there is 4 questions in total

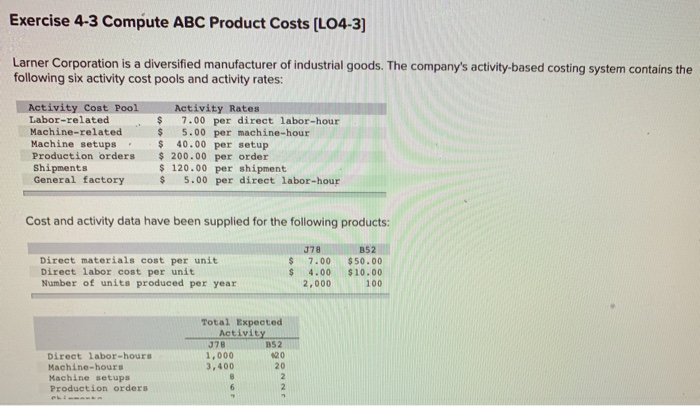

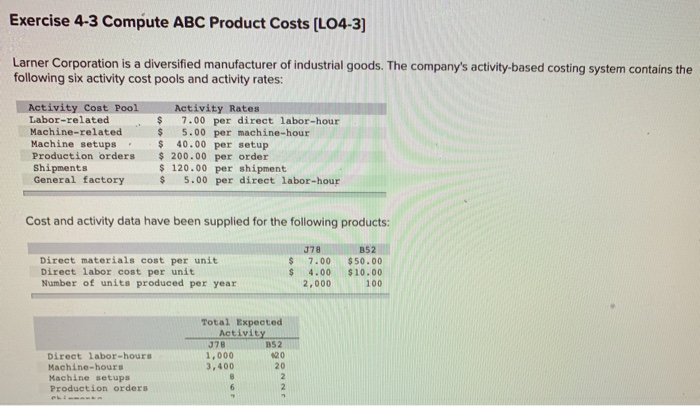

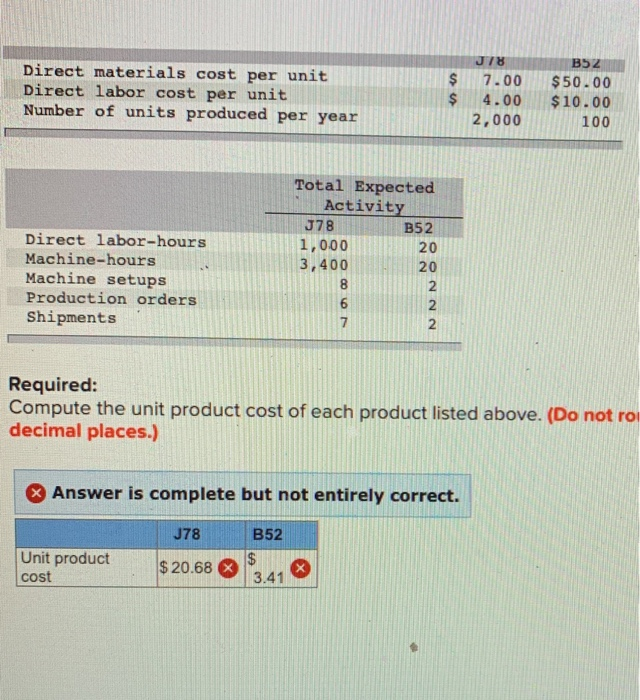

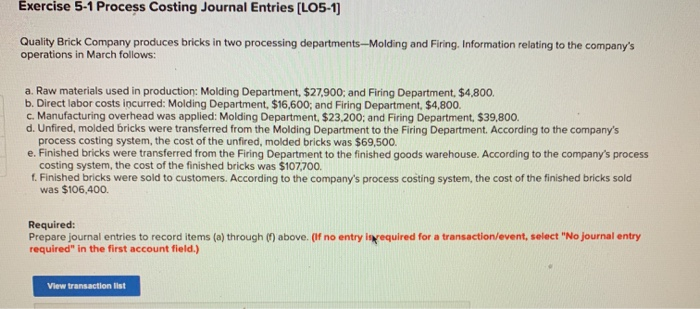

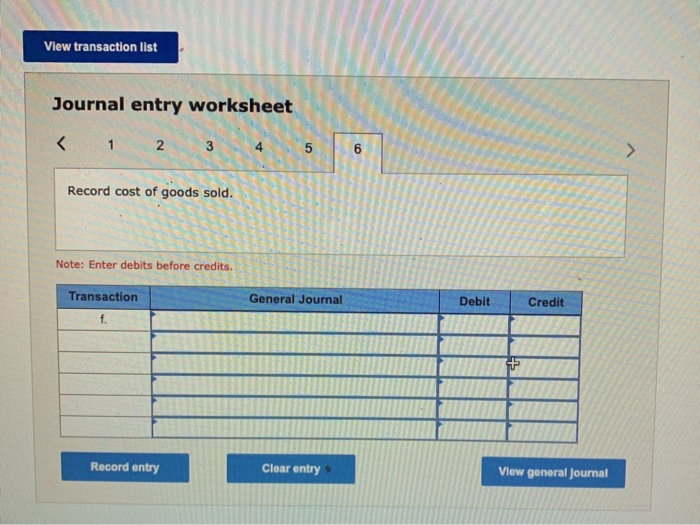

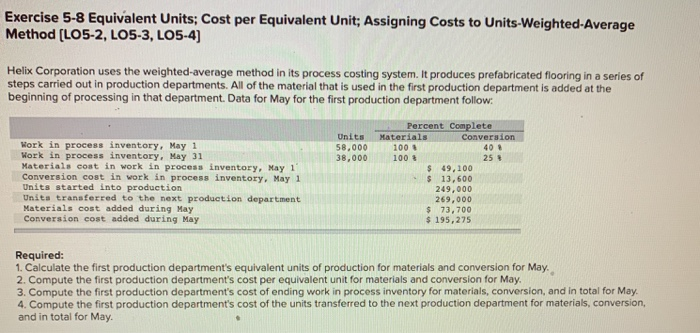

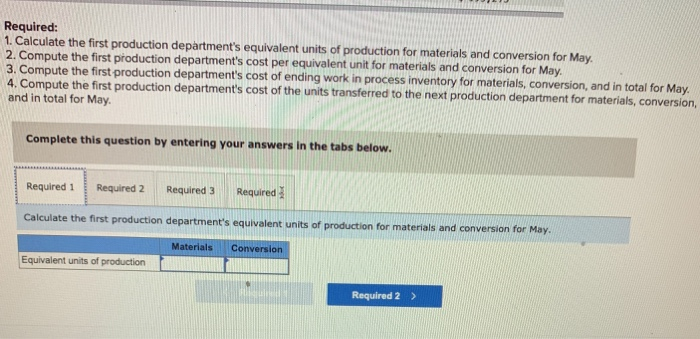

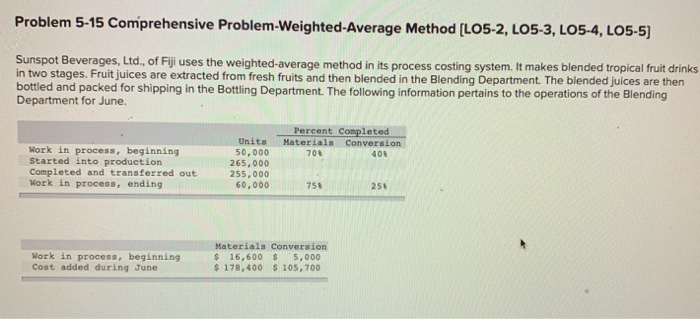

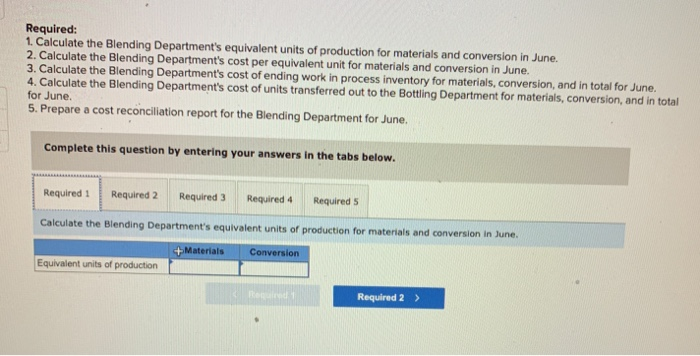

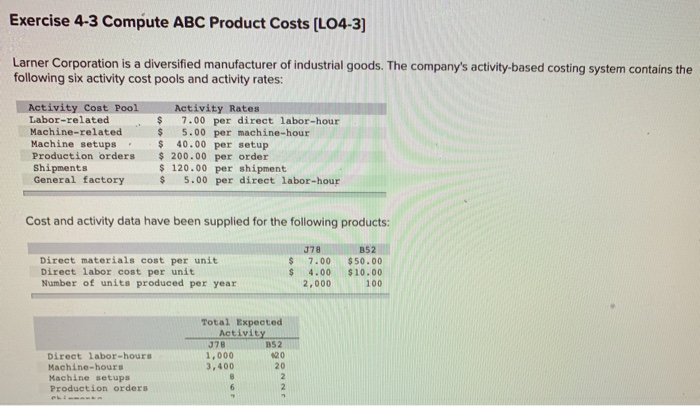

Exercise 4-3 Compute ABC Product Costs (L04-3] Larner Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system contains the following six activity cost pools and activity rates: Activity Cost Pool Activity Rates Labor-related $ 7.00 per direct labor-hour Machine-related $ 5.00 per machine-hour Machine setups $ 40.00 per setup Production orders $ 200.00 per order Shipments $ 120.00 per shipment General factory 5.00 per direct labor-hour $ Cost and activity data have been supplied for the following products: $ Direct materials cost per unit Direct labor cost per unit Number of units produced per year 378 7.00 4.00 2,000 B52 $50.00 $10.00 100 $ Direct labor-hours Machine-hours Machine setups Production orders Total Expected Activity J78 B52 1,000 $20 3,400 20 8 2 6 2 Direct materials cost per unit Direct labor cost per unit Number of units produced per year $ $ JI 7.00 4.00 2,000 B52 $50.00 $10.00 100 Direct labor-hours Machine-hours Machine setups Production orders Shipments Total Expected Activity J78 B52 1,000 20 3,400 8 6 7 NNNO Required: Compute the unit product cost of each product listed above. (Do not roi decimal places.) Answer is complete but not entirely correct. J78 B52 Unit product cost $ 20.68 $ 3.41 Exercise 5-1 Process Costing Journal Entries (LO5-1) Quality Brick Company produces bricks in two processing departments--Molding and Firing. Information relating to the company's operations in March follows: a. Raw materials used in production: Molding Department, $27,900; and Firing Department, $4,800. b. Direct labor costs incurred: Molding Department, $16,600; and Firing Department, $4,800. c. Manufacturing overhead was applied: Molding Department. $23.200; and Firing Department. $39,800. d. Unfired, molded bricks were transferred from the Molding Department to the Firing Department. According to the company's process costing system, the cost of the unfired, molded bricks was $69,500. e. Finished bricks were transferred from the Firing Department to the finished goods warehouse. According to the company's process costing system, the cost of the finished bricks was $107,700. 