these are only two questions. first two pictures makes "one" and the rest of the pictures makes "second" question. thank you

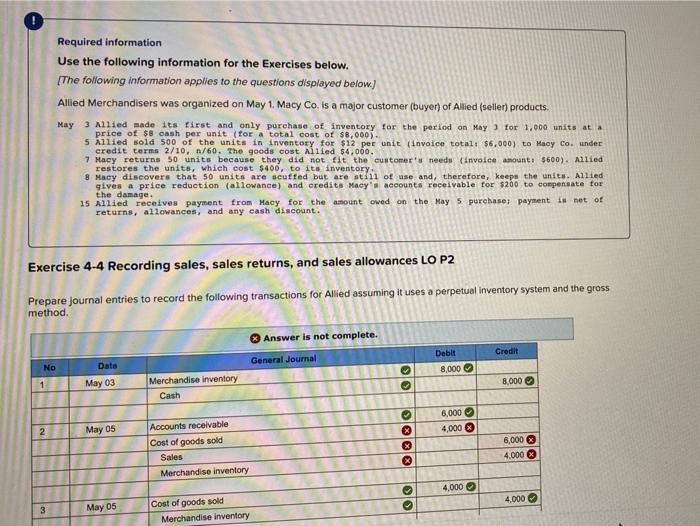

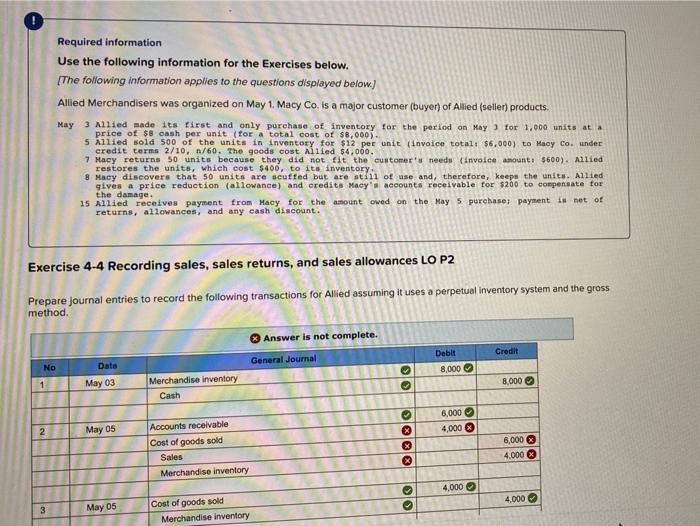

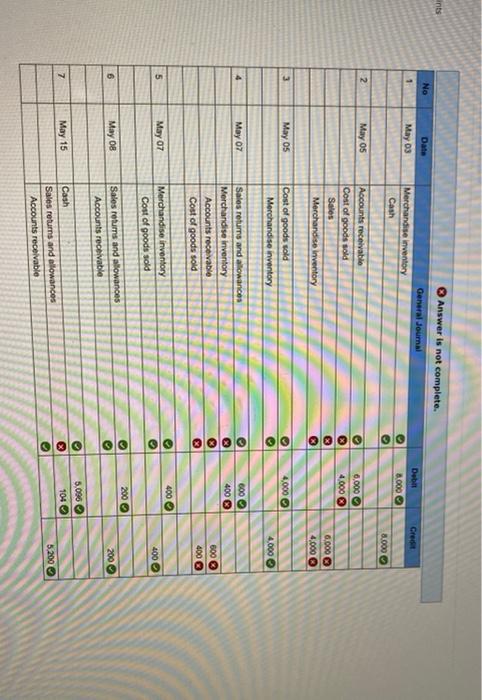

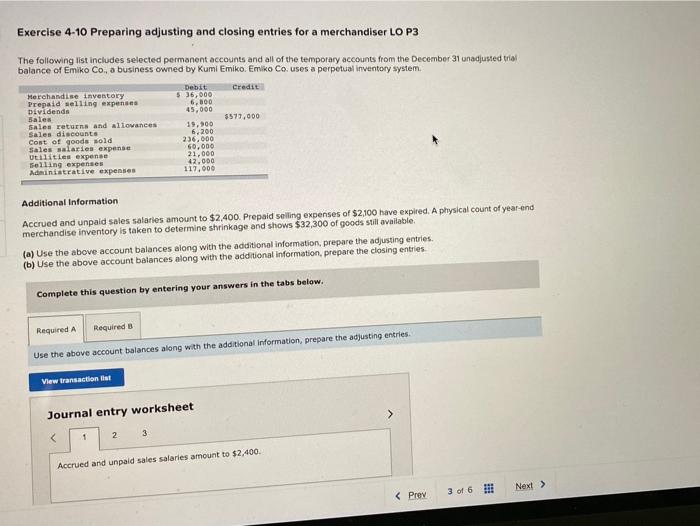

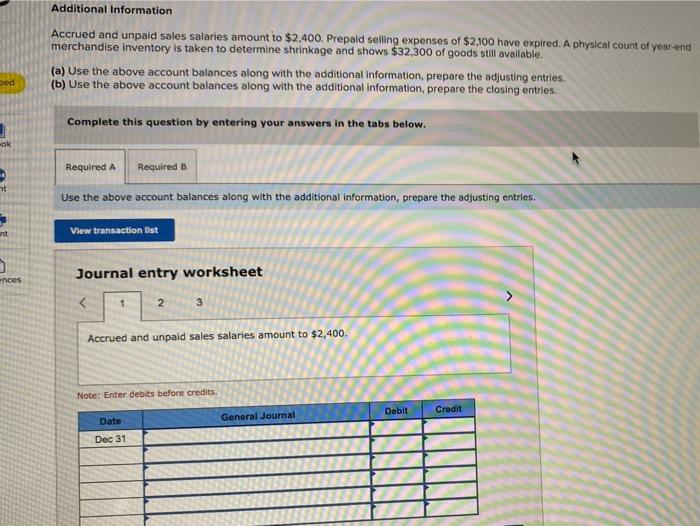

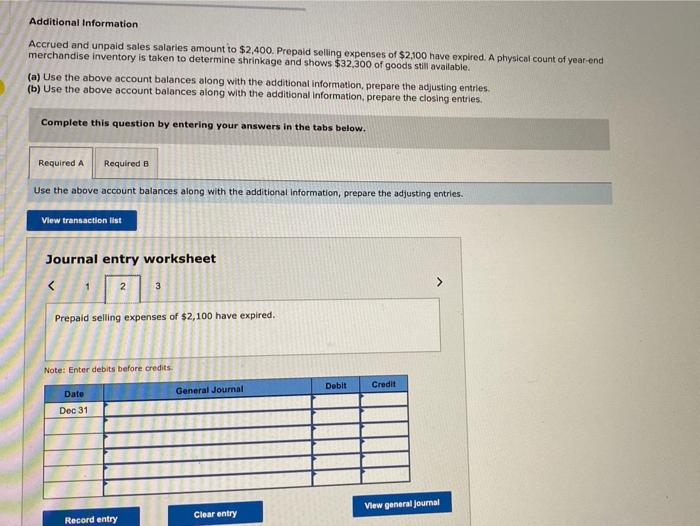

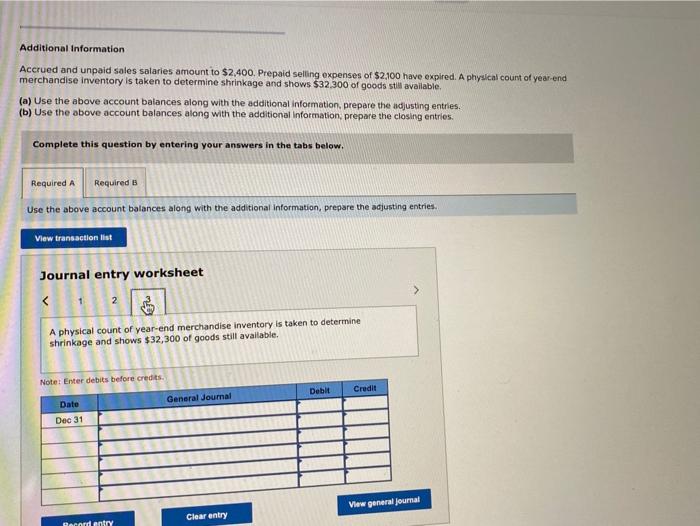

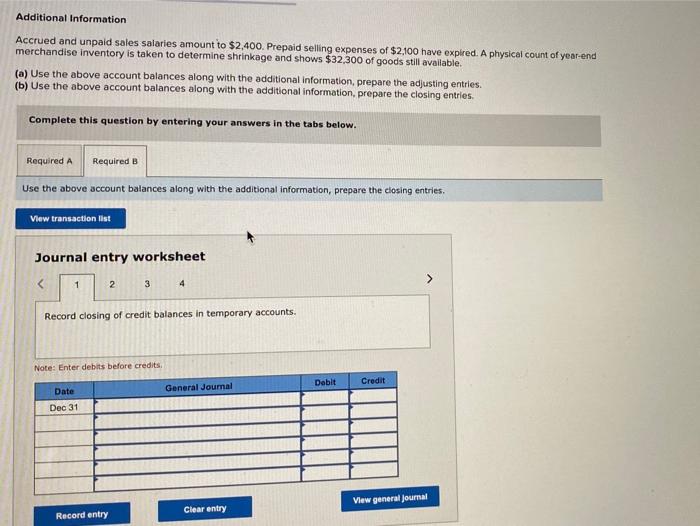

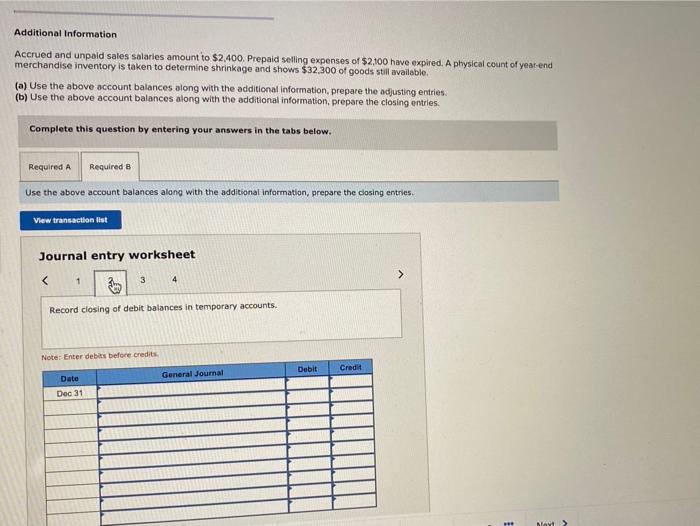

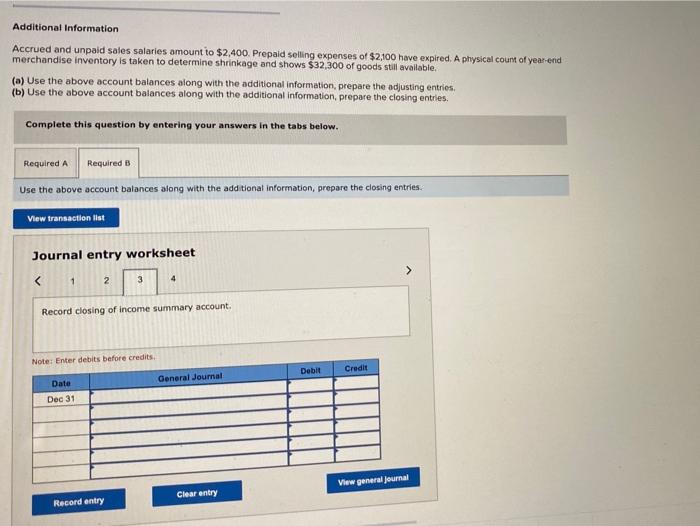

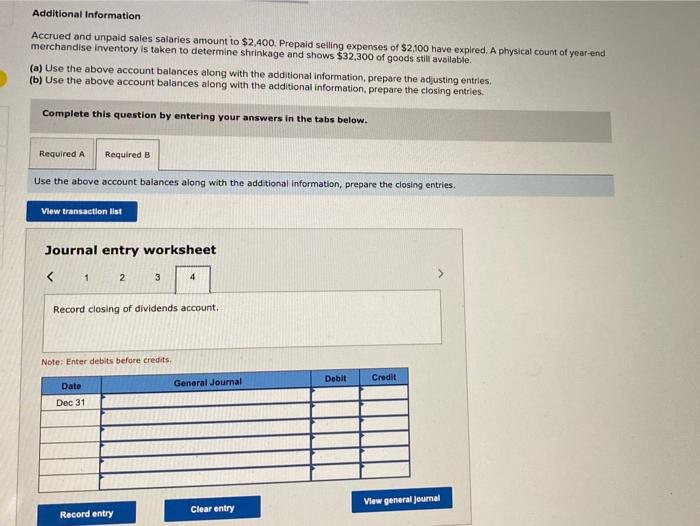

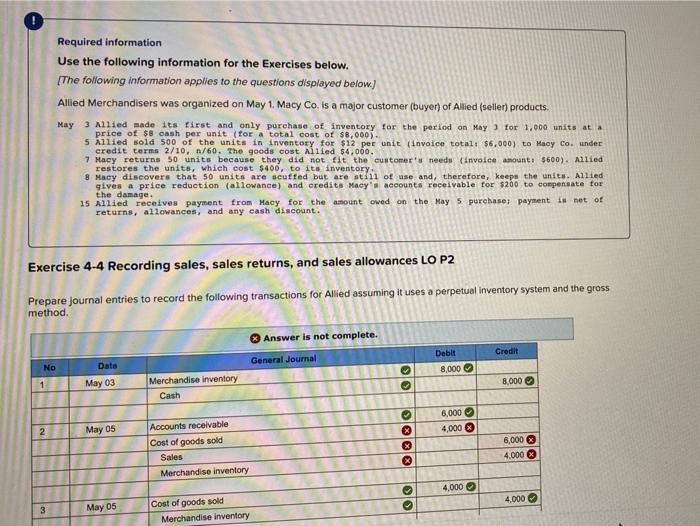

Required information Use the following information for the Exercises below. [The following information applies to the questions displayed below) Allied Merchandisers was organized on May 1. Macy Co. is a major customer (buyer) of Allied (seller) products. May 3 Allied made its first and only purchase of inventory for the period on May 1 for 1.000 units at price of $8 cash per unit (for a total cost of $8,000). 5 Allied sold 500 of the units in inventory for $12 per unit (invoice total: $6,000) to Macy Co. under credit terms 2/10, 1/60. The goods cost Allied $4,000. 7 Hacy returns 50 units because they did not fit the customer's needs (invoice amount: $600). Allied restores the units, which cost $400, to its inventory, 8 Macy discovers that 50 units are scuffed but are still of use and, therefore, keeps the units. Allied gives a price reduction (allowance) and credits Macy's accounts receivable for $200 to compensate for the damage. 