These are the pages stated in the passage.

are the transaction not the information given in the yellow? i apologize for the inconvience

switch the highlighted transaction amount with the same transaction on chart of account document.

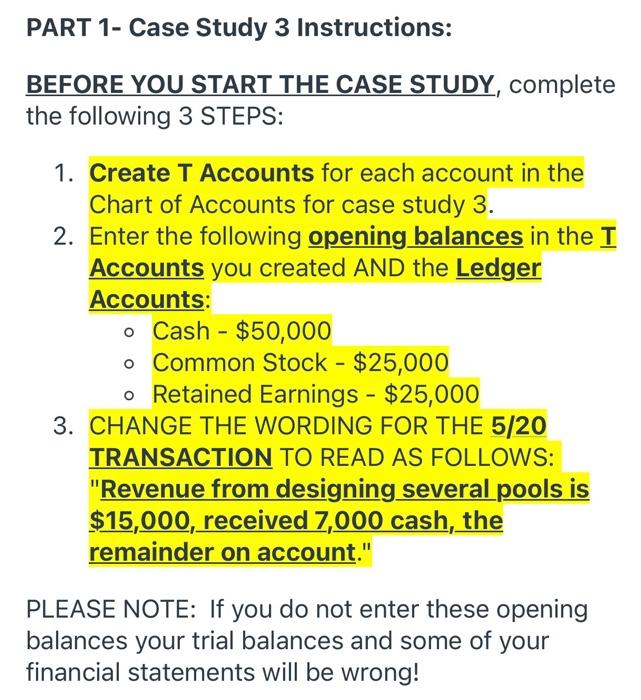

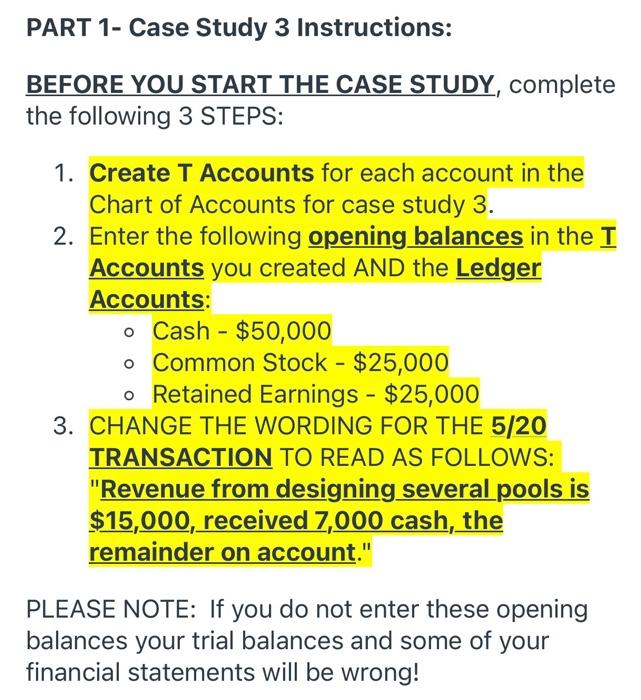

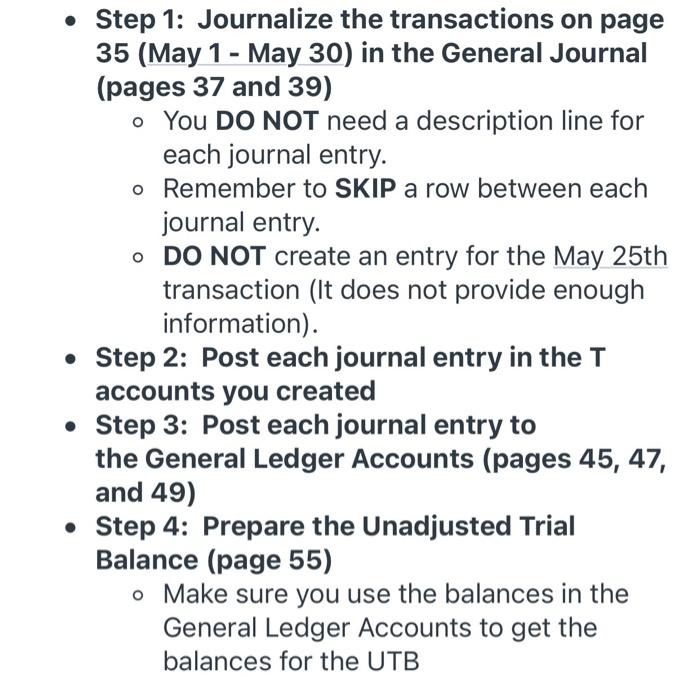

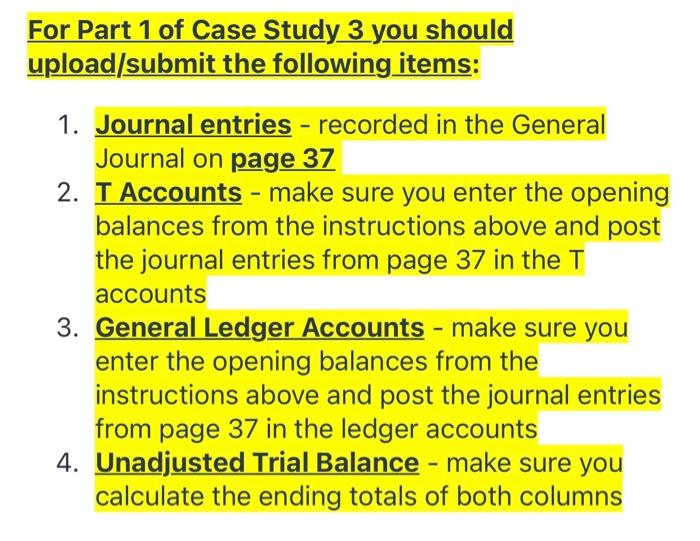

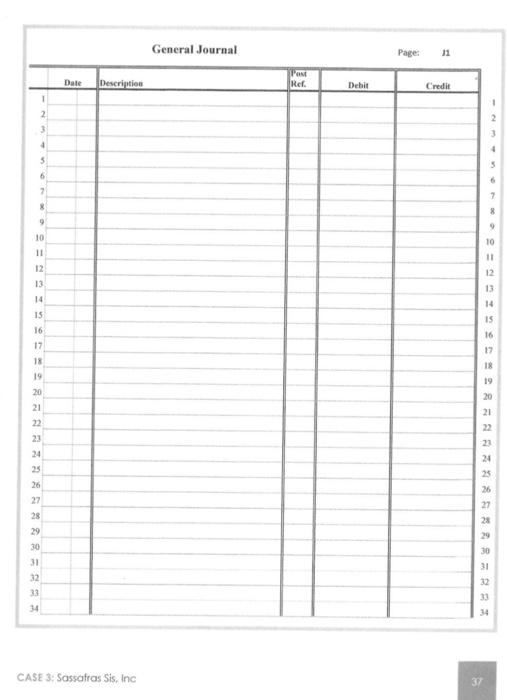

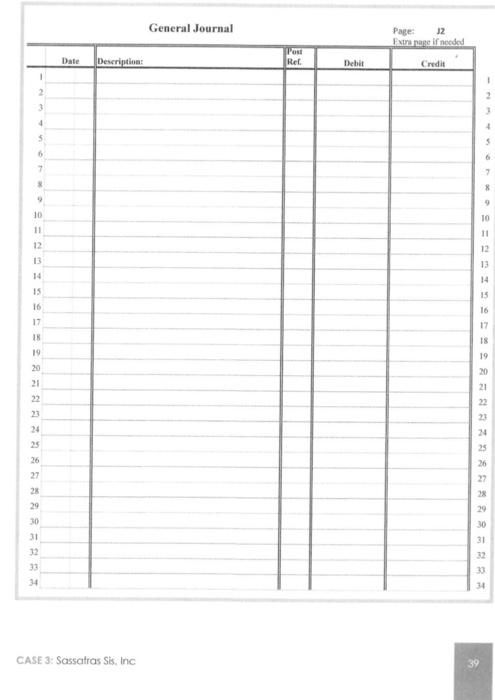

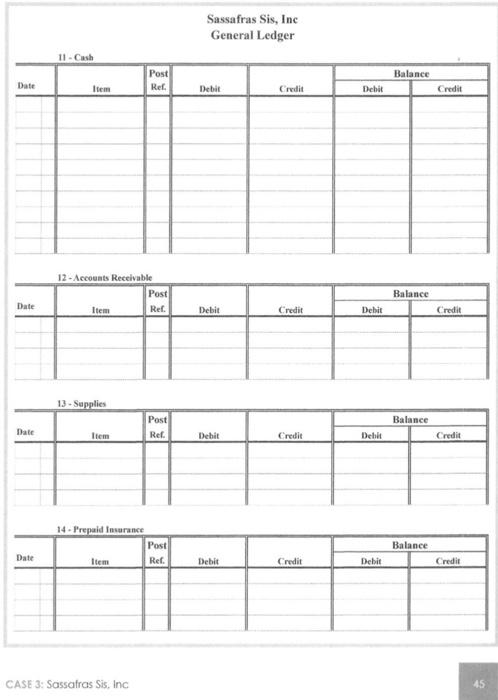

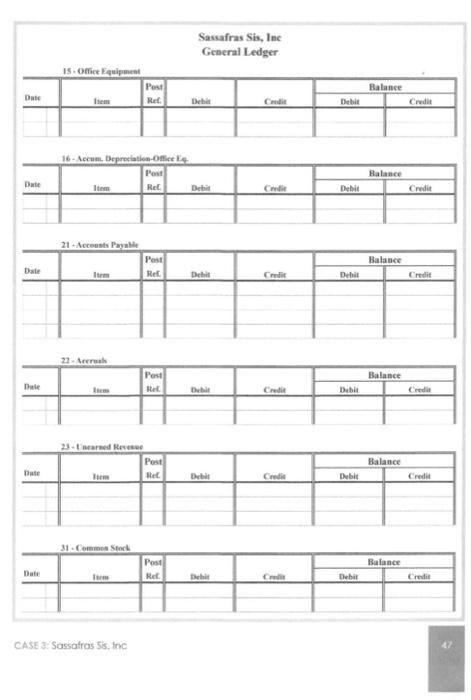

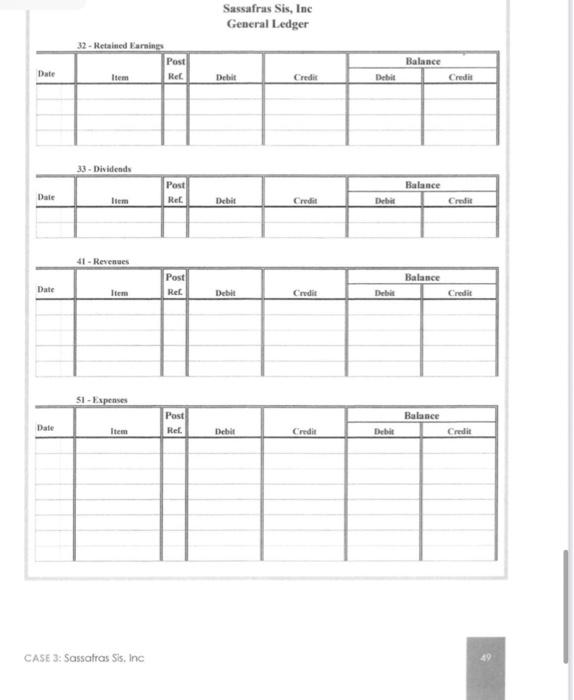

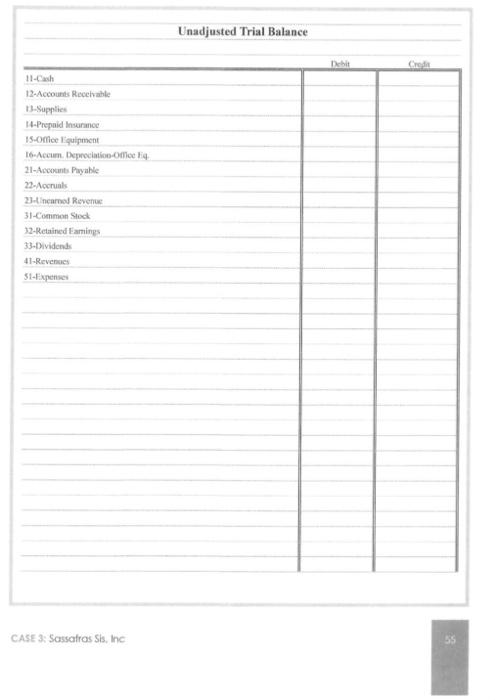

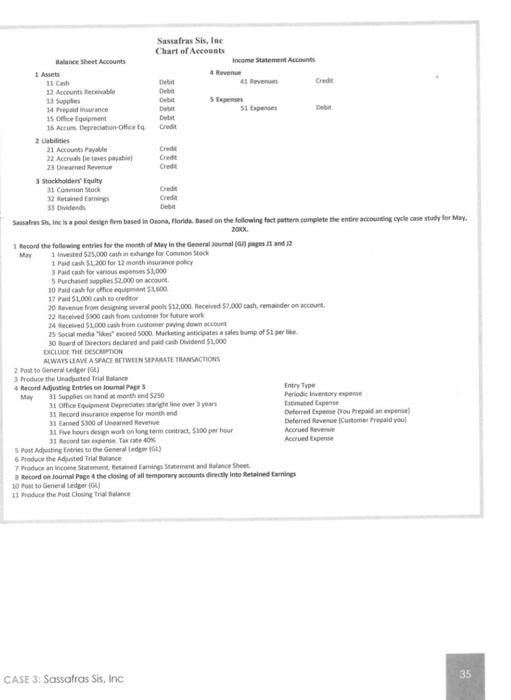

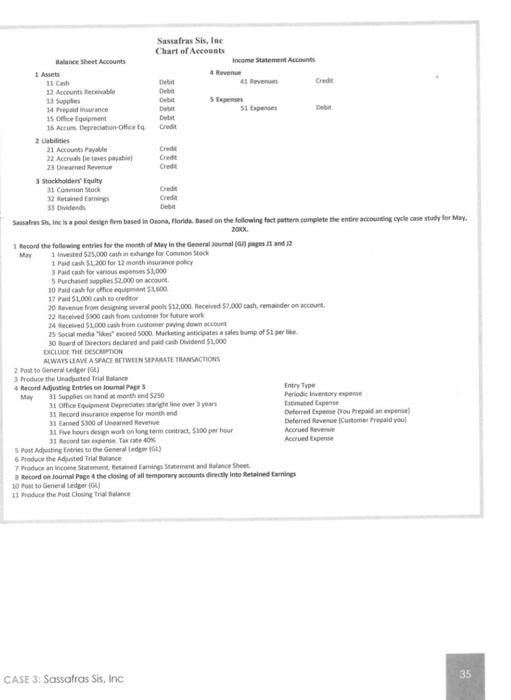

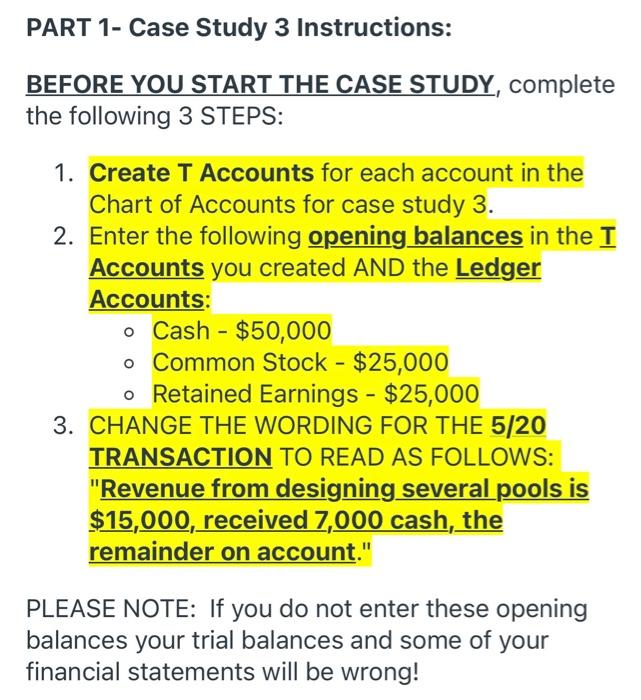

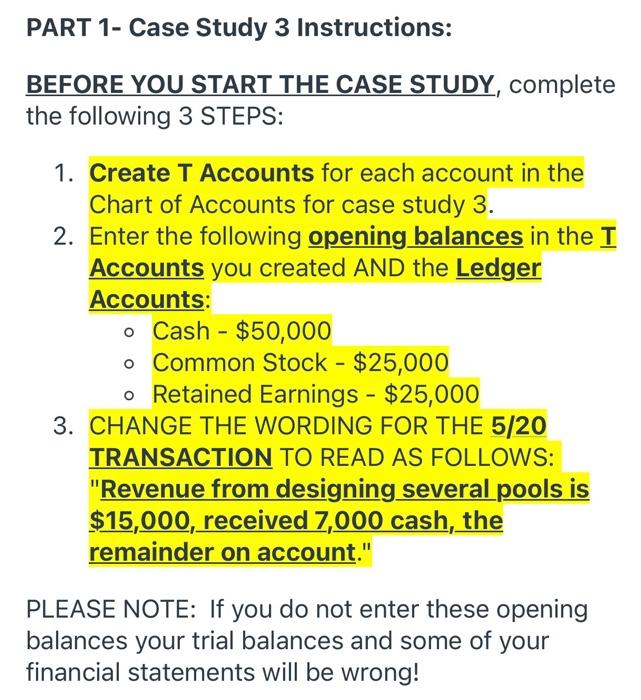

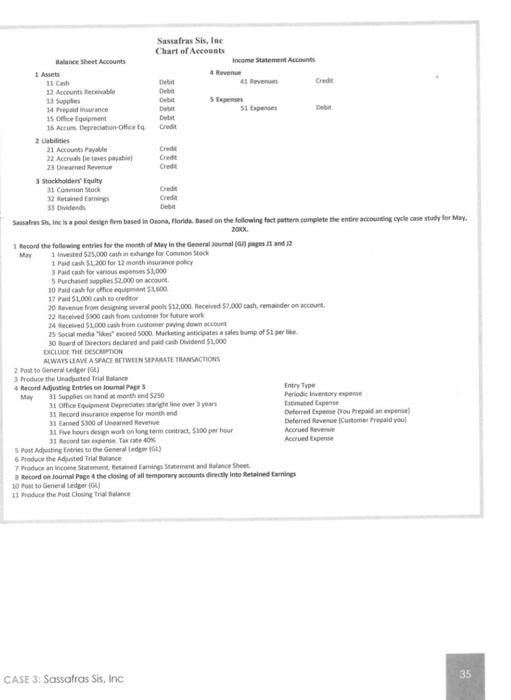

PART 1- Case Study 3 Instructions: BEFORE YOU START THE CASE STUDY, complete the following 3 STEPS: 1. Create T Accounts for each account in the Chart of Accounts for case study 3. 2. Enter the following opening balances in the I Accounts you created AND the Ledger Accounts: o Cash - $50,000 o Common Stock - $25,000 o Retained Earnings - $25,000 3. CHANGE THE WORDING FOR THE 5/20 TRANSACTION TO READ AS FOLLOWS: "Revenue from designing several pools is $15,000, received 7,000 cash, the remainder on account." PLEASE NOTE: If you do not enter these opening balances your trial balances and some of your financial statements will be wrong! Step 1: Journalize the transactions on page 35 (May 1 - May 30) in the General Journal (pages 37 and 39) o You DO NOT need a description