1. Finished bricks were sold to customers. According to the company's process costing system, the cost of the finished bricks sold was $106,400. Required: Prepare journal entries to record items (a) through () above. (If no entry is equired for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View transaction list Journal entry worksheet Record cost of goods sold. Note: Enter debits before credits. Transaction General Journal Debit Credit f. Record entry Clear entry View general Journal Exercise 5-8 Equivalent Units; Cost per Equivalent Unit; Assigning Costs to Units-Weighted-Average Method (LO5-2, LO5-3, L05-4) Helix Corporation uses the weighted-average method in its process costing system. It produces prefabricated flooring in a series of steps carried out in production departments. All of the material that is used in the first production department is added at the beginning of processing in that department. Data for May for the first production department follow: Units 58,000 38,000 Work in process inventory, May 1 Work in process inventory, May 31 Materials coat in work in process inventory, May 1 Conversion cost in work in process inventory, May 1 Units started into production Units transferred to the next production department Materials cost added during May Conversion cost added during May Percent Complete Materials Conversion 100 40 100 25 $ 49,100 $ 13,600 249,000 269,000 $ 73, 700 $ 195,275 Required: 1. Calculate the first production department's equivalent units of production for materials and conversion for May. 2. Compute the first production department's cost per equivalent unit for materials and conversion for May. 3. Compute the first production department's cost of ending work in process inventory for materials, conversion, and in total for May. 4. Compute the first production department's cost of the units transferred to the next production department for materials, conversion, and in total for May. Required: 1. Calculate the first production department's equivalent