Answered step by step

Verified Expert Solution

Question

1 Approved Answer

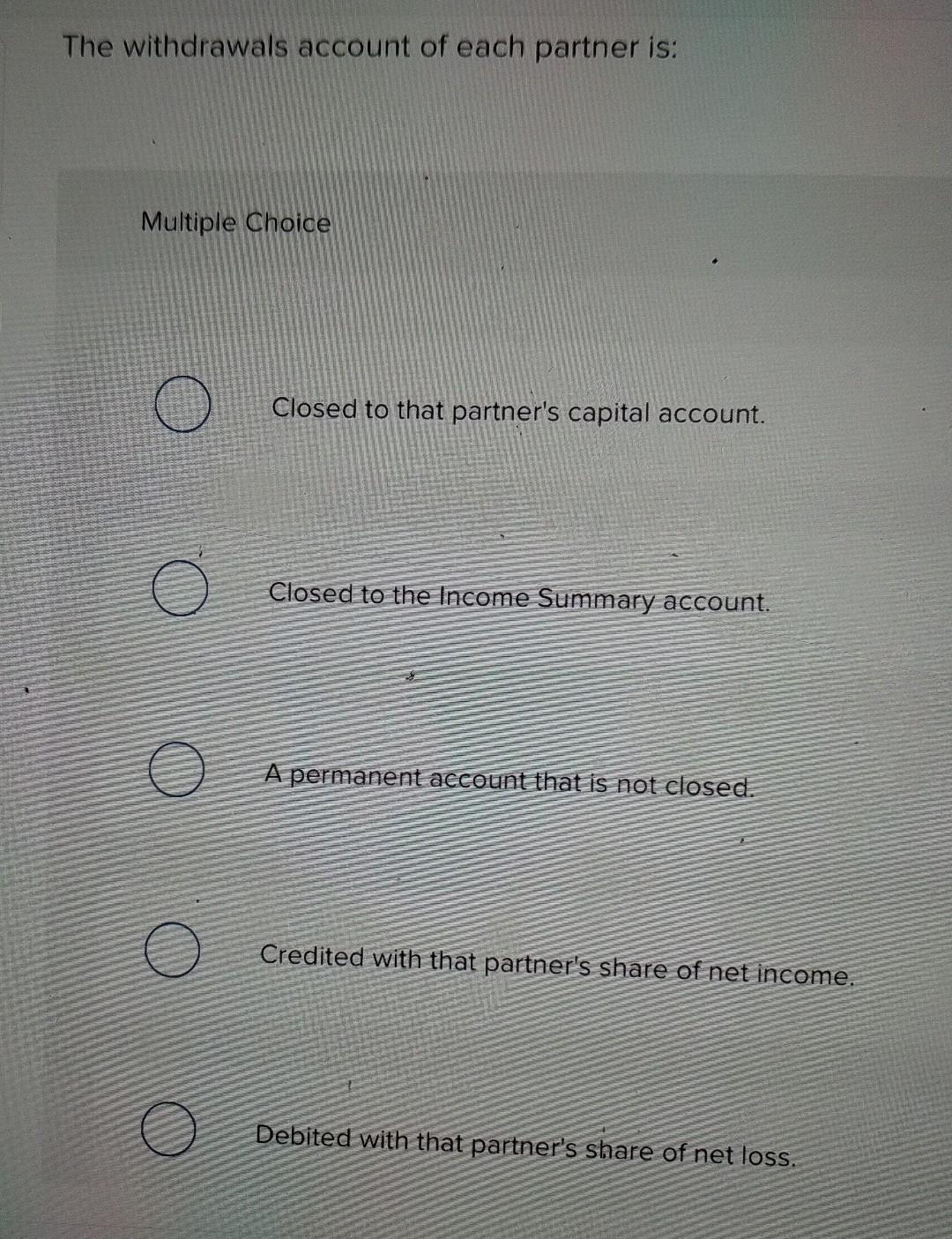

The withdrawals account of each partner is: Multiple Choice Closed to that partner's capital account. Closed to the Income Summary account. O o A permanent

