These Questions are accumlative

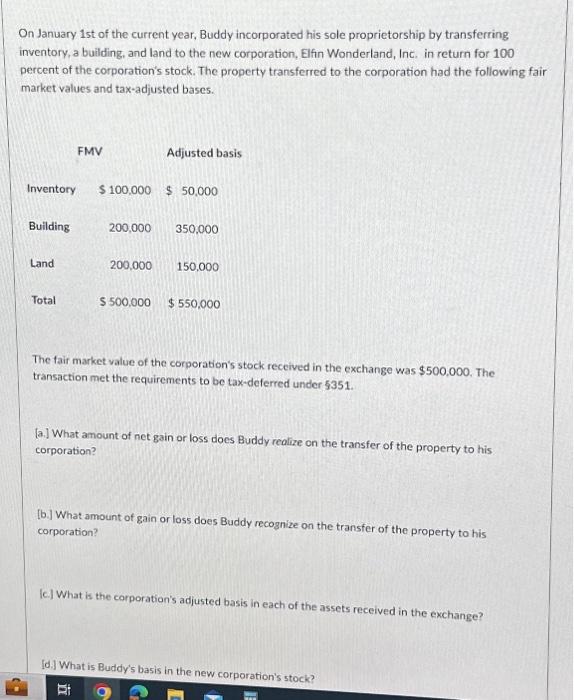

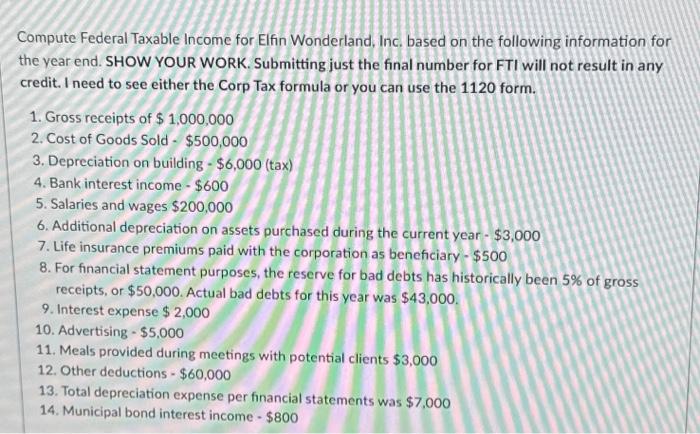

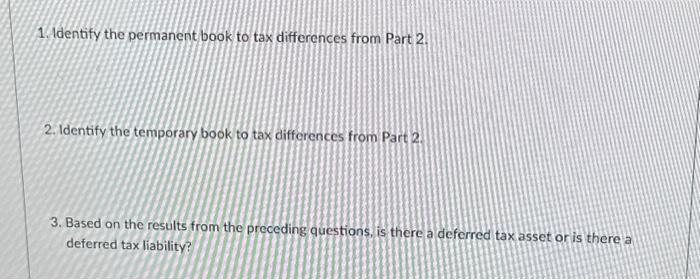

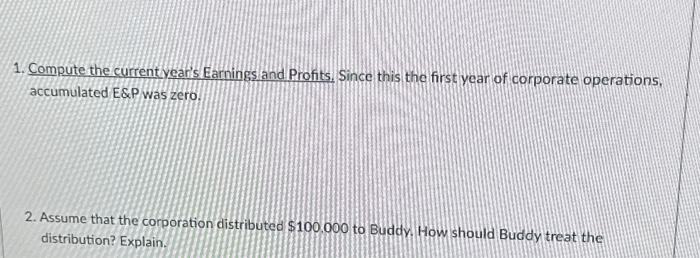

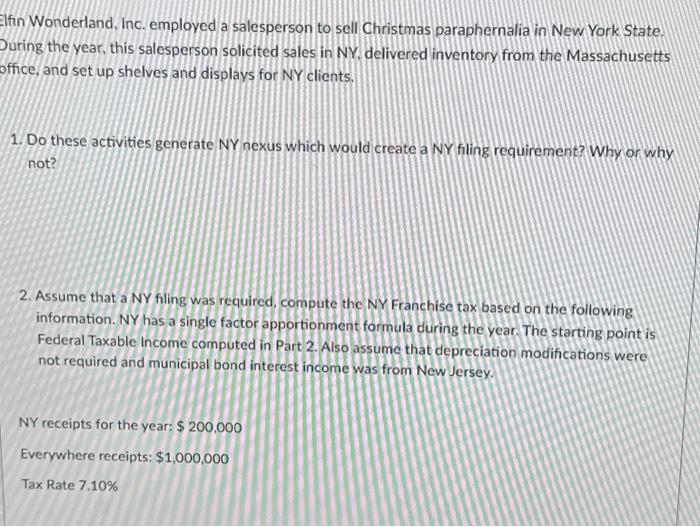

On January 1st of the current year, Buddy incorporated his sole proprietorship by transferring inventory, a building, and land to the new corporation, Elfin Wonderland, Inc, in return for 100 percent of the corporation's stock. The property transferred to the corporation had the following fair market values and tax-adjusted bases. The fair market value of the corporation's stock received in the exchange was $500,000. The transaction met the requirements to be tax-deferred under $351. [a.] What amount of net gain or loss does Buddy realize on the transfer of the property to his corporation? [b.] What amount of gain or loss does Buddy recognize on the transfer of the property to his corporation? [c.) What is the corporation's adjusted basis in each of the assets received in the exchange? [d] What is Buddy's basis in the new corporation's stock? Compute Federal Taxable Income for Elfin Wonderland, Inc. based on the following information for the year end. SHOW YOUR WORK. Submitting just the final number for FTI will not result in any credit. I need to see either the Corp Tax formula or you can use the 1120 form. 1. Gross receipts of $1,000,000 2. Cost of Goods Sold - $500,000 3. Depreciation on building - $6,000(tax) 4. Bank interest income $600 5. Salaries and wages $200,000 6. Additional depreciation on assets purchased during the current year $3,000 7. Life insurance premiums paid with the corporation as beneficiary $500 8. For financial statement purposes, the reserve for bad debts has historically been 5% of gross receipts, or $50,000. Actual bad debts for this year was $43,000. 9. Interest expense $2,000 10. Advertising - $5,000 11. Meals provided during meetings with potential clients $3,000 12. Other deductions $60,000 13. Total depreciation expense per financial statements was $7,000 14. Municipal bond interest income - $800 1. Identify the permanent book to tax differences from Part 2. 2. Identify the temporary book to tax differences from Part 2 . 3. Based on the results from the preceding questions, is there a deferred tax asset or is there a deferred tax liability? 1. Compute the currentyear's Earnings and Profits. Since this the first year of corporate operations, accumulated E\&P was zero. 2. Assume that the corporation distributed $100.000 to Buddy. How should Buddy treat the distribution? Explain. fin Wonderland, Inc. employed a salesperson to sell Christmas paraphernalia in New York State. uring the year, this salesperson solicited sales in NY, delivered inventory from the Massachusetts ffice, and set up shelves and displays for NY clients. 1. Do these activities generate NY nexus which would create a NY filing requirement? Why or why not? 2. Assume that a NY filing was required, compute the NY Franchise tax based on the following information. NY has a single factor apportionment formula during the year. The starting point is Federal Taxable Income computed in Part 2. Also assume that depreciation modifications were not required and municipal bond interest income was from New Jersey. NY receipts for the year: $200,000 Everywhere receipts: $1,000,000 Tax Rate 7.10%