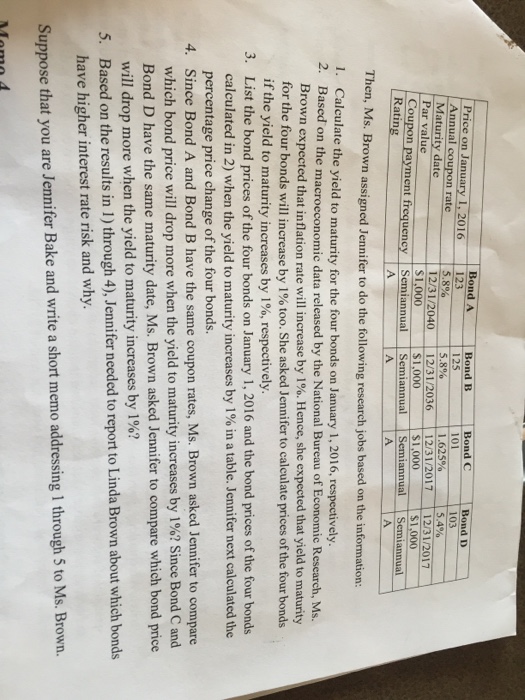

Then, Ms. Brown assigned Jennifer to do the following research jobs based on the information: 1. Calculate the yield to maturity for the four bonds on January 1, 2016, respectively. 2. Based on the macroeconomic data released by the National Bureau of Economic Research, Ms. Brown expected that inflation rate will increase by 1%. Hence, she expected that yield to maturity for the four bonds will increase by 1% too. She asked Jennifer to calculate prices of the four bonds it the yield to maturity increases by 1%, respectively. 3. List the bond prices of the four bonds on January 1, 2016 and the bond prices of the four bonds calculated in 2) when the yield to maturity increases by 1% in a table. Jennifer next calculated the percentage price change of the four bonds. Since Bond A and Bond B have the same coupon rates, Ms. Brown asked Jennifer to compare which bond price will drop more when the yield to maturity increases by l%? Since Bond C and Bond D have the same maturity date, Ms. Brown asked Jennifer to compare which bond price will drop more when the yield to maturity increases by 1%? Based on the results in 1) through 4), Jennifer needed to report to Linda Brown about which bonds have higher interest rate risk and why. Suppose that you are Jennifer Bake and write a short memo addressing 1 through 5 to Ms. Brown. Then, Ms. Brown assigned Jennifer to do the following research jobs based on the information: 1. Calculate the yield to maturity for the four bonds on January 1, 2016, respectively. 2. Based on the macroeconomic data released by the National Bureau of Economic Research, Ms. Brown expected that inflation rate will increase by 1%. Hence, she expected that yield to maturity for the four bonds will increase by 1% too. She asked Jennifer to calculate prices of the four bonds it the yield to maturity increases by 1%, respectively. 3. List the bond prices of the four bonds on January 1, 2016 and the bond prices of the four bonds calculated in 2) when the yield to maturity increases by 1% in a table. Jennifer next calculated the percentage price change of the four bonds. Since Bond A and Bond B have the same coupon rates, Ms. Brown asked Jennifer to compare which bond price will drop more when the yield to maturity increases by l%? Since Bond C and Bond D have the same maturity date, Ms. Brown asked Jennifer to compare which bond price will drop more when the yield to maturity increases by 1%? Based on the results in 1) through 4), Jennifer needed to report to Linda Brown about which bonds have higher interest rate risk and why. Suppose that you are Jennifer Bake and write a short memo addressing 1 through 5 to Ms. Brown