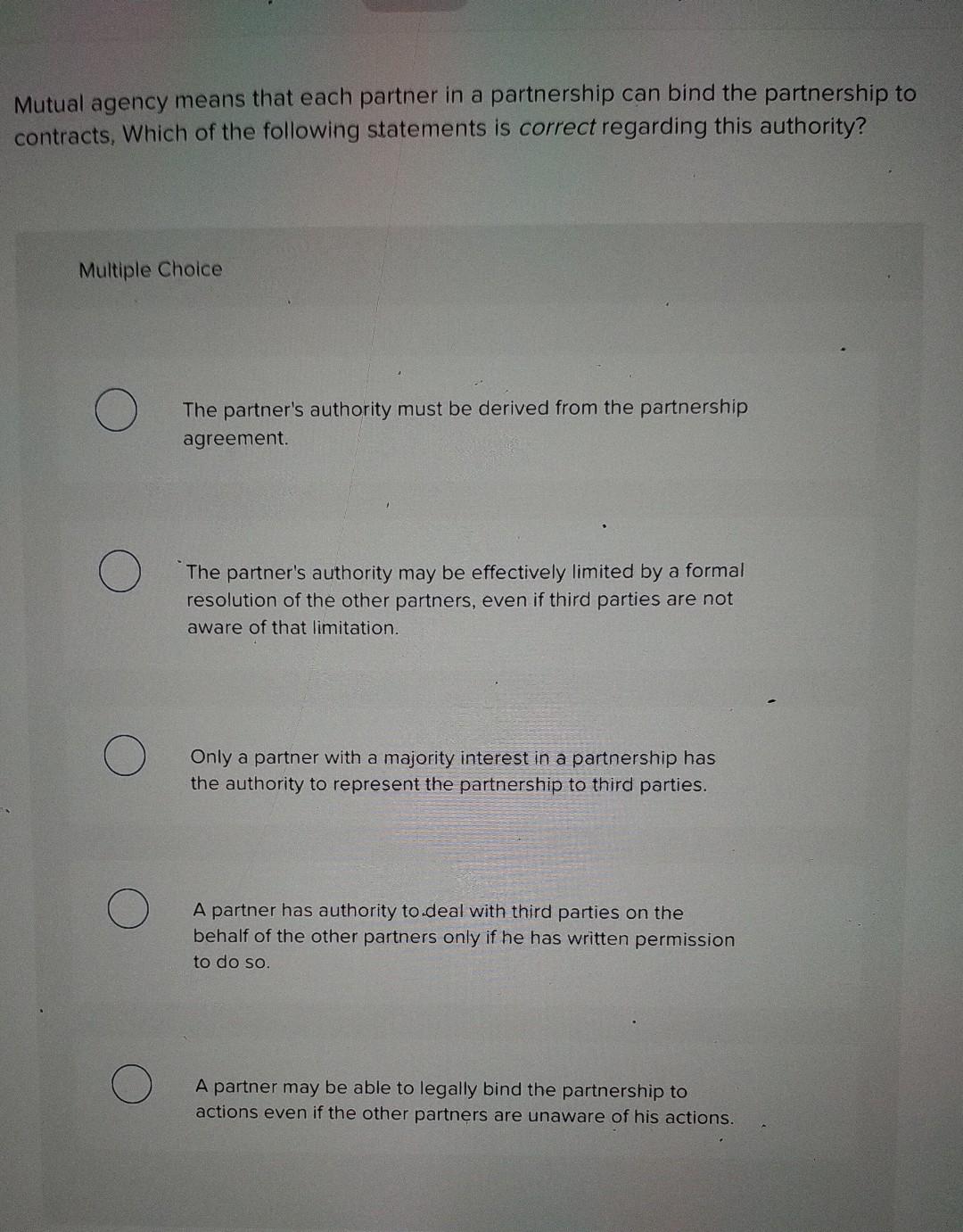

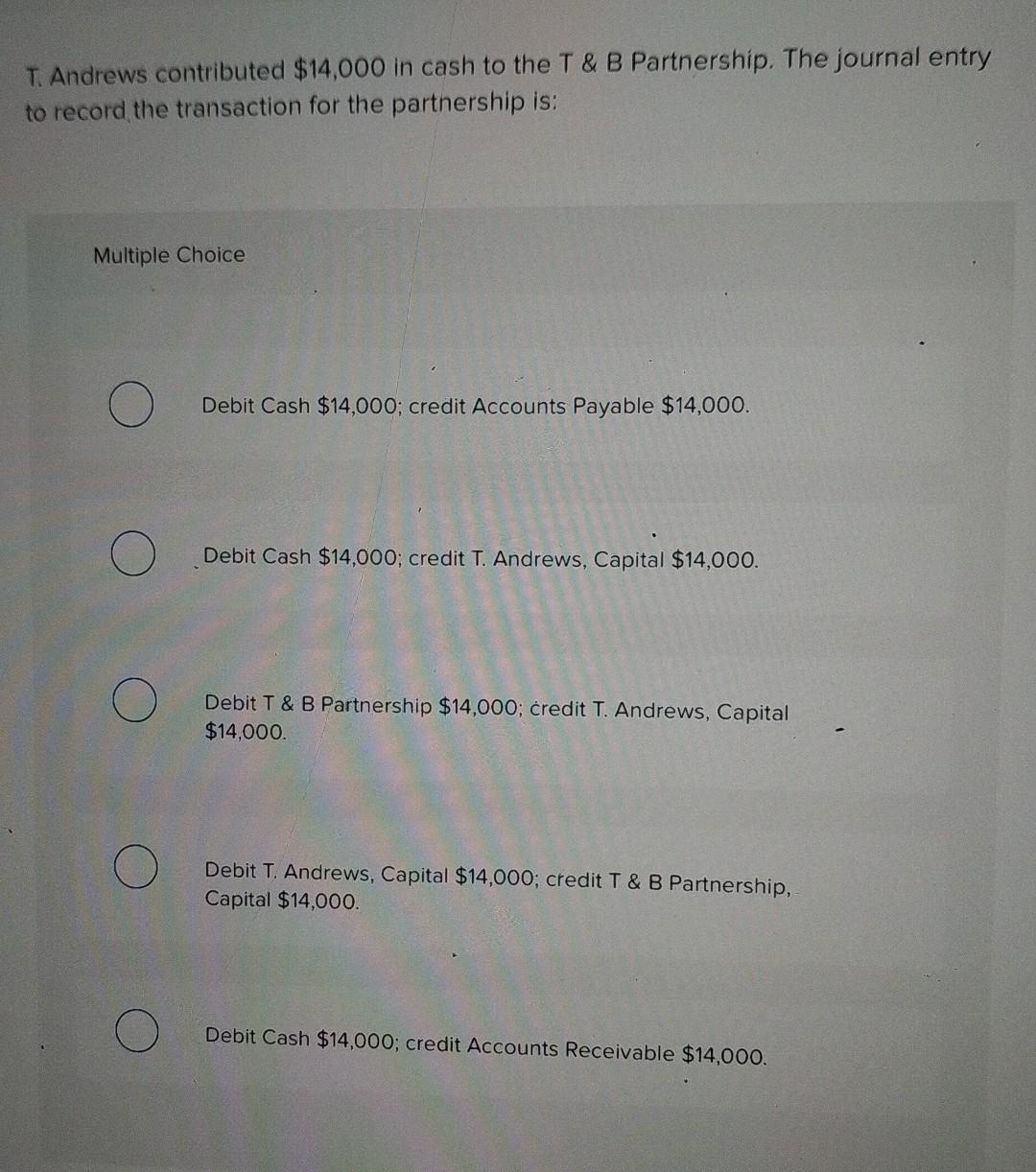

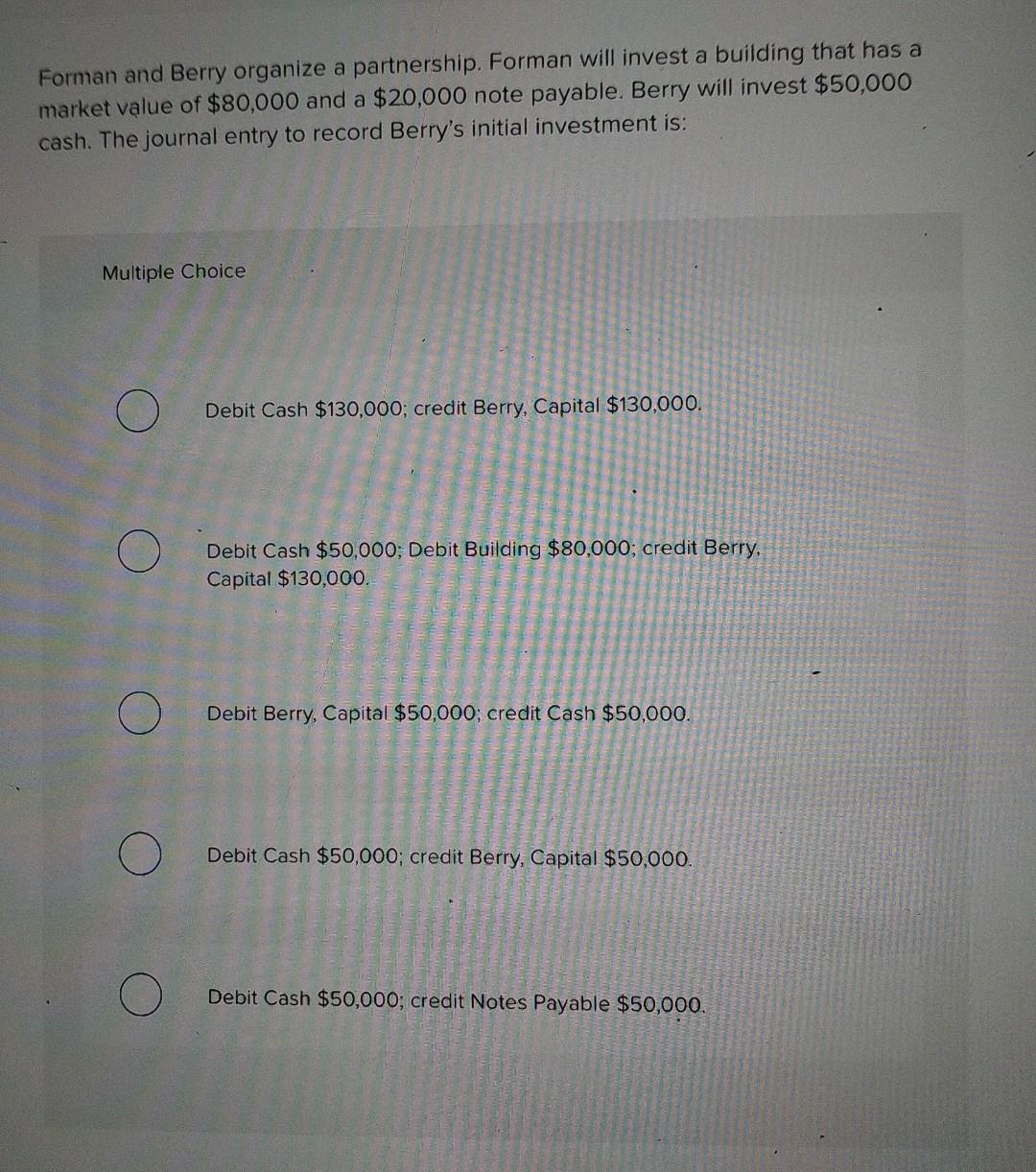

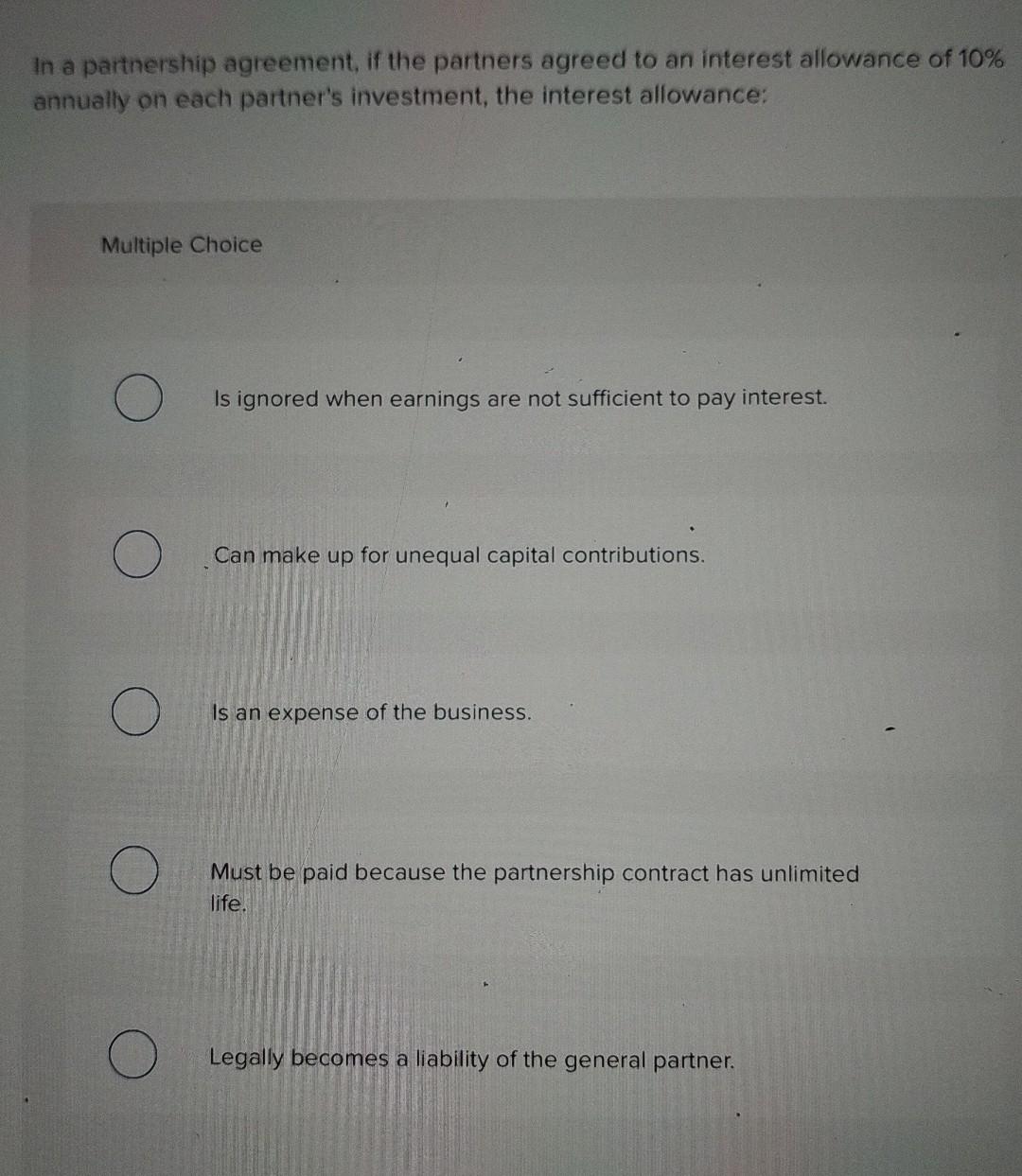

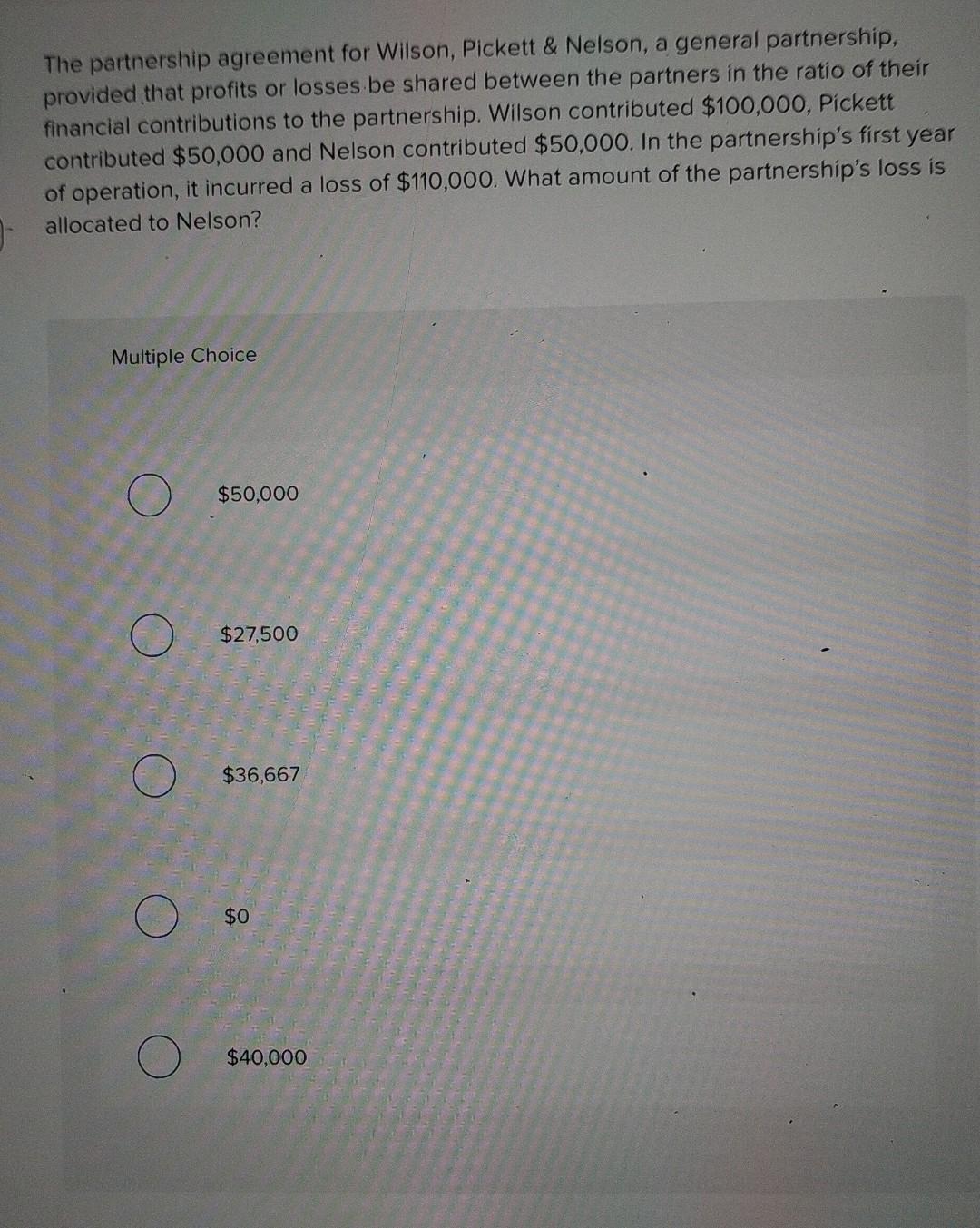

The withdrawals account of each partner is: Multiple Choice Closed to that partner's capital account. Closed to the Income Summary account. O o A permanent account that is not closed. o Credited with that partner's share of net income. Debited with that partner's share of net loss. Mutual agency means that each partner in a partnership can bind the partnership to contracts, Which of the following statements is correct regarding this