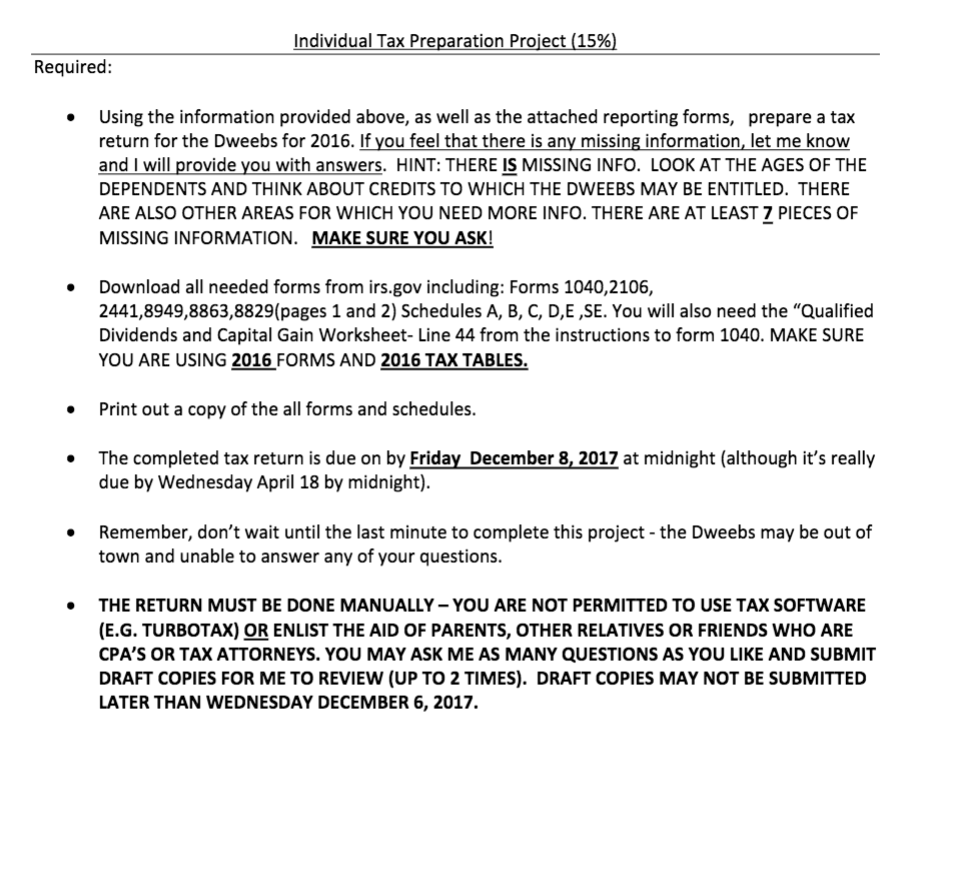

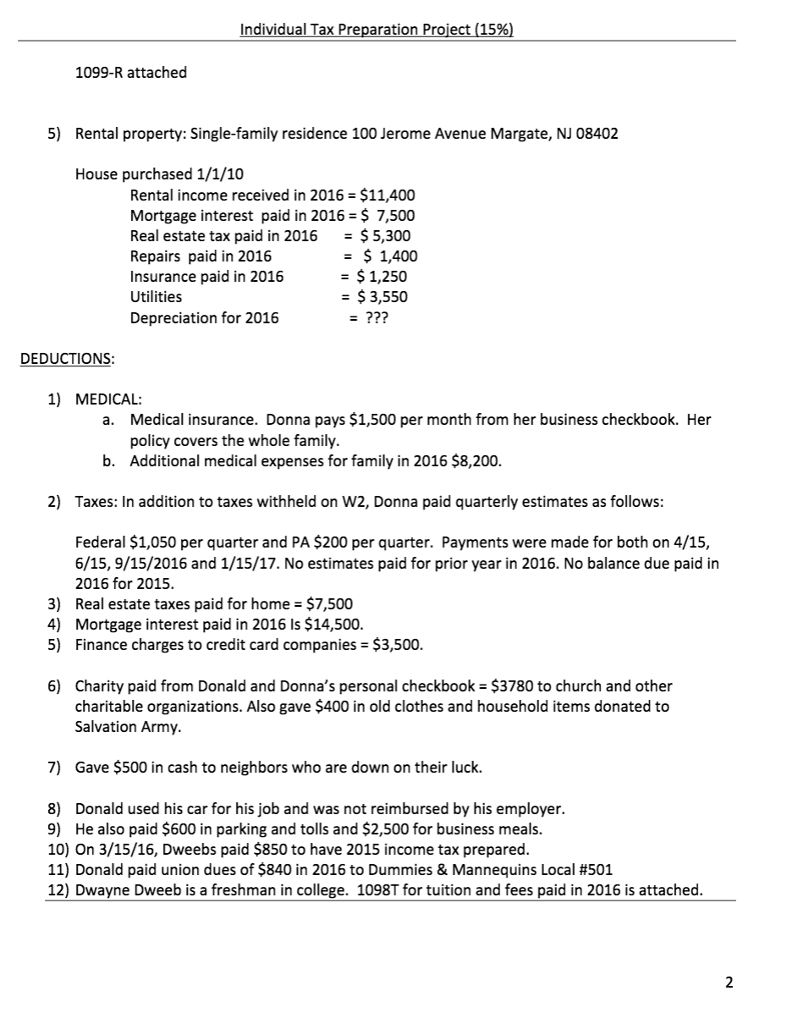

There are 7 questions missing here and those questions are,

1. Date and price of original purchase of shares?

2. Donnas Social Security Number?

3. How much they pay for daycare?

4. How much did they pay for rental property?

5. Who are the 2 children? Is Darlene a child of Donald and Donna?

6. What year was Donald car placed in service. How many miles on the car? How many of the miles were used for work? Donald commuting distance? 7. Donnas business mileage on car?

