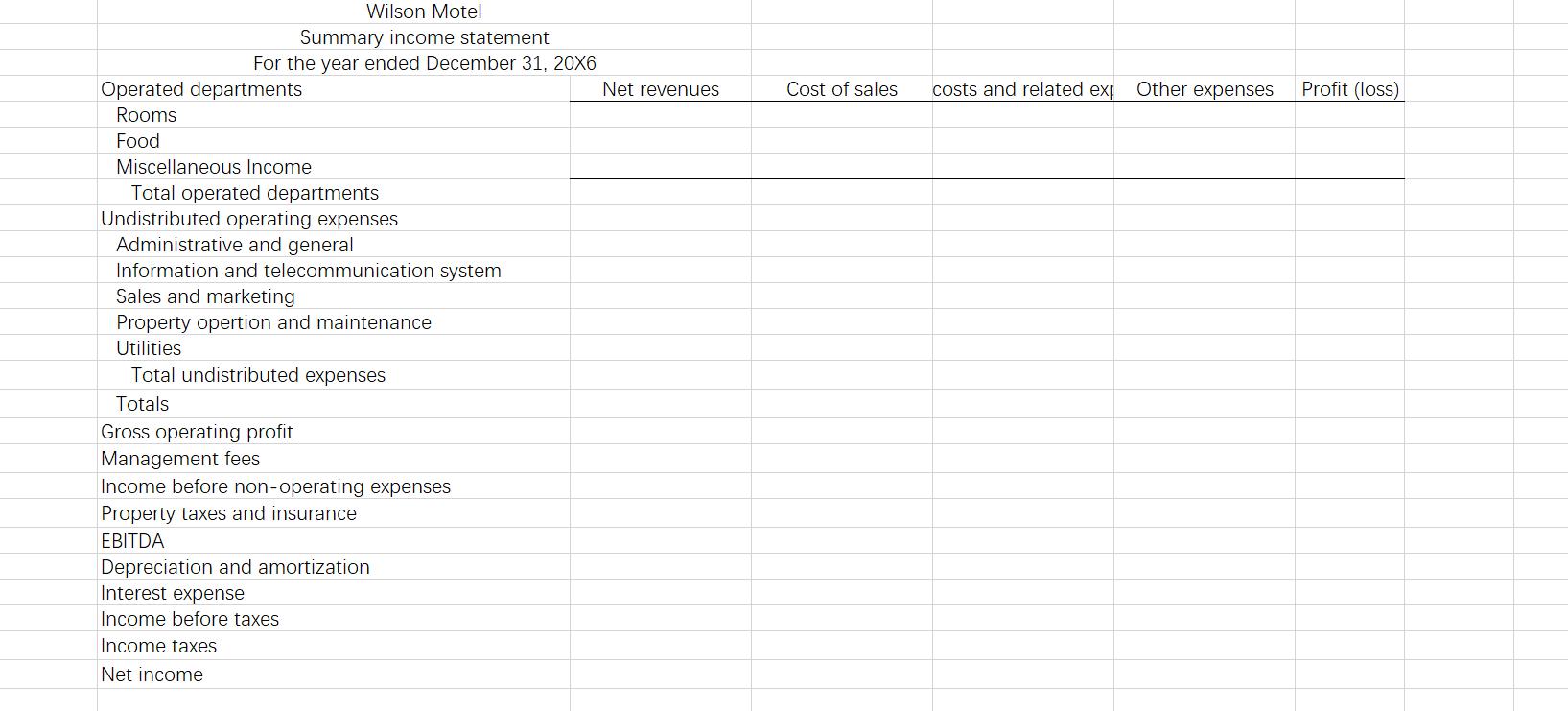

The Wilson Motel has two major operated departments: rooms and food. The following information is supplied to you as of December 31, 20X6. Account

