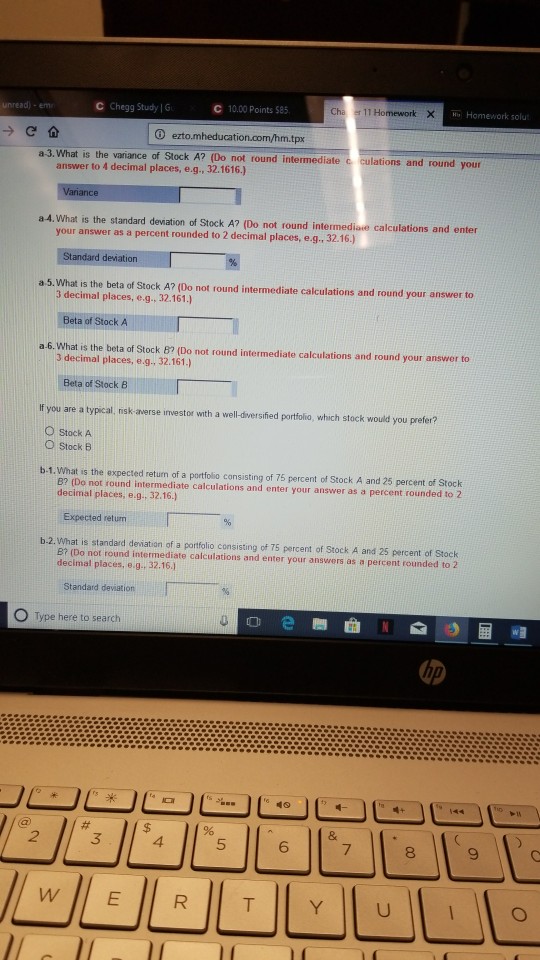

Question

There are two stocks in the market, Stock A and Stock B . The price of Stock A today is $85. The price of Stock

There are two stocks in the market, Stock A and Stock B . The price of Stock A today is $85. The price of Stock A next year will be $74 if the economy is in a recession, $97 if the economy is normal, and $107 if the economy is expanding. The probabilities of recession, normal times, and expansion are .30, .50, and .20, respectively. Stock A pays no dividends and has a correlation of .80 with the market portfolio. Stock B has an expected return of 15.0 percent, a standard deviation of 35.0 percent, a correlation with the market portfolio of .34, and a correlation with Stock A of .46. The market portfolio has a standard deviation of 19.0 percent. Assume the CAPM holds.

here is the question data. Thank You.

unread) - em C Chegg Study IG. ? 10.00 Points se5 Cha 511 Homework Homework solu a-3. What is the vaiance of Stock A? (Do not round intermediate c culations and round your answer to 4 decimal places, e.g. 32.1616.) a-4. What is the standard deviation of Stock A? (Do not round intermediase calculations and enter your answer as a percent rou Btandarddeviation--???% 3 decimal places, e.g., 32.161.) Beta of Stock A 3 decimal places, e.g. 32.161.) a-5. What is the beta of Stock A? (Do not round intermediate calculations and round your answer to a-6. What is the beta of Stock B? (Do not round intermediate calculations and round your answer to Beta of Stock B If you are a typical, nsk-averse investor with a well-dversifed portfolio, which stock would you prefer? O Stock A O Stock B b-1. What is the expected retun of a portfolio consisting of 75 percent of Stock A and 25 percent of Stock B? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g. 32.16.) Expected return 96 b.2. What is standard deviation of a portfolio consisting of 75 percent of Stock A and 25 percent of Stock B? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g. 32.16. Standard deviation O Type here to search hp 49 5 6 7 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started