Answered step by step

Verified Expert Solution

Question

1 Approved Answer

they want you to look at the balance sheet im going to upload and answer the question part a and b 51. Identify & Explain

they want you to look at the balance sheet im going to upload and answer the question part a and b

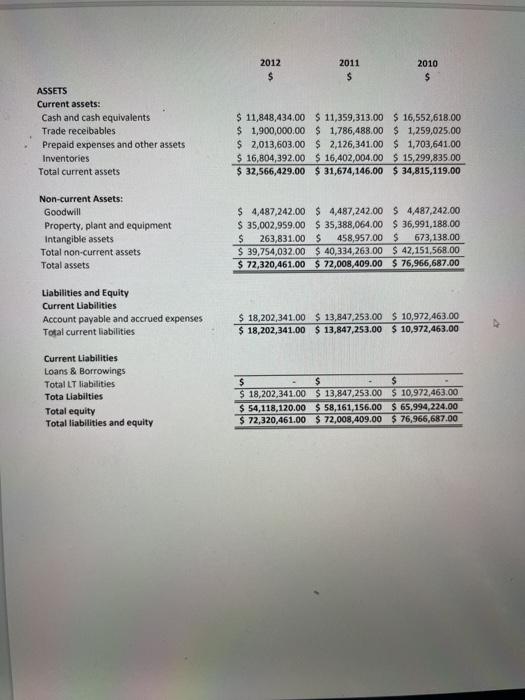

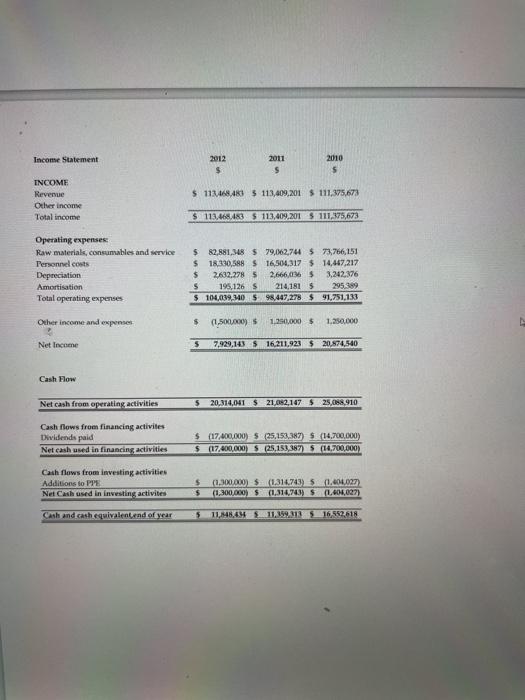

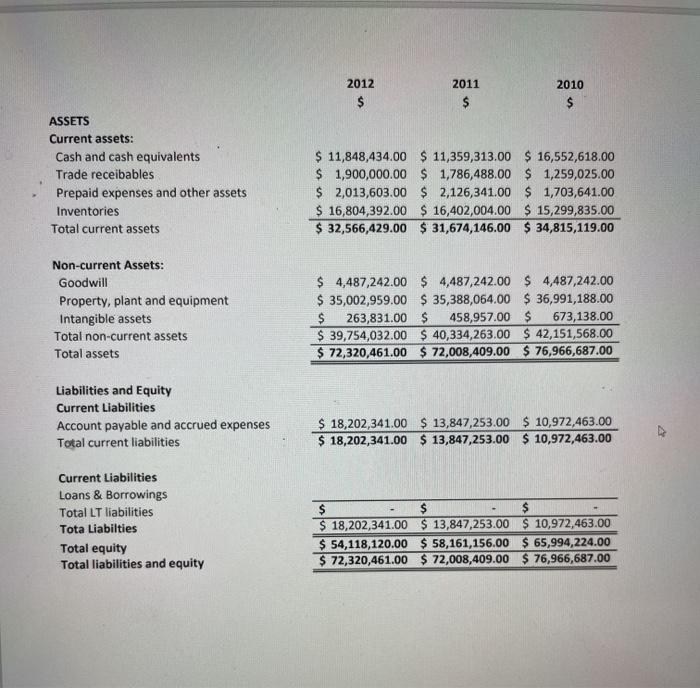

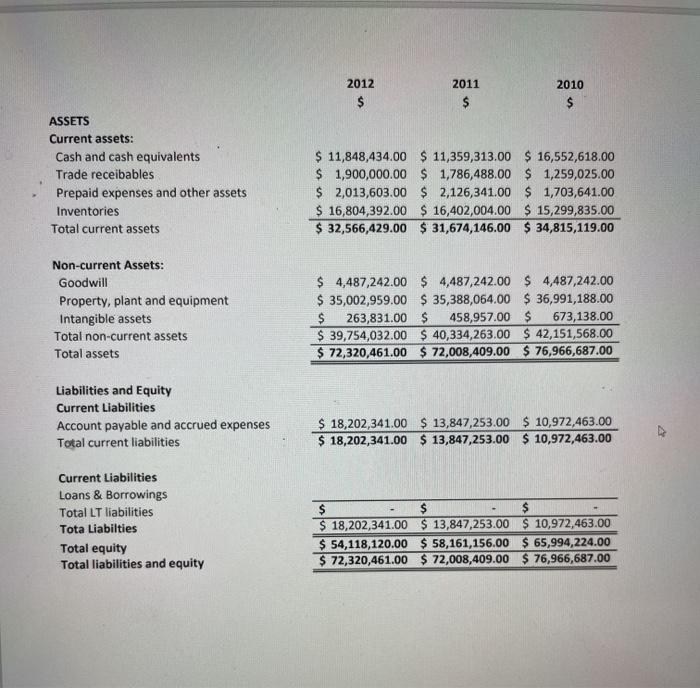

51. Identify & Explain three positive observations from the balance sheet. (6 Points) Enter your answer 52. Identify & Explain three negative observations from the balance sheet. (6 Points) 2011 2012 $ 2010 $ $ ASSETS Current assets: Cash and cash equivalents Trade receibables Prepaid expenses and other assets Inventories Total current assets $ 11,848,434.00 $ 11,359,313.00 $ 16,552,618.00 $ 1,900,000.00 $ 1,786,488.00 $ 1,259,025.00 $ 2,013,603.00 $ 2,126,341.00 $ 1,703,641.00 $ 16,804,392.00 $ 16,402,004.00 $ 15,299,835.00 $ 32,566,429.00 $ 31,674,146.00 $ 34,815,119.00 Non-current Assets: Goodwill Property, plant and equipment Intangible assets Total non-current assets Total assets $ 4,487,242.00 $ 4,487,242.00 $4,487,242.00 $ 35,002,959.00 $ 35,388,064.00 $ 36,991,188.00 $ 263,831.00 $ 458,957.00 $ 673,138.00 $ 39,754,032.00 $ 40,334,263.00 $ 42,151,568.00 $ 72,320,461.00 $ 72,008,409.00 $ 76,966,687.00 Liabilities and Equity Current Liabilities Account payable and accrued expenses Total current liabilities $ 18,202,341.00 $ 13,847,253.00 $ 10,972,463.00 $ 18,202,341.00 $ 13,847,253,00 $ 10,972,463.00 Current Liabilities Loans & Borrowings Total LT liabilities Tota Liabilties Total equity Total liabilities and equity $ $ $ $ 18,202,341,00 $ 13,847,253.00 $ 10,972,463.00 $ 54,118,120.00 $ 58,161,156.00 $ 65,994,224.00 $ 72,320,461.00 $ 72,008,409.00 $ 76,966,687.00 Income Statement 2012 $ 2011 $ 2010 5 $ 112,468,481 $ 113,409,201 $ 111,375,673 INCOME Revenue Other income Total income 113.466.483 $ 113,009,2015 111,375,673 Operating expenses Raw materials, consumables and service Personnel costs