authority? Multiple Choice The partner's authority must be derived from the partnership agreement. The partner's authority may be effectively limited by a formal resolution of the other partners, even if third parties are not aware of that limitation. Only a partner with a majority interest in a partnership has the authority to represent the partnership to third parties. A partner has authority to deal with third parties on the behalf of the other partners only if he has written permission to do so. A partner may be able to legally bind the partnership to actions even if the other partners are unaware of his actions. T. Andrews contributed $14,000 in cash to the T & B Partnership. The journal entry to record the transaction for the partnership is: Multiple Choice Debit Cash $14,000; credit Accounts Payable $14,000. Debit Cash $14,000; credit T. Andrews, Capital $14,000. Debit T & B Partnership $14,000; credit T. Andrews, Capital $14,000 Debit T. Andrews, Capital $14,000; credit T&B Partnership, Capital $14,000. Debit Cash $14,000; credit Accounts Receivable $14,000. Forman and Berry organize a partnership. Forman will invest a building that has a market value of $80,000 and a $20,000 note payable. Berry will invest $50,000 cash. The journal entry to record Berry's initial investment is: Multiple Choice ( ) O Debit Cash $130,000; credit Berry, Capital $130,000. Debit Cash $50,000; Debit Building $80,000; credit Berry, Capital $130,000. O O Debit Berry, Capital $50,000; credit Cash $50,000. Debit Cash $50,000; credit Berry, Capital $50,000. Debit Cash $50,000; credit Notes Payable $50,000. In a partnership agreement, if the partners agreed to an interest allowance of 10% annually on each partner's investment, the interest allowance: Multiple Choice Is ignored when earnings are not sufficient to pay interest. Can make up for unequal capital contributions. Is an expense of the business. Must be paid because the partnership contract has unlimited life. Legally becomes a liability of the general partner. The partnership agreement for Wilson, Pickett & Nelson, a general partnership, provided that profits or losses be shared between the partners in the ratio of their financial contributions to the partnership. Wilson contributed $100,000, Pickett contributed $50,000 and Nelson contributed $50,000. In the partnership's first year of operation, it incurred a loss of $110,000. What amount of the partnership's loss is allocated to Nelson? Multiple Choice $50,000 $27,500 $36,667 $0 $40,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started