Question

There are two alternatives to take a loan (credit) worth 50,000, to pay in 16 months (four four-month periods). ALTERNATIVE 1: Pay in 'four equal

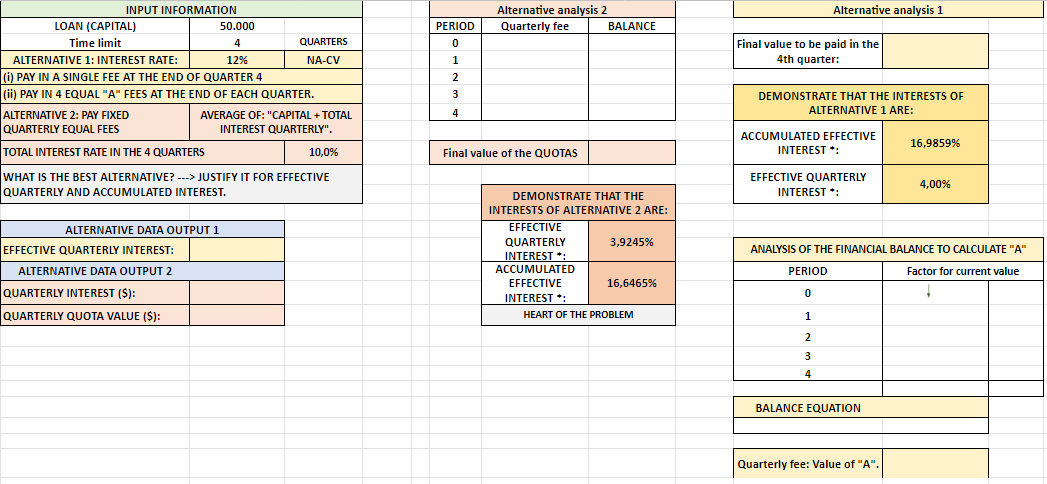

There are two alternatives to take a loan (credit) worth 50,000, to pay in 16 months (four four-month periods).

ALTERNATIVE 1: Pay in 'four equal quarterly installments' with an interest rate of 12% NA-CV, or pay in a single installment payable at the end of month 16 (equal interest rate).

ALTERNATIVE 2: Pay the loan in 'four equal quarterly installments' calculated as follows: "average loan plus total interest (calculated at 10% on loan principal)".

The question is: (i) Which alternative should be selected? Justify the decision taking as criteria the "quarterly effective interest of each alternative" and the "effective interest accumulated in the 16 months for each alternative". (ii) Compare the value of the fees to be paid in each alterative.

Complete the tables.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started