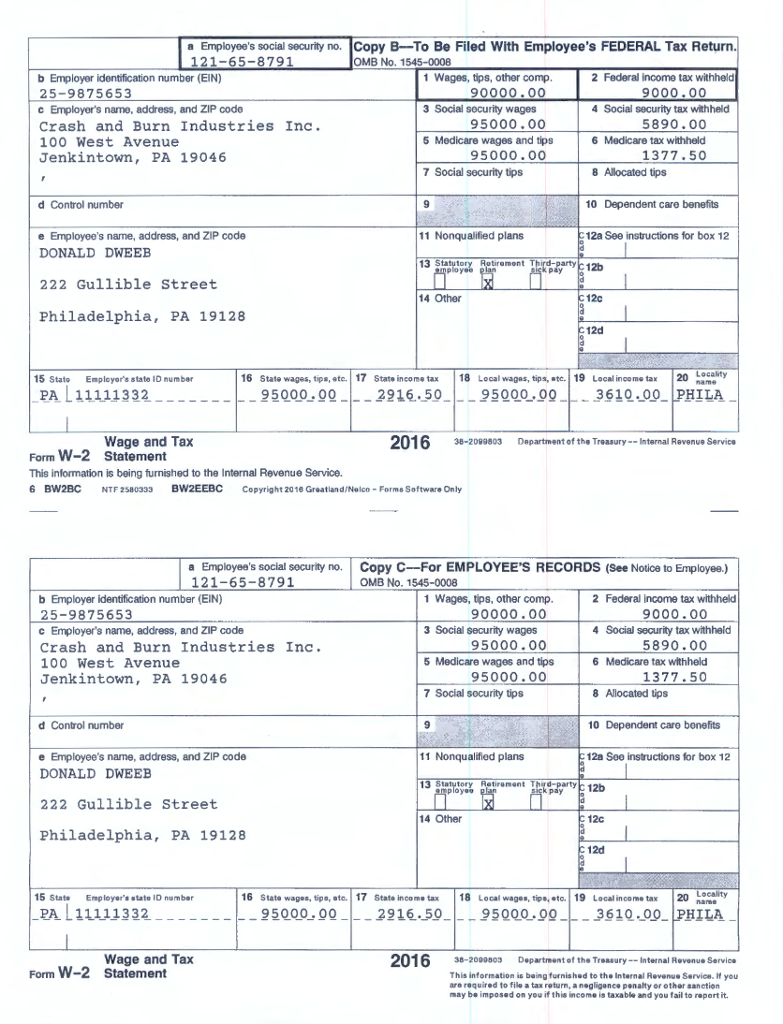

First 2 pages are the information adn 3rd page is how to do it, rest pages are the w2 forms. Thanks!

