Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There are 4 parts to the question Foley Associates, a law firm, hires Attorney Lucy Jodoin at an annual salary of $126,500. The law firm

There are 4 parts to the question

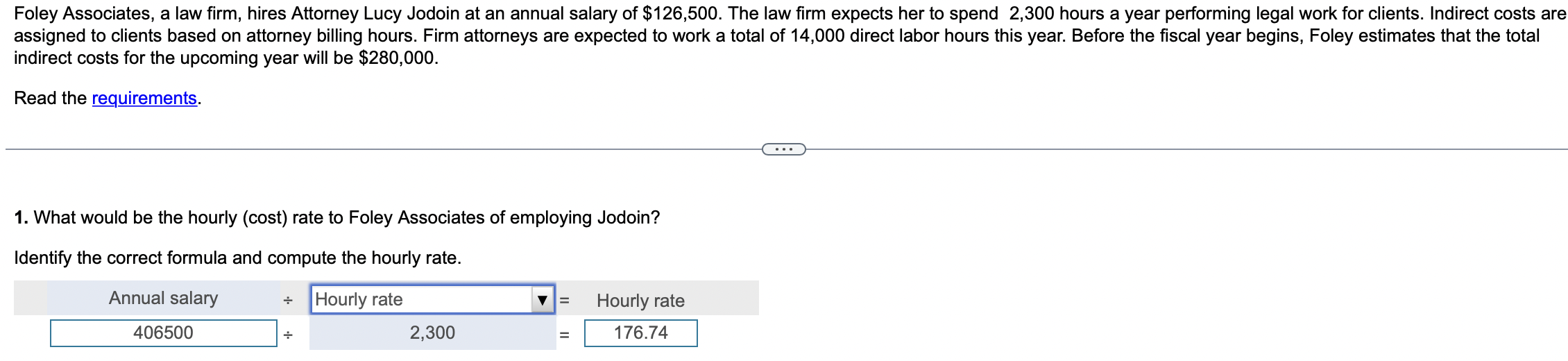

Foley Associates, a law firm, hires Attorney Lucy Jodoin at an annual salary of $126,500. The law firm expects her to spend 2,300 hours a year performing legal work for clients. Indirect costs are assigned to clients based on attorney billing hours. Firm attorneys are expected to work a total of 14,000 direct labor hours this year. Before the fiscal year begins, Foley estimates that the total indirect costs for the upcoming year will be $280,000. Read the requirements. 1. What would be the hourly (cost) rate to Foley Associates of employing Jodoin? Identify the correct formula and compute the hourly rate. 2. If Jodoin works on Client 367 for 18 hours, what direct labor cost would be traced to Client 367 ? 3. What is the indirect cost allocation rate? 4. What indirect costs will be allocated to Client 367 ? 5. What is the total job cost for Client 367

Foley Associates, a law firm, hires Attorney Lucy Jodoin at an annual salary of $126,500. The law firm expects her to spend 2,300 hours a year performing legal work for clients. Indirect costs are assigned to clients based on attorney billing hours. Firm attorneys are expected to work a total of 14,000 direct labor hours this year. Before the fiscal year begins, Foley estimates that the total indirect costs for the upcoming year will be $280,000. Read the requirements. 1. What would be the hourly (cost) rate to Foley Associates of employing Jodoin? Identify the correct formula and compute the hourly rate. 2. If Jodoin works on Client 367 for 18 hours, what direct labor cost would be traced to Client 367 ? 3. What is the indirect cost allocation rate? 4. What indirect costs will be allocated to Client 367 ? 5. What is the total job cost for Client 367 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started