Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There are five questions. Some will refer to the spreadsheet FINA 4 6 2 HW 1 . Please turn in your solutions, including work on

There are five questions. Some will refer to the spreadsheet FINAHW Please turn in your

solutions, including work on the spreadsheet to the Assignment # dropbox by the due date. Note

that showing work is important as it allows for partial credit.

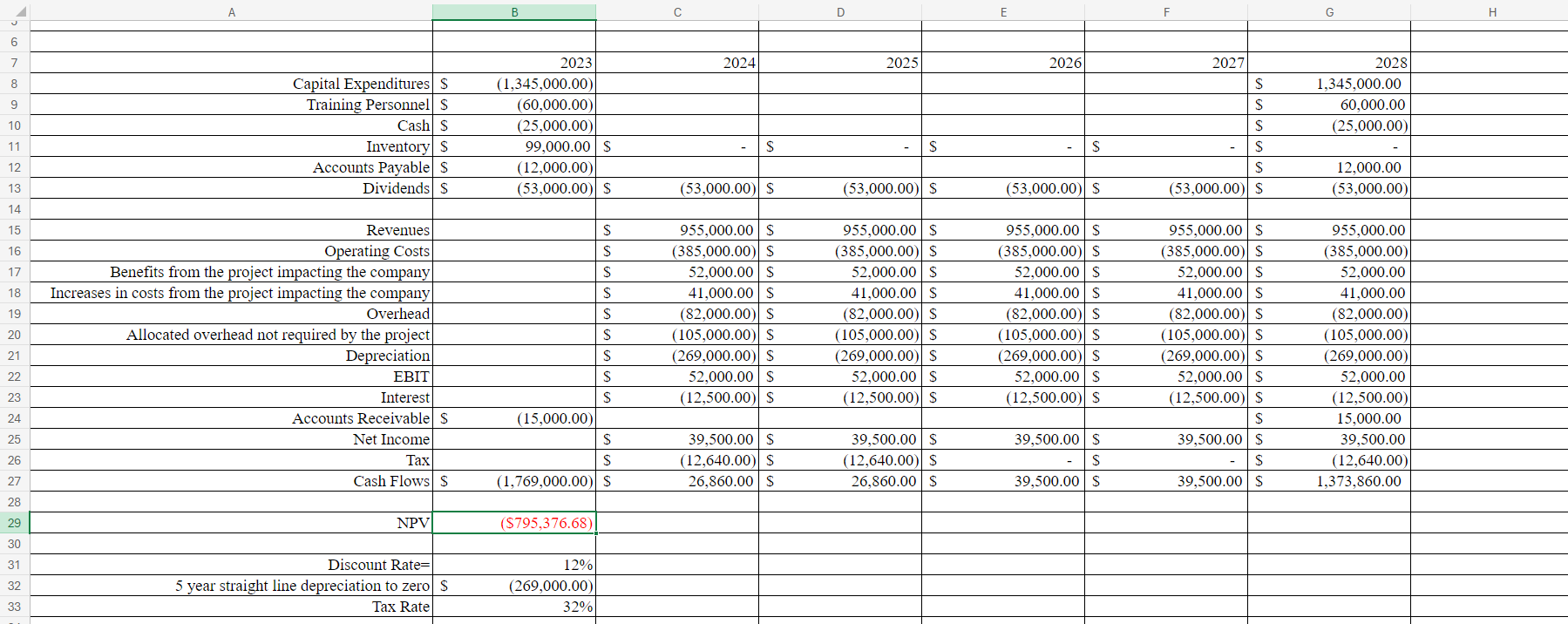

Look at the spreadsheet. Zachary Taylor has been working on a project for Truist

Financial with information laid out in tab The project is being prepared to start on

January There are some items that appear to possibly have been done

incorrectly. Some may be justifiable under particular conditions, but are still possibly

incorrect. List each one that appears to potentially be wrong and indicate why you

believe it may be in error.

Now determine and list the information that you would need to actually know whether

the entries are correct or incorrect. Finally, make assumptions about what to dowhat to

includehow to adjust and list them. Then, in tab B create a revised version of the

project with your assumptions and calculate NPV

Look at the # tab in the workbook. You have the cash flows for two mutually exclusive

projects. Which one should be chosen, if any? Why? Then convert each into an

equivalent annual annuity. How much is the annuity amount for each of the projects? Be

sure to show your work.

KRaft Corp. is looking at a series of projects listed in tab of the excel file. It cannot

invest more than $ million dollars. Some of the projects are indivisible and they are

indicated by a in column F Projects and Larceny Creek and Wild Forester are

mutually exclusive. Projects and Eagle Rarified Mountain Expeditions and Buffalo

Craig Tours are also mutually exclusive. Which projects should KRaft Corp. take and

what is the total NPV

Nolocontendere Ltd produces speakers that sell for $ and have a variable cost of $

per unit. Nondepreciation fixed costs are $ per year, and the initial investment of

$ depreciates straight line over four years to zero. The discount rate is What

is the accounting break even, assuming no taxes? What is the financial breakeven

assuming no taxes, no interest payments, no change in NWC or CAPEXafter the initial

and a four year time frame? What if the tax rate of is paid? You may wish to

use goal seek.

Chapter discusses cognitivebehavioural biases. Consider I. Apruv is estimating the

inputs to a series of capital budgeting projects. Some biases may be creeping into the

analysis. Consider each of the following biases and indicate how it might impact the

input values, the interpretation of the risk analysis, the decision, the project value, or the

value of the options abandon expand, etc. or if the bias should have no impact.

a Optimism Bias

b Anchoring

c Confirmation Bias

d Commitment Bias

e Base Rate NeglecttableJABcDEFGCapital Expenditures,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started