Answered step by step

Verified Expert Solution

Question

1 Approved Answer

these are the answers.....I just want to know how we got them......please help Information For this case, we will analyze the available computers that can

these are the answers.....I just want to know how we got them......please help

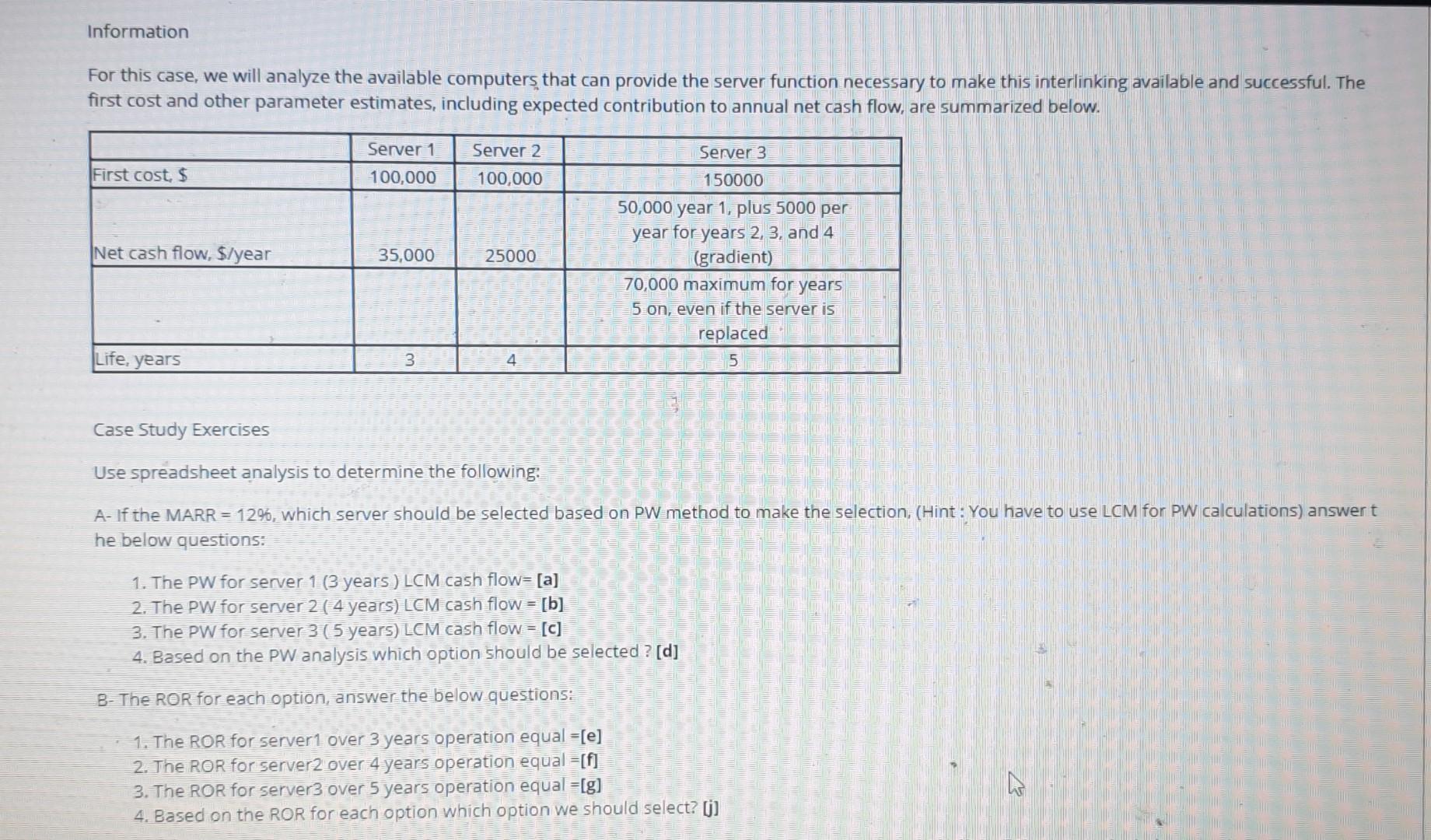

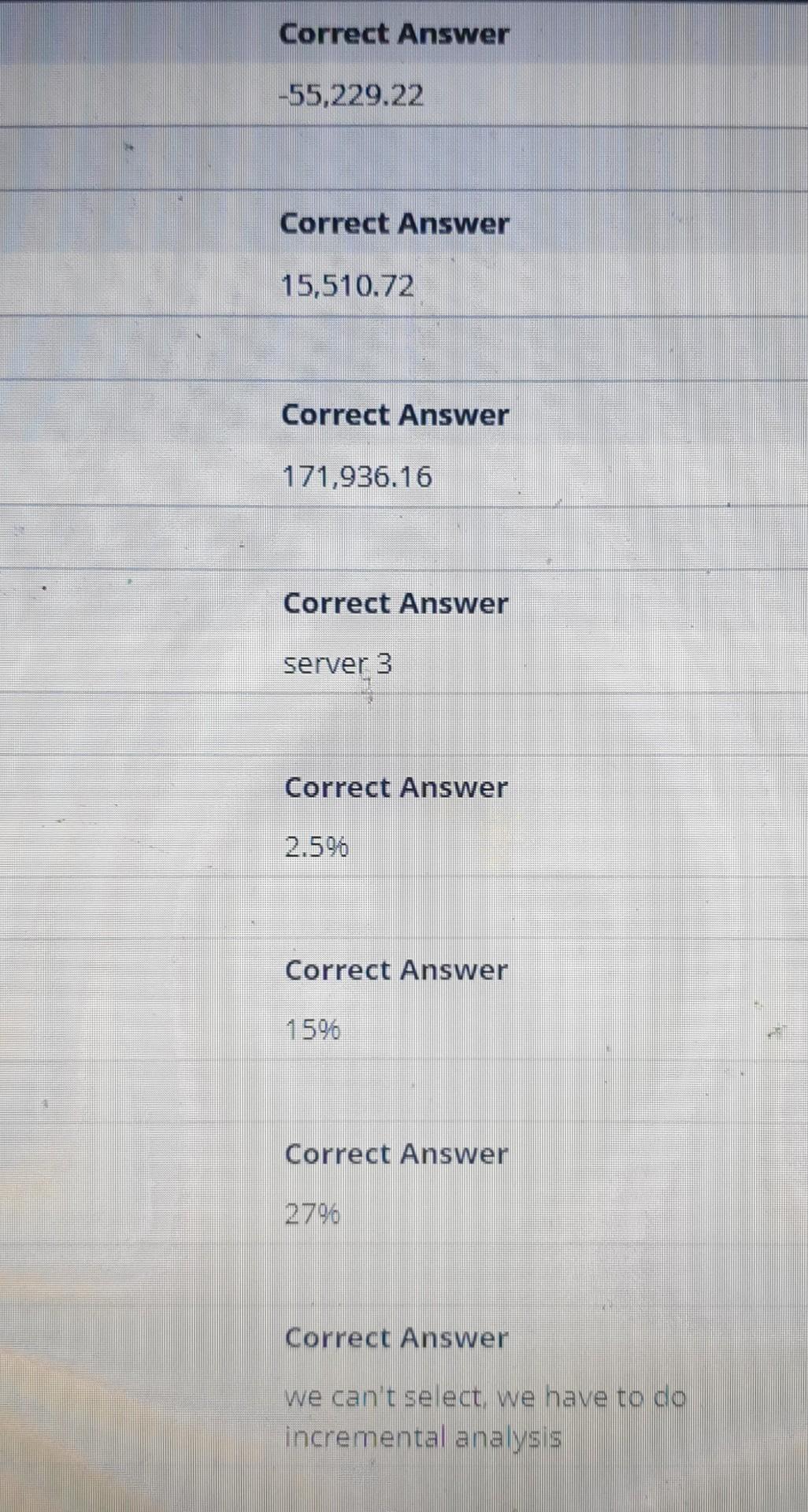

Information For this case, we will analyze the available computers that can provide the server function necessary to make this interlinking available and successful. The first cost and other parameter estimates, including expected contribution to annual net cash flow, are summarized below. Server 1 Server 2 100,000 First cost $ 100,000 Net cash flow, $/year Server 3 150000 50,000 year 1, plus 5000 per year for years 2, 3, and 4 (gradient) 70,000 maximum for years 5 on, even if the server is replaced 35,000 25000 Life, years 3 4 5 Case Study Exercises Use spreadsheet analysis to determine the following: A- If the MARR = 1296, which server should be selected based on PW method to make the selection, (Hint: You have to use LCM for PW calculations) answert he below questions: 1. The PW for server 1 (3 years ) LCM cash flow= (a) 2. The PW for server 2 ( 4 years) LCM cash flow = [b] 3. The PW for server 3 (5 years) LCM cash flow = [C] 4. Based on the PW analysis which option should be selected ? [d] B- The ROR for each option, answer the below questions: 1. The ROR for server 1 over 3 years operation equal =[e] 2. The ROR for server2 over 4 years operation equal =[f] 3. The ROR for server over 5 years operation equal =[g] 4. Based on the ROR for each option which option we should select? [] Correct Answer -55,229.22 Correct Answer 15,510.72 