Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There are TWO scenario parts. Please complete both for a upvote. Lastly, just complete the true and false. Thank you You don't need tables. There

There are TWO scenario parts. Please complete both for a upvote. Lastly, just complete the true and false. Thank you

You don't need tables. There is a answer for each scenario.

Part 2

True/False

Thank you, if answered all correctly. Will receive an UpVote.

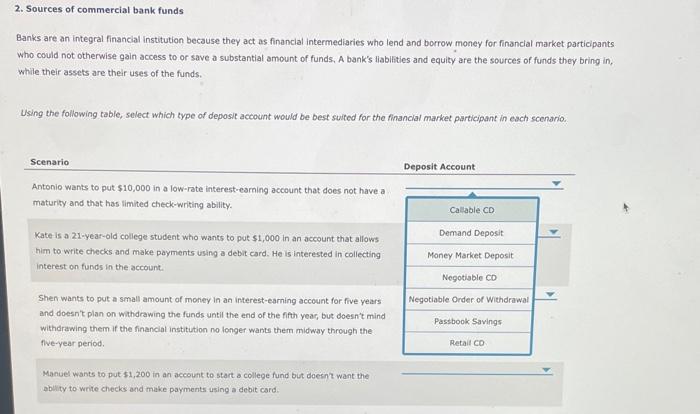

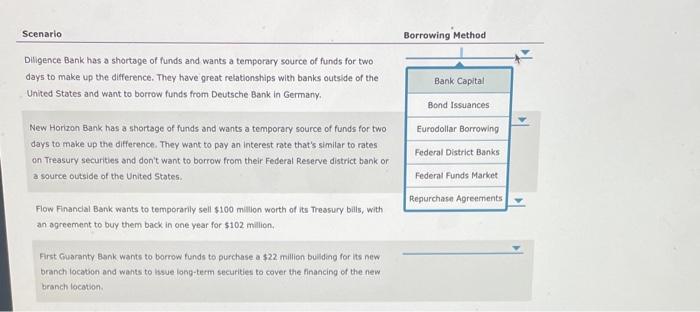

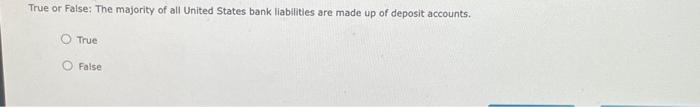

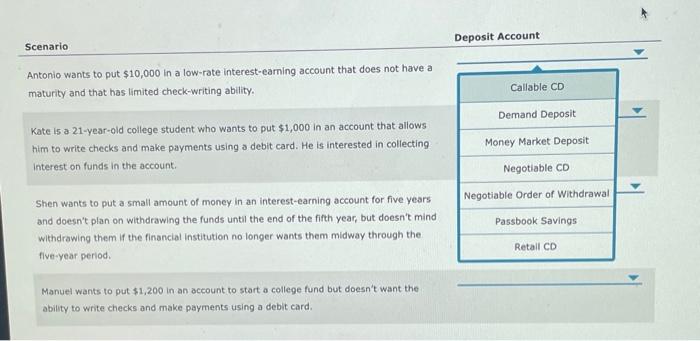

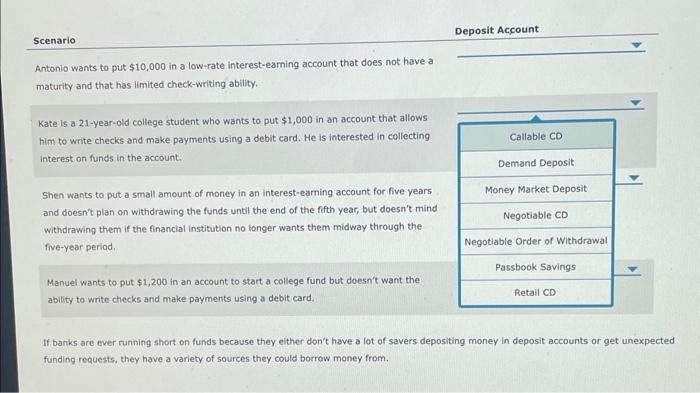

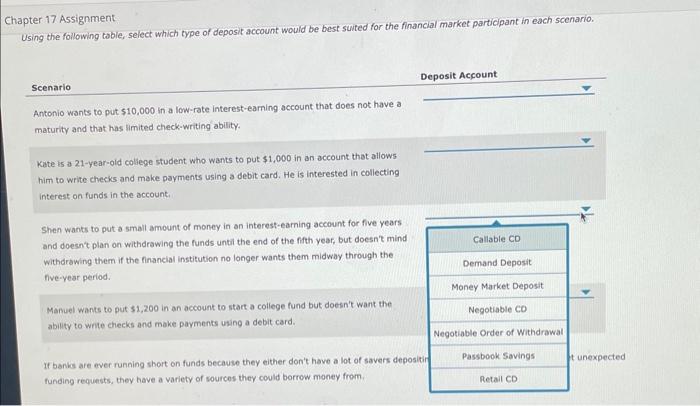

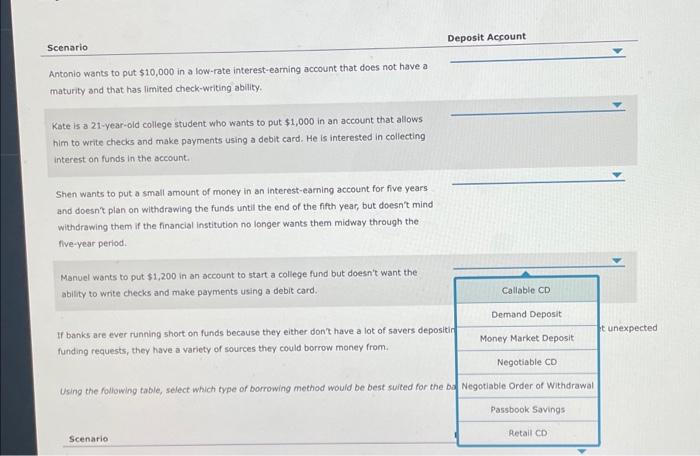

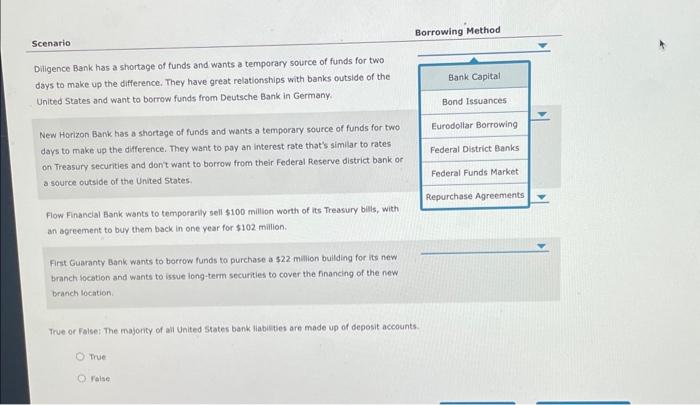

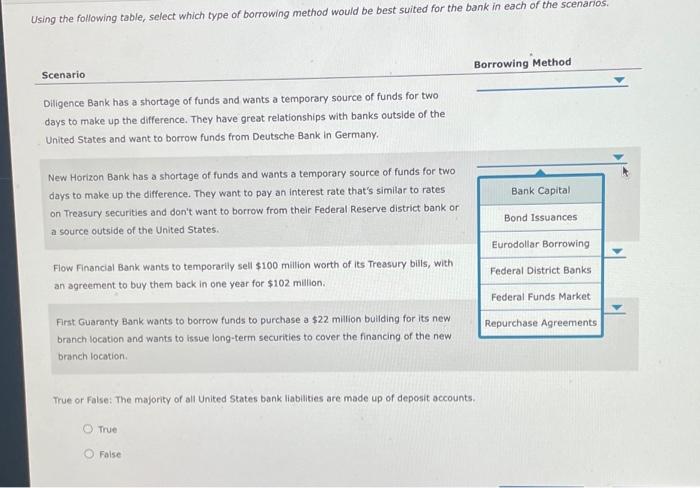

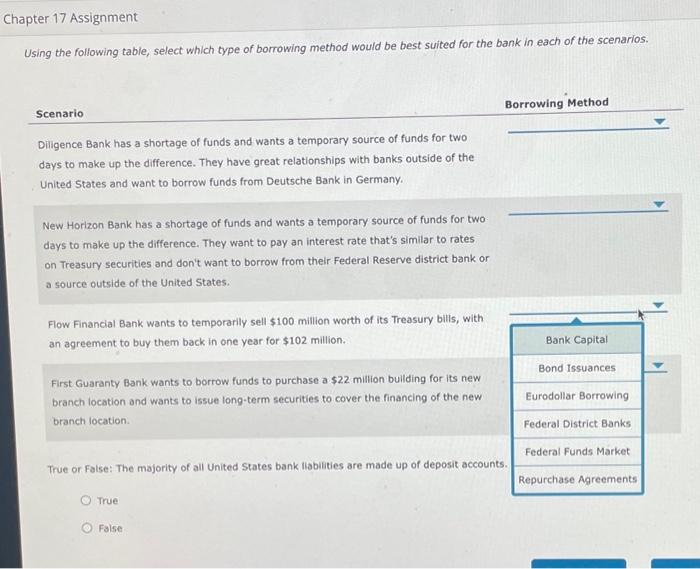

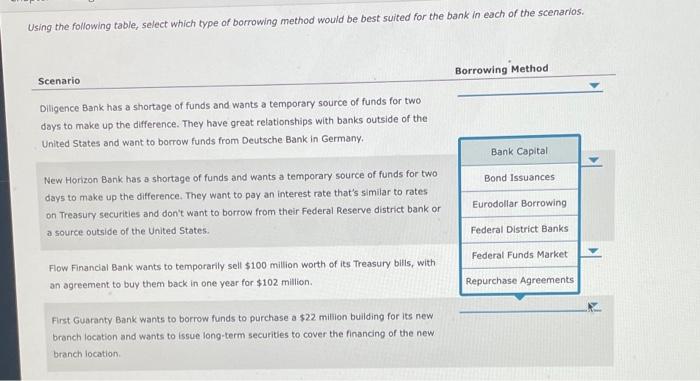

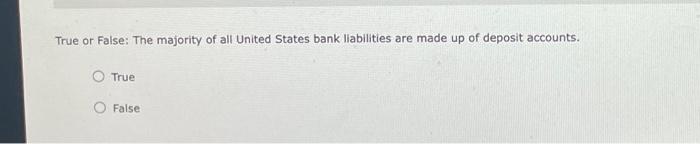

2. Sources of commercial bank funds Banks are an integral financial institution because they act as financlal intermediaries who lend and borrow money for financial market particlpants who could not otherwise gain access to or save a substantial amount of funds. A bank's liablities and equity are the sources of funds they bring in, while their assets are their uses of the funds. Using the following table, select which type of deposit account would be best suited for the financial market participant in each scenario. Scenario Diligence Bank has a shortage of funds and wants a temporary source of funds for two days to make up the difference. They have great relationships with banks outside of the United States and want to borrow funds from Deutsche Bank in Germany. New Horizon Bank has a shortage of funds and wants a temporary source of funds for two days to make up the difference. They want to pay an interest rote that's similar to rates an Treasury securities and don't want to borrow from their Federal Reserve district bank or a source outside of the United States. Flow Financial Bank wants to temporarily sell $100 milion worth of its Treasury balls, with an sgreement to buy them back in one year for $102 milion. First cuaranty Bank wants to borrow funds to purchase a $22 million buliding for its new branch locatoon and wants to hsue long-term securities to cover the financing of the new branch location. True or False: The majority of all United States bank liablities are made up of deposit accounts. True False Deposit Account Scenario Antonio wants to put $10,000 in a low-rate interest-earning account that does not have a maturity and that has limited check-writing ability. Kate is a 21-year-old college student who wants to put $1,000 in an account that allows him to write