Answered step by step

Verified Expert Solution

Question

1 Approved Answer

there are 10 returns for XYZ IV. Given below are the time series of two asset returns. Calculate the covariance and the correlation between the

there are 10 returns for XYZ

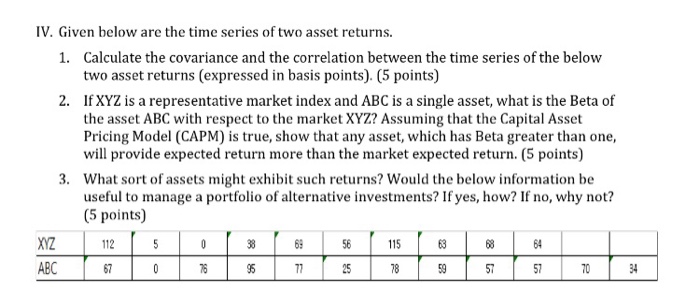

IV. Given below are the time series of two asset returns. Calculate the covariance and the correlation between the time series of the below two asset returns (expressed in basis points). (5 points) 1. If XYZ is a representative market index and ABC is a single asset, what is the Beta of the asset ABC with respect to the market XYZ? Assuming that the Capita Asset Pricing Model (CAPM) is true, show that any asset, which has Beta greater than one, will provide expected return more than the market expected return. (5 points) What sort of assets might exhibit such returns? Would the below information be useful to manage a portfolio of alternative investments? If yes, how? If no, why not? (5 points) 2. 3. XZ 125866115 ABC 67 95 25 59 57 57 34Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started