There is one risk-free asset that pays a return of rF=0.005. There are 3 risky assets: A, B and C. The expected returns of the risky assets are: A=0.01, B=0.02, C=0.03. The variances are: 2A=0.00001, 2B=0.0004, 2C=0.0036. The covariances are: AB=0.0002, AC=0, BC=-0.0002. Combining A,B and C, we create four risky portofolios, called 1,2,3 and 4. The shares of assets A, B and C in portfolio 1 are: w1A=0.6, w1B=0.2 and w1C=0.2. Similarly, the share in portfolio 2 are: w2A=0.2, w2B=0.4 and w2C=0.4. Porfolio 3 shares are: w3A=0.3, w3B=0.2 and w3C=0.5. Finally the shares in portfolio 4 are: w4A=0.2, w4B=0.6 and w4C=0.2.

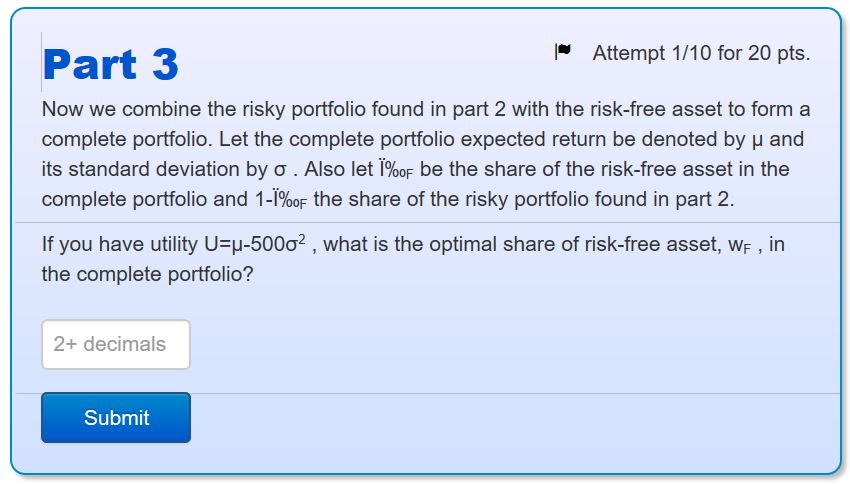

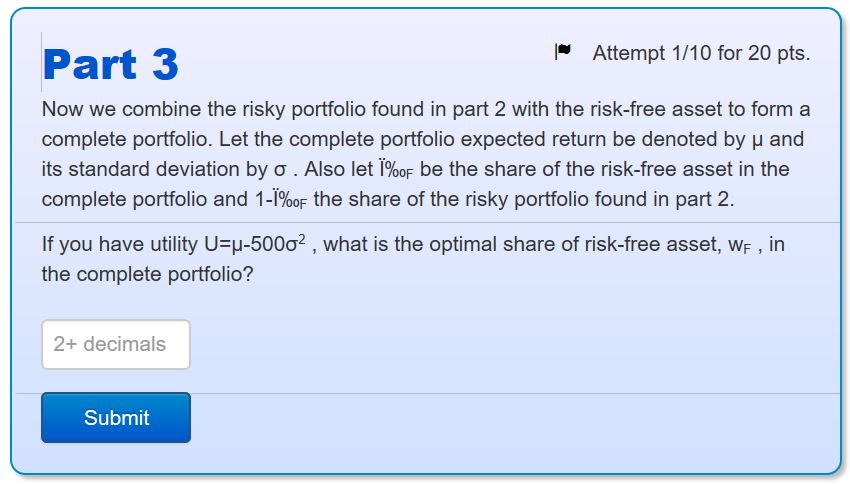

Now we combine the risky portfolio found in part 2 with the risk-free asset to form a complete portfolio. Let the complete portfolio expected return be denoted by and its standard deviation by . Also let F be the share of the risk-free asset in the complete portfolio and 1-F the share of the risky portfolio found in part 2.

If you have utility U=-5002 , what is the optimal share of risk-free asset, wF , in the complete portfolio?

I only need help with PART 3 & PART4, I provided screenshots of the previous answers.