checks and make payments using a debit card. He is interested in collecting interest on funds in the account. Shen wants to put a small amount of money in an interest-earning account for five years and doesn't plan on withdrawing the funds until the end of the fifth year, but doesn't mind withdrawing them if the financial institution no longer wants them midway through the flve-year period. \begin{tabular}{c} \hline Callable CD \\ \hline Demand Deposit \\ \hline Money Market Deposit \\ \hline Negotiable CD \\ \hline Negotiabie Order of Withdrawal \\ \hline Retall CD \\ \hline \end{tabular} Manuel wants to put $1,200 in an account to start a college fund but doesn't want the ability to write checks and make payments using a debit card. Antonio wants to put $10,000 in a low-rate interest-earning account that does not have a maturity and that has limited check-writing ability. Kate is a 21-year-old college student who wants to put $1,000 in an account that allows him to write checks and make payments using a debit card. He is interested in collecting interest on funds in the account. Shen wants to put a small amount of money in an interest-earning account for five years and doesn't plan on withdrawing the funds until the end of the ffth year, but doesn't mind withdrawing them if the financial institution no longer wants them midway through the five-year period Manuel wants to put $1,200 in an account to start a college fund but doesn't want the ability to write checks and make payments using a debit card. If banks are ever running short on funds because they either don't have a lot of savers depositing money in deposit accounts or get unexpected funding requests, they have a variety of sources they could borrow money from. Using the following table, select which type of deposit account would be best suited for the financial market particjpant in each scenario. apter 17 Assignment Deposit Account Scenario Antonio wants to put $10,000 in a low-rate interest-eaming account that does not have a maturity and that has limited check-writing ability. Kate is a 21-year-old college student who wants to put $1,000 in an account that alows him to write checks and make payments using a debit card. He is interested in collecting interest on funds in the account. Shen wants to put a small amount of money in an interest-eaming account for five years and doesn't plan on withdrawing the funds until the end of the fifth year, but doesn't mind withdrawing them if the financial institution no longer wants them midway through the five-year period. Manuel wants to put $1,200 in an account to start a college fund but doesn't want the ability to write checks and make payments using a debit card. If banks are ever running short on funds because they