Answered step by step

Verified Expert Solution

Question

1 Approved Answer

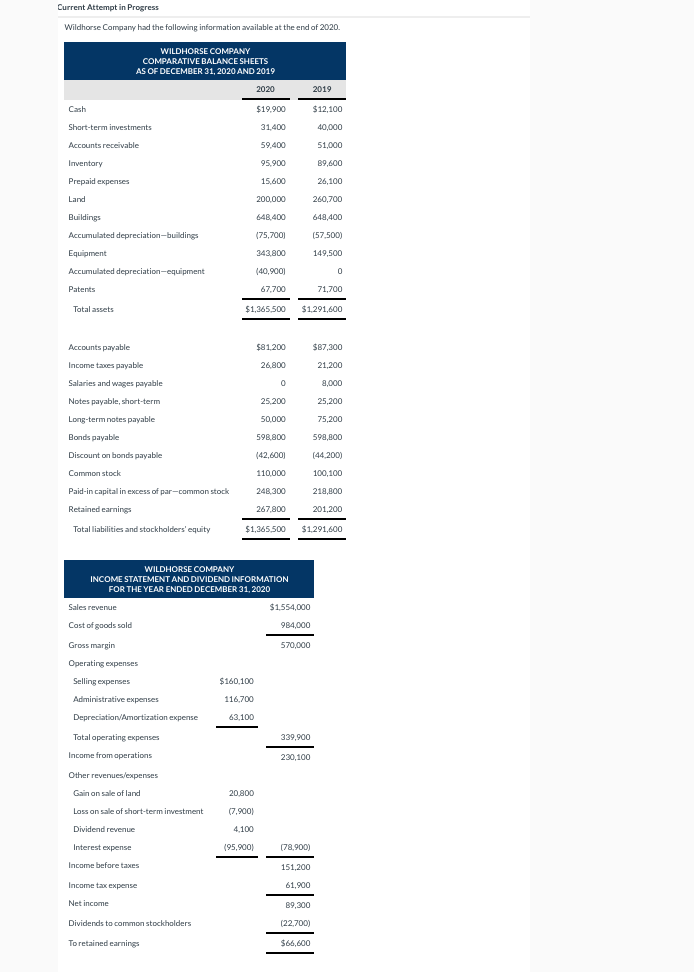

There are insutrsutions ask me to do but I dont even know the answer. Current Attempt in Progress Wildhorse Company had the following information available

There are insutrsutions ask me to do but I dont even know the answer.

Current Attempt in Progress Wildhorse Company had the following information available at the end of 2020 WILDHORSE COMPANY COMPARATIVE BALANCE SHEETS AS OF DECEMBER 31, 2020 AND 2019 2020 2019 Cash $19.900 $12,100 Short-term investments 31.400 40.000 Accounts receivable 59,400 51,000 Inventory 95.900 B9,600 Prepaid expenses 15,600 26,100 Land 200.000 260,700 648.400 648,400 Buildings Accumulated depreciation-building (75,7001 (57.500) 343.800 149.500 Equipment Accumulated depreciation-equipment Patents (40.9001 0 67.700 71,700 Total assets $1,365.500 $1.291,600 Accounts payable $81.200 $87,300 Income taxes payable 26.800 21,200 Salaries and wages payable 0 2,000 Notes payable, short-term 25.200 25,200 50,000 75,200 Long-term notes payable Bonds payable 598.800 599,800 Discount on bonds payable (42,6001 (44.200) 110,000 100,100 Common stock Paid-in capital in excess of par-common stock Retained earnings 2481300 219,800 267,800 201,200 Total liabilities and stockholders' equity $1,365.500 $1.291,600 WILDHORSE COMPANY INCOME STATEMENT AND DIVIDEND INFORMATION FOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $1.554,000 Cost of goods sold 984.000 Gross margin 570,000 Operating expenses Selling expenses $160,100 Administrative expenses 116.700 Depreciation/Amortization expense 63.100 Total operating expenses 339,900 Income from operations 230,100 Other revenues/expenses Gain on sale of land 20.800 (7,900) Loss on sale of short-term investment Dividend revenue 4,100 Interest expense (95.900) (78.900) Income before taxes 151,200 Income tax expense 61,900 Net income B9,300 Dividends to common stockholders (22.700 To retained earnings $66,800 To retained earnings $66,600 Prepare a statement of cash flows for Wildhorse Company using the direct method accompanied by a reconciliation schedule. Assume the short-term investments are classified as available-for-sale. (Show amounts in the investing and financing sections that decrease cash flow with either a-simeg.-15,000 or in parenthesis eg (15,000.) WILDHORSE COMPANY Statement of Cash Flows (Direct Method) Cash receipts: $ Cash payments:Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started