Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Things Fall Apart (TFA) Ltd manufactures bottled fruit juice, Hibiya. During the first year of operations for the fiscal year ended 31 st December

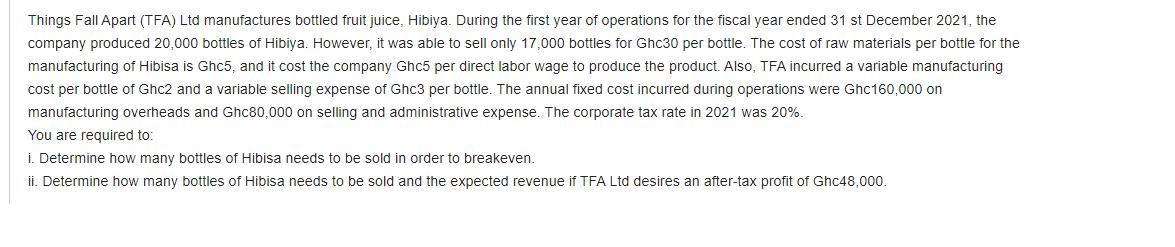

Things Fall Apart (TFA) Ltd manufactures bottled fruit juice, Hibiya. During the first year of operations for the fiscal year ended 31 st December 2021, the company produced 20,000 bottles of Hibiya. However, it was able to sell only 17,000 bottles for Ghc30 per bottle. The cost of raw materials per bottle for the manufacturing of Hibisa is Ghc5, and it cost the company Ghc5 per direct labor wage to produce the product. Also, TFA incurred a variable manufacturing cost per bottle of Ghc2 and a variable selling expense of Ghc3 per bottle. The annual fixed cost incurred during operations were Ghc160,000 on manufacturing overheads and Ghc80,000 on selling and administrative expense. The corporate tax rate in 2021 was 20%. You are required to: i. Determine how many bottles of Hibisa needs to be sold in order to breakeven. ii. Determine how many bottles of Hibisa needs to be sold and the expected revenue if TFA Ltd desires an after-tax profit of Ghc48,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Step 13 Given information of Things Fall Apart TFA Ltd Manufactures Production 20000 Bottles Sales 17000 Bottles Ghc30 per bottle Cost of Raw Material ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started