either dont have a lot of savers depositir funding requests, they have a variety of sources they could borrow money from. Using the following table, select which type of borrowing method would be best suited for the ba Scenario Scenario Diligence Bank has a shortage of funds and wants a temporary source of funds for two days to make up the difference. They have great relationships with banks outside of the United States and want to borrow funds from Deutsehe Bank in Germany. New Horizon Bank has a shortage of funds and wants a temporary source of funds for two days to make up the difference. They want to pay an interest rate that's similar to rates on Treasury securities and dont want to borrow from their Federal Reserve district bank or a source outside of the United States. Flow Financial Bank wants to temporarily sell $100 million worth of its Treasury bilis, with an agreement to buy them back in one year for $102 milion. First Guaranty Bank wants to borrow funds to purchase a $22 milion bullding for its new branch focation and wants to issue long-term securities to cover the financing of the now branch location. The or False: The majonty of ail United States bank liabisties are made up of deposit accounts. True Foise Using the following table, select which type of borrowing methad would be best suited for the bank in each of the scenarios. True or False: The majority of all United States bank liabilities are made up of deposit accounts. True False Using the following table, select which type of borrowing method would be best suited for the bank in each of the scenarios. False Using the following table, select which type of borrowing method would be best suited for the bank in each of the scenarios. True or False: The majority of all United States bank liabilities are made up of deposit accounts. True Faise 2. Sources of commercial bank funds Banks are an integral financial institution because they act as financlal intermediaries who lend and borrow money for financial market particlpants who could not otherwise gain access to or save a substantial amount of funds. A bank's liablities and equity are the sources of funds they bring in, while their assets are their uses of the funds. Using the following table, select which type of deposit account would be best suited for the financial market participant in each scenario. Scenario Diligence Bank has a shortage of funds and wants a temporary source of funds for two days to make up the difference. They have great relationships with banks outside of the United States and want to borrow funds from Deutsche Bank in Germany. New Horizon Bank has a shortage of funds and wants a temporary source of funds for two days to make up the difference. They want to pay an interest rote that's