Answered step by step

Verified Expert Solution

Question

1 Approved Answer

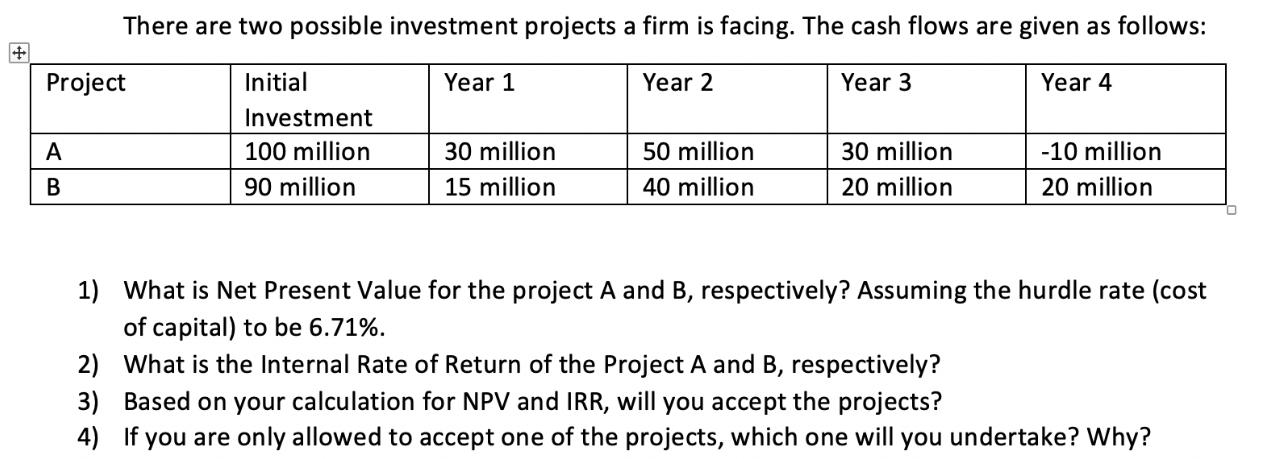

+ There are two possible investment projects a firm is facing. The cash flows are given as follows: Year 1 Year 2 Year 3

+ There are two possible investment projects a firm is facing. The cash flows are given as follows: Year 1 Year 2 Year 3 Year 4 Initial Investment 100 million 90 million Project A B 30 million 15 million 50 million 40 million 30 million 20 million -10 million 20 million 1) What is Net Present Value for the project A and B, respectively? Assuming the hurdle rate (cost of capital) to be 6.71%. 2) What is the Internal Rate of Return of the Project A and B, respectively? 3) Based on your calculation for NPV and IRR, will you accept the projects? 4) If you are only allowed to accept one of the projects, which one will you undertake? Why?

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the Net Present Value NPV for each project we need to discount the cash flows to the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started