there are only two questions, PLEASE answer both for credit & thumbs up... second one already has recorded the name of entries on balance sheet

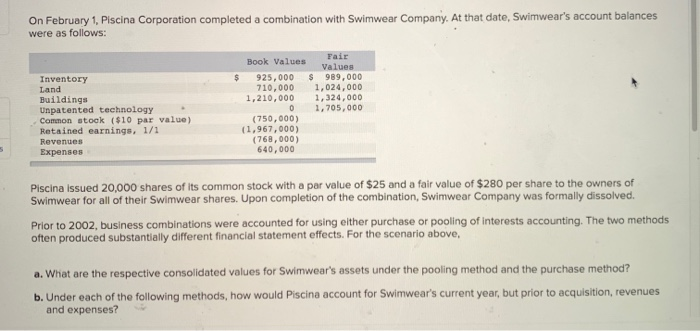

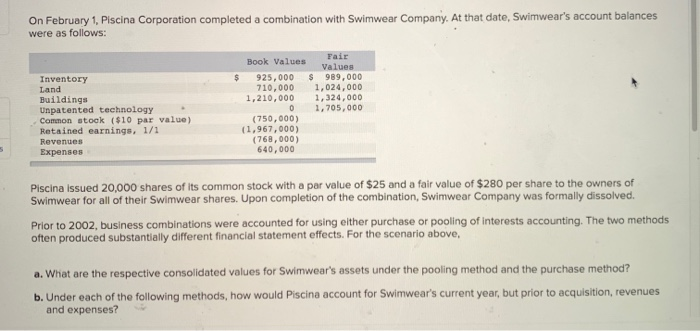

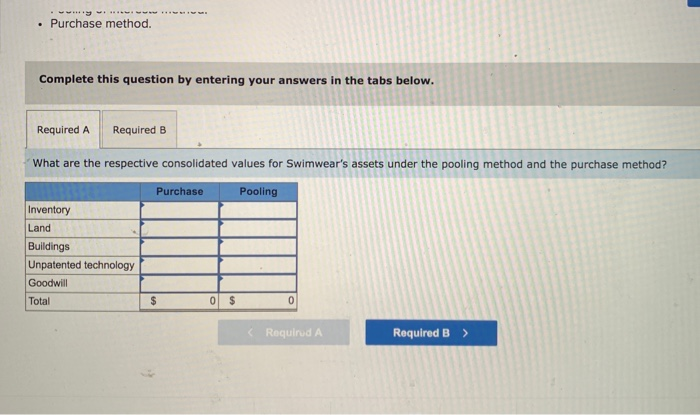

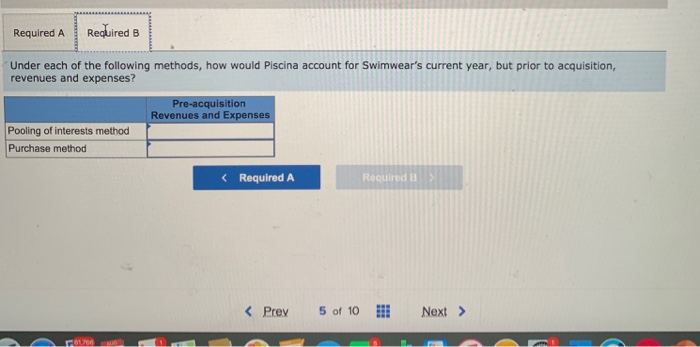

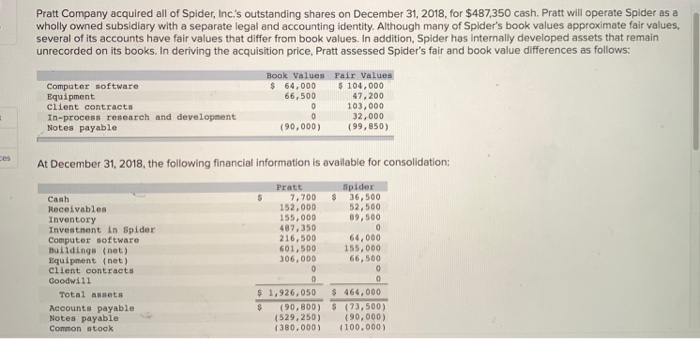

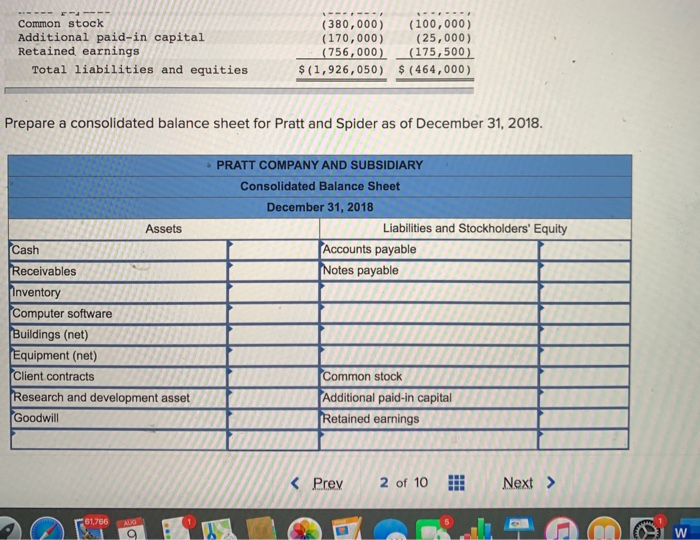

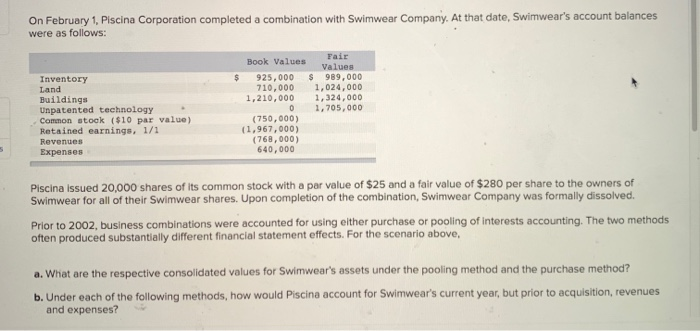

On February 1, Piscina Corporation completed a combination with Swimwear Company. At that date, Swimwear's account balances were as follows: $ Inventory Land Buildings Unpatented technology Common stock ($10 par value) Retained earnings, 1/1 Revenues Expenses Fair Book Values Values 925,000 $ 989,000 710,000 1,024,000 1,210,000 1,324,000 0 1,705,000 (750,000) (1,967,000) (768,000) 640,000 Piscina issued 20,000 shares of its common stock with a par value of $25 and a fair value of $280 per share to the owners of Swimwear for all of their Swimwear shares. Upon completion of the combination, Swimwear Company was formally dissolved. Prior to 2002, business combinations were accounted for using elther purchase or pooling of Interests accounting. The two methods often produced substantially different financial statement effects. For the scenario above, a. What are the respective consolidated values for Swimwear's assets under the pooling method and the purchase method? b. Under each of the following methods, how would Piscina account for Swimwear's current year, but prior to acquisition, revenues and expenses? Purchase method. Complete this question by entering your answers in the tabs below. Required A Required B What are the respective consolidated values for Swimwear's assets under the pooling method and the purchase method? Purchase Pooling Inventory Land Buildings Unpatented technology Goodwill Total $ $ 0 0 Required A Required B Under each of the following methods, how would Piscina account for