similar to rates an Treasury securities and don't want to borrow from their Federal Reserve district bank or a source outside of the United States. Flow Financial Bank wants to temporarily sell $100 milion worth of its Treasury balls, with an sgreement to buy them back in one year for $102 milion. First cuaranty Bank wants to borrow funds to purchase a $22 million buliding for its new branch locatoon and wants to hsue long-term securities to cover the financing of the new branch location. True or False: The majority of all United States bank liablities are made up of deposit accounts. True False Deposit Account Scenario Antonio wants to put $10,000 in a low-rate interest-earning account that does not have a maturity and that has limited check-writing ability. Kate is a 21-year-old college student who wants to put $1,000 in an account that allows him to write checks and make payments using a debit card. He is interested in collecting interest on funds in the account. Shen wants to put a small amount of money in an interest-earning account for five years and doesn't plan on withdrawing the funds until the end of the fifth year, but doesn't mind withdrawing them if the financial institution no longer wants them midway through the flve-year period. \begin{tabular}{c} \hline Callable CD \\ \hline Demand Deposit \\ \hline Money Market Deposit \\ \hline Negotiable CD \\ \hline Negotiabie Order of Withdrawal \\ \hline Retall CD \\ \hline \end{tabular} Manuel wants to put $1,200 in an account to start a college fund but doesn't want the ability to write checks and make payments using a debit card. Antonio wants to put $10,000 in a low-rate interest-earning account that does not have a maturity and that has limited check-writing ability. Kate is a 21-year-old college student who wants to put $1,000 in an account that allows him to write checks and make payments using a debit card. He is interested in collecting interest on funds in the account. Shen wants to put a small amount of money in an interest-earning account for five years and doesn't plan on withdrawing the funds until the end of the ffth year, but doesn't mind withdrawing them if the financial institution no longer wants them midway through the five-year period Manuel wants to put $1,200 in an account to start a college fund but doesn't want the ability to write checks and make payments using a debit card. If banks are ever running short on funds because they either don't have a lot of savers depositing money in deposit accounts or get unexpected funding requests, they have a variety of sources they could borrow money from. Using the following table, select which type of deposit account would be best suited for the financial market particjpant in each scenario. apter 17 