Answered step by step

Verified Expert Solution

Question

1 Approved Answer

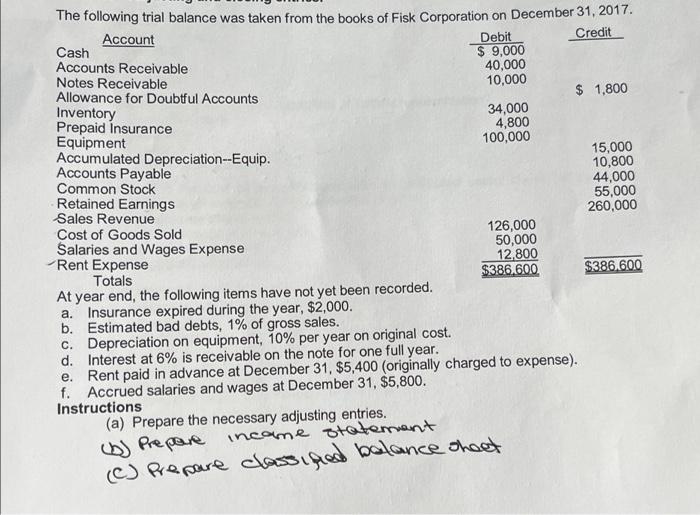

The following trial balance was taken from the books of Fisk Corporation on December 31, 2017. Account Credit Cash Accounts Receivable Notes Receivable Allowance for

The following trial balance was taken from the books of Fisk Corporation on December 31, 2017. Account Credit Cash Accounts Receivable Notes Receivable Allowance for Doubtful Accounts Inventory Prepaid Insurance Equipment Accumulated Depreciation--Equip. c. d. e. f. Debit $9,000 40,000 10,000 Accounts Payable Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Salaries and Wages Expense Rent Expense Totals At year end, the following items have not yet been recorded. Insurance expired during the year, $2,000. b. Estimated bad debts, 1% of gross sales. a. Depreciation on equipment, 10% per year on original cost. Interest at 6% is receivable on the note for one full year. Rent paid in advance at December 31, $5,400 (originally charged to expense). Accrued salaries and wages at December 31, $5,800. Instructions 34,000 4,800 100,000 income statement 126,000 50,000 12,800 $386.600 (a) Prepare the necessary adjusting entries. (b) Prepare (C) Prepare classified balance sheet $ 1,800 15,000 10,800 44,000 55,000 260,000 $386.600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started