Answered step by step

Verified Expert Solution

Question

1 Approved Answer

theory (b) Calculate goodwill and non-controlling interest on the consolidated statement of financial theory position at December 31, Year 2, under parent company extension Problem

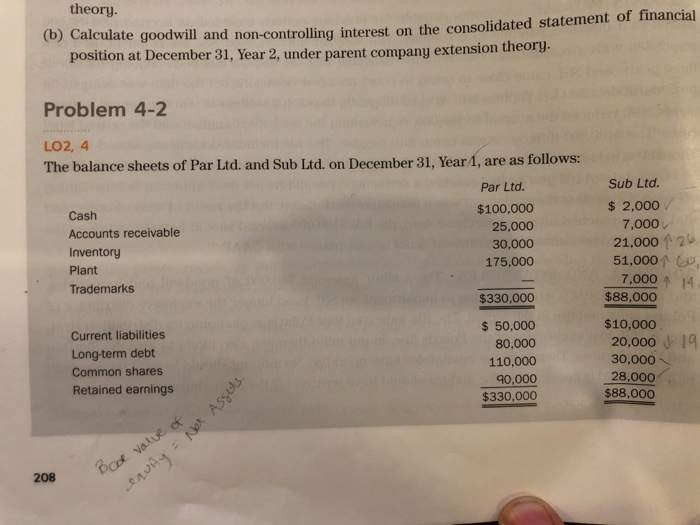

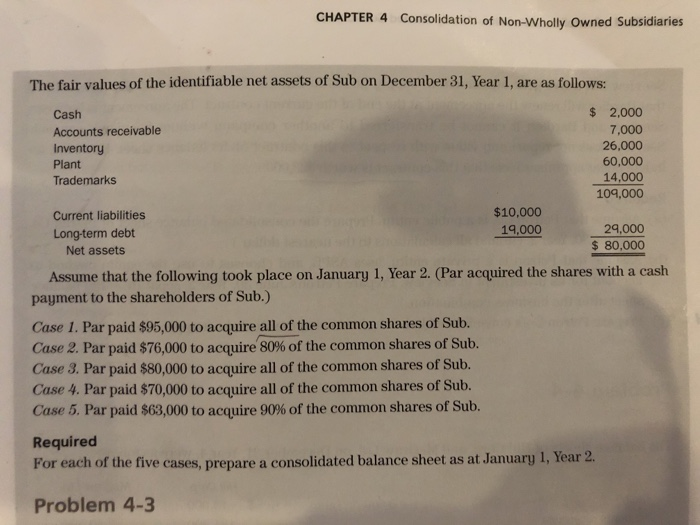

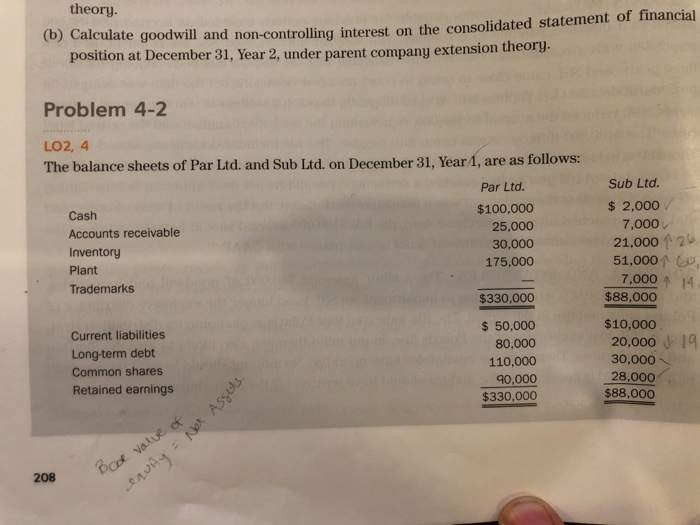

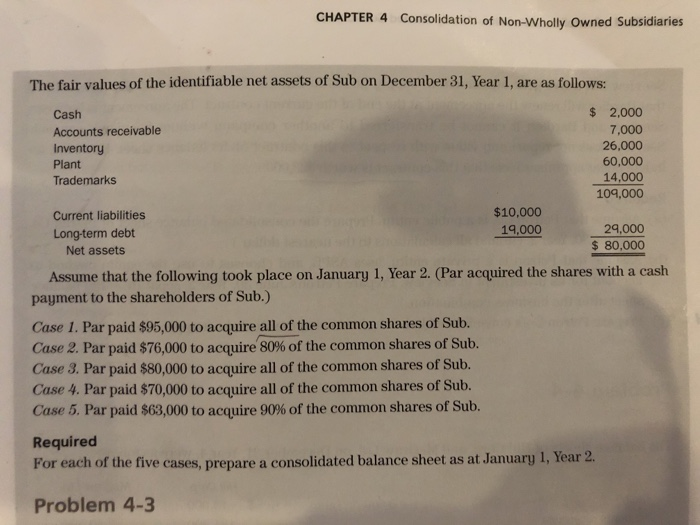

theory (b) Calculate goodwill and non-controlling interest on the consolidated statement of financial theory position at December 31, Year 2, under parent company extension Problem 4-2 LO2, 4 The balance sheets of Par Ltd. and Sub Ltd. on December 31, Year1, are as follows Par Ltd. Sub Ltd. Cash Accounts receivable Inventory Plant Trademarks $100,000 25,000 30,000 175,000 $2,000 7,000 21,000 51,000 7.000 14 $330,000 $88,000 $50,000 80,000 110,000 40,000 $330,000 $10,000 Current liabilities Long-term debt Common shares Retained earnings 20,00019 30,000 28,000 $88,000 208 CHAPTER 4 Consolidation of Non-Wholly Owned Subsidiaries The fair values of the identifiable net assets of Sub on December 31, Year 1, are as follows: Cash Accounts receivable Inventory Plant Trademarks $2,000 7,000 26,000 60,000 14,000 109,000 Current liabilities Long-term debt $10,000 19,000 29,000 $80,000 Net assets Assume that the following took place on January 1, Year 2. (Par acquired the shares with a cash payment to the shareholders of Sub.) Case 1. Par paid $95,000 to acquire all of the common shares of Sub. Case 2, Par paid $76,000 to acquire 80% of the common shares of Sub. Case 3. Par paid $80,000 to acquire all of the common shares of Sub. Case 4. Par paid $70,000 to acquire all of the common shares of Sub. Case 5, Par paid $63,000 to acquire 90% of the common shares of Sub. Required For each of the five cases, prepare a consolidated balance sheet as at January 1, Year 2. Problem 4-3