Assignment Deposit Account Scenario Antonio wants to put $10,000 in a low-rate interest-eaming account that does not have a maturity and that has limited check-writing ability. Kate is a 21-year-old college student who wants to put $1,000 in an account that alows him to write checks and make payments using a debit card. He is interested in collecting interest on funds in the account. Shen wants to put a small amount of money in an interest-eaming account for five years and doesn't plan on withdrawing the funds until the end of the fifth year, but doesn't mind withdrawing them if the financial institution no longer wants them midway through the five-year period. Manuel wants to put $1,200 in an account to start a college fund but doesn't want the ability to write checks and make payments using a debit card. If banks are ever running short on funds because they either dont have a lot of savers depositir funding requests, they have a variety of sources they could borrow money from. Using the following table, select which type of borrowing method would be best suited for the ba Scenario Scenario Diligence Bank has a shortage of funds and wants a temporary source of funds for two days to make up the difference. They have great relationships with banks outside of the United States and want to borrow funds from Deutsehe Bank in Germany. New Horizon Bank has a shortage of funds and wants a temporary source of funds for two days to make up the difference. They want to pay an interest rate that's similar to rates on Treasury securities and dont want to borrow from their Federal Reserve district bank or a source outside of the United States. Flow Financial Bank wants to temporarily sell $100 million worth of its Treasury bilis, with an agreement to buy them back in one year for $102 milion. First Guaranty Bank wants to borrow funds to purchase a $22 milion bullding for its new branch focation and wants to issue long-term securities to cover the financing of the now branch location. The or False: The majonty of ail United States bank liabisties are made up of deposit accounts. True Foise Using the following table, select which type of borrowing methad would be best suited for the bank in each of the scenarios. True or False: The majority of all United States bank liabilities are made up of deposit accounts. True False Using the following table, select which type of borrowing method would be best suited for the bank in each of the scenarios. False Using the following table, select which type of borrowing method would be best suited for the bank in each of the scenarios. True or False: The majority of all United States bank liabilities are made up of deposit accounts. True Faise

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started