Answered step by step

Verified Expert Solution

Question

1 Approved Answer

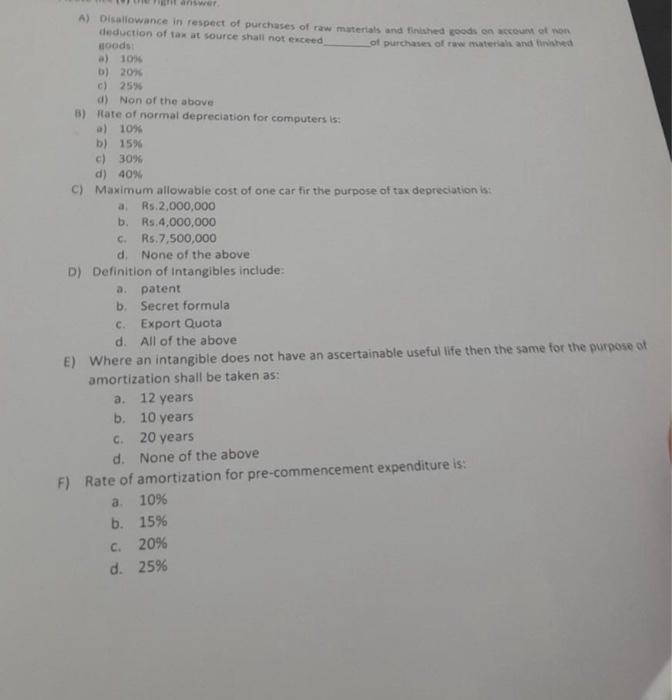

these are mcqs of taxation pla help with correct answers asap A) Dikaliowance in respect of purchases of raw materials and finiahed goods on acreum

these are mcqs of taxation pla help with correct answers asap

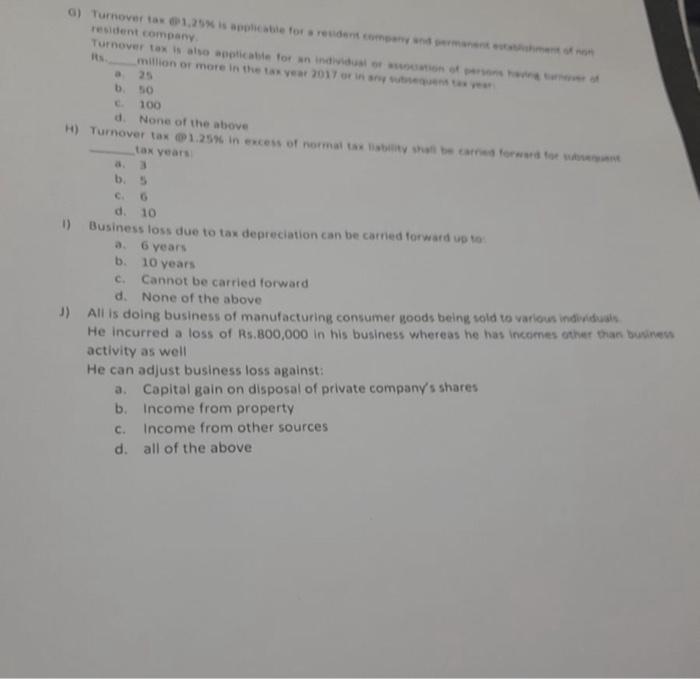

A) Dikaliowance in respect of purchases of raw materials and finiahed goods on acreum ot now deduction of tan at source shall not ekceed noads of purchases of rawe materiah and finiched a) 1005 b) 20 c) 25% a) Non of the above B) Hate of normal depreciation for computers is: a) 10% b) 15% c) 30% d) 40% C) Maximum allowable cost of one car fir the purpose of tax depreciation is: a. Rs.2,000,000 b. Rs, 4,000,000 c. Rs.7,500,000 d. None of the above D) Definition of Intangibles include: a. patent b. Secret formula c. Export Quota d. All of the above E) Where an intangible does not have an ascertainable useful life then the same for the purpose of amortization shall be taken as: a. 12 years b. 10 years c. 20 years d. None of the above F) Rate of amortization for pre-commencement expenditure is: a. 10% b. 15% c. 20% d. 25% Turnover tex is also agpticable tor an individual of arseiarion of perpins hiving tiencwer of. 14. million or mare in the tax vear 3017 or in soy tubiepuens tar owas a. 25 c. 100 a. None of the above H) Turnover tax (i) 1.25% in excess of normat tas lisbinty shef be earned forwara tae uavenane. tax years. a. 3 b. 5 c. 6 d. 10 1) Business loss due to tax depreciation can be carried torward up to: a. 6 years b. 10 years c. Cannot be carried forward d. None of the above 1) All is doing business of manufacturing consumer goods being vold to varlows indiuiduals He incurred a loss of Rs.800,000 in his business whereas he has incornes other than buwines activity as well He can adjust business loss against: a. Capital gain on disposal of private company's shares b. Income from property c. Income from other sources d. all of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started