Answered step by step

Verified Expert Solution

Question

1 Approved Answer

there 5 parts... A,B,C,D and E and previous problems /solutions are similar but not the same Following is the current balance sheet for a local

there 5 parts... A,B,C,D and E and previous problems /solutions are similar but not the same

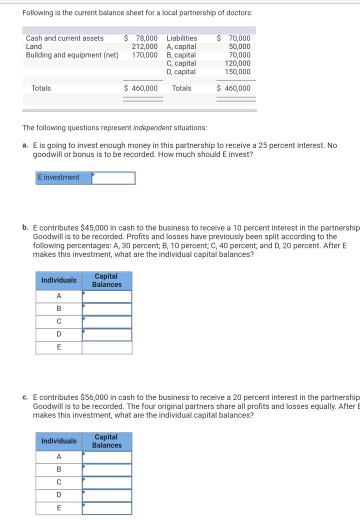

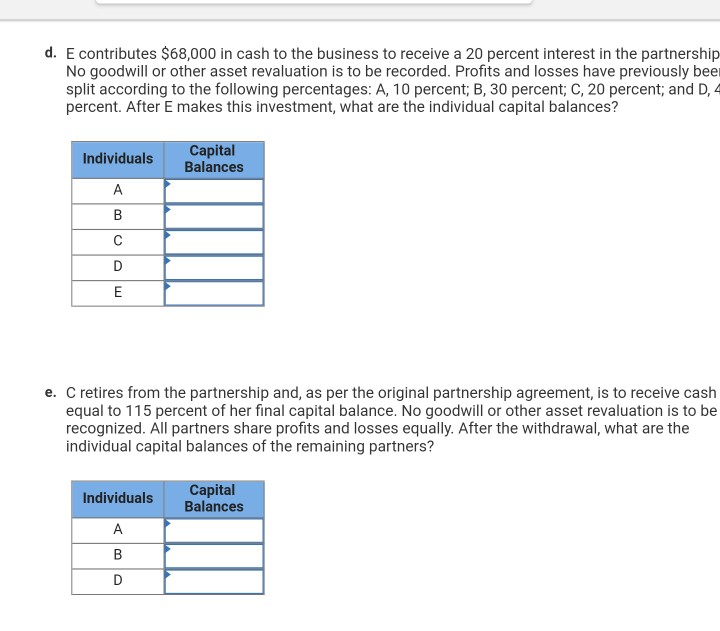

Following is the current balance sheet for a local partnership of doctors 70,000 0,000 0,000 20,000 150,000 Cash and current assets 78,000 Liablities 212,000 A, capital Building and equipment (net) 70,000 B, capital C, capital D capital Totals S 460,000 Totals 460,000 The following questions represent independent situations: a. E is going to invest enough money in this partnership to receive a 25 percent interest. No goodwill or bonus is to be recorded. How much should E invest? b. E contributes $45,000 in cash to the business to receive a 10 percent interest in the partnership Goodwill is to be recorded. Profits and losses have previously been split according to the following percentages: A, 30 percent; B, 10 percent C,40 percent and D, 20 percent. After E makes this investment, what are the individual capital balances? e. E contributes $56,000 in cash to the business to receive a 20 percent interest in the partnership Goodwill is to be recorded. The four original partners share all profits and losses equally. After E makes this investment, what are the individual capital balancesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started