Question

Thirty five years ago, Raul Cristo and his wife, Maria, established, Muddy Waters Car Wash on 20 acres of worthless desert on the outskirts of

Thirty five years ago, Raul Cristo and his wife, Maria, established, Muddy Waters Car Wash on 20 acres of worthless desert on the outskirts of Las Cruces. They would have never imagined the urban sprawl that now engulfed their business. For years, the Cristos worked 12 hours a day seven days a week to support their family almost losing the business several times. All that changed when developers lured by inexpensive desert land prices began to build large subdivisions all around Muddy Waters. With each new subdivision, sales at Muddy Waters, the only local carwash, increased significantly allowing the Cristos to hire their adult children after they graduated from high school paying them each a not so modest $70,200 per year. Joe, the oldest, was responsible for maintaining their aging equipment and Julie, his little sister, took charge of marketing.

The Cristos will never get rich, but Muddy Waters provides enough income to support their family and generates employment for the disadvantaged in their community. Long ago, Raul and Maria decided to hire graduates from Hope Ministries, a local drug and alcohol rehab program. While most stayed at Muddy Waters for only a year or two, a few graduates continued to work with the Cristos for several years. Raul and Maria considered them like family.

Raul and Maria, now in their late 50's began to envision a retirement where they would slow down. Their plan was to transition day-to-day operation of Muddy Waters to their children. They would continue to draw a combined salary of $78,000. With only $250,000 remaining in their retirement savings after Raul's recent battle with cancer, Muddy Waters was their only hope for a comfortable retirement. For years, commercial real estate developers have been buying the desert land all around Muddy Waters to build fast food and quick service restaurants, convenience stores and even a dollar store, but no one expressed interest in Muddy Waters - until today. While Maria was out of the office, a representative from big box retailer, BigBox, approached Raul and offered him $1.85 million dollars for Muddy Waters. The deal includes all 20 acres with the intention of levelling (tearing down) the business in order to build a massive 180,000 square foot hyper-market to sell groceries and general merchandise. While Raul was excited to share the good news with Maria, he decided to wait and discuss the offer with her in person.

Sharing the Good News

After another long day, Raul was again stuck in traffic on his drive home. He couldn't help but contemplate what life would be like without Muddy Waters. When he finally got home, Raul started, "I had an interesting meeting today. A representative from BigBox stopped by the office."

With surprise in her voice Maria replied, "What did he want?"

"BigBox is interested in purchasing Muddy Waters," Raul replied matter-of-factly.

"I figured eventually somebody would want to buy us out, but I had no idea it would be BigBox. What was their offer?" she asked.

"He offered $92,500 per acre for all 20 acres."

"One million eight hundred fifty thousand dollars seems high. I remember when Guillermo sold his 5 acre tract, Randy's Burgers only paid him $250,000. Why are they offering so much?" Maria pondered.

"Well, there is a bit of catch. The reason they offered us so much more to us is because they are including Muddy Waters in their offer."

"What will they do with Muddy Waters?" Maria asked not really wanting to know his reply.

"Their plan is to level Muddy Waters for parking for the new BigBox store."

"So, if we sell to BigBox, we won't have a carwash anymore. Right?" Maria questioned.

"That's right, but we will be $1.75 million dollars richer. Isn't that great?"

"I don't know. What happens if we don't accept their offer?"

"From what I understand, they approached several businesses with a comparable offer, but our location by far is the best. Maria, this is our opportunity to retire comfortably. I doubt we will get this opportunity again. What do you think?"

"Raul, I agree with you, but what will happen to Joe and Julie and the others who have been with us for so many years?"

"I am worried about them too. We only have a few days to decide before BigBox moves onto other locations. Let's discuss with Kris, our accountant first thing Monday morning."

"Sounds good. Let's get some sleep. Tomorrow will be another long day," Maria replied.

Meeting with the Accountant

"Hi Kris. Thanks for meeting with me on such short notice," Maria commented. "I am sorry Raul can't be here. The main pump went down again last night. He was at Muddy Waters all night to get it fixed, just so we could open this morning. We can't afford to lose all of those sales."

"Maria, I completely understand. Tell me what is so urgent?"

"On Friday, BigBox offered us $1.85 million dollars for Muddy Waters and the surrounding land. While it sounds like a great deal, Raul and I are nervous. We are not sure if BigBox's offer is what is best for us and we need your help to analyze our options."

"That sounds like a great offer. Tell me more," said Kris.

A confident Maria continued, "Muddy Waters is profitable now and we fully expect our profitability to increase in the future. We'd planned to run the business for another 10 years and expected to sell it for $2.3 million dollars. Unfortunately, to do that, we would deplete all of our retirement savings to upgrade the equipment, but it will reduce our maintenance costs by $0.25 per carwash."

"That would be a tough decision," Kris replied.

"On the other hand, if we don't accept their offer, BigBox will move onto another location and we could be passing up a golden opportunity to retire. Please, we really need your help."

"I would be happy to help. Did you bring your most recent financials?" Kris asked.