line for each journal entry. o Remember to SKIP a row between each journal entry. DO NOT create an entry for the May 25th transaction (It does not provide enough information). Step 2: Post each journal entry in the T accounts you created Step 3: Post each journal entry to the General Ledger Accounts (pages 45, 47, and 49) Step 4: Prepare the Unadjusted Trial Balance (page 55) o Make sure you use the balances in the General Ledger Accounts to get the balances for the UTB For Part 1 of Case Study 3 you should upload/submit the following items: 1. Journal entries - recorded in the General Journal on page 37 2. I Accounts - make sure you enter the opening balances from the instructions above and post the journal entries from page 37 in the T accounts 3. General Ledger Accounts - make sure you enter the opening balances from the instructions above and post the journal entries from page 37 in the ledger accounts 4. Unadjusted Trial Balance - make sure you calculate the ending totals of both columns General Journal Page: 11 Date Description Pa Rer Debit Credit 1 2 3 4 5 6 2 X 9 10 11 10 11 12 13 12 13 14 15 14 16 17 18 19 15 16 12 18 19 20 20 21 21 22 21 24 23 24 23 26 27 25 26 27 29 28 29 30 30 31 31 32 33 34 32 33 CASE 3: Sassafras Sis, Inc 37 General Journal Page: J2 Extra page if needed Post Description: Rel Debit Credit 10 10 11 11 12 12 13 14 15 15 16 17 17 IS 19 19 20 20 21 21 22 24 26 27 25 29 30 31 31 12 33 34 32 34 CASE 3: Sassafras Sis. Inc Sassafras Sis, Inc General Ledger 11 - Cash Balance Date Post Ref: Item Debit Credit Debit Credit 12 - Accounts Receivable Post Item Rer. Balance Date Debit Credit Debit Credit 