15 Allied receives payment from Macy for the amount owed on the May 5 purchase payment is net of returns, allowances, and any cash discount. Exercise 4-4 Recording sales, sales returns, and sales allowances LO P2 Prepare journal entries to record the following transactions for Allied assuming it uses a perpetual inventory system and the gross method. Answer is not complete. General Journal Credit Debit 8,000 No Date May 03 1 Olo Merchandise inventory Cash 8.000 6,000 4,000 2 May 05 Accounts receivable Cost of goods sold Sales Merchandise inventory 6,000 4,000 4,000 010 4,000 3 May 05 Cost of goods sold Merchandise inventory ng Answer is not complete. No Date General Journal 1 Crest May 03 Merchandise inventory Cash Dent 8.000 olol 8.000 2 May 05 Accounts receivable Cost of goods sold Sales Merchandise Inventory 0.000 4.000 6.000 4.000 3 May 05 4,000 Cost of goods sold Merchandise inventory OOOO OOOOOO 4.000 4 May 07 600 Blo 400 Sales returns and allowances Merchandise inventory Accounts receivable Cost of goods sold 600 400 400 5 May 07 Merchandise inventory Cost of goods sold oo 400 200 6 May be Sales returns and allowances Accounts receivable 200 DO OO 5.095 104 7 May 15 Cash Sales returns and allowances Accounts receivable 5.200 