Answered step by step

Verified Expert Solution

Question

1 Approved Answer

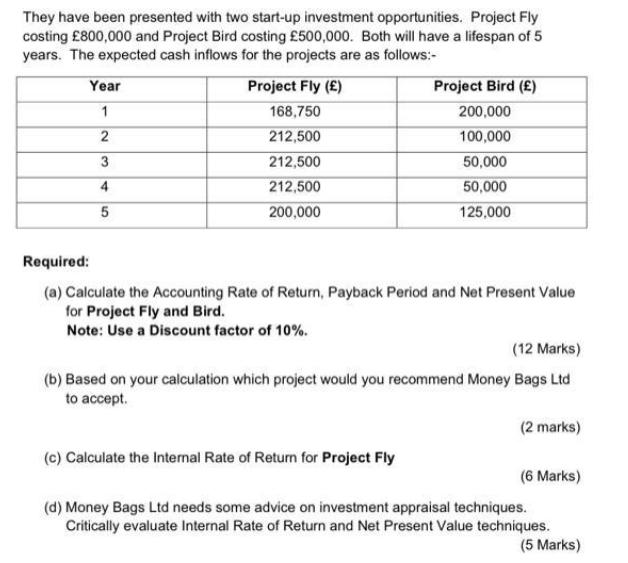

They have been presented with two start-up investment opportunities. Project Fly costing 800,000 and Project Bird costing 500,000. Both will have a lifespan of

They have been presented with two start-up investment opportunities. Project Fly costing 800,000 and Project Bird costing 500,000. Both will have a lifespan of 5 years. The expected cash inflows for the projects are as follows:- Year Project Bird () Project Fly () 1 168,750 200,000 2 212,500 100,000 3 212,500 50,000 4 212,500 50,000 5 200,000 125,000 Required: (a) Calculate the Accounting Rate of Return, Payback Period and Net Present Value for Project Fly and Bird. Note: Use a Discount factor of 10%. (12 Marks) (b) Based on your calculation which project would you recommend Money Bags Ltd to accept. (2 marks) (c) Calculate the Internal Rate of Return for Project Fly (6 Marks) (d) Money Bags Ltd needs some advice on investment appraisal techniques. Critically evaluate Internal Rate of Return and Net Present Value techniques. (5 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started