theory (b) Calculate goodwill and non-controlling interest on the consolidated statement of financial theory position at December 31, Year 2, under parent company extension Problem 4-2 LO2, 4 The balance sheets of Par Ltd. and Sub Ltd. on December 31, Year1, are as follows Par Ltd. Sub Ltd. Cash Accounts receivable Inventory Plant Trademarks $100,000 25,000 30,000 175,000 $2,000 7,000 21,000 51,000 7.000 14 $330,000 $88,000 $50,000 80,000 110,000 40,000 $330,000 $10,000 Current liabilities Long-term debt Common shares Retained earnings 20,00019 30,000 28,000 $88,000 208 CHAPTER 4 Consolidation of Non-Wholly Owned Subsidiaries The fair values of the identifiable net assets of Sub on December 31, Year 1, are as follows: Cash Accounts receivable Inventory Plant Trademarks $2,000 7,000 26,000 60,000 14,000 109,000 Current liabilities Long-term debt $10,000 19,000 29,000 $80,000 Net assets Assume that the following took place on January 1, Year 2. (Par acquired the shares with a cash payment to the shareholders of Sub.) Case 1. Par paid $95,000 to acquire all of the common shares of Sub. Case 2, Par paid $76,000 to acquire 80% of the common shares of Sub. Case 3. Par paid $80,000 to acquire all of the common shares of Sub. Case 4. Par paid $70,000 to acquire all of the common shares of Sub. Case 5, Par paid $63,000 to acquire 90% of the common shares of Sub. Required For each of the five cases, prepare a consolidated balance sheet as at January 1, Year 2. Problem 4-3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started