Exercise 4-10 Preparing adjusting and closing entries for a merchandiser LO P3 The following list includes selected permanent accounts and all of the temporary accounts from the December 31 unadjusted trial balance of Emiko Co., a business owned by Kumi Emiko, Emiko Co uses a perpetual inventory system Debit Credit Merchandise inventory 5 36,000 Prepaid selling expenses 6.000 Dividends 45,000 Sales $577,000 sales returns and allowances 19,900 Sales discounts 6.200 Cost of goods sold 236.000 Sales salaries expense 60.000 Utilities expense 21,000 Selling expenses 42.000 Administrative expenses 117,000 Additional Information Accrued and unpaid sales salaries amount to $2,400. Prepaid selling expenses of $2,100 have expired. A physical count of year-end merchandise inventory is taken to determine shrinkage and shows $32,300 of goods still available (a) Use the above account balances along with the additional information, prepare the adjusting entries. (b) Use the above account balances along with the additional information, prepare the closing entries Complete this question by entering your answers in the tabs below. Required a Required B Use the above account balances along with the additional information, prepare the adjusting entries View transaction list Journal entry worksheet > Additional Information Accrued and unpaid sales salaries amount to $2,400. Prepaid selling expenses of $2,100 have expired. A physical count of year-end merchandise inventory is taken to determine shrinkage and shows $32,300 of goods still available. (a) Use the above account balances along with the additional information, prepare the adjusting entries. (b) Use the above account balances along with the additional information, prepare the closing entries. Doo Complete this question by entering your answers in the tabs below. ok Required A Required B Use the above account balances along with the additional Information, prepare the adjusting entries. nt View transaction list Journal entry worksheet ences 1 2 Accrued and unpaid sales salaries amount to $2,400. Note: Enter debits before credits Deblt Credit Date General Journal Dec 31 Additional Information Accrued and unpaid sales salaries amount to $2.400. Prepaid selling expenses of $2,100 have expired. A physical count of year-end merchandise inventory is taken to determine shrinkage and shows $32,300 of goods still available. (a) Use the above account balances along with the additional information, prepare the adjusting entries. (b) Use the above account balances along with the additional Information, prepare the closing entries. Complete this question by entering your answers in the tabs below. Required A Required B Use the above account balances along with the additional Information, prepare the adjusting entries. View transaction list Journal entry worksheet