Answered step by step

Verified Expert Solution

Question

1 Approved Answer

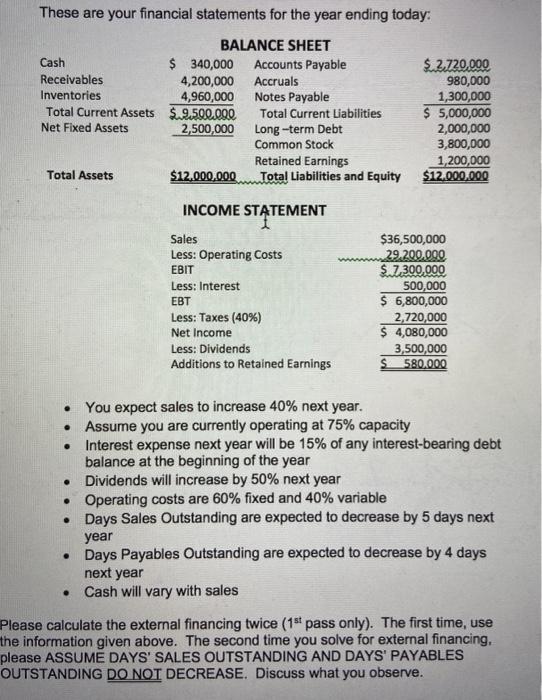

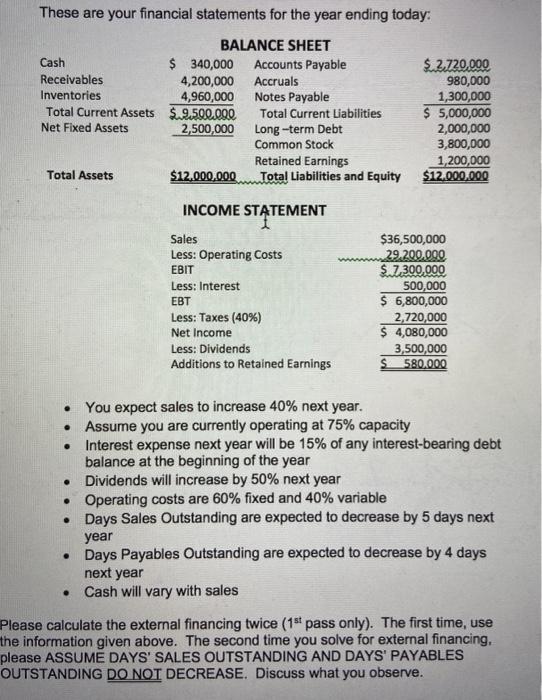

These are your financial statements for the year ending today: BALANCE SHEET Cash $ 340,000 Accounts Payable $2.720,000 Receivables 4,200,000 Accruals 980,000 Inventories 4,960,000 Notes

These are your financial statements for the year ending today: BALANCE SHEET Cash $ 340,000 Accounts Payable $2.720,000 Receivables 4,200,000 Accruals 980,000 Inventories 4,960,000 Notes Payable 1,300,000 Total Current Assets $.9.500.000 Total Current Liabilities $ 5,000,000 Net Fixed Assets 2,500,000 Long-term Debt 2,000,000 Common Stock 3,800,000 Retained Earnings 1,200,000 Total Assets $12.000.000 Total Liabilities and Equity $12,000,000 INCOME STATEMENT Sales Less: Operating costs EBIT Less: Interest EBT Less: Taxes (40%) Net Income Less: Dividends Additions to Retained Earnings $36,500,000 29.200.000 $.7.300.000 500,000 $ 6,800,000 2,720,000 $ 4,080,000 3,500,000 S 580,000 . . You expect sales to increase 40% next year. Assume you are currently operating at 75% capacity Interest expense next year will be 15% of any interest-bearing debt balance at the beginning of the year Dividends will increase by 50% next year Operating costs are 60% fixed and 40% variable Days Sales Outstanding are expected to decrease by 5 days next year Days Payables Outstanding are expected to decrease by 4 days next year Cash will vary with sales Please calculate the external financing twice (1a pass only). The first time, use the information given above. The second time you solve for external financing, please ASSUME DAYS' SALES OUTSTANDING AND DAYS' PAYABLES OUTSTANDING DO NOT DECREASE. Discuss what you observe

These are your financial statements for the year ending today: BALANCE SHEET Cash $ 340,000 Accounts Payable $2.720,000 Receivables 4,200,000 Accruals 980,000 Inventories 4,960,000 Notes Payable 1,300,000 Total Current Assets $.9.500.000 Total Current Liabilities $ 5,000,000 Net Fixed Assets 2,500,000 Long-term Debt 2,000,000 Common Stock 3,800,000 Retained Earnings 1,200,000 Total Assets $12.000.000 Total Liabilities and Equity $12,000,000 INCOME STATEMENT Sales Less: Operating costs EBIT Less: Interest EBT Less: Taxes (40%) Net Income Less: Dividends Additions to Retained Earnings $36,500,000 29.200.000 $.7.300.000 500,000 $ 6,800,000 2,720,000 $ 4,080,000 3,500,000 S 580,000 . . You expect sales to increase 40% next year. Assume you are currently operating at 75% capacity Interest expense next year will be 15% of any interest-bearing debt balance at the beginning of the year Dividends will increase by 50% next year Operating costs are 60% fixed and 40% variable Days Sales Outstanding are expected to decrease by 5 days next year Days Payables Outstanding are expected to decrease by 4 days next year Cash will vary with sales Please calculate the external financing twice (1a pass only). The first time, use the information given above. The second time you solve for external financing, please ASSUME DAYS' SALES OUTSTANDING AND DAYS' PAYABLES OUTSTANDING DO NOT DECREASE. Discuss what you observe

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started