they are two questions please do it well in boxes for easy understanding. i will rate your answer. thank you

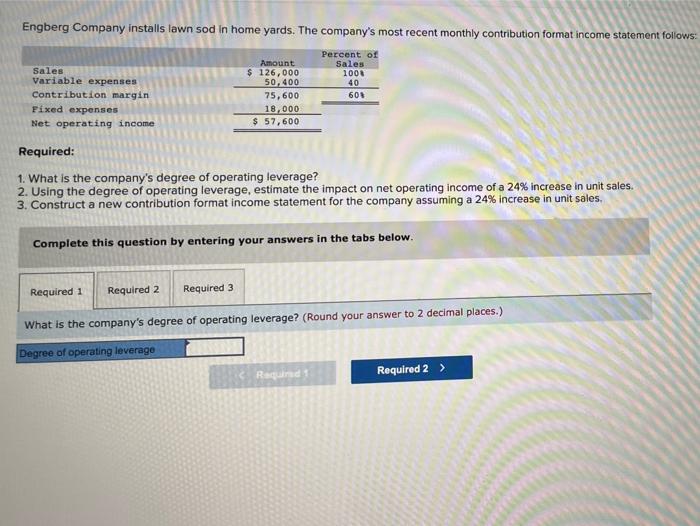

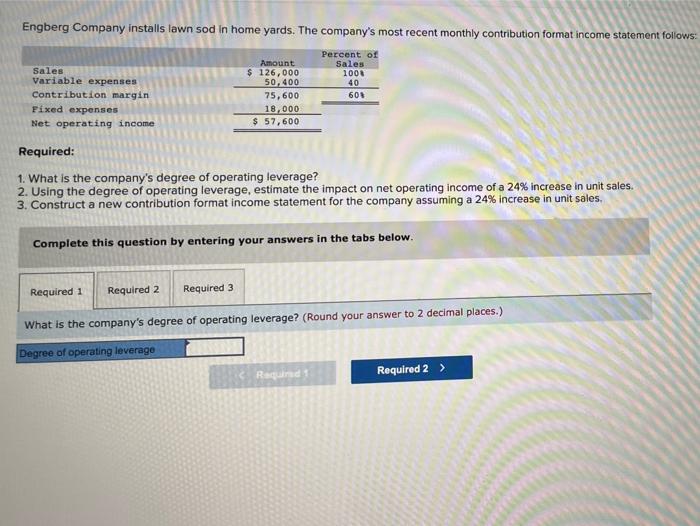

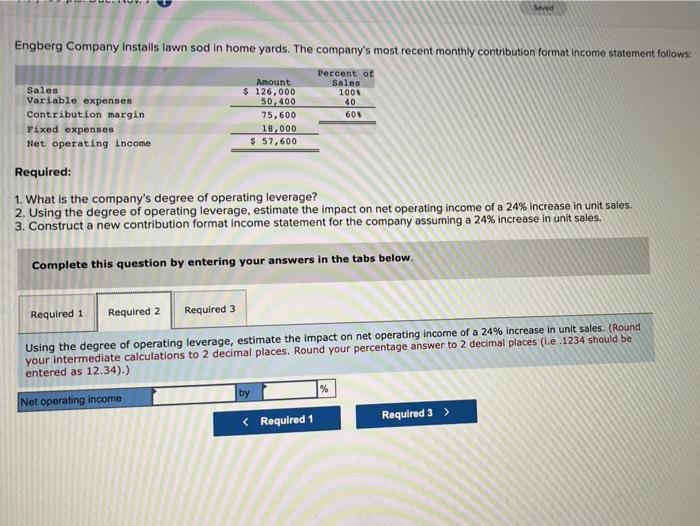

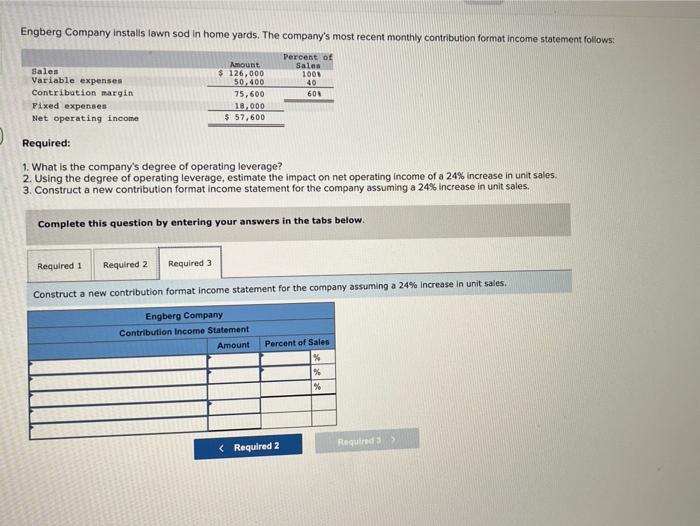

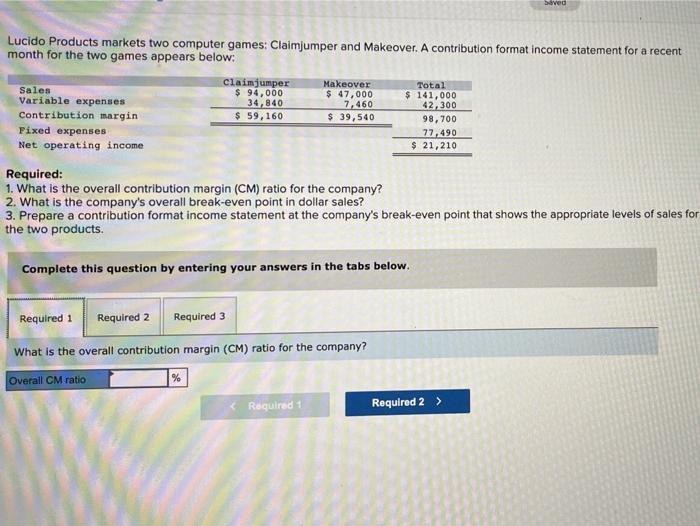

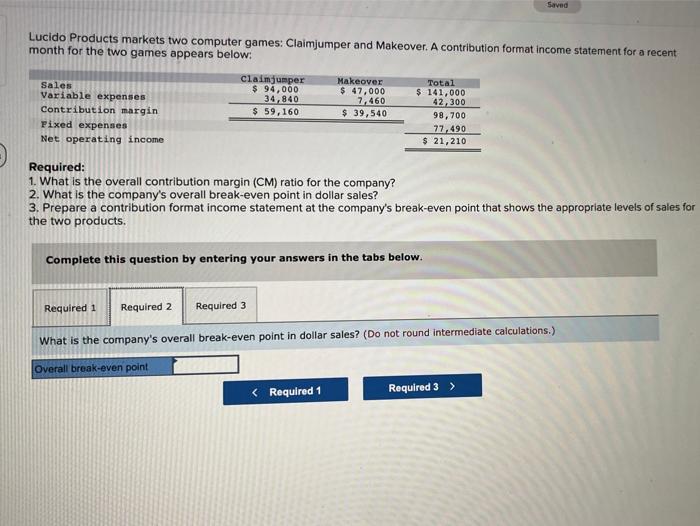

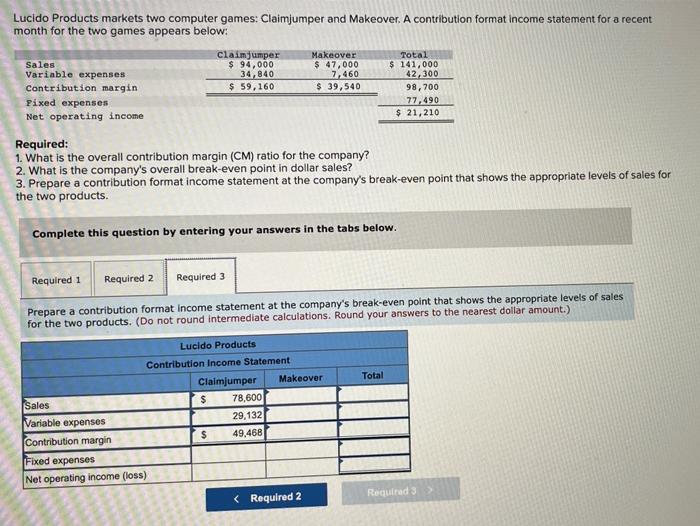

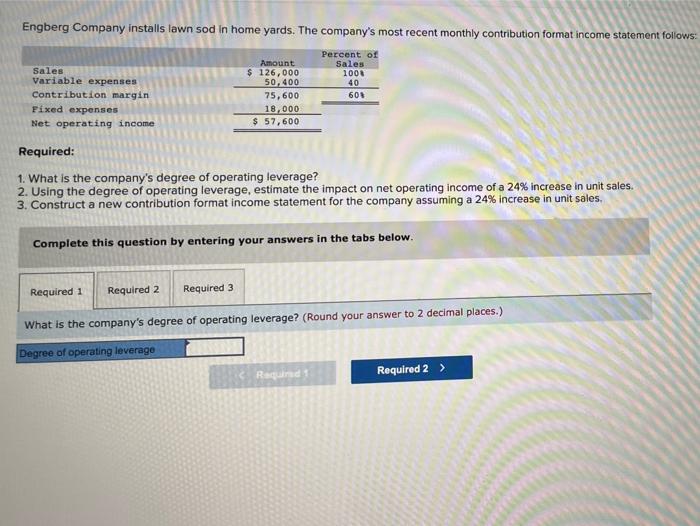

Engberg Company installs lawn sod in home yards. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income Amount $ 126,000 50,400 75,600 18,000 $ 57,600 Percent of Sales 1000 40 605 Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 24% increase in unit sales. 3. Construct a new contribution format income statement for the company assuming a 24% increase in unit sales. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the company's degree of operating leverage? (Round your answer to 2 decimal places.) Degree of operating leverage Required: Required 2 > > Saved Engberg Company installs lawn sod in home yards. The company's most recent monthly contribution format income statement follows: Percent of Amount Sales Sales $ 126,000 1001 Variable expenses 50,400 40 Contribution margin 75,600 600 Fixed expenses 18,000 Net operating income $ 57,600 Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 24% increase in unit sales. 