these go together please help

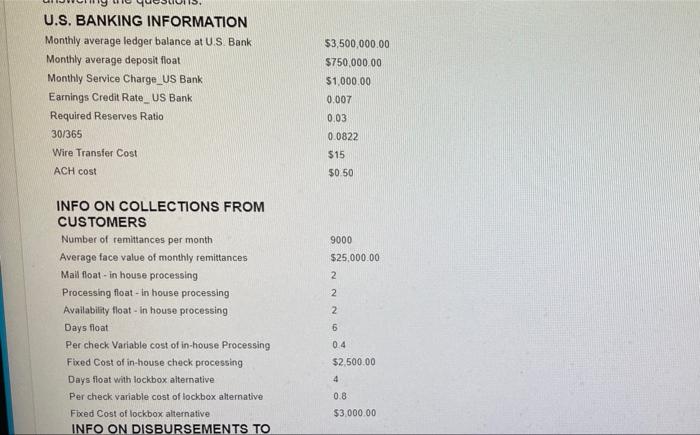

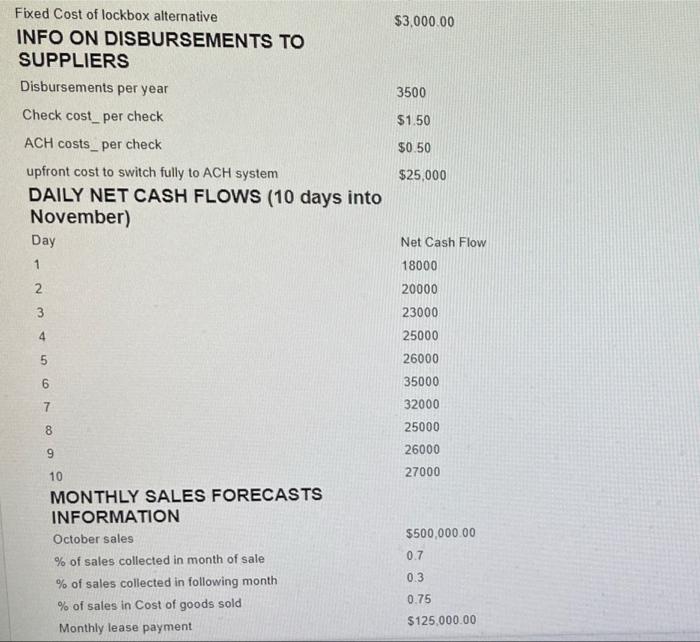

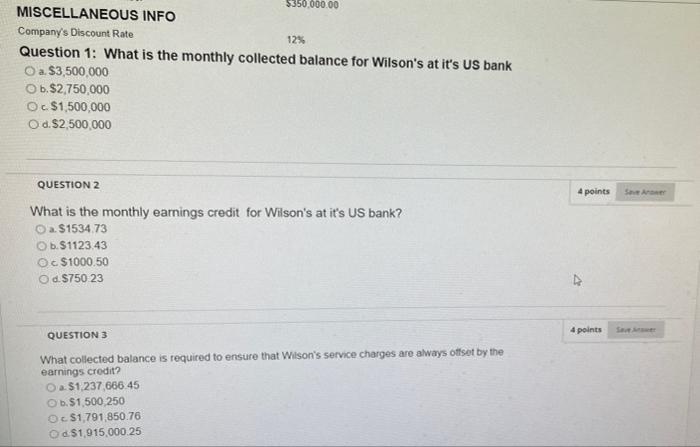

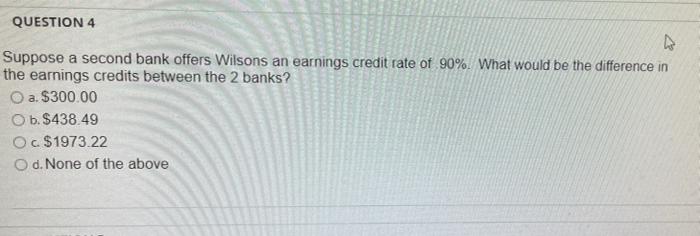

U.S. BANKING INFORMATION Monthly average ledger balance at US Bank Monthly average deposit float Monthly Service Charge_US Bank Earnings Credit Rate_US Bank Required Reserves Ratio 30/365 Wire Transfer Cost $3,500,000.00 $750,000.00 $1,000.00 0.007 0.03 0.0822 $15 ACH cost 50 50 9000 $25,000.00 2 2 2 INFO ON COLLECTIONS FROM CUSTOMERS Number of remittances per month Average face value of monthly remittances Mailfloat - in house processing Processing float - in house processing Availability float - in house processing Days float Per check Variable cost of in-house Processing Fixed Cost of in-house check processing Days float with lockbox alternative Per check variable cost of lockbox alternative Fixed Cost of lockbox alternative INFO ON DISBURSEMENTS TO 0.4 $2,500.00 4 0.8 $3,000.00 $3,000.00 3500 Fixed Cost of lockbox alternative INFO ON DISBURSEMENTS TO SUPPLIERS Disbursements per year Check cost_per check ACH costs_per check upfront cost to switch fully to ACH system DAILY NET CASH FLOWS (10 days into November) Day $1.50 $0.50 $25,000 1 Net Cash Flow 18000 20000 23000 2 3 4 25000 5 6 26000 35000 32000 25000 7 8 9 26000 27000 10 MONTHLY SALES FORECASTS INFORMATION October sales % of sales collected in month of sale % of sales collected in following month % of sales in Cost of goods sold Monthly lease payment $500,000.00 0.7 0.3 0.75 $125,000.00 $350,000.00 MISCELLANEOUS INFO Company's Discount Rate 12% Question 1: What is the monthly collected balance for Wilson's at it's US bank a. $3,500,000 O b.$2,750,000 Oc$1,500,000 O d. $2,500,000 QUESTION 2 4 points SA What is the monthly earnings credit for Wilson's at it's US bank? 2. 1534 73 Ob. 1123.43 Oc $1000.50 Od $750 23 4 points Sa QUESTION 3 What collected balance is required to ensure that Wilson's service charges are always offset by the earnings credit? Om $1,237,666.45 Ob.