13 - Supplies Post Balance Date Item Rel Debit Credit Dehli Credit 14. Prepaid Insurance Post Item Rer Balance Date Debit Credit Debit Credit CASE 3: Sassafras Sis. Inc Sassafras Sis, Inc General Ledger 15 Office Equipment Post sem Ret Date Balance Credit Debit C Debit 16- Accum. Depreciation Offices Post Ret Debit Date Balance Credit Debit 21. Accounts Payable Balance Pest Rek Dell Dehit Credit 22. Ar Balance Date Post RE Debit Credit Deble Credit 23.ned Reve Balance Post Re Date Dahil Credi Debit Credit 31-Comm Stock Balance Date Post Het De C Debit Credit CASE 3: Sassafras Sis, Inc Sassafras Sis, Inc General Ledger 32 - Retained Earnings Post Item Rek Balance Date Dehit Credit Debit Credil 33 - Dividends Balance Dale Post Reb Item Debit Credit Debat Credit 41 - Revenues Balance Post Rer Date Item Debit Credit Credit 51 - Expenses Balance Date Post Ret Item Debit Credit Debit Credit CASE 3: Sassafras Sis. Inc Unadjusted Trial Balance Det Cred 12-Accounts Receivable 13- Supplies 14-Prepaid loro 15-Ocequipment 16. Accum. Depreciation om 21-Accounts Payable 22-Accruals 21-Linearnod Revenue 31-Common Stock 32-Retained Emines 33-Dividende 41-Revenues 31xpenses CASE 3: Sassafras Sis, Inc Sassafras Sis, Inc Chart of Accounts lance Sheet Accounts Income Statement Account 11 Cash Der Credit 12 Accounts Receivable De 13 Supplies 34 Prepaid inance D 51 persen 15 Oct Dit 16 Accu Depreciation Office Credit 2 abilities 21 Accounts Payable Credit 22 Accretares Oude 23 Ured Rete Credit Stockholders' Equity * Como Stock ined Emin Crede 33 Dividende Debit Sisal Se, ne le pool design tem based on Omona, Florida. Based on the following