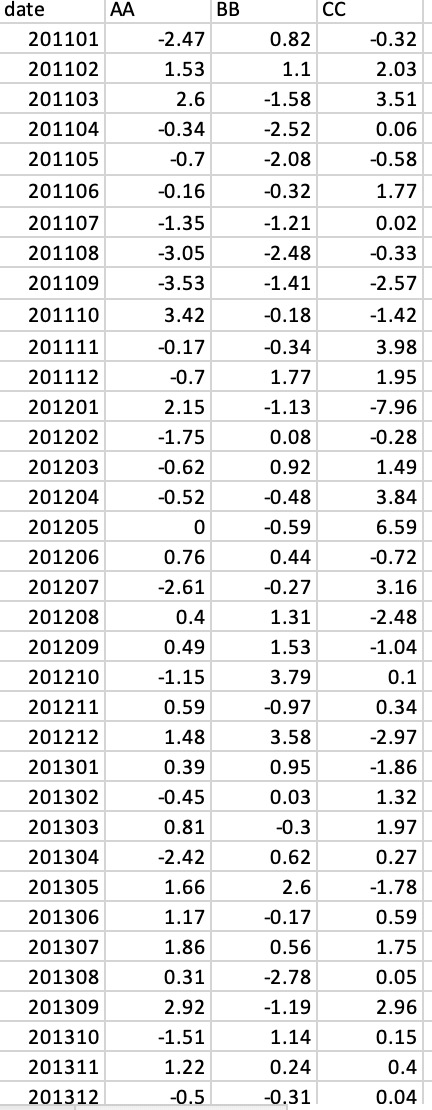

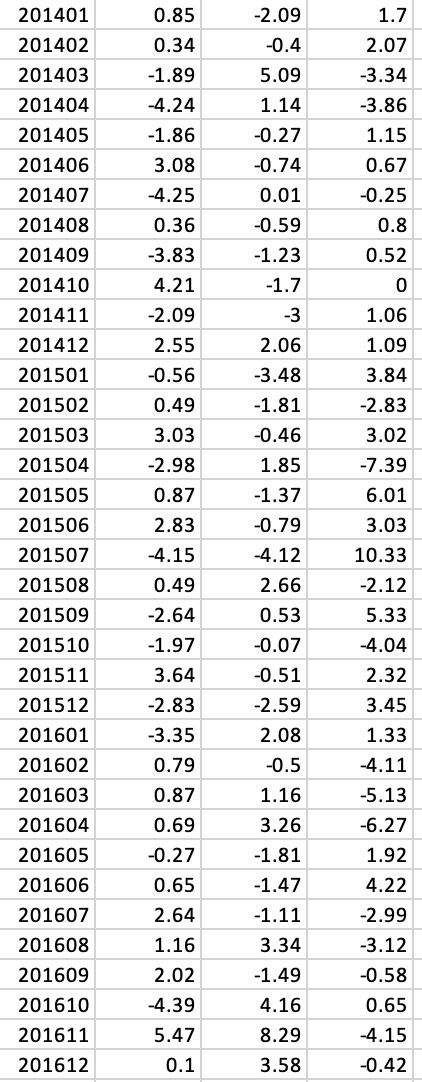

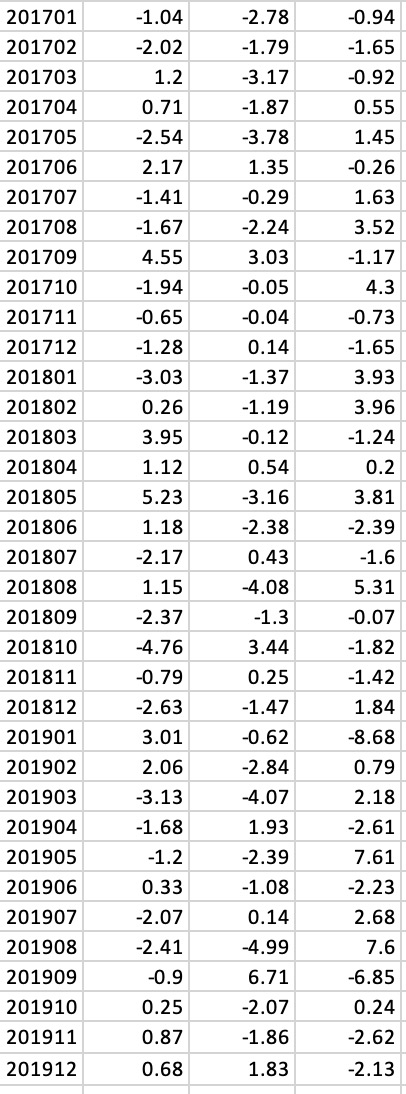

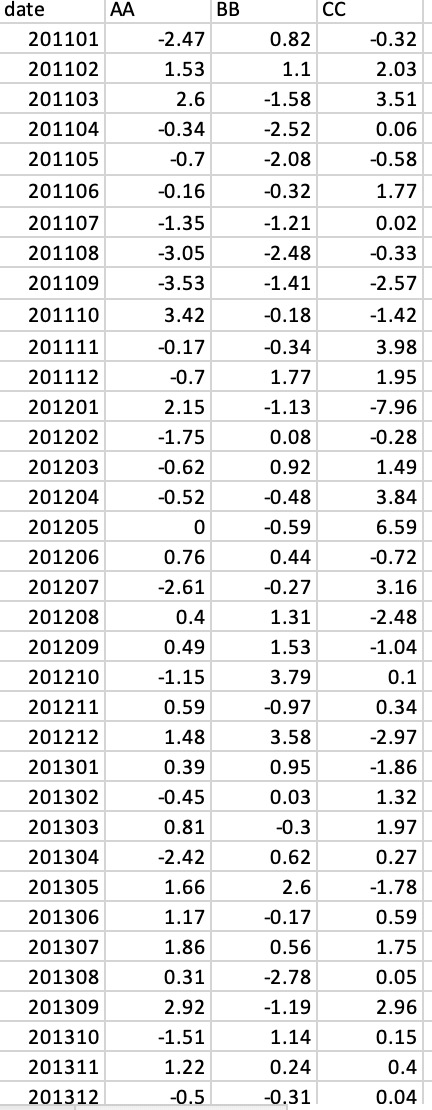

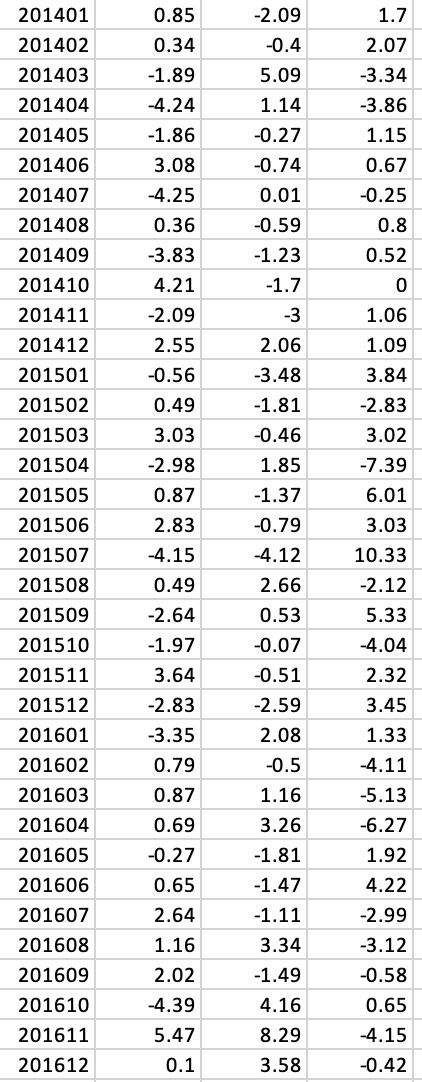

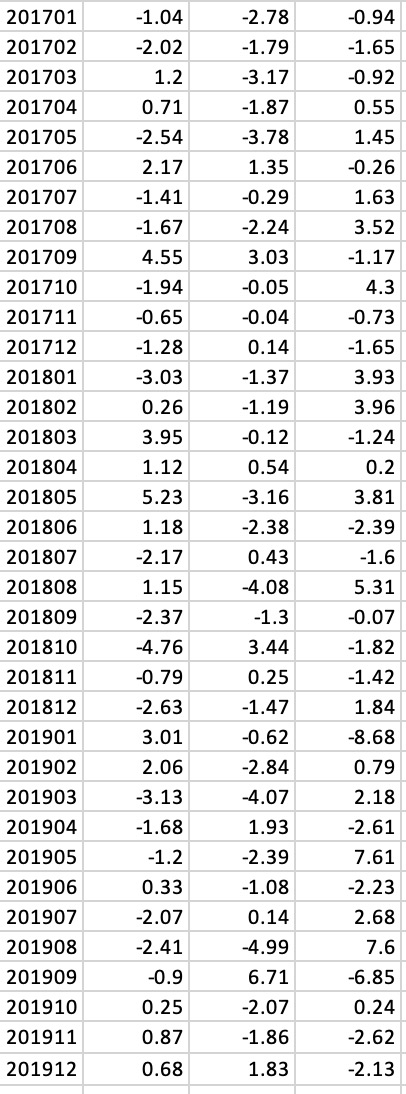

These three images contain monthly return (in %) for three trading strategies from Jan 2011 to Dec 2019.

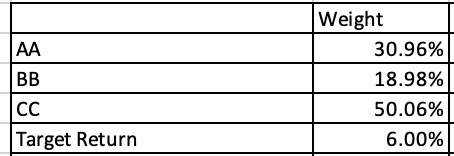

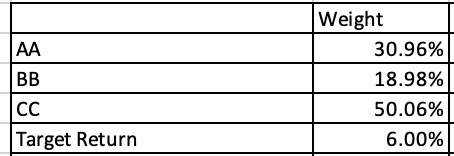

Consider the portfolio below, please report the portfolio cumulative return and annual geometric average over the period (show the steps in excel) and explain why your portfolio does not deliver the annual geometric mean of 6%. Your explanation should include relevant theories and practical implementation of the Mean-Variance framework.