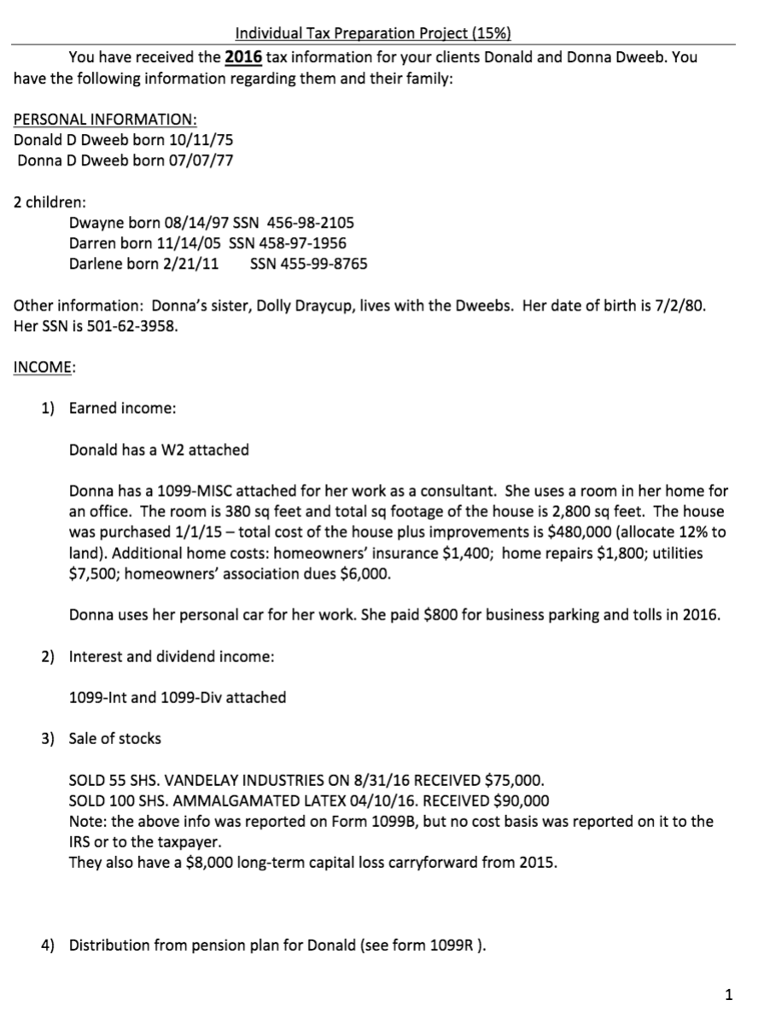

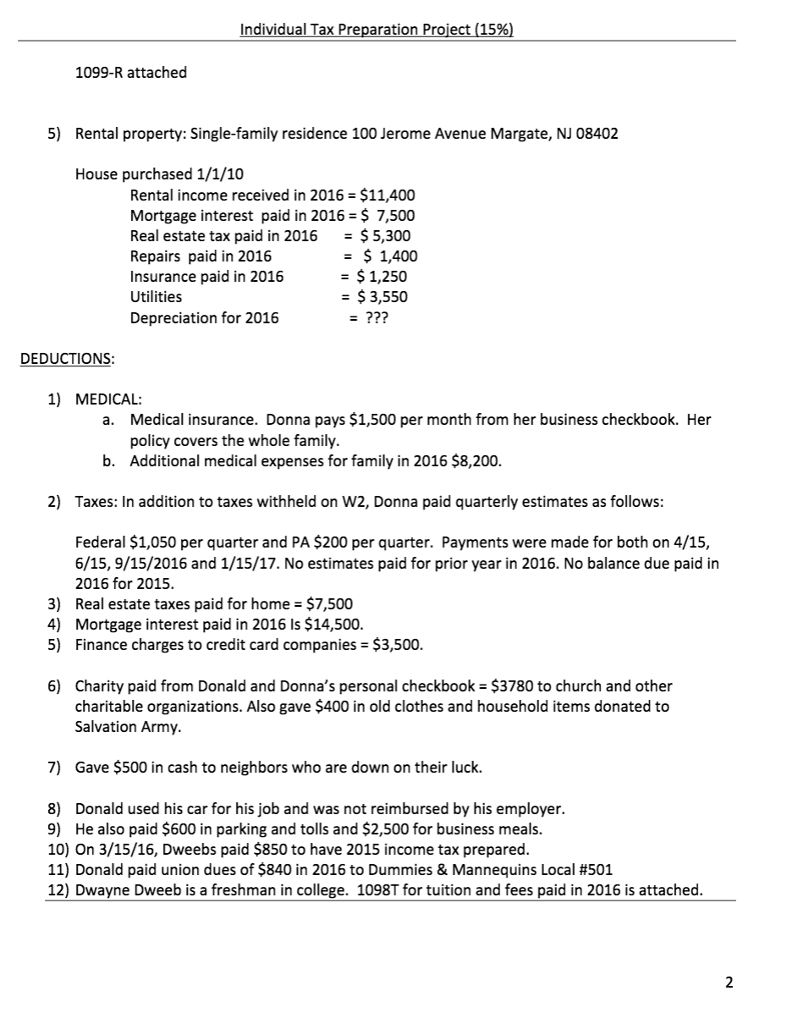

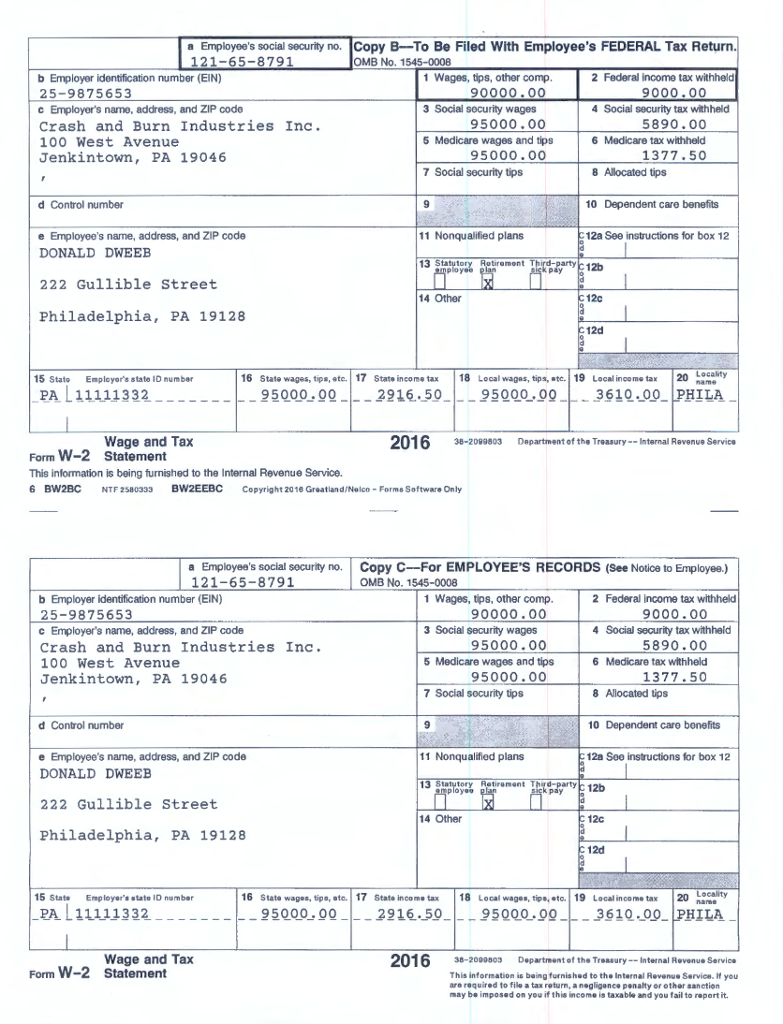

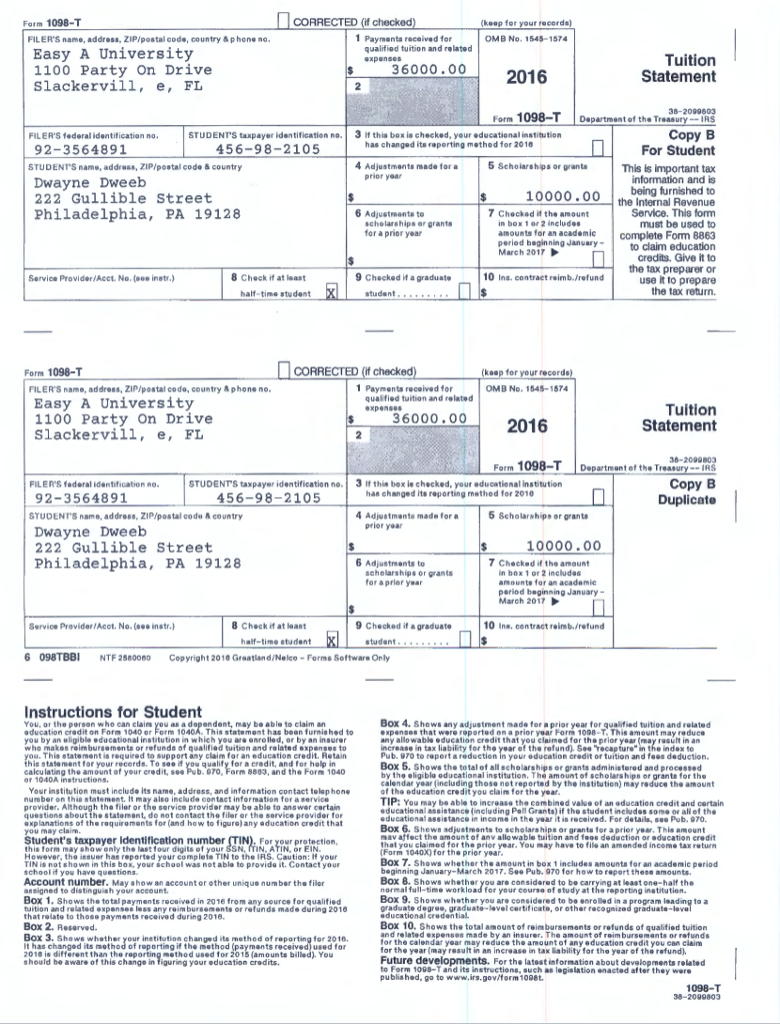

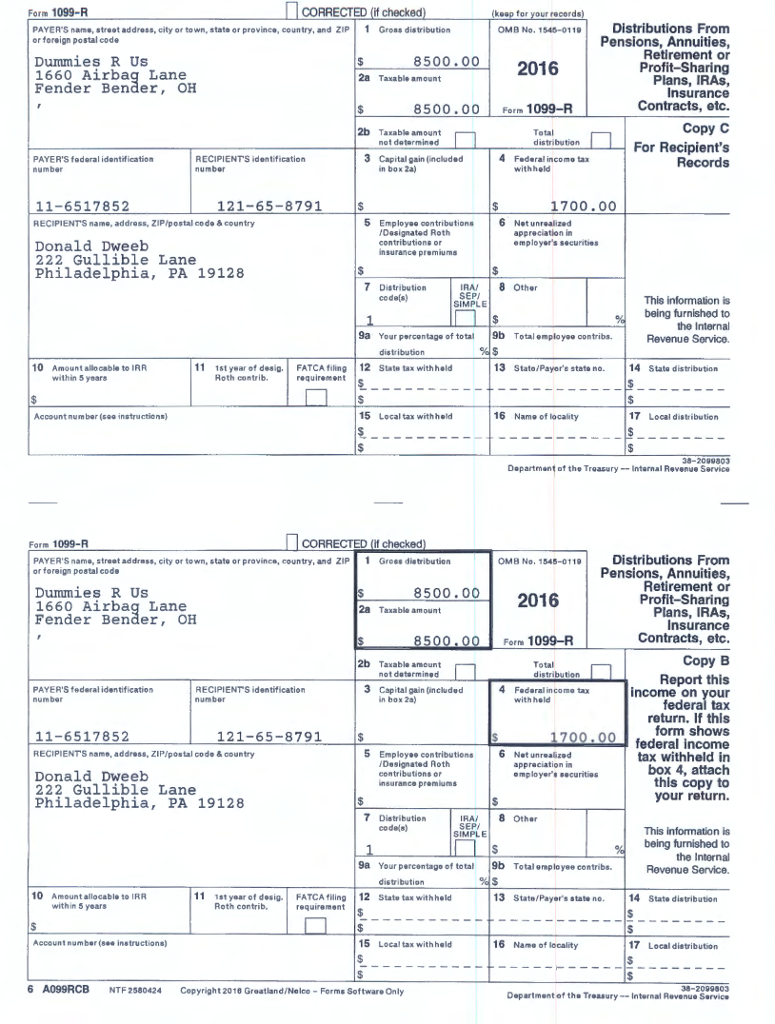

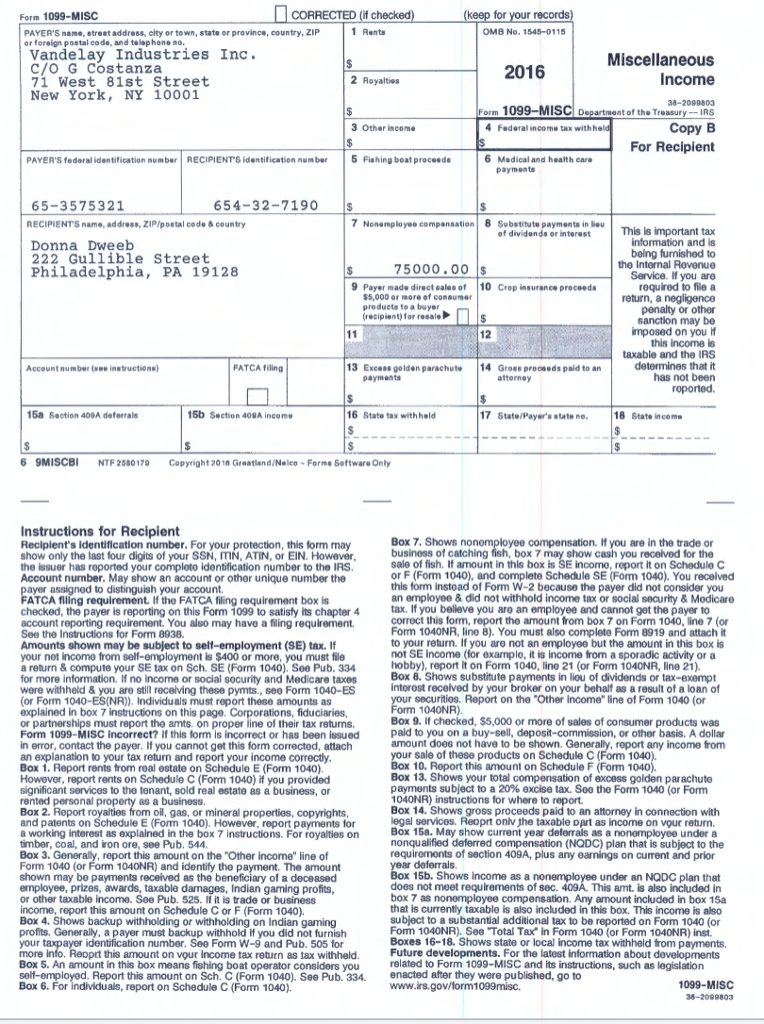

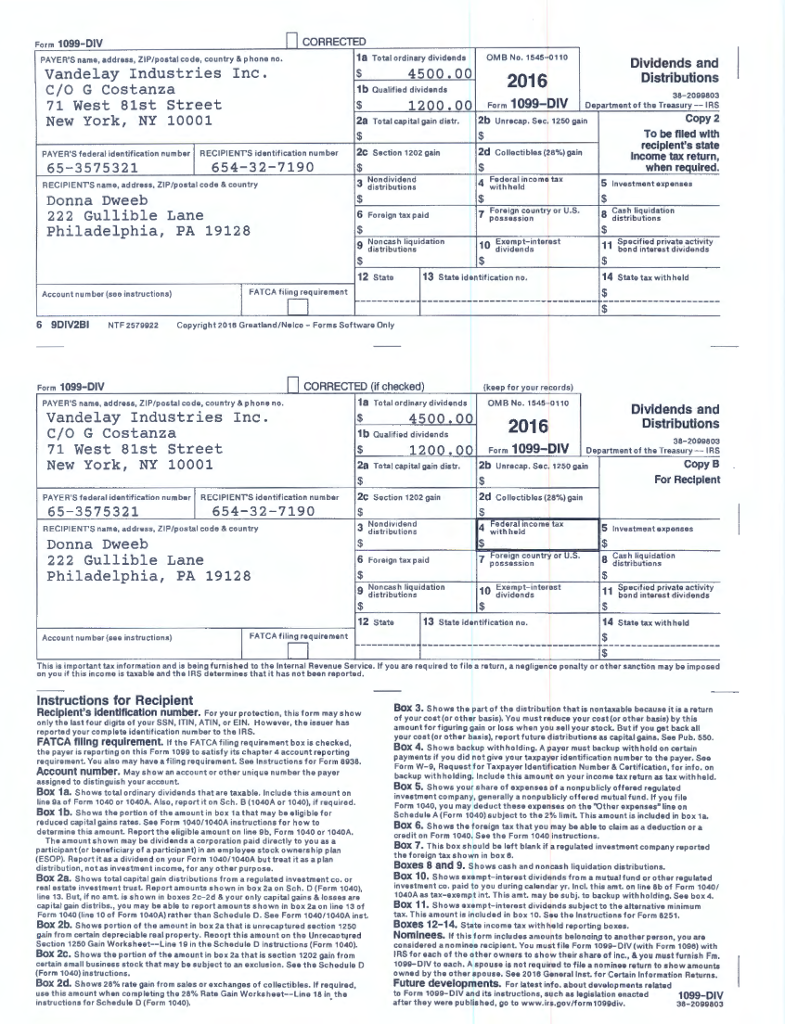

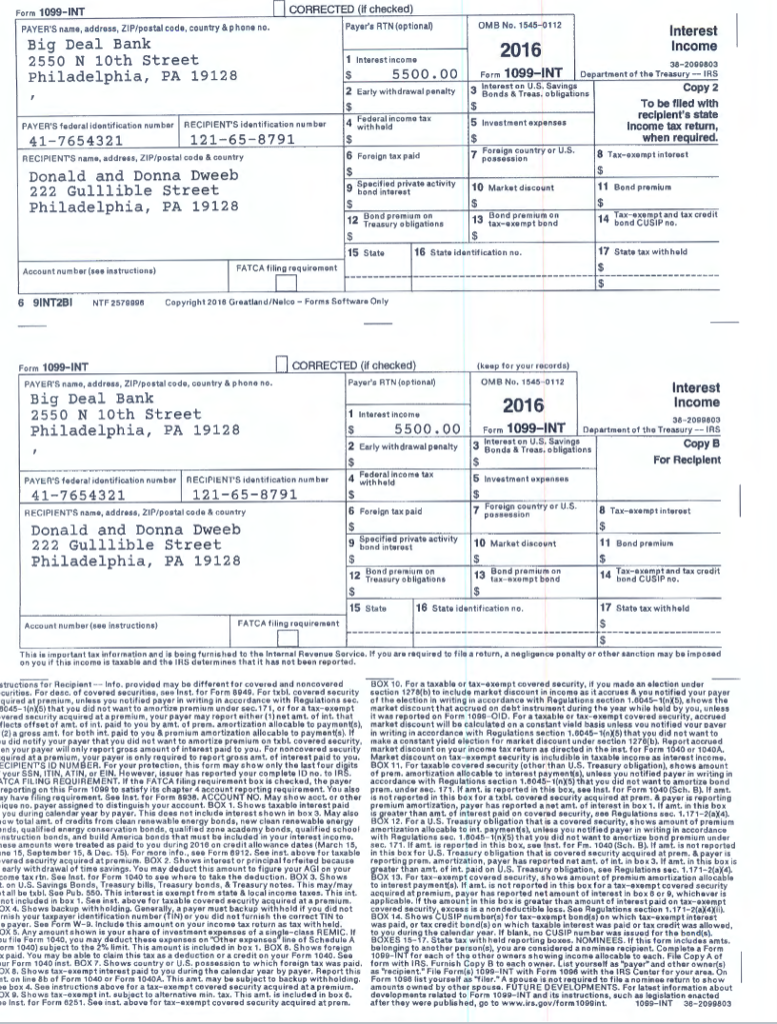

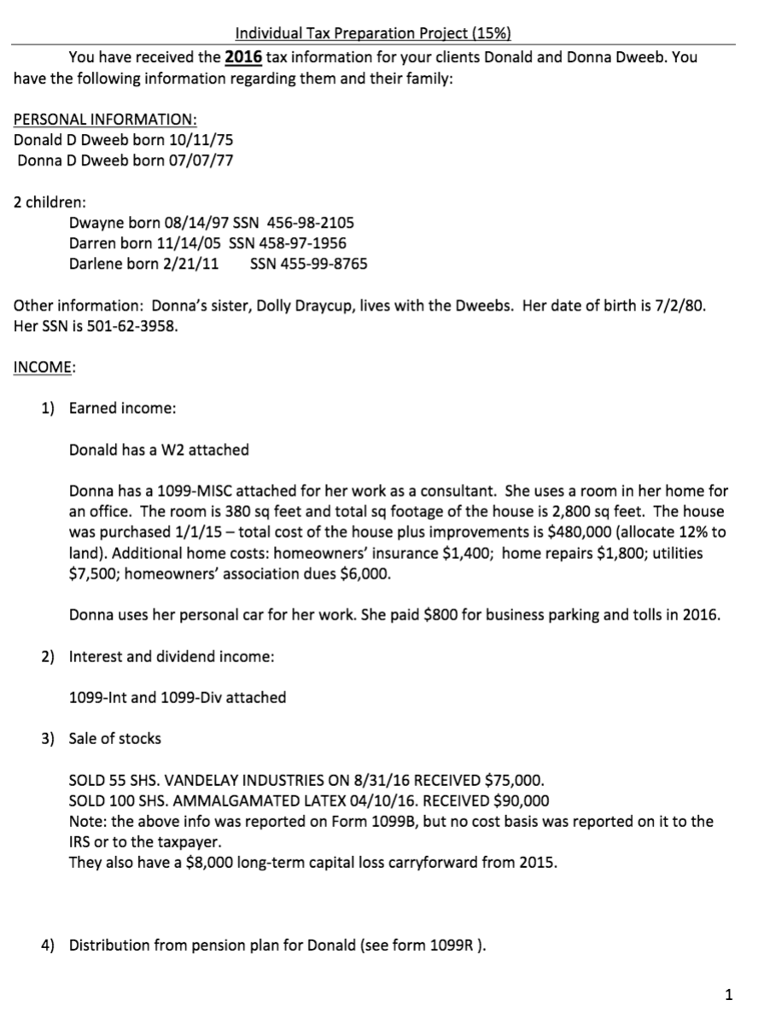

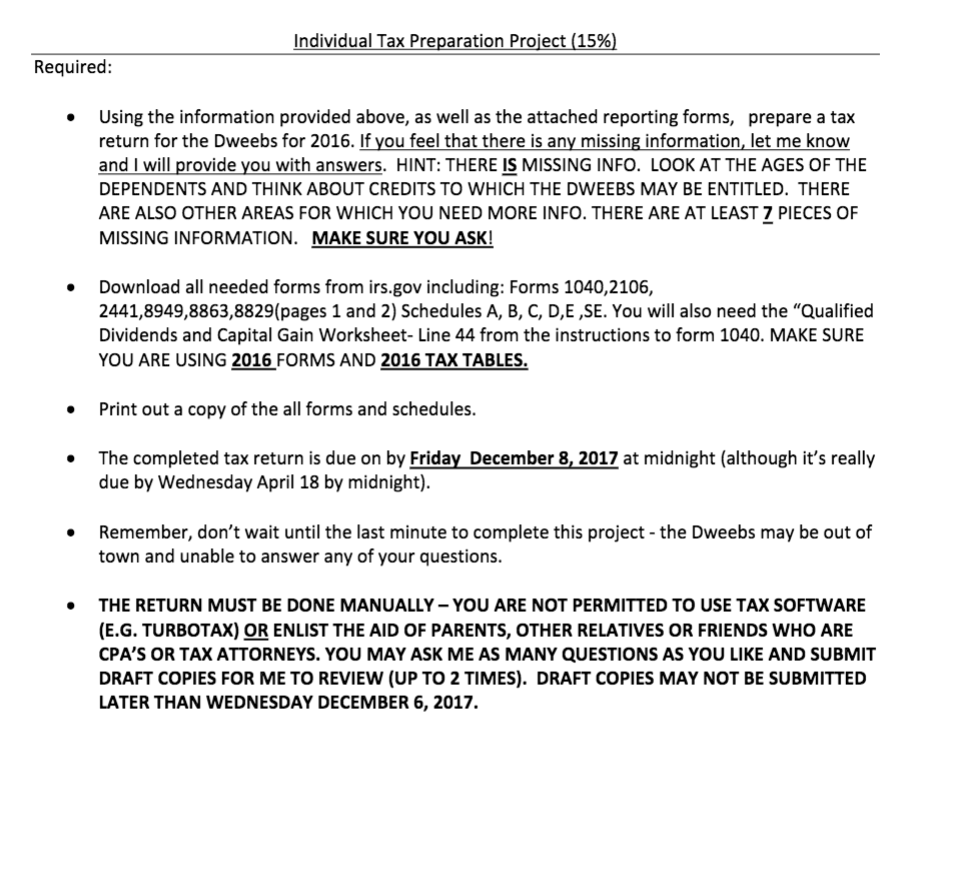

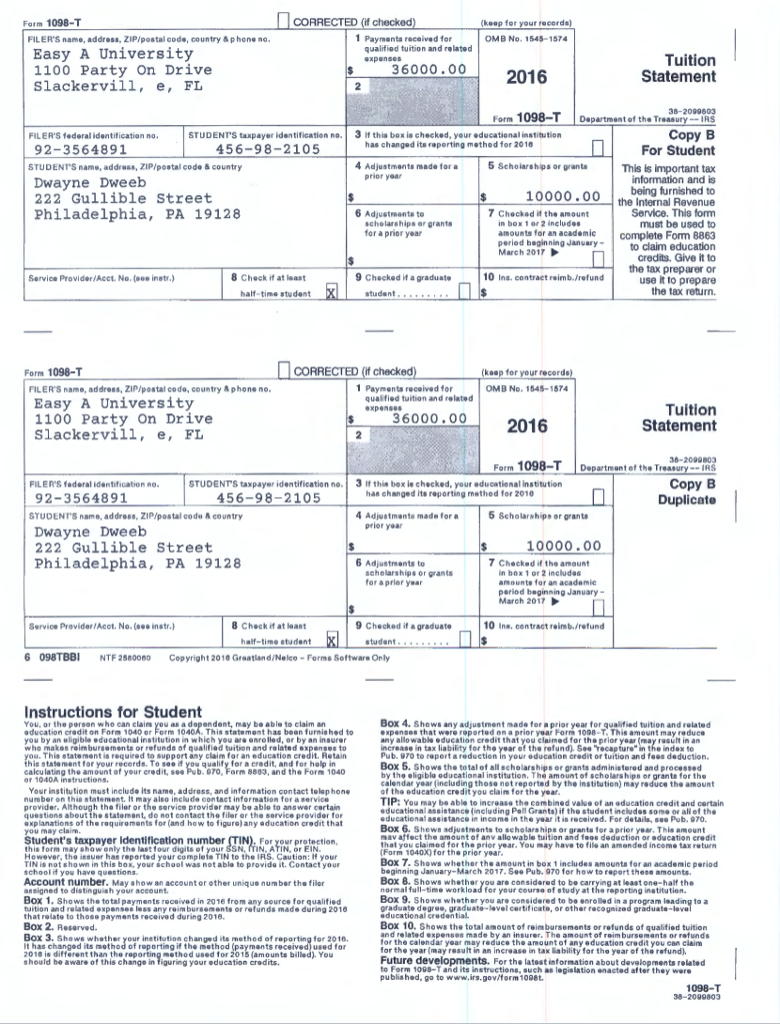

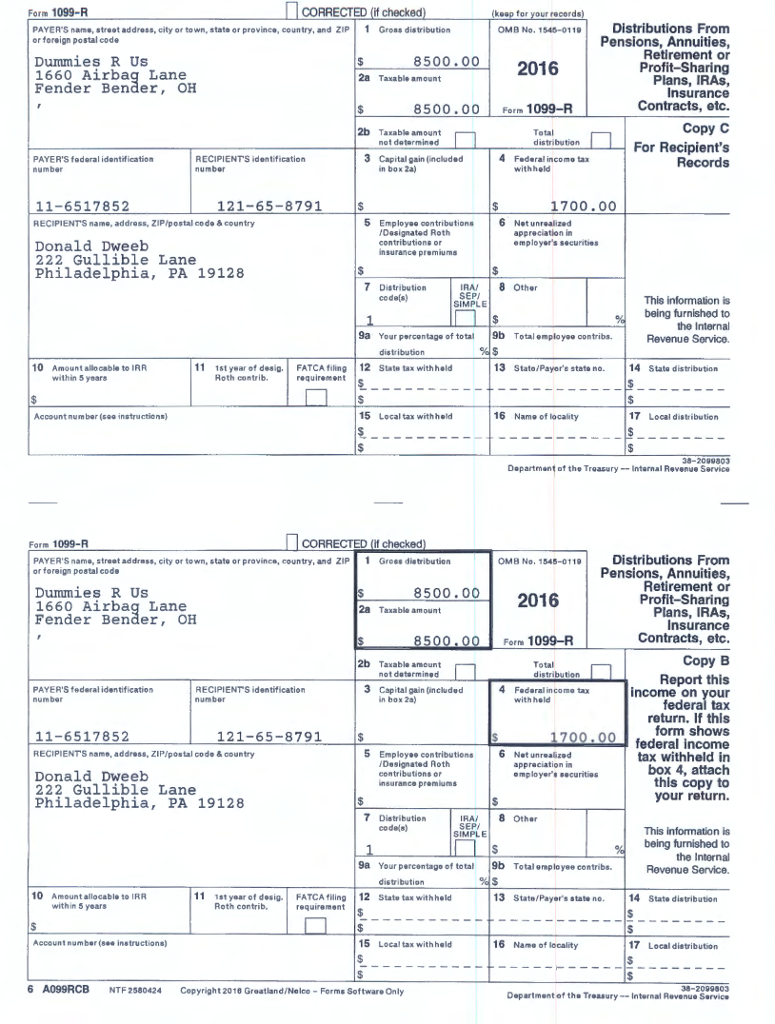

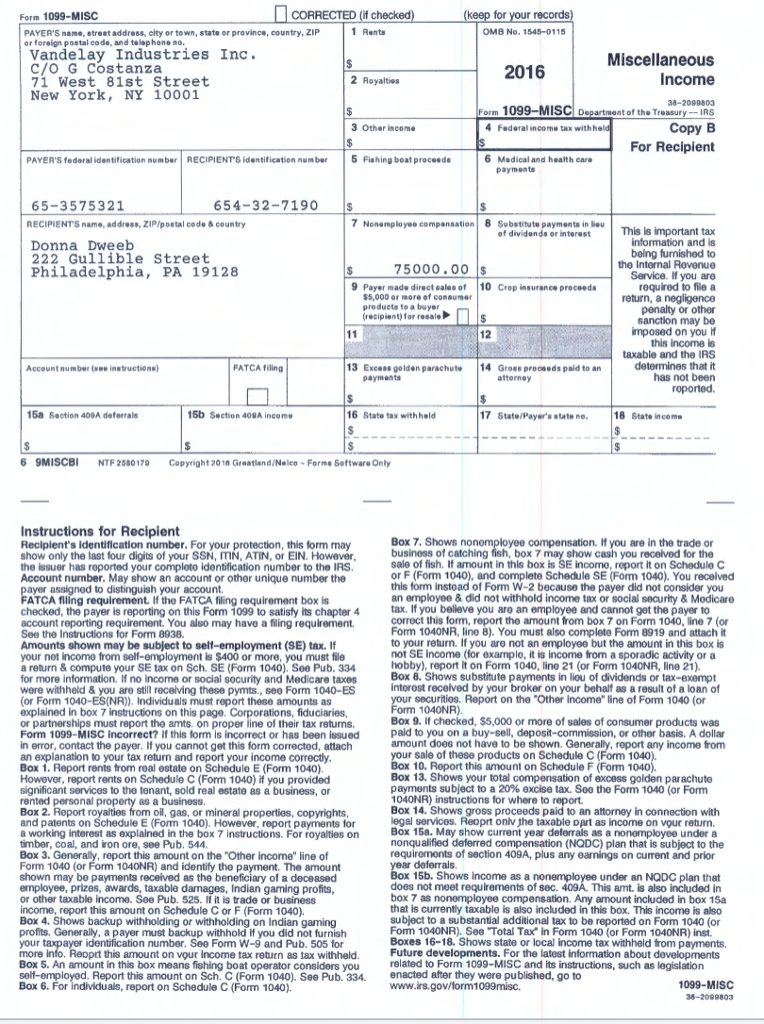

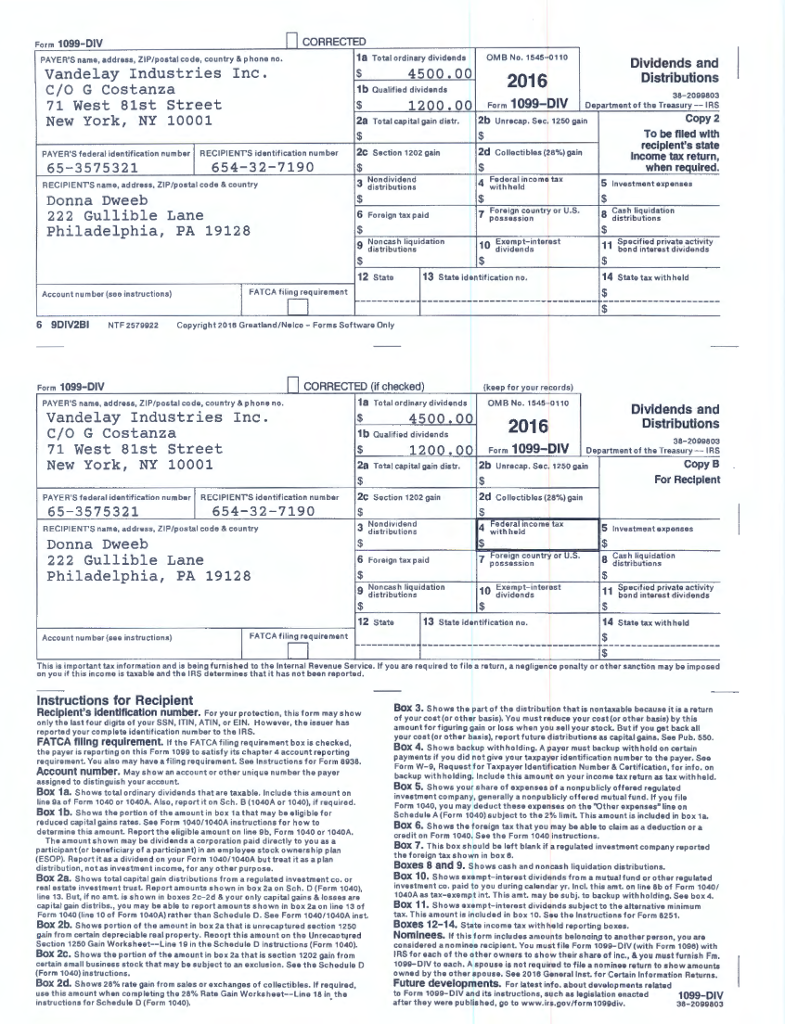

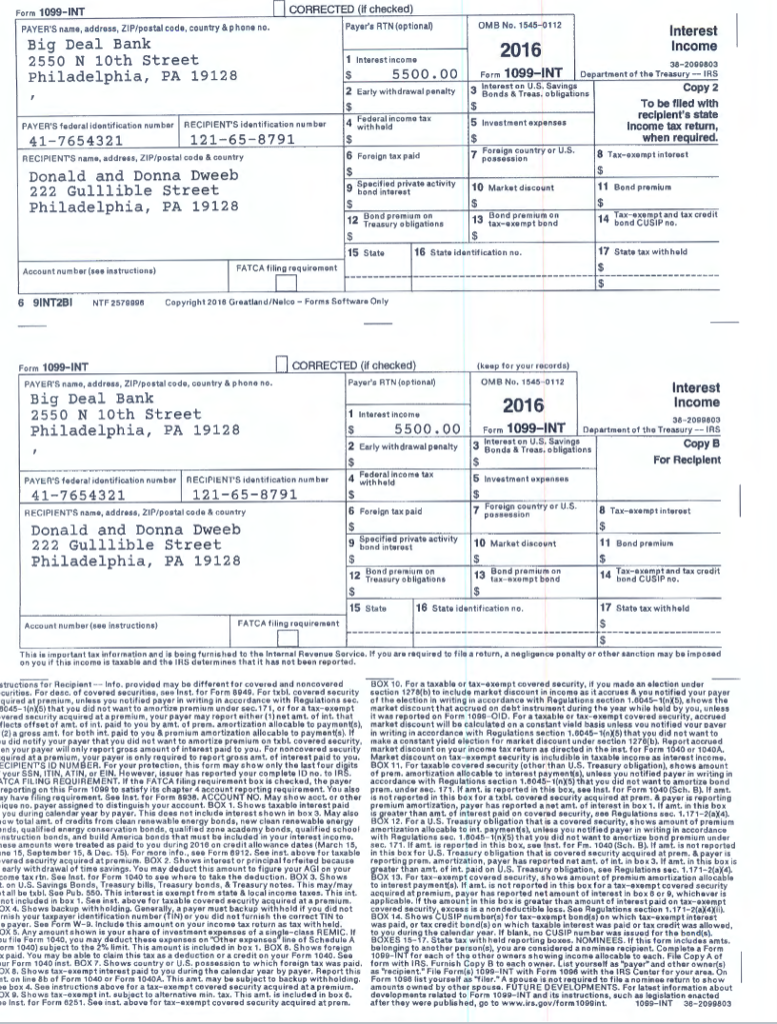