the pattern complete the entire accounting cycle case study for May. BOX 1 Record the following entries for the month of May in the German and Mary invested 525,000 change for Common Stock Pada 1200 for 12 monthurance policy Pald cash for a 1000 Purchased aplies $2.000 on account 10 Paid cash for office equipment $1,000 17.00 h to creditor 20 Revenue from designing $12,000 Received $2.000 cash, remander on court 22 received cash from customer for future work 24seved 1,000 cash from com prying down 25 Social media exceed 5000 Marketing states a sales bump of 1 30 of Director declared and paidah Dividend 1.000 EXCLUDE THE DESCRIPTION ALWAYS LEAVE A SPACE BETWEEN SEPARATE TRANSACTIONS 2 out to Generador (0) Produce the interace 4 Record Adjusting Entries on oumal Pages Entry Type May 1 Supplies as and a month and $250 Periodic Inventory me Oficient Depressie over years med Expense 31 Record insurance expense for month and Deferred tape roupa penia) 31 med 300 of Uncanned even Deferred Revenue Curter Tread you 11 hours design work on long term contract. 5100 per hour Acord Revenue 31 Record Toote 40% Accrued Expense 5 Post Astries to the Generated) 6 Produce the Adjustedral Balance Product an income Statem, etiaming Statement and lance sheet Record on Jumal Page the closing of all temporary accounts directly into Retained turning 10 Posto General Ledger 11 Preduce the Post Closing Trance CASE 3: Sassafras Sis, Inc 35 PART 1- Case Study 3 Instructions: BEFORE YOU START THE CASE STUDY, complete the following 3 STEPS: 1. Create T Accounts for each account in the Chart of Accounts for case study 3. 