Swimwear's current year, but prior to acquisition, revenues and expenses? Pre-acquisition Revenues and Expenses Pooling of interests method Purchase method Pratt Company acquired all of Spider, Inc's outstanding shares on December 31, 2018, for $487,350 cash. Pratt will operate Spider as a wholly owned subsidiary with a separate legal and accounting identity. Although many of Spider's book values approximate fair values, several of its accounts have fair values that differ from book values. In addition, Spider has internally developed assets that remain unrecorded on its books. In deriving the acquisition price, Pratt assessed Spider's fair and book value differences as follows: Book Values Fair Values $ 104,000 Equipment 66,500 47,200 client contracts 103,000 In-process research and development 32,000 Notes payable (90,000) (99,850) Computer software $ 64,000 0 0 At December 31, 2018, the following financial information is available for consolidation: Cash Receivables Inventory Investnent in Spider Computer software Buildings (net) Equipment (net) client contracts Goodwill Total assets Accounts payable Notes payable Common stock Pratt Spider $ 7,700 $36,500 152,000 52,500 155,000 09,500 487,350 0 216,500 64,000 601,500 155,000 306,000 66,500 0 0 0 0 $ 1,926,050 $ 464,000 $ (90,800) $ (73,500) (529,250) (90,000) (380.000) (100.000) --- Common stock Additional paid-in capital Retained earnings Total liabilities and equities (380,000) (100,000) (170,000) (25,000) (756,000 (175,500) $(1,926,050) $ (464,000). Prepare a consolidated balance sheet for Pratt and Spider as of December 31, 2018. PRATT COMPANY AND SUBSIDIARY Consolidated Balance Sheet December 31, 2018 Liabilities and Stockholders' Equity Accounts payable Notes payable Assets Cash Receivables Inventory Computer software Buildings (net) Equipment (net) Client contracts Research and development asset Goodwill Common stock Additional paid-in capital Retained earnings 61,766 W