Individual Tax Preparation Project (1596) You have received the 2016 tax information for your clients Donald and Donna Dweeb. You have the following information regarding them and their family PERSONAL INFORMATION: Donald D Dweeb born 10/11/75 Donna D Dweeb born 07/07/77 2 childrern Dwayne born 08/14/97 SSN 456-98-2105 Darren born 11/14/05 SSN 458-97-1956 Darlene born 2/21/11 SSN 455-99-8765 Other information: Donna's sister, Dolly Draycup, lives with the Dweebs. Her date of birth is 7/2/80 Her SSN is 501-62-3958 INCOME 1) Earned income: Donald has a W2 attached Donna has a 1099-MISC attached for her work as a consultant. She uses a room in her home for an office. The room is 380 sq feet and total sq footage of the house is 2,800 sq feet. The house was purchased 1/1/15 _ total cost of the house plus improvements is $480,000 (allocate 12% to land). Additional home costs: homeowners' insurance $1,400; home repairs $1,800; utilities $7,500; homeowners' association dues $6,000 Donna uses her personal car for her work. She paid $800 for business parking and tolls in 2016 2) Interest and dividend income 1099-Int and 1099-Div attached 3) Sale of stocks SOLD 55 SHS. VANDELAY INDUSTRIES ON 8/31/16 RECEIVED $75,000 SOLD 100 SHS. AMMALGAMATED LATEX 04/10/16. RECEIVED $90,000 Note: the above info was reported on Form 1099B, but no cost basis was reported on it to the RS or to the taxpayer. They also have a $8,000 long-term capital loss carryforward from 2015 4) Distribution from pension plan for Donald (see form 1099R) Individual Tax Preparation Project (1596) You have received the 2016 tax information for your clients Donald and Donna Dweeb. You have the following information regarding them and their family PERSONAL INFORMATION: Donald D Dweeb born 10/11/75 Donna D Dweeb born 07/07/77 2 childrern Dwayne born 08/14/97 SSN 456-98-2105 Darren born 11/14/05 SSN 458-97-1956 Darlene born 2/21/11 SSN 455-99-8765 Other information: Donna's sister, Dolly Draycup, lives with the Dweebs. Her date of birth is 7/2/80 Her SSN is 501-62-3958 INCOME 1) Earned income: Donald has a W2 attached Donna has a 1099-MISC attached for her work as a consultant. She uses a room in her home for an office. The room is 380 sq feet and total sq footage of the house is 2,800 sq feet. The house was purchased 1/1/15 _ total cost of the house plus improvements is $480,000 (allocate 12% to land). Additional home costs: homeowners' insurance $1,400; home repairs $1,800; utilities $7,500; homeowners' association dues $6,000 Donna uses her personal car for her work. She paid $800 for business parking and tolls in 2016 2) Interest and dividend income 1099-Int and 1099-Div attached 3) Sale of stocks SOLD 55 SHS. VANDELAY INDUSTRIES ON 8/31/16 RECEIVED $75,000 SOLD 100 SHS. AMMALGAMATED LATEX 04/10/16. RECEIVED $90,000 Note: the above info was reported on Form 1099B, but no cost basis was reported on it to the RS or to the taxpayer. They also have a $8,000 long-term capital loss carryforward from 2015 4) Distribution from pension plan for Donald (see form 1099R)