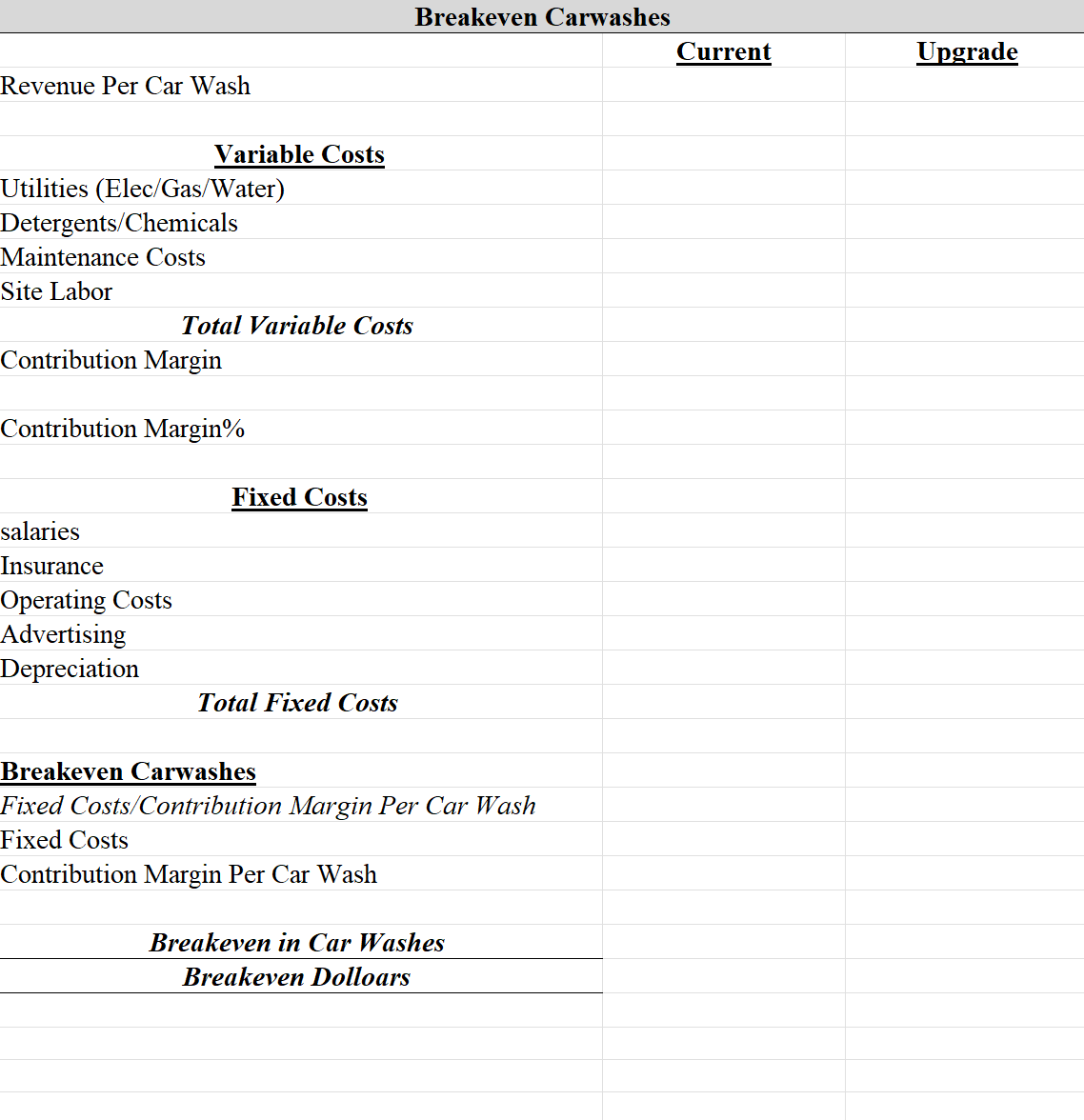

Maria replied handing Kris a paper with handwritten figures, "Yes. While Raul was working last night, I put together the following projections for next year."

"Thanks. I will have something for you in the morning."

Revenue:

Average revenue per car wash $14.00

Forecasted annual volume growth in carwashes 3 percent

Expenses:

Current variable costs per carwash

Utilities (Elec/gas/water) $0.88

Detergents/chemicals 0.64

Maintenance costs 0.47

Site labor 1.34

Total Variable Costs $3.33

Fixed costs per carwash (Based on 37,500 carwashes)

Salaries $5.60

Insurance 0.40

Operating costs 0.84

Advertising 0.62

Depreciation (current) 0.00**

Total Fixed Costs 7.46

Total $10.79

*No net changes in working capital are expected

**New equipment useful life 10 years with no salvage/disposal value- straight-line

***Rate of return (discount rate) 8%

| Investment/ Tax Information | |

| Interest Rate | 8.00% |

| Equipment Investment | $250,000 |

| Net book value if sold today | $40,000 |

| Useful Life (Years) | 10 |

| Salvage Value | $0 |

| Maintenance Cost Decrease Per Car Wash | $0.25 |

| Long Term Capital Gains Tax Rate | 20.00% |

| Corporate Income Tax Rate | 21.00% |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started