2. Enter the following opening balances in the I Accounts you created AND the Ledger Accounts: o Cash - $50,000 o Common Stock - $25,000 o Retained Earnings - $25,000 3. CHANGE THE WORDING FOR THE 5/20 TRANSACTION TO READ AS FOLLOWS: "Revenue from designing several pools is $15,000, received 7,000 cash, the remainder on account." PLEASE NOTE: If you do not enter these opening balances your trial balances and some of your financial statements will be wrong! PART 1- Case Study 3 Instructions: BEFORE YOU START THE CASE STUDY, complete the following 3 STEPS: 1. Create T Accounts for each account in the Chart of Accounts for case study 3. 2. Enter the following opening balances in the I Accounts you created AND the Ledger Accounts: o Cash - $50,000 o Common Stock - $25,000 o Retained Earnings - $25,000 3. CHANGE THE WORDING FOR THE 5/20 TRANSACTION TO READ AS FOLLOWS: "Revenue from designing several pools is $15,000, received 7,000 cash, the remainder on account." PLEASE NOTE: If you do not enter these opening balances your trial balances and some of your financial statements will be wrong! Step 1: Journalize the transactions on page 35 (May 1 - May 30) in the General Journal (pages 37 and 39) o You DO NOT need a description line for each journal entry. o Remember to SKIP a row between each journal entry. DO NOT create an entry for the May 25th transaction (It does not provide enough information). Step 2: Post each journal entry in the T accounts you created Step 3: Post each journal entry to the General Ledger Accounts (pages 45, 47, and 49) Step 4: Prepare the Unadjusted Trial Balance (page 55) o Make sure you use the balances in the General Ledger