$1,500 250 Oc$1,791,850.76 Od $1,915,000.25 QUESTION 4 Suppose a second bank offers Wilsons an earnings credit rate of 90%. What would be the difference in the earnings credits between the 2 banks? a. $300.00 b. $438.49 O c. $1973.22 Od. None of the above U.S. BANKING INFORMATION Monthly average ledger balance at US Bank Monthly average deposit float Monthly Service Charge_US Bank Earnings Credit Rate_US Bank Required Reserves Ratio 30/365 Wire Transfer Cost $3,500,000.00 $750,000.00 $1,000.00 0.007 0.03 0.0822 $15 ACH cost 50 50 9000 $25,000.00 2 2 2 INFO ON COLLECTIONS FROM CUSTOMERS Number of remittances per month Average face value of monthly remittances Mailfloat - in house processing Processing float - in house processing Availability float - in house processing Days float Per check Variable cost of in-house Processing Fixed Cost of in-house check processing Days float with lockbox alternative Per check variable cost of lockbox alternative Fixed Cost of lockbox alternative INFO ON DISBURSEMENTS TO 0.4 $2,500.00 4 0.8 $3,000.00 $3,000.00 3500 Fixed Cost of lockbox alternative INFO ON DISBURSEMENTS TO SUPPLIERS Disbursements per year Check cost_per check ACH costs_per check upfront cost to switch fully to ACH system DAILY NET CASH FLOWS (10 days into November) Day $1.50 $0.50 $25,000 1 Net Cash Flow 18000 20000 23000 2 3 4 25000 5 6 26000 35000 32000 25000 7 8 9 26000 27000 10 MONTHLY SALES FORECASTS INFORMATION October sales % of sales collected in month of sale % of sales collected in following month % of sales in Cost of goods sold Monthly lease payment $500,000.00 0.7 0.3 0.75 $125,000.00 $350,000.00 MISCELLANEOUS INFO Company's Discount Rate 12% Question 1: What is the monthly collected balance for Wilson's at it's US bank a. $3,500,000 O b.$2,750,000 Oc$1,500,000 O d. $2,500,000 QUESTION 2 4 points SA What is the monthly earnings credit for Wilson's at it's US bank? 2. 1534 73 Ob. 1123.43 Oc $1000.50 Od $750 23 4 points Sa QUESTION 3 What collected balance is required to ensure that Wilson's service charges are always offset by the earnings credit? Om $1,237,666.45 Ob.$1,500 250 Oc$1,791,850.76 Od $1,915,000.25 QUESTION 4 Suppose a second bank offers Wilsons an earnings credit rate of 90%. What would be the difference in the earnings credits between the 2 banks? a. $300.00 b. $438.49 O c. $1973.22 Od. None of the above