Answered step by step

Verified Expert Solution

Question

1 Approved Answer

There was no shipping expense because the Navy would pay it. He estimated state and federal income taxes at 35% of profit. He estimated

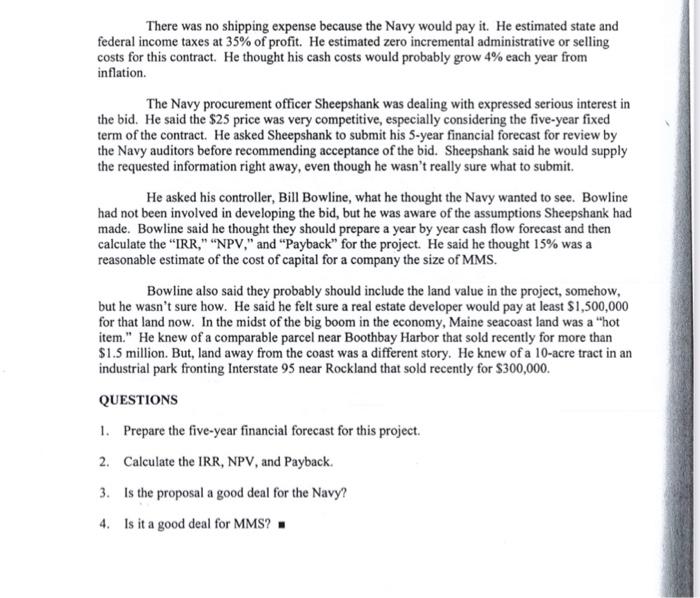

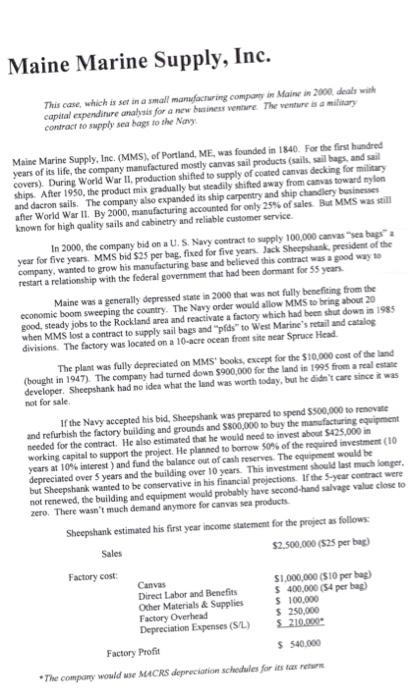

There was no shipping expense because the Navy would pay it. He estimated state and federal income taxes at 35% of profit. He estimated zero incremental administrative or selling costs for this contract. He thought his cash costs would probably grow 4% each year from inflation. The Navy procurement officer Sheepshank was dealing with expressed serious interest in the bid. He said the $25 price was very competitive, especially considering the five-year fixed term of the contract. He asked Sheepshank to submit his 5-year financial forecast for review by the Navy auditors before recommending acceptance of the bid. Sheepshank said he would supply the requested information right away, even though he wasn't really sure what to submit. He asked his controller, Bill Bowline, what he thought the Navy wanted to see. Bowline had not been involved in developing the bid, but he was aware of the assumptions Sheepshank had made. Bowline said he thought they should prepare a year by year cash flow forecast and then calculate the "IRR," "NPV," and "Payback" for the project. He said he thought 15% was a reasonable estimate of the cost of capital for a company the size of MMS. Bowline also said they probably should include the land value in the project, somehow, but he wasn't sure how. He said he felt sure a real estate developer would pay at least $1,500,000 for that land now. In the midst of the big boom in the economy, Maine seacoast land was a "hot item." He knew of a comparable parcel near Boothbay Harbor that sold recently for more than $1.5 million. But, land away from the coast was a different story. He knew of a 10-acre tract in an industrial park fronting Interstate 95 near Rockland that sold recently for $300,000. QUESTIONS 1. Prepare the five-year financial forecast for this project. 2. Calculate the IRR, NPV, and Payback. 3. Is the proposal a good deal for the Navy? 4. Is it a good deal for MMS? Maine Marine Supply, Inc. This case, which is set in a small manufacturing company in Maine in 2000, deals with capital expenditure analysis for a new business venture. The venture is a military contract to supply sea bags to the Navy Maine Marine Supply, Inc. (MMS), of Portland, ME, was founded in 1840. For the first hundred years of its life, the company manufactured mostly canvas sail products (sails, sail bags, and sail covers). During World War II, production shifted to supply of coated canvas decking for military ships. After 1950, the product mix gradually but steadily shifted away from canvas toward nylon and dacron sails. The company also expanded its ship carpentry and ship chandlery businesses after World War II. By 2000, manufacturing accounted for only 25% of sales. But MMS was still known for high quality sails and cabinetry and reliable customer service. In 2000, the company bid on a U. S. Navy contract to supply 100,000 canvas "sea bags a year for five years. MMS bid $25 per bag, fixed for five years. Jack Sheepshank, president of the company, wanted to grow his manufacturing base and believed this contract was a good way to restart a relationship with the federal government that had been dormant for 55 years. Maine was a generally depressed state in 2000 that was not fully benefiting from the economic boom sweeping the country. The Navy order would allow MMS to bring about 20 good, steady jobs to the Rockland area and reactivate a factory which had been shut down in 1985 when MMS lost a contract to supply sail bags and "pfds" to West Marine's retail and catalog divisions. The factory was located on a 10-acre ocean front site near Spruce Head The plant was fully depreciated on MMS' books, except for the $10,000 cost of the land (bought in 1947). The company had turned down $900,000 for the land in 1995 from a real estate developer. Sheepshank had no idea what the land was worth today, but he didn't care since it was not for sale. If the Navy accepted his bid, Sheepshank was prepared to spend $500,000 to renovate and refurbish the factory building and grounds and $800,000 to buy the manufacturing equipment needed for the contract. He also estimated that he would need to invest about $425,000 in working capital to support the project. He planned to borrow 50% of the required investment (10 years at 10% interest) and fund the balance out of cash reserves. The equipment would be depreciated over 5 years and the building over 10 years. This investment should last much longer, but Sheepshank wanted to be conservative in his financial projections. If the 5-year contract were not renewed, the building and equipment would probably have second-hand salvage value close to zero. There wasn't much demand anymore for canvas sea products Sheepshank estimated his first year income statement for the project as follows: Sales Factory cost $2,500,000 ($25 per bag) Canvas Direct Labor and Benefits Other Materials & Supplies Factory Overhead Depreciation Expenses (S/L) Factory Profit $1,000,000 ($10 per bag) $ 400,000 ($4 per bag) $ 100,000 $ 250,000 $210.000 $540,000 The company would use MACRS depreciation schedules for its tax return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started