Accounts to get the balances for the UTB For Part 1 of Case Study 3 you should upload/submit the following items: 1. Journal entries - recorded in the General Journal on page 37 2. I Accounts - make sure you enter the opening balances from the instructions above and post the journal entries from page 37 in the T accounts 3. General Ledger Accounts - make sure you enter the opening balances from the instructions above and post the journal entries from page 37 in the ledger accounts 4. Unadjusted Trial Balance - make sure you calculate the ending totals of both columns General Journal Page: 11 Date Description Pa Rer Debit Credit 1 2 3 4 5 6 2 X 9 10 11 10 11 12 13 12 13 14 15 14 16 17 18 19 15 16 12 18 19 20 20 21 21 22 21 24 23 24 23 26 27 25 26 27 29 28 29 30 30 31 31 32 33 34 32 33 CASE 3: Sassafras Sis, Inc 37 General Journal Page: J2 Extra page if needed Post Description: Rel Debit Credit 10 10 11 11 12 12 13 14 15 15 16 17 17 IS 19 19 20 20 21 21 22 24 26 27 25 29 30 31 31 12 33 34 32 34 CASE 3: Sassafras Sis. Inc Sassafras Sis, Inc General Ledger 11 - Cash Balance Date Post Ref: Item Debit Credit Debit Credit 12 - Accounts Receivable Post Item Rer. Balance Date Debit Credit Debit Credit 13 - Supplies Post Balance Date Item Rel Debit Credit Dehli Credit 14. Prepaid Insurance Post Item Rer Balance Date Debit Credit Debit Credit CASE 3: Sassafras Sis. Inc Sassafras Sis, Inc General Ledger 15 Office Equipment Post sem Ret Date Balance Credit Debit C Debit 16- Accum. Depreciation Offices Post Ret Debit Date Balance Credit Debit 21. Accounts Payable Balance Pest Rek Dell Dehit Credit 22. Ar Balance Date Post RE Debit