BB cc 0.82 1.1 -1.58 -2.52 -2.08 -0.32 -1.21 -2.48 -1.41 -0.18 date AA 201101 201102 201103 201104 201105 201106 201107 201108 201109 201110 201111 201112 201201 201202 201203 201204 201205 201206 201207 201208 201209 201210 201211 201212 201301 201302 201303 201304 201305 201306 201307 201308 201309 201310 201311 201312 -2.47 1.53 2.6 -0.34 -0.7 -0.16 -1.35 3.05 3.53 3.42 -0.17 07 2.15 -1.75 -0.62 -0.52 0 0.76 -2.61 0.4 0.49 -1.15 0.59 1.48 0.39 0.45 0.81 -2.42 1.66 1.17 1.86 0.31 2.92 -1.51 1.22 -0.5 -0.34 1.77 -1.13 0.08 0.92 -0.48 -0.59 0.44 -0.27 1.31 1.53 3.79 -0.97 3.58 0.95 0.03 -0.32 2.03 3.51 0.06 -0.58 1.77 0.02 -0.33 -2.57 -1.42 3.98 1.95 -7.96 -0.28 1.49 3.84 6.59 -0.72 3.16 -2.48 -1.04 0.1 0.34 -2.97 -1.86 1.32 1.97 0.27 -1.78 0.59 1.75 0.05 2.96 0.15 0.4 0.04 | g 0.3 # 0.62 2.6 -0.17 0.56 -2.78 -1.19 1.14 0.24 -0.31 -2.09 -0.4 5.09 1.14 -0.27 -0.74 10.01 -0.59 -1.23 -1.7 -3 201401 201402 201403 201404 201405 201406 201407 201408 201409 | 201410 201411 201412 201501 201502 201503 201504 201505 201506 201507 201508 201509 201510 201511 201512 201601 201602 201603 201604 201605 201606 201607 201608 201609 201610 201611 201612 0.85 0.34 -1.89 4.24 -1.86 3.08 4.25 10.36 -3.83 4.21 -2.09 2.55 -0.56 0.49 3.03 -2.98 0.87 2.83 -4.15 0.49 -2.64 -1.97 3.64 -2.83 -3.35 0.79 0.87 0.69 -0.27 0.65 2.64 1.16 2.02 4.39 5.47 2.06 -3.48 -1.81 -0.46 1.85 -1.37 -0.79 4.12 2.66 0.53 17 2.07 -3.34 -3.86 1.15 10.67 -0.25 0.8 0.52 0 1.06 1.09 3.84 -2.83 3.02 -7.39 6.01 3.03 | 10.33 -2.12 5.33 4.04 2.32 3.45 1.33 -0.07 -4.11 -0.51 -2.59 2.08 -0.5 1.16 3.26 -1.81 -1.47 -1.11 3.34 -1.49 4.16 8.29 3.58 -5.13 -6.27 1.92 4.22 -2.99 -3.12 -0.58 0.65 -4.15 -0.42 10.1 -0.94 -1.65 -0.92 10.55 1.45 -0.26 1.63 3.52 -1.17 4.3 -0.73 -1.65 3.93 3.96 -1.24 0.2 201701 201702 201703 201704 201705 201706 201707 201708 201709 201710 201711 201712 201801 201802 201803 201804 201805 201806 | 201807 201808 201809 | 201810 201811 201812 201901 201902 201903 201904 201905 201906 201907 201908 201909 | 201910 | 201911 201912 -1.04 -2.02 1.2 10.71 -2.54 2.17 -1.41 -1.67 4.55 -1.94 0.65 -1.28 -3.03 0.26 3.95 1.12 5.23 1.18 -2.17 1.15 -2.37 4.76 0.79 -2.63 3.01 2.06 -3.13 -1.68 -1.2 0.33 -2.07 -2.41 -0.9 0.25 0.87 0.68 -2.78 -1.79 -3.17 -1.87 -3.78 1.35 -0.29 -2.24 3.03 -0.05 -0.04 0.14 -1.37 -1.19 -0.12 0.54 -3.16 -2.38 0.43 4.08 -1.3 3.44 10.25 -1.47 -0.62 -2.84 4.07 1.93 -2.39 -1.08 0.14 -4.99 6.71 -2.07 -1.86 1.83 3.81 -2.39 -1.6 5.31 -0.07 -1.82 -1.42 1.84 -8.68 10.79 2.18 -2.61 7.61 -2.23 12.68 7.6 -6.85 10.24 -2.62 -2.13 Target Return Weight 30.96% 18.98% 50.06% 6.00% BB