Question

The WorldValue fund has value weights on asset classes and returns as given in the table below. There are four major asset classes: Europe, Pacific,

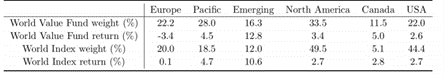

The WorldValue fund has value weights on asset classes and returns as given in the table below. There are four major asset classes: Europe, Pacific, Emerging and North America (Canada and USA).The table also shows the weights and returns of the funds benchmark portfolio, the World Index.

(a.) How did the World Value fund perform compared with the benchmark, over-performance or under-performance?

(b.) Provide a performance attribution of World Values return in terms of its broad asset class allocation and stock selection relative to the benchmark.

(c.) Provide a specific performance attribution within the North America asset class. [Hint: Consider the North America portfolio only. Calculate the weights of Canada and USA in the North American portfolio.]

Europe Pacific Emerging North America Canada USA 22.2 28.0 16.3 11.5 22.0 12.8 3.4 5.0 2.6 20.0 18.5 5.1 44.4 0.1 10.6 2.7 2.8 2.7 World Value Fund weight (%) World Value Fund return (%) World Index weight (%) World Index return (%) 4.5 12.0 Europe Pacific Emerging North America Canada USA 22.2 28.0 16.3 11.5 22.0 12.8 3.4 5.0 2.6 20.0 18.5 5.1 44.4 0.1 10.6 2.7 2.8 2.7 World Value Fund weight (%) World Value Fund return (%) World Index weight (%) World Index return (%) 4.5 12.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started