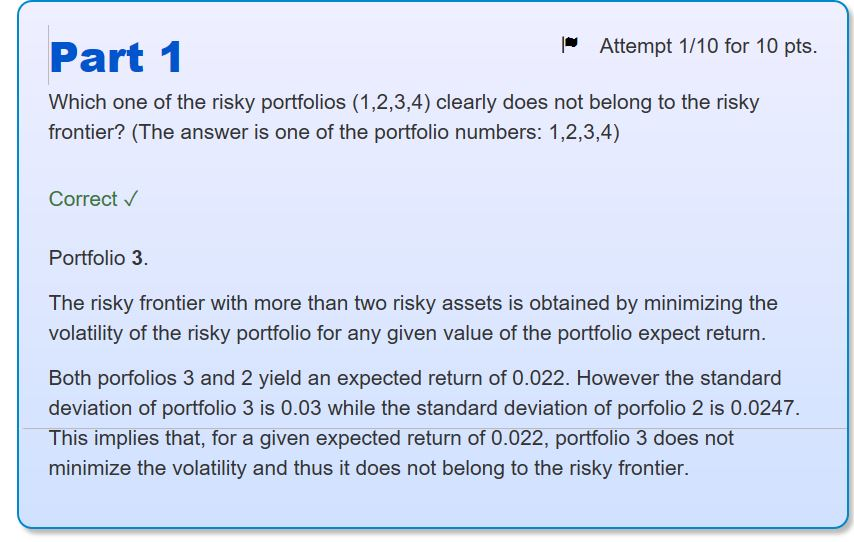

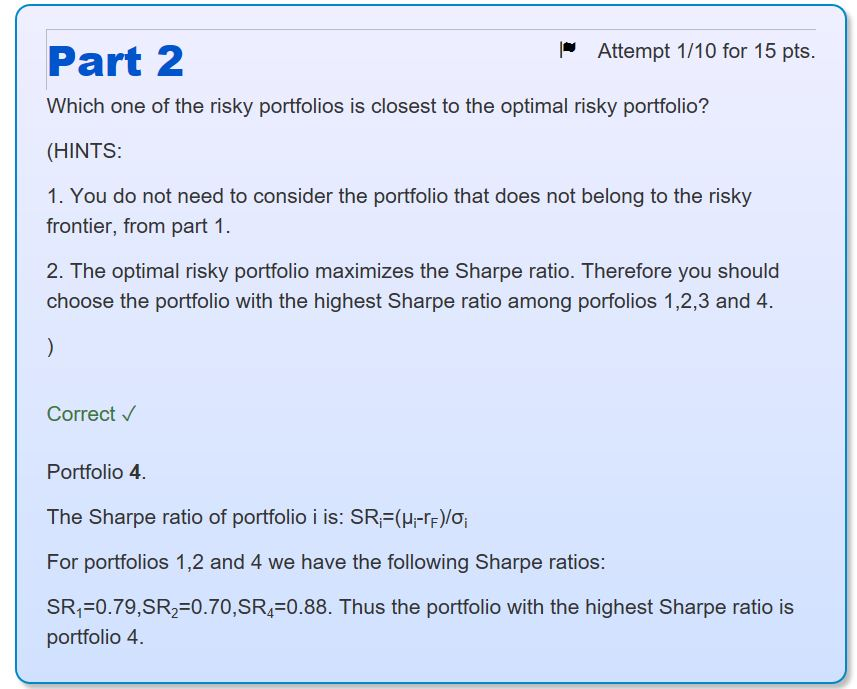

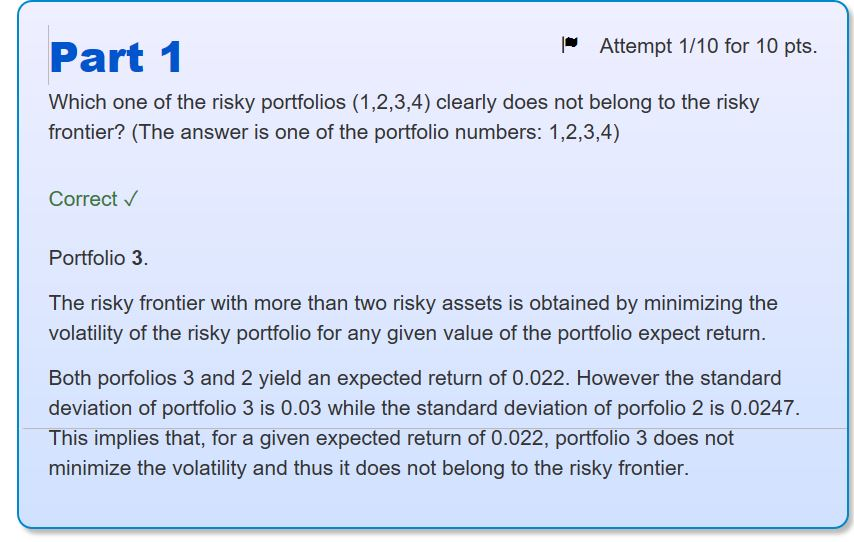

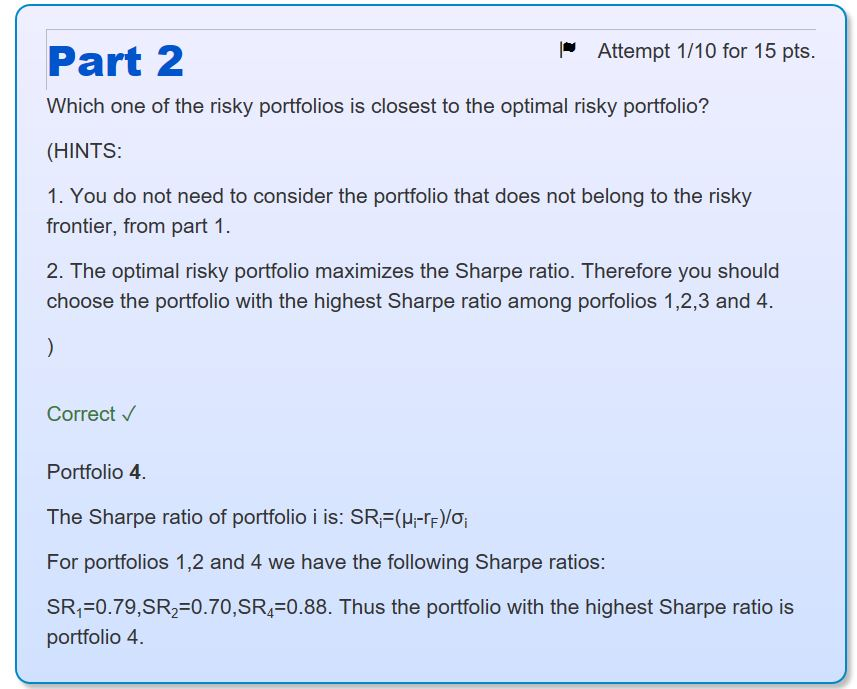

Attempt 1/10 for 10 pts. Part 1 Which one of the risky portfolios (1,2,3,4) clearly does not belong to the risky frontier? (The answer is one of the portfolio numbers: 1,2,3,4) Correct Portfolio 3. The risky frontier with more than two risky assets is obtained by minimizing the volatility of the risky portfolio for any given value of the portfolio expect return. Both porfolios 3 and 2 yield an expected return of 0.022. However the standard deviation of portfolio 3 is 0.03 while the standard deviation of porfolio 2 is 0.0247 This implies that, for a given expected return of 0.022, portfolio 3 does not minimize the volatility and thus it does not belong to the risky frontier. Attempt 1/10 for 15 pts. Part 2 Which one of the risky portfolios is closest to the optimal risky portfolio? (HINTS: 1. You do not need to consider the portfolio that does not belong to the risky frontier, from part 1 2. The optimal risky portfolio maximizes the Sharpe ratio. Therefore you should choose the portfolio with the highest Sharpe ratio among porfolios 1,2,3 and 4. Correct v Portfolio 4. The Sharpe ratio of portfolio i is: SRF(H-TF)o, For portfolios 1,2 and 4 we have the following Sharpe ratios: SRi-0.79,SR2 0.70,SR4-0.88. Thus the portfolio with the highest Sharpe ratio is portfolio 4 Part 3 Attempt 1/10 for 20 pts. Now we combine the risky portfolio found in part 2 with the risk-free asset to form a complete portfolio. Let the complete portfolio expected return be denoted by u and its standard deviation by . Also let T%OF be the share of the risk-free asset in the complete portfolio and 11%OF the share of the risky portfolio found in part 2. If you have utility U u-5002 , what is the optimal share of risk-free asset, wF , in the complete portfolio? 2+ decimals Submit Attempt 1/10 for 15 pts. Part 4 Finally, what is the share of asset A in the complete portfolio that you determined in part 3? 