Depreciation Amortisation Total operating expenses $ 82,881,348 $ 79,062,744 $ 73,766,151 $ 18.330,588 $ 16,504.317 $ 14,467,217 $ 2632.278 5 2.666,0136 3.242,376 5 195,1265 214,181 295.389 $ 104,039,340 $ 98,447,278 $ 91,751,133 Other income and expenses $ (1,500,000) 1,250,000 $ 1.250.000 Net Income 5 7,929,143 $ 16,211,923 $ 20.574,540 Cash Flow Net cash from operating activities 5 20,314,041 $ 21,042,147 $ 25,088,910 Cash flows from financing activites Dividends paid Net cash used in financing activities $ 17,000,000) 5 (25.153.387) $(14,700.000) $ (17.400.000) $25,153,387) 5 (14,700,000) Cash flows from investing activities Additions to 11 Na Cash used in investing activites $ $ (1,300,000) $(1,314.743) 50.404.027) (1.300.000) (1,314,743) (1,406,007) Cash and cash equivalent end of year S 11,848.49 11.3593135 16 552.618 2011 2012 $ 2010 $ $ ASSETS Current assets: Cash and cash equivalents Trade receibables Prepaid expenses and other assets Inventories Total current assets $ 11,848,434.00 $ 11,359,313.00 $ 16,552,618.00 $ 1,900,000.00 $ 1,786,488.00 $ 1,259,025.00 $ 2,013,603.00 $ 2,126,341.00 $ 1,703,641.00 $ 16,804,392.00 $ 16,402,004.00 $ 15,299,835.00 $ 32,566,429.00 $ 31,674,146.00 $ 34,815,119.00 Non-current Assets: Goodwill Property, plant and equipment Intangible assets Total non-current assets Total assets $ 4,487,242.00 $ 4,487,242.00 $ 4,487,242.00 $ 35,002,959.00 $ 35,388,064.00 $ 36,991,188.00 $ 263,831.00 $ 458,957.00 $ 673,138.00 $ 39,754,032.00 $ 40,334,263.00 $ 42,151,568.00 $ 72,320,461.00 $ 72,008,409.00 $ 76,966,687.00 Liabilities and Equity Current Liabilities Account payable and accrued expenses Total current liabilities $ 18,202,341.00 $ 13,847,253.00 $ 10,972,463.00 $ 18,202,341.00 $ 13,847,253.00 $ 10,972,463.00 Current Liabilities Loans & Borrowings Total LT liabilities Tota Liabilties Total equity Total liabilities and equity $ $ $ $ 18,202,341.00 $ 13,847,253.00 $ 10,972,463.00 $ 54,118,120.00 $ 58,161,156.00 $ 65,994,224.00 $ 72,320,461.00 $ 72,008,409.00 $ 76,966,687.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started