cc 0.82 1.1 -1.58 -2.52 -2.08 -0.32 -1.21 -2.48 -1.41 -0.18 date AA 201101 201102 201103 201104 201105 201106 201107 201108 201109 201110 201111 201112 201201 201202 201203 201204 201205 201206 201207 201208 201209 201210 201211 201212 201301 201302 201303 201304 201305 201306 201307 201308 201309 201310 201311 201312 -2.47 1.53 2.6 -0.34 -0.7 -0.16 -1.35 3.05 3.53 3.42 -0.17 07 2.15 -1.75 -0.62 -0.52 0 0.76 -2.61 0.4 0.49 -1.15 0.59 1.48 0.39 0.45 0.81 -2.42 1.66 1.17 1.86 0.31 2.92 -1.51 1.22 -0.5 -0.34 1.77 -1.13 0.08 0.92 -0.48 -0.59 0.44 -0.27 1.31 1.53 3.79 -0.97 3.58 0.95 0.03 -0.32 2.03 3.51 0.06 -0.58 1.77 0.02 -0.33 -2.57 -1.42 3.98 1.95 -7.96 -0.28 1.49 3.84 6.59 -0.72 3.16 -2.48 -1.04 0.1 0.34 -2.97 -1.86 1.32 1.97 0.27 -1.78 0.59 1.75 0.05 2.96 0.15 0.4 0.04 | g 0.3 # 0.62 2.6 -0.17 0.56 -2.78 -1.19 1.14 0.24 -0.31 -2.09 -0.4 5.09 1.14 -0.27 -0.74 10.01 -0.59 -1.23 -1.7 -3 201401 201402 201403 201404 201405 201406 201407 201408 201409 | 201410 201411 201412 201501 201502 201503 201504 201505 201506 201507 201508 201509 201510 201511 201512 201601 201602 201603 201604 201605 201606 201607 201608 201609 201610 201611 201612 0.85 0.34 -1.89 4.24 -1.86 3.08 4.25 10.36 -3.83 4.21 -2.09 2.55 -0.56 0.49 3.03 -2.98 0.87 2.83 -4.15 0.49 -2.64 -1.97 3.64 -2.83 -3.35 0.79 0.87 0.69 -0.27 0.65 2.64 1.16 2.02 4.39 5.47 2.06 -3.48 -1.81 -0.46 1.85 -1.37 -0.79 4.12 2.66 0.53 17 2.07 -3.34 -3.86 1.15 10.67 -0.25 0.8 0.52 0 1.06 1.09 3.84 -2.83 3.02 -7.39 6.01 3.03 | 10.33 -2.12 5.33 4.04 2.32 3.45 1.33 -0.07 -4.11 -0.51 -2.59 2.08 -0.5 1.16 3.26 -1.81 -1.47 -1.11 3.34 -1.49 4.16 8.29 3.58 -5.13 -6.27 1.92 4.22 -2.99 -3.12 -0.58 0.65 -4.15 -0.42 10.1 -0.94 -1.65 -0.92 10.55 1.45 -0.26 1.63 3.52 -1.17 4.3 -0.73 -1.65 3.93 3.96 -1.24 0.2 201701 201702 201703 201704 201705 201706 201707 201708 201709 201710 201711 201712 201801 201802 201803 201804 201805 201806 | 201807 201808 201809 | 201810 201811 201812 201901 201902 201903 201904 201905 201906 201907 201908 201909 | 201910 | 201911 201912 -1.04 -2.02 1.2 10.71 -2.54 2.17 -1.41 -1.67 4.55 -1.94 0.65 -1.28 -3.03 0.26 3.95 1.12 5.23 1.18 -2.17 1.15 -2.37 4.76 0.79 -2.63 3.01 2.06 -3.13 -1.68 -1.2 0.33 -2.07 -2.41 -0.9 0.25 0.87 0.68 -2.78 -1.79 -3.17 -1.87 -3.78 1.35 -0.29 -2.24 3.03 -0.05 -0.04 0.14 -1.37 -1.19 -0.12 0.54 -3.16 -2.38 0.43 4.08 -1.3 3.44 10.25 -1.47 -0.62 -2.84 4.07 1.93 -2.39 -1.08 0.14 -4.99 6.71 -2.07 -1.86 1.83 3.81 -2.39 -1.6 5.31 -0.07 -1.82 -1.42 1.84 -8.68 10.79 2.18 -2.61 7.61 -2.23 12.68 7.6 -6.85 10.24 -2.62 -2.13 Target Return Weight 30.96% 18.98% 50.06% 6.00%