Correct Answer 171,936.16 Correct Answer server 3 > Correct Answer Correct Answer 1596 Correct Answer 2796 Correct we can't se ect we have to do incremental analysis Information For this case, we will analyze the available computers that can provide the server function necessary to make this interlinking available and successful. The first cost and other parameter estimates, including expected contribution to annual net cash flow, are summarized below. Server 1 Server 2 100,000 First cost $ 100,000 Net cash flow, $/year Server 3 150000 50,000 year 1, plus 5000 per year for years 2, 3, and 4 (gradient) 70,000 maximum for years 5 on, even if the server is replaced 35,000 25000 Life, years 3 4 5 Case Study Exercises Use spreadsheet analysis to determine the following: A- If the MARR = 1296, which server should be selected based on PW method to make the selection, (Hint: You have to use LCM for PW calculations) answert he below questions: 1. The PW for server 1 (3 years ) LCM cash flow= (a) 2. The PW for server 2 ( 4 years) LCM cash flow = [b] 3. The PW for server 3 (5 years) LCM cash flow = [C] 4. Based on the PW analysis which option should be selected ? [d] B- The ROR for each option, answer the below questions: 1. The ROR for server 1 over 3 years operation equal =[e] 2. The ROR for server2 over 4 years operation equal =[f] 3. The ROR for server over 5 years operation equal =[g] 4. Based on the ROR for each option which option we should select? [] Correct Answer -55,229.22 Correct Answer 15,510.72 Correct Answer 171,936.16 Correct Answer server 3 > Correct Answer Correct Answer 1596 Correct Answer 2796 Correct we can't se ect we have to do incremental analysisStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started