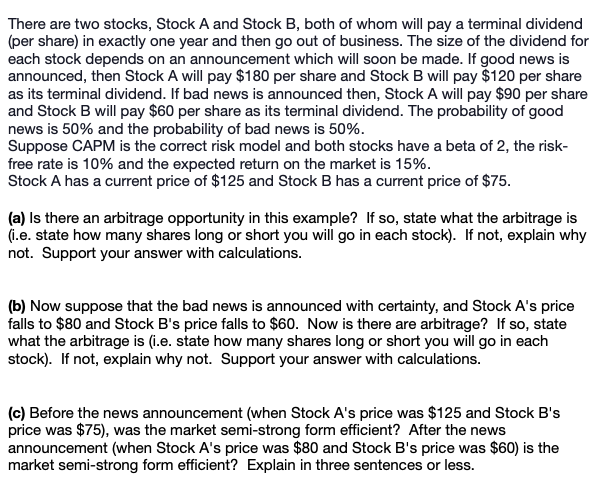

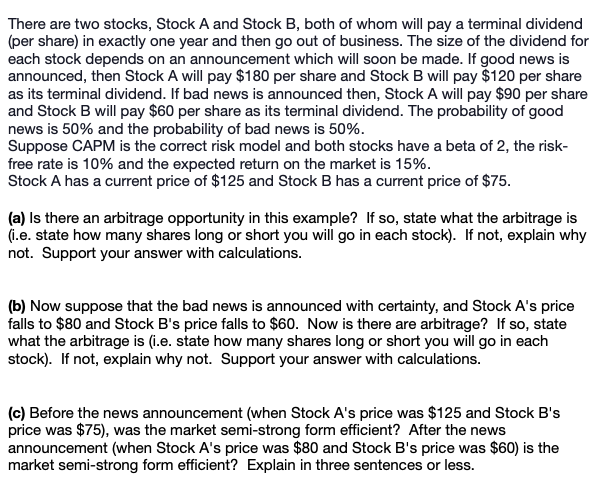

There are two stocks, Stock A and Stock B, both of whom will pay a terminal dividend (per share) in exactly one year and then go out of business. The size of the dividend for each stock depends on an announcement which will soon be made. If good news is announced, then Stock A will pay $180 per share and Stock B will pay $120 per share as its terminal dividend. If bad news is announced then, Stock A will pay $90 per share and Stock B will pay $60 per share as its terminal dividend. The probability of good news is 50% and the probability of bad news is 50%. Suppose CAPM is the correct risk model and both stocks have a beta of 2, the risk- free rate is 10% and the expected return on the market is 15%. Stock A has a current price of $125 and Stock B has a current price of $75. (a) Is there an arbitrage opportunity in this example? If so, state what the arbitrage is (i.e. state how many shares long or short you will go in each stock). If not, explain why not. Support your answer with calculations. (b) Now suppose that the bad news is announced with certainty, and Stock A's price falls to $80 and Stock B's price falls to $60. Now is there are arbitrage? If so, state what the arbitrage is (i.e. state how many shares long or short you will go in each stock). If not, explain why not. Support your answer with calculations. (c) Before the news announcement (when Stock A's price was $125 and Stock B's price was $75), was the market semi-strong form efficient? After the news announcement (when Stock A's price was $80 and Stock B's price was $60) is the market semi-strong form efficient? Explain in three sentences or less. There are two stocks, Stock A and Stock B, both of whom will pay a terminal dividend (per share) in exactly one year and then go out of business. The size of the dividend for each stock depends on an announcement which will soon be made. If good news is announced, then Stock A will pay $180 per share and Stock B will pay $120 per share as its terminal dividend. If bad news is announced then, Stock A will pay $90 per share and Stock B will pay $60 per share as its terminal dividend. The probability of good news is 50% and the probability of bad news is 50%. Suppose CAPM is the correct risk model and both stocks have a beta of 2, the risk- free rate is 10% and the expected return on the market is 15%. Stock A has a current price of $125 and Stock B has a current price of $75. (a) Is there an arbitrage opportunity in this example? If so, state what the arbitrage is (i.e. state how many shares long or short you will go in each stock). If not, explain why not. Support your answer with calculations. (b) Now suppose that the bad news is announced with certainty, and Stock A's price falls to $80 and Stock B's price falls to $60. Now is there are arbitrage? If so, state what the arbitrage is (i.e. state how many shares long or short you will go in each stock). If not, explain why not. Support your answer with calculations. (c) Before the news announcement (when Stock A's price was $125 and Stock B's price was $75), was the market semi-strong form efficient? After the news announcement (when Stock A's price was $80 and Stock B's price was $60) is the market semi-strong form efficient? Explain in three sentences or less