These are Taxation question kindly help me with my homework.Thankyou

KAMYAB ENTERPRISES (KE)

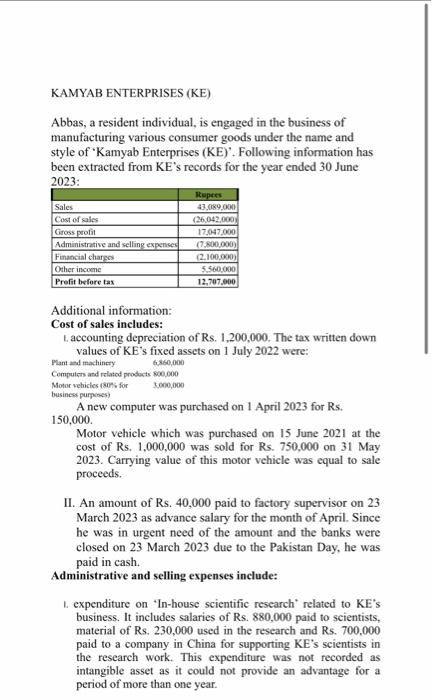

Abbas, a resident individual, is engaged in the business of manufacturing various consumer goods under the name and style of Kamyab Enterprises (KE). Following information has been extracted from KEs records for the year ended 30 June 2023:

| |

| |

| |

| |

Administrative and selling expenses | |

| |

| |

| |

Additional information:

Cost of sales includes:

I. accounting depreciation of Rs. 1,200,000. The tax written down values of KEs fixed assets on 1 July 2022 were:

| | |

Computers and related products | | |

Motor vehicles (80% for business purposes) | | |

A new computer was purchased on 1 April 2023 for Rs. 150,000.

Motor vehicle which was purchased on 15 June 2021 at the cost of Rs. 1,000,000 was sold for Rs. 750,000 on 31 May 2023. Carrying value of this motor vehicle was equal to sale proceeds.

II. An amount of Rs. 40,000 paid to factory supervisor on 23 March 2023 as advance salary for the month of April. Since he was in urgent need of the amount and the banks were closed on 23 March 2023 due to the Pakistan Day, he was paid in cash.

Administrative and selling expenses include:

I. expenditure on In-house scientific research related to KEs business. It includes salaries of Rs. 880,000 paid to scientists, material of Rs. 230,000 used in the research and Rs. 700,000 paid to a company in China for supporting KEs scientists in the research work. This expenditure was not recorded as intangible asset as it could not provide an advantage for a period of more than one year.

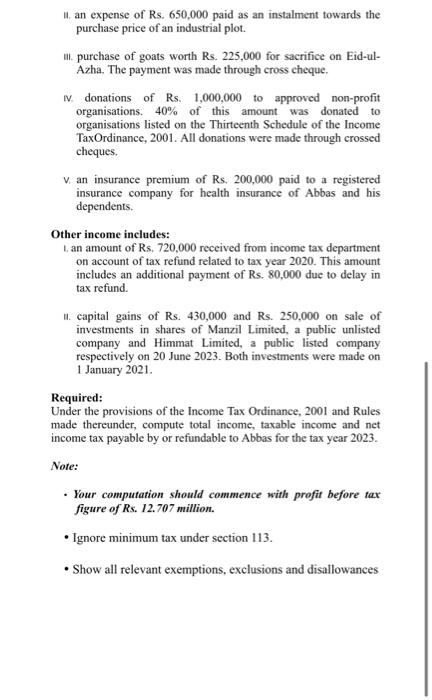

II. an expense of Rs. 650,000 paid as an instalment towards the purchase price of an industrial plot.

III. purchase of goats worth Rs. 225,000 for sacrifice on Eid-ul-Azha. The payment was made through cross cheque.

IV. donations of Rs. 1,000,000 to approved non-profit organisations. 40% of this amount was donated to organisations listed on the Thirteenth Schedule of the Income TaxOrdinance, 2001. All donations were made through crossed cheques.

V. an insurance premium of Rs. 200,000 paid to a registered insurance company for health insurance of Abbas and his dependents.

Other income includes:

I. an amount of Rs. 720,000 received from income tax department on account of tax refund related to tax year 2020. This amount includes an additional payment of Rs. 80,000 due to delay in tax refund.

II. capital gains of Rs. 430,000 and Rs. 250,000 on sale of investments in shares of Manzil Limited, a public unlisted company and Himmat Limited, a public listed company respectively on 20 June 2023. Both investments were made on 1 January 2021.

Required:

Under the provisions of the Income Tax Ordinance, 2001 and Rules made thereunder, compute total income, taxable income and net income tax payable by or refundable to Abbas for the tax year 2023.

Note:

Your computation should commence with profit before tax figure of Rs. 12.707 million.

Ignore minimum tax under section 113.

Show all relevant exemptions, exclusions and disallowances

KAMYAB ENTERPRISES (KE) Abbas, a resident individual, is engaged in the business of manufacturing various consumer goods under the name and style of 'Kamyab Enterprises (KE)'. Following information has been extracted from KE's records for the year ended 30 June 2023 : Additional information: Cost of sales includes: L. accounting depreciation of Rs. 1,200,000. The tax written down values of KE's fixed assets on 1 July 2022 were: PhantasdmachineryCompulenandrelatiodprosects6,860,00050,000 business purposest A new computer was purchased on 1 April 2023 for Rs. 150,000. Motor vehicle which was purchased on 15 June 2021 at the cost of Rs. 1,000,000 was sold for Rs. 750,000 on 31 May 2023. Carrying value of this motor vehicle was equal to sale proceeds. II. An amount of Rs. 40,000 paid to factory supervisor on 23 March 2023 as advance salary for the month of April. Since he was in urgent need of the amount and the banks were closed on 23 March 2023 due to the Pakistan Day, he was paid in cash. Administrative and selling expenses include: L. expenditure on "In-house scientific research' related to KE's business. It includes salaries of Rs. 880,000 paid to scientists, material of Rs. 230,000 used in the research and Rs. 700,000 paid to a company in China for supporting KE's scientists in the research work. This expenditure was not recorded as intangible asset as it could not provide an advantage for a period of more than one year. 11. an expense of Rs. 650,000 paid as an instalment towards the purchase price of an industrial plot. III. purchase of goats worth Rs. 225,000 for sacrifice on Eid-ulAzha. The payment was made through cross cheque. IV. donations of Rs. 1,000,000 to approved non-profit organisations. 40% of this amount was donated to organisations listed on the Thirteenth Schedule of the Income TaxOrdinance, 2001. All donations were made through crossed cheques. V. an insurance premium of Rs. 200,000 paid to a registered insurance company for health insurance of Abbas and his dependents. Other income includes: L. an amount of Rs. 720,000 received from income tax department on account of tax refund related to tax year 2020 . This amount includes an additional payment of Rs. 80,000 due to delay in tax refund. 18. capital gains of Rs. 430,000 and Rs. 250,000 on sale of investments in shares of Manzil Limited, a public unlisted company and Himmat Limited, a public listed company respectively on 20 June 2023 . Both investments were made on 1 January 2021. Required: Under the provisions of the Income Tax Ordinance, 2001 and Rules made thereunder, compute total income, taxable income and net income tax payable by or refundable to Abbas for the tax year 2023. Note: - Your computation should commence with profit before tax figure of Rs. 12.707 million. - Ignore minimum tax under section 113. - Show all relevant exemptions, exclusions and disallowances