Question

These are the questions: These are the answers given: The pro forma financial statements for the years 2023 to 2027, based on the provided assumptions,

These are the questions:

These are the answers given:

These are the answers given:

The pro forma financial statements for the years 2023 to 2027, based on the provided assumptions, are shown below.

Income Statement:

| Particulars | 2023 | 2024 | 2025 | 2026 | 2027 |

| Sales | 3990 | 4307 | 4652 | 5027 | 5435 |

| Cost of goods sold | 1648 | 1781 | 1923 | 2083 | 2263 |

| Gross Profit | 2342 | 2526 | 2729 | 2944 | 3172 |

| Expenses | 1468 | 1584 | 1713 | 1855 | 2010 |

| Interest on Overdraft | 0 | 0 | 0 | 0 | 0 |

| Interest on LT Loan | 36 | 36 | 36 | 36 | 36 |

| Depreciation | 386 | 416 | 449 | 485 | 524 |

| Earnings before tax | 452 | 486 | 531 | 568 | 603 |

| Tax | 126 | 136 | 149 | 160 | 170 |

| Earnings after tax | 326 | 350 | 382 | 408 | 433 |

| Dividend | 240 | 259 | 281 | 302 | 325 |

| Retained Earnings | 86 | 91 | 101 | 106 | 108 |

Balance sheet

| Particulars | 2023 | 2024 | 2025 | 2026 | 2027 |

| Fixed Assets - Cost | 4590 | 4932 | 5302 | 5703 | 6136 |

| Accum. Depreciation | 1710 | 1990 | 2295 | 2628 | 2991 |

| Fixed Assets - Net | 2880 | 2942 | 3007 | 3075 | 3145 |

| Current Assets | 1343 | 1451 | 1569 | 1697 | 1835 |

| Total Assets | 4223 | 4393 | 4576 | 4772 | 4980 |

| Overdraft | 2 | 2 | 2 | 2 | 2 |

| Payables | 828 | 894 | 967 | 1047 | 1134 |

| Long Term Loan | 600 | 600 | 600 | 600 | 600 |

| Capital | 2400 | 2400 | 2400 | 2400 | 2400 |

| Retained Earnings | 393 | 497 | 607 | 723 | 844 |

| Total Liabiities | 4223 | 4393 | 4576 | 4772 | 4980 |

Can the correct answers be give as these answers are wrong?

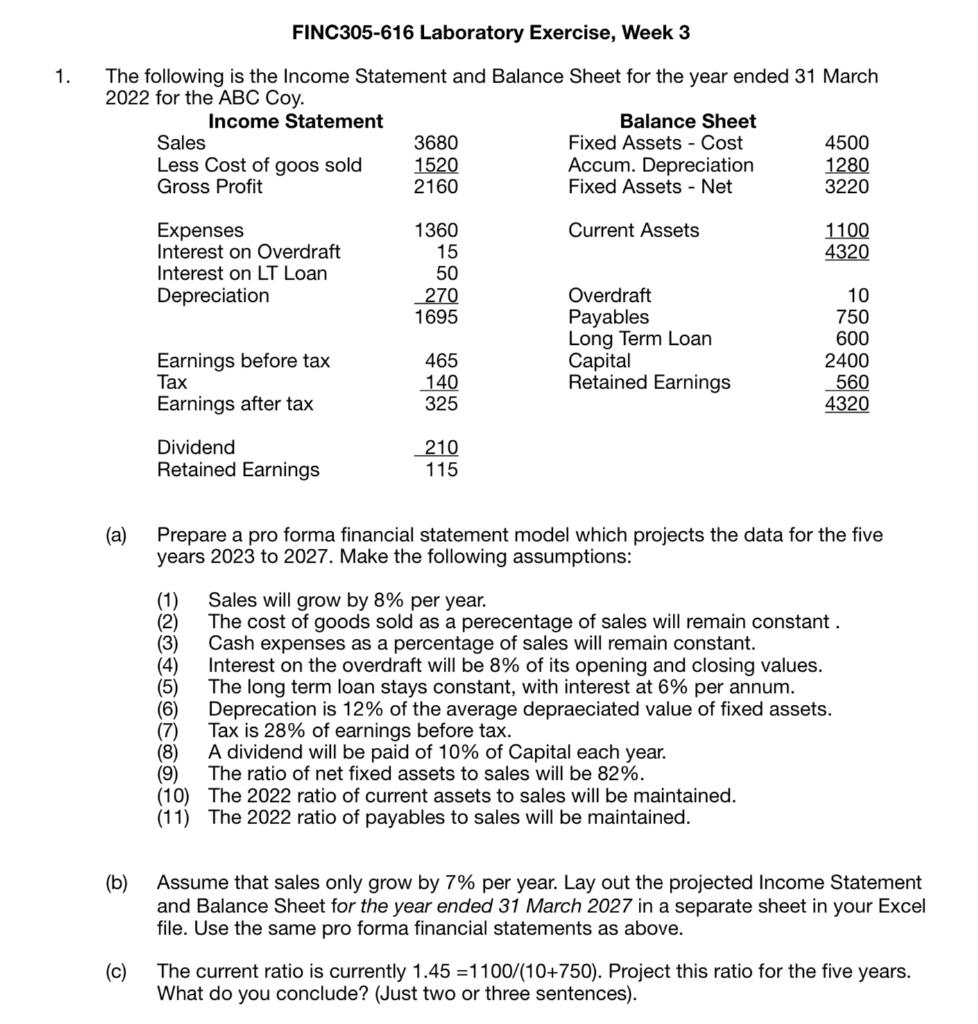

FINC305-616 Laboratory Exercise, Week 3 The following is the Income Statement and Balance Sheet for the year ended 31 March 2022 for the ARC C Cnv (a) Prepare a pro forma financial statement model which projects the data for the five years 2023 to 2027 . Make the following assumptions: (1) Sales will grow by 8% per year. (2) The cost of goods sold as a perecentage of sales will remain constant. (3) Cash expenses as a percentage of sales will remain constant. (4) Interest on the overdraft will be 8% of its opening and closing values. (5) The long term loan stays constant, with interest at 6% per annum. (6) Deprecation is 12% of the average depraeciated value of fixed assets. (7) Tax is 28% of earnings before tax. (8) A dividend will be paid of 10% of Capital each year. (9) The ratio of net fixed assets to sales will be 82%. (10) The 2022 ratio of current assets to sales will be maintained. (11) The 2022 ratio of payables to sales will be maintained. (b) Assume that sales only grow by 7% per year. Lay out the projected Income Statement and Balance Sheet for the year ended 31 March 2027 in a separate sheet in your Excel file. Use the same pro forma financial statements as above. (c) The current ratio is currently 1.45=1100/(10+750). Project this ratio for the five years. What do you conclude? (Just two or three sentences)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started