Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The working paper entry to eliminate S companys stockholders' equity December 31, 2020 (consolidation JE S) On January 1, 2020, P company acquires 90 percent

The working paper entry to eliminate S companys stockholders' equity December 31, 2020 (consolidation JE S)

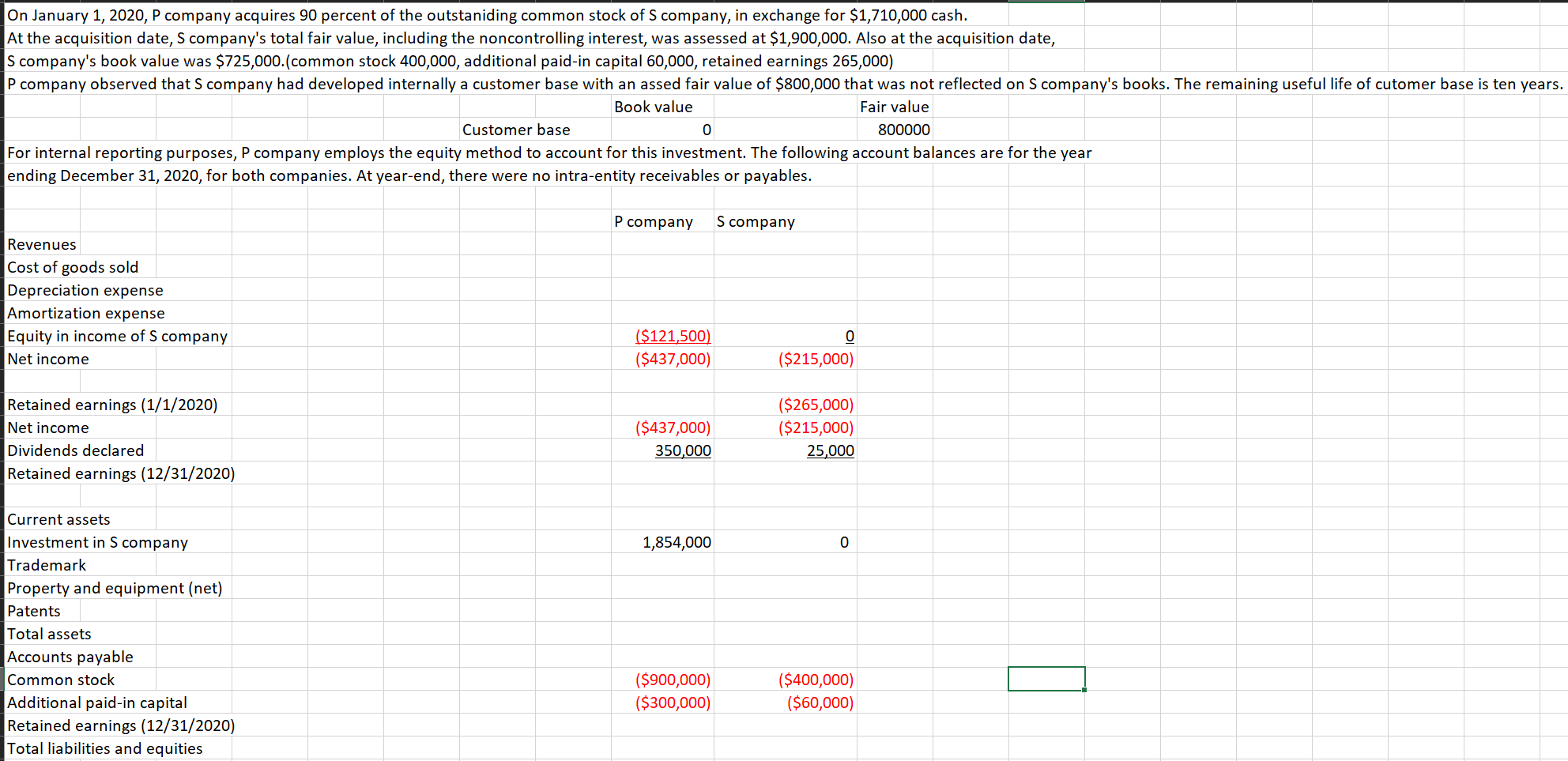

On January 1, 2020, P company acquires 90 percent of the outstaniding common stock of S company, in exchange for $1,710,000 cash. At the acquisition date, S company's total fair value, including the noncontrolling interest, was assessed at $1,900,000. Also at the acquisition date, S company's book value was $725,000.(common stock 400,000, additional paid-in capital 60,000, retained earnings 265,000) company observed that S company had developed internally a customer base with an assed fair value of $800,000 that was not reflected on Scompany's books. The remaining useful life of cutomer base is ten years. Book value Fair value Customer base 0 800000 For internal reporting purposes, P company employs the equity method to account for this investment. The following account balances are for the year ending December 31, 2020, for both companies. At year-end, there were no intra-entity receivables or payables. P company S company Revenues Cost of goods sold Depreciation expense Amortization expense Equity in income of S company Net income ($121,500) ($437,000) 0 ($215,000) Retained earnings (1/1/2020) Net income Dividends declared Retained earnings (12/31/2020) ($437,000) 350,000 ($265,000) ($215,000) 25,000 1,854,000 0 Current assets Investment in Scompany Trademark Property and equipment (net) Patents Total assets Accounts payable Common stock Additional paid-in capital Retained earnings (12/31/2020) Total liabilities and equities ($900,000) ($300,000) ($400,000) ($60,000) On January 1, 2020, P company acquires 90 percent of the outstaniding common stock of S company, in exchange for $1,710,000 cash. At the acquisition date, S company's total fair value, including the noncontrolling interest, was assessed at $1,900,000. Also at the acquisition date, S company's book value was $725,000.(common stock 400,000, additional paid-in capital 60,000, retained earnings 265,000) company observed that S company had developed internally a customer base with an assed fair value of $800,000 that was not reflected on Scompany's books. The remaining useful life of cutomer base is ten years. Book value Fair value Customer base 0 800000 For internal reporting purposes, P company employs the equity method to account for this investment. The following account balances are for the year ending December 31, 2020, for both companies. At year-end, there were no intra-entity receivables or payables. P company S company Revenues Cost of goods sold Depreciation expense Amortization expense Equity in income of S company Net income ($121,500) ($437,000) 0 ($215,000) Retained earnings (1/1/2020) Net income Dividends declared Retained earnings (12/31/2020) ($437,000) 350,000 ($265,000) ($215,000) 25,000 1,854,000 0 Current assets Investment in Scompany Trademark Property and equipment (net) Patents Total assets Accounts payable Common stock Additional paid-in capital Retained earnings (12/31/2020) Total liabilities and equities ($900,000) ($300,000) ($400,000) ($60,000)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started