4+ decimals Submit Attempt 1/10 for 10 pts. Part 1 Which one of the risky portfolios (1,2,3,4) clearly does not belong to the risky frontier? (The answer is one of the portfolio numbers: 1,2,3,4) Correct Portfolio 3. The risky frontier with more than two risky assets is obtained by minimizing the volatility of the risky portfolio for any given value of the portfolio expect return. Both porfolios 3 and 2 yield an expected return of 0.022. However the standard deviation of portfolio 3 is 0.03 while the standard deviation of porfolio 2 is 0.0247 This implies that, for a given expected return of 0.022, portfolio 3 does not minimize the volatility and thus it does not belong to the risky frontier. Attempt 1/10 for 15 pts. Part 2 Which one of the risky portfolios is closest to the optimal risky portfolio? (HINTS: 1. You do not need to consider the portfolio that does not belong to the risky frontier, from part 1 2. The optimal risky portfolio maximizes the Sharpe ratio. Therefore you should choose the portfolio with the highest Sharpe ratio among porfolios 1,2,3 and 4. Correct v Portfolio 4. The Sharpe ratio of portfolio i is: SRF(H-TF)o, For portfolios 1,2 and 4 we have the following Sharpe ratios: SRi-0.79,SR2 0.70,SR4-0.88. Thus the portfolio with the highest Sharpe ratio is portfolio 4 Part 3 Attempt 1/10 for 20 pts. Now we combine the risky portfolio found in part 2 with the risk-free asset to form a complete portfolio. Let the complete portfolio expected return be denoted by u and its standard deviation by . Also let T%OF be the share of the risk-free asset in the complete portfolio and 11%OF the share of the risky portfolio found in part 2. If you have utility U u-5002 , what is the optimal share of risk-free asset, wF , in the complete portfolio? 2+ decimals Submit Attempt 1/10 for 15 pts. Part 4 Finally, what is the share of asset A in the complete portfolio that you determined in part 3? 4+ decimals Submit