Credit Deble Credit 23.ned Reve Balance Post Re Date Dahil Credi Debit Credit 31-Comm Stock Balance Date Post Het De C Debit Credit CASE 3: Sassafras Sis, Inc Sassafras Sis, Inc General Ledger 32 - Retained Earnings Post Item Rek Balance Date Dehit Credit Debit Credil 33 - Dividends Balance Dale Post Reb Item Debit Credit Debat Credit 41 - Revenues Balance Post Rer Date Item Debit Credit Credit 51 - Expenses Balance Date Post Ret Item Debit Credit Debit Credit CASE 3: Sassafras Sis. Inc Unadjusted Trial Balance Det Cred 12-Accounts Receivable 13- Supplies 14-Prepaid loro 15-Ocequipment 16. Accum. Depreciation om 21-Accounts Payable 22-Accruals 21-Linearnod Revenue 31-Common Stock 32-Retained Emines 33-Dividende 41-Revenues 31xpenses CASE 3: Sassafras Sis, Inc Sassafras Sis, Inc Chart of Accounts lance Sheet Accounts Income Statement Account 11 Cash Der Credit 12 Accounts Receivable De 13 Supplies 34 Prepaid inance D 51 persen 15 Oct Dit 16 Accu Depreciation Office Credit 2 abilities 21 Accounts Payable Credit 22 Accretares Oude 23 Ured Rete Credit Stockholders' Equity * Como Stock ined Emin Crede 33 Dividende Debit Sisal Se, ne le pool design tem based on Omona, Florida. Based on the following the pattern complete the entire accounting cycle case study for May. BOX 1 Record the following entries for the month of May in the German and Mary invested 525,000 change for Common Stock Pada 1200 for 12 monthurance policy Pald cash for a 1000 Purchased aplies $2.000 on account 10 Paid cash for office equipment $1,000 17.00 h to creditor 20 Revenue from designing $12,000 Received $2.000 cash, remander on court 22 received cash