units of production for materials and conversion for May. 2. Compute the first production department's cost per equivalent unit for materials and conversion for May. 3. Compute the first production department's cost of ending work in process inventory for materials, conversion, and in total for May 4. Compute the first production department's cost of the units transferred to the next production department for materials, conversion, and in total for May Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required Calculate the first production department's equivalent units of production for materials and conversion for May. Materials Conversion Equivalent units of production Required 2 > Problem 5-15 Comprehensive Problem-Weighted-Average Method [LO5-2, LO5-3, LO5-4, LO5-5) Sunspot Beverages, Ltd., of Fiji uses the weighted-average method in its process costing system. It makes blended tropical fruit drinks in two stages. Fruit juices are extracted from fresh fruits and then blended in the Blending Department. The blended juices are then bottled and packed for shipping in the Bottling Department. The following information pertains to the operations of the Blending Department for June Percent Completed Materials Conversion Work in process, beginning 50,000 Started into production 265,000 Completed and transferred out 255,000 Work in process, ending 60,000 Units 703 40% 758 250 Work in process, beginning Cost added during June Materials Conversion $ 16,600 $ 5,000 $ 178,400 $ 105,700 Required: 1. Calculate the Blending Department's equivalent units of production for materials and conversion in June. 2. Calculate the Blending Department's cost per equivalent unit for materials and conversion in June. 3. Calculate the Blending Department's cost of ending work in process inventory for materials, conversion, and in total for June. 4. Calculate the Blending Department's cost of units transferred out to the Bottling Department for materials, conversion, and in total for June 5. Prepare a cost reconciliation report for the Blending Department for June. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Calculate the Blending Department's equivalent units of production for materials and conversion in June. + Materials Equivalent units of production Conversion Required 2 >