Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The year is 2032 and you welcome a new baby into your family. You name them Fausta, meaning lucky one. You want to make

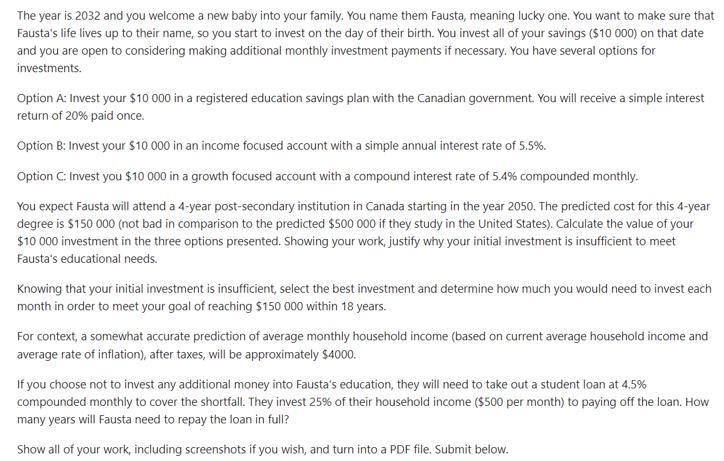

The year is 2032 and you welcome a new baby into your family. You name them Fausta, meaning lucky one. You want to make sure that Fausta's life lives up to their name, so you start to invest on the day of their birth. You invest all of your savings ($10 000) on that date and you are open to considering making additional monthly investment payments if necessary. You have several options for investments. Option A: Invest your $10 000 in a registered education savings plan with the Canadian government. You will receive a simple interest return of 20% paid once. Option B: Invest your $10 000 in an income focused account with a simple annual interest rate of 5.5%. Option C: Invest you $10 000 in a growth focused account with a compound interest rate of 5.4% compounded monthly. You expect Fausta will attend a 4-year post-secondary institution in Canada starting in the year 2050. The predicted cost for this 4-year degree is $150 000 (not bad in comparison to the predicted $500 000 if they study in the United States). Calculate the value of your $10 000 investment in the three options presented. Showing your work, justify why your initial investment is insufficient to meet Fausta's educational needs. Knowing that your initial investment is insufficient, select the best investment and determine how much you would need to invest each month in order to meet your goal of reaching $150 000 within 18 years. For context, a somewhat accurate prediction of average monthly household income (based on current average household income and average rate of inflation), after taxes, will be approximately $4000. If you choose not to invest any additional money into Fausta's education, they will need to take out a student loan at 4.5% compounded monthly to cover the shortfall. They invest 25% of their household income ($500 per month) to paying off the loan. How many years will Fausta need to repay the loan in full? Show all of your work, including screenshots if you wish, and turn into a PDF file. Submit below. Your posting must include the following elements: 1. Calculations showing the results of your 18 year investment in option A. [3 points] 2. Calculations showing the results of your 18 year investment in option B. [3 points] 3. Calculations showing the results of your 18 year investment in option C. [3 points] 4. Calculations showing how you determined the monthly payment required to meet your goal and discussion. [3 points] 5. Calculations showing the number of year's Fausta will be repaying her student loan if you choose not to invest regularly in their education. [3 points] For all questions, you must show all of your work. If you are completing calculations by hand, show both the original formula used as well as your substitutions. If completing calculations using your graphing calculator, show the key values entered into your TVM solver (N=, 1%=, etc.).

Step by Step Solution

★★★★★

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 Calculations showing the results of your 18 year investment in option A Investment 1000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started