from customer for future work 24seved 1,000 cash from com prying down 25 Social media exceed 5000 Marketing states a sales bump of 1 30 of Director declared and paidah Dividend 1.000 EXCLUDE THE DESCRIPTION ALWAYS LEAVE A SPACE BETWEEN SEPARATE TRANSACTIONS 2 out to Generador (0) Produce the interace 4 Record Adjusting Entries on oumal Pages Entry Type May 1 Supplies as and a month and $250 Periodic Inventory me Oficient Depressie over years med Expense 31 Record insurance expense for month and Deferred tape roupa penia) 31 med 300 of Uncanned even Deferred Revenue Curter Tread you 11 hours design work on long term contract. 5100 per hour Acord Revenue 31 Record Toote 40% Accrued Expense 5 Post Astries to the Generated) 6 Produce the Adjustedral Balance Product an income Statem, etiaming Statement and lance sheet Record on Jumal Page the closing of all temporary accounts directly into Retained turning 10 Posto General Ledger 11 Preduce the Post Closing Trance CASE 3: Sassafras Sis, Inc 35 PART 1- Case Study 3 Instructions: BEFORE YOU START THE CASE STUDY, complete the following 3 STEPS: 1. Create T Accounts for each account in the Chart of Accounts for case study 3. 2. Enter the following opening balances in the I Accounts you created AND the Ledger Accounts: o Cash - $50,000 o Common Stock - $25,000 o Retained Earnings - $25,000 3. CHANGE THE WORDING FOR THE 5/20 TRANSACTION TO READ AS FOLLOWS: "Revenue from designing several pools is $15,000, received 7,000 cash, the remainder on account." PLEASE NOTE: If you do not enter these opening balances your trial balances and some of your financial statements will be wrong