Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There is a startup that specializes in this product, and they are already selling to in your target market. As a result, your organization has

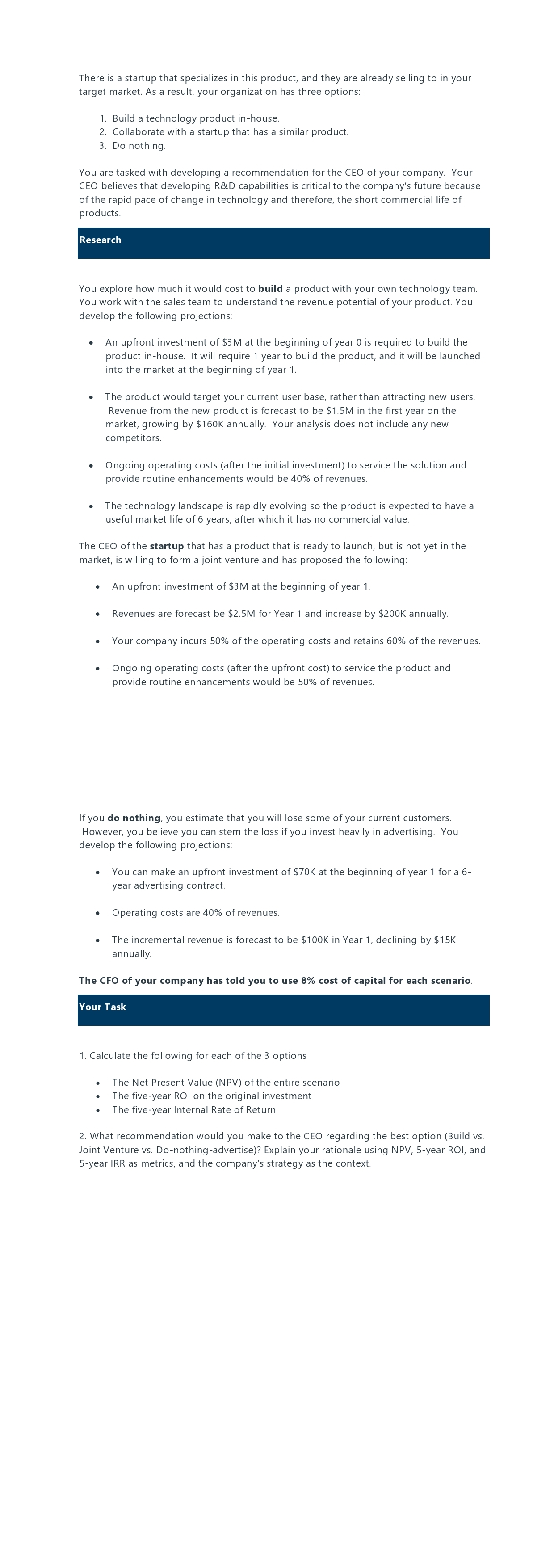

There is a startup that specializes in this product, and they are already selling to in your target market. As a result, your organization has three options: 1. Build a technology product in-house. 2. Collaborate with a startup that has a similar product. 3. Do nothing. You are tasked with developing a recommendation for the CEO of your company. Your CEO believes that developing R\&D capabilities is critical to the company's future because of the rapid pace of change in technology and therefore, the short commercial life of products. Research You explore how much it would cost to build a product with your own technology team. You work with the sales team to understand the revenue potential of your product. You develop the following projections: - An upfront investment of $3M at the beginning of year 0 is required to build the product in-house. It will require 1 year to build the product, and it will be launched into the market at the beginning of year 1 . - The product would target your current user base, rather than attracting new users. Revenue from the new product is forecast to be $1.5M in the first year on the market, growing by $160K annually. Your analysis does not include any new competitors. - Ongoing operating costs (after the initial investment) to service the solution and provide routine enhancements would be 40% of revenues. - The technology landscape is rapidly evolving so the product is expected to have a useful market life of 6 years, after which it has no commercial value. The CEO of the startup that has a product that is ready to launch, but is not yet in the market, is willing to form a joint venture and has proposed the following: - An upfront investment of $3M at the beginning of year 1 . - Revenues are forecast be $2.5M for Year 1 and increase by $200K annually. - Your company incurs 50% of the operating costs and retains 60% of the revenues. - Ongoing operating costs (after the upfront cost) to service the product and provide routine enhancements would be 50% of revenues. If you do nothing, you estimate that you will lose some of your current customers. However, you believe you can stem the loss if you invest heavily in advertising. You develop the following projections: - You can make an upfront investment of $70K at the beginning of year 1 for a 6 year advertising contract. - Operating costs are 40% of revenues. - The incremental revenue is forecast to be $100K in Year 1 , declining by $15K annually. The CFO of your company has told you to use 8% cost of capital for each scenario Your Task 1. Calculate the following for each of the 3 options - The Net Present Value (NPV) of the entire scenario - The five-year ROI on the original investment - The five-year Internal Rate of Return 2. What recommendation would you make to the CEO regarding the best option (Build vs. Joint Venture vs. Do-nothing-advertise)? Explain your rationale using NPV, 5-year ROI, and 5-year IRR as metrics, and the company's strategy as the context

There is a startup that specializes in this product, and they are already selling to in your target market. As a result, your organization has three options: 1. Build a technology product in-house. 2. Collaborate with a startup that has a similar product. 3. Do nothing. You are tasked with developing a recommendation for the CEO of your company. Your CEO believes that developing R\&D capabilities is critical to the company's future because of the rapid pace of change in technology and therefore, the short commercial life of products. Research You explore how much it would cost to build a product with your own technology team. You work with the sales team to understand the revenue potential of your product. You develop the following projections: - An upfront investment of $3M at the beginning of year 0 is required to build the product in-house. It will require 1 year to build the product, and it will be launched into the market at the beginning of year 1 . - The product would target your current user base, rather than attracting new users. Revenue from the new product is forecast to be $1.5M in the first year on the market, growing by $160K annually. Your analysis does not include any new competitors. - Ongoing operating costs (after the initial investment) to service the solution and provide routine enhancements would be 40% of revenues. - The technology landscape is rapidly evolving so the product is expected to have a useful market life of 6 years, after which it has no commercial value. The CEO of the startup that has a product that is ready to launch, but is not yet in the market, is willing to form a joint venture and has proposed the following: - An upfront investment of $3M at the beginning of year 1 . - Revenues are forecast be $2.5M for Year 1 and increase by $200K annually. - Your company incurs 50% of the operating costs and retains 60% of the revenues. - Ongoing operating costs (after the upfront cost) to service the product and provide routine enhancements would be 50% of revenues. If you do nothing, you estimate that you will lose some of your current customers. However, you believe you can stem the loss if you invest heavily in advertising. You develop the following projections: - You can make an upfront investment of $70K at the beginning of year 1 for a 6 year advertising contract. - Operating costs are 40% of revenues. - The incremental revenue is forecast to be $100K in Year 1 , declining by $15K annually. The CFO of your company has told you to use 8% cost of capital for each scenario Your Task 1. Calculate the following for each of the 3 options - The Net Present Value (NPV) of the entire scenario - The five-year ROI on the original investment - The five-year Internal Rate of Return 2. What recommendation would you make to the CEO regarding the best option (Build vs. Joint Venture vs. Do-nothing-advertise)? Explain your rationale using NPV, 5-year ROI, and 5-year IRR as metrics, and the company's strategy as the context Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started