The Wilson Motel has two major operated departments: rooms and food. The following information is supplied to you as of December 31, 20X6. Account Account balance Insurance (fire) Rooms department salaries and wages Food department salaries and wages Supplies food department Food purchases 5.000 80,000 60,000 20,000 55,000 Room sales 380,000 Interest income 1,000 Interest expense ? Cost of food sold ? Food sales 180,000 A & G - wages 50,000 Advertising 10,000 Maintenance - contract 20,000 Depreciation 50,000 Heat 15,000 Information & telecom. Systems - contract Power and lights 10,000 12,000 Franchise fee 30,000 30,000 Supplies and other rooms department Property taxes A & G - other expense 12,000 10,000 Other information |1. The Wilson Motel borrowed $50,000 two year ago from the Wilmore Savings and Loan. On June 30, 20X6, the first non-interest payment is made to Wilmore of $10,000. The funds were borrowed at an interest rate of 10%. 2. The beginning and ending inventories of food were $2,000 and $3,000 respectively. Food consumed by the food and rooms department employees during the year (free of charge) totaled $500 and $300, respectively. 3. Benefits and payroll taxes for all employees, including free food, are 20 percent of gross salaries and wages. 4. The Wilson Motel pays an average of 25 percent of its pretax income to the various gouvernmental units in the form of income taxes. 5. The management fee to be paid to the management company is 3 percent of room sales and 10 percent of total income after undistributed operating expenses. Required Prepare a summary income statement for the Wilson Motel. Wilson Motel Summary income statement For the year ended December 31, 20X6 Operated departments Net revenues Cost of sales costs and related exp Other expenses Profit (loss) Rooms Food Miscellaneous Income Total operated departments Undistributed operating expenses Administrative and general Information and telecommunication system Sales and marketing Property opertion and maintenance Utilities Total undistributed expenses Totals Gross operating profit Management fees Income before non-operating expenses Property taxes and insurance EBITDA Depreciation and amortization Interest expense Income before taxes Income taxes Net income The Wilson Motel has two major operated departments: rooms and food. The following information is supplied to you as of December 31, 20X6. Account Account balance Insurance (fire) Rooms department salaries and wages Food department salaries and wages Supplies food department Food purchases 5.000 80,000 60,000 20,000 55,000 Room sales 380,000 Interest income 1,000 Interest expense ? Cost of food sold ? Food sales 180,000 A & G - wages 50,000 Advertising 10,000 Maintenance - contract 20,000 Depreciation 50,000 Heat 15,000 Information & telecom. Systems - contract Power and lights 10,000 12,000 Franchise fee 30,000 30,000 Supplies and other rooms department Property taxes A & G - other expense 12,000 10,000 Other information |1. The Wilson Motel borrowed $50,000 two year ago from the Wilmore Savings and Loan. On June 30, 20X6, the first non-interest payment is made to Wilmore of $10,000. The funds were borrowed at an interest rate of 10%. 2. The beginning and ending inventories of food were $2,000 and $3,000 respectively. Food consumed by the food and rooms department employees during the year (free of charge) totaled $500 and $300, respectively. 3. Benefits and payroll taxes for all employees, including free food, are 20 percent of gross salaries and wages. 4. The Wilson Motel pays an average of 25 percent of its pretax income to the various gouvernmental units in the form of income taxes. 5. The management fee to be paid to the management company is 3 percent of room sales and 10 percent of total income after undistributed operating expenses. Required Prepare a summary income statement for the Wilson Motel. Wilson Motel Summary income statement For the year ended December 31, 20X6 Operated departments Net revenues Cost of sales costs and related exp Other expenses Profit (loss) Rooms Food Miscellaneous Income Total operated departments Undistributed operating expenses Administrative and general Information and telecommunication system Sales and marketing Property opertion and maintenance Utilities Total undistributed expenses Totals Gross operating profit Management fees Income before non-operating expenses Property taxes and insurance EBITDA Depreciation and amortization Interest expense Income before taxes Income taxes Net income The Wilson Motel has two major operated departments: rooms and food. The following information is supplied to you as of December 31, 20X6. Account Account balance Insurance (fire) Rooms department salaries and wages Food department salaries and wages Supplies food department Food purchases 5.000 80,000 60,000 20,000 55,000 Room sales 380,000 Interest income 1,000 Interest expense ? Cost of food sold ? Food sales 180,000 A & G - wages 50,000 Advertising 10,000 Maintenance - contract 20,000 Depreciation 50,000 Heat 15,000 Information & telecom. Systems - contract Power and lights 10,000 12,000 Franchise fee 30,000 30,000 Supplies and other rooms department Property taxes A & G - other expense 12,000 10,000 Other information |1. The Wilson Motel borrowed $50,000 two year ago from the Wilmore Savings and Loan. On June 30, 20X6, the first non-interest payment is made to Wilmore of $10,000. The funds were borrowed at an interest rate of 10%. 2. The beginning and ending inventories of food were $2,000 and $3,000 respectively. Food consumed by the food and rooms department employees during the year (free of charge) totaled $500 and $300, respectively. 3. Benefits and payroll taxes for all employees, including free food, are 20 percent of gross salaries and wages. 4. The Wilson Motel pays an average of 25 percent of its pretax income to the various gouvernmental units in the form of income taxes. 5. The management fee to be paid to the management company is 3 percent of room sales and 10 percent of total income after undistributed operating expenses. Required Prepare a summary income statement for the Wilson Motel. Wilson Motel Summary income statement For the year ended December 31, 20X6 Operated departments Net revenues Cost of sales costs and related exp Other expenses Profit (loss) Rooms Food Miscellaneous Income Total operated departments Undistributed operating expenses Administrative and general Information and telecommunication system Sales and marketing Property opertion and maintenance Utilities Total undistributed expenses Totals Gross operating profit Management fees Income before non-operating expenses Property taxes and insurance EBITDA Depreciation and amortization Interest expense Income before taxes Income taxes Net income

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

ES COST OF SALES SCHEDULE ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started