3. Construct a new contribution format income statement for the company assuming a 24% increase in unit sales, Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Using the degree of operating leverage, estimate the impact on net operating income of a 24% increase in unit sales. (Round your intermediate calculations to 2 decimal places. Round your percentage answer to 2 decimal places (.e.1234 should be entered as 12.34).) Net operating income Engberg Company installs lawn sod in home yards. The company's most recent monthly contribution format income statement follows: Sales Variable expenses Contribution margin Fixed expenses Net operating income Amount $ 126,000 50,400 75,600 18.000 $ 57,600 Percent of Sales 100N 40 601 Required: 1. What is the company's degree of operating leverage? 2. Using the degree of operating leverage, estimate the impact on net operating income of a 24% increase in unit sales. 3. Construct a new contribution format income statement for the company assuming a 24% increase in unit sales Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Construct a new contribution format income statement for the company assuming a 24% Increase in unit sales. Engberg Company Contribution Income Statement Amount Percent of Sales % % % Saved Lucido Products markets two computer games: Claimjumper and Makeover. A contribution format income statement for a recent month for the two games appears below: Sales Variable expenses Contribution margin Fixed expenses Net operating income Claimjumper $ 94,000 34,840 $ 59,160 Makeover $ 47,000 7,460 $ 39,540 Total $ 141,000 42,300 98,700 77.490 $ 21,210 Required: 1. What is the overall contribution margin (CM) ratio for the company? 2. What is the company's overall break-even point in dollar sales? 3. Prepare a contribution format income statement at the company's break-even point that shows the appropriate levels of sales for the two products. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the company's overall break-even point in dollar sales? (Do not round intermediate calculations.) Overall break-even point Lucido Products markets two computer games: Claimjumper and Makeover. A contribution format income statement for a recent month for the two games appears below: Sales Variable expenses Contribution margin Fixed expenses Net operating income claimjumper $ 94,000 34,840 $ 59,160 Makeover $ 47,000 7,460 $ 39,540 Total $ 141,000 42,300 98,700 77,490 $ 21,210 Required: 1. What is the overall contribution margin (CM) ratio for the company? 2. What is the company's overall break-even point in dollar sales? 3. Prepare a contribution format income statement at the company's break-even point that shows the appropriate levels of sales for the two products. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a contribution format income statement at the company's break-even point that shows the appropriate levels of sales for the two products. (Do not round intermediate calculations. Round your answers to the nearest dollar amount.) Total Lucido Products Contribution Income Statement Claimjumper Makeover Sales $ 78,600 Variable expenses 29,132 Contribution margin $ 49,468 Fixed expenses Net operating income (loss) Required