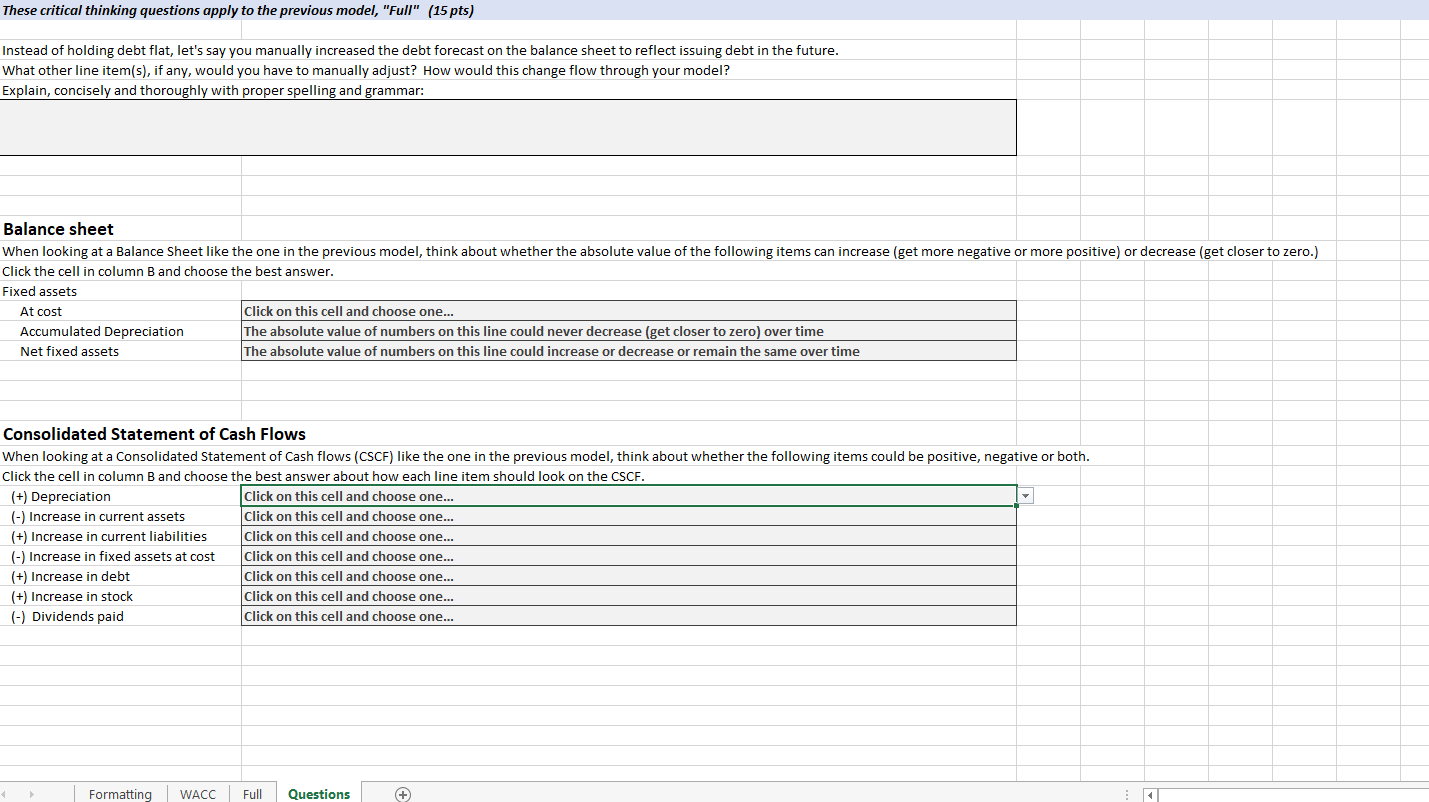

These critical thinking questions apply to the previous model, "Full" (15 pts) Instead of holding debt flat, let's say you manually increased the debt forecast on the balance sheet to reflect issuing debt in the future. What other line item(s), if any, would you have to manually adjust? How would this change flow through your model? Explain, concisely and thoroughly with proper spelling and grammar: Balance sheet When looking at a Balance Sheet like the one in the previous model, think about whether the absolute value of the following items can increase (get more negative or more positive) or decrease (get closer to zero.) Click the cell in column B and choose the best answer. Fixed assets At cost Click on this cell and choose one... Accumulated Depreciation The absolute value of numbers on this line could never decrease (get closer to zero) over time Net fixed assets The absolute value of numbers on this line could increase or decrease or remain the same over time Consolidated Statement of Cash Flows When looking at a Consolidated Statement of Cash flows (CSCF) like the one in the previous model, think about whether the following items could be positive, negative or both. Click the cell in column B and choose the best answer about how each line item should look on the CSCF. (+) Depreciation Click on this cell and choose one... (-) Increase in current assets click on this cell and choose one... (+) Increase in current liabilities Click on this cell and choose one... (-) Increase in fixed assets at cost Click on this cell and choose one... (+) Increase in debt Click on this cell and choose one... (+) Increase in stock Click on this cell and choose one... (-) Dividends paid Click on this cell and choose one... Formatting WACC Full Questions These critical thinking questions apply to the previous model, "Full" (15 pts) Instead of holding debt flat, let's say you manually increased the debt forecast on the balance sheet to reflect issuing debt in the future. What other line item(s), if any, would you have to manually adjust? How would this change flow through your model? Explain, concisely and thoroughly with proper spelling and grammar: Balance sheet When looking at a Balance Sheet like the one in the previous model, think about whether the absolute value of the following items can increase (get more negative or more positive) or decrease (get closer to zero.) Click the cell in column B and choose the best answer. Fixed assets At cost Click on this cell and choose one... Accumulated Depreciation The absolute value of numbers on this line could never decrease (get closer to zero) over time Net fixed assets The absolute value of numbers on this line could increase or decrease or remain the same over time Consolidated Statement of Cash Flows When looking at a Consolidated Statement of Cash flows (CSCF) like the one in the previous model, think about whether the following items could be positive, negative or both. Click the cell in column B and choose the best answer about how each line item should look on the CSCF. (+) Depreciation Click on this cell and choose one... (-) Increase in current assets click on this cell and choose one... (+) Increase in current liabilities Click on this cell and choose one... (-) Increase in fixed assets at cost Click on this cell and choose one... (+) Increase in debt Click on this cell and choose one... (+) Increase in stock Click on this cell and choose one... (-) Dividends paid Click on this cell and choose one... Formatting WACC Full Questions