This assignment consists of following the instructions above, the role is financial analyst and we have to determine if it's high risk or low risk, on the excel workbook everything in the green boxes needs to have a formula and the brown/tan boxes the answer can be typed in, lastly there is a a few questions at the last page of the instructions that require answering.

The following are the corrections to the instructions:

page 6, discussion of Year 41, item 1: the cell in which you calculate your real dollar payout in retirement is B12 (not B16 as listed)

pages 6-7: discussion of Year 41, item 3.b.: the allocation between stocks and bonds in the previous year is in cells V45 and W45, respectively (not cells T45 and U45 as listed)

page 7: discussion of Year 41, paragraph in italic font: should read, Carry out your calculations for years 42 through 60 (not years 42 through 85 as listed)

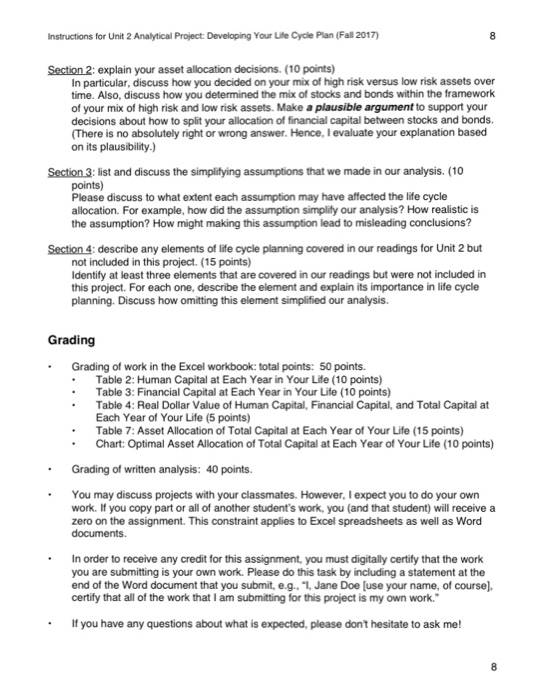

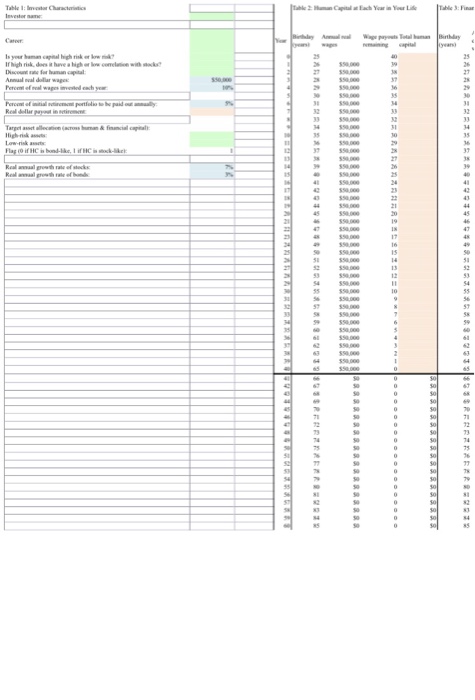

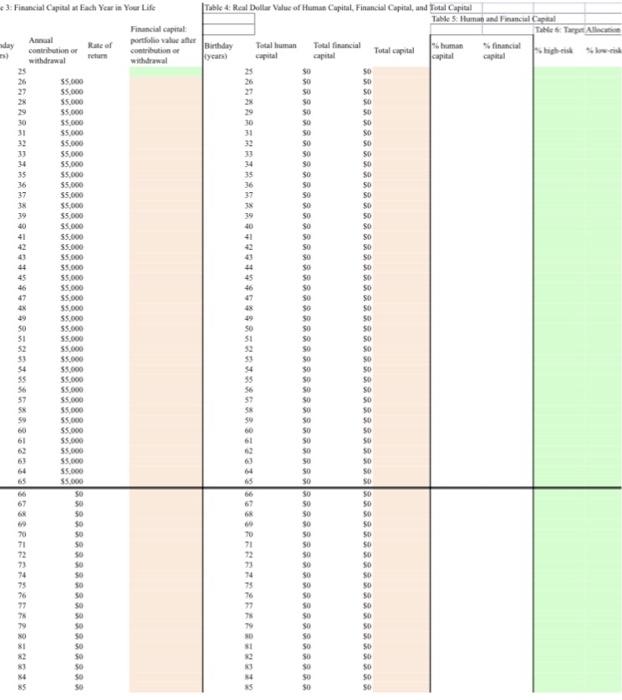

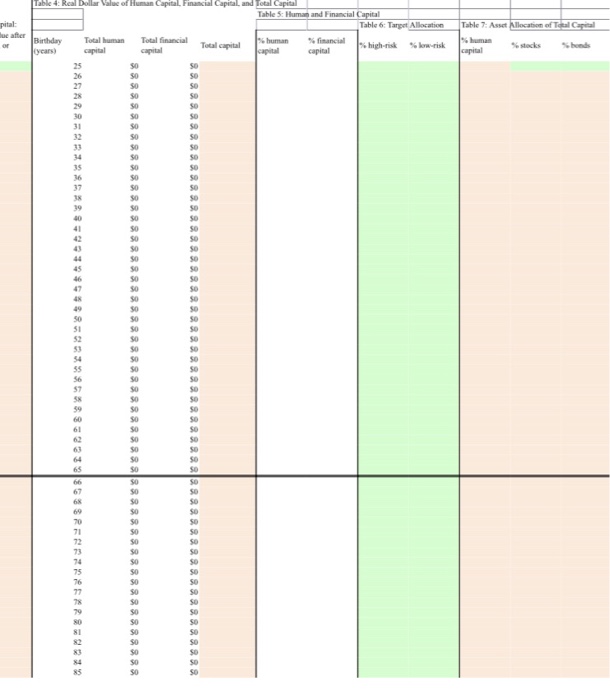

Instructions for Unit 2 Analytical Project: Developing Your Life Cycle Plan (Fall 2017) Overview The purpose of this assignment is to give you an opportunity to step through the process of developing your own life cycle allocation. The Unit 2 readings describe this process in detail. This project is relatively high level. Technically, it is a bit challenging. To help you, I prepared an Excel workbook that already is structured for the process. Thus, you will be able to focus on the most important elements of the life cycle planning and avoid getting bogged down in setting up the necessary tables. The project also is high level in a fundamental sense. Financial planners often neglect this task. Yet a life cycle plan is an essential step for establishing an asset allocation plan for an investor's lifetime. Investor Characteristics A good life cycle plan is tailored to the individual investor. In this project, I assign each of you a role. Specifically, I assign you: (1) a career (2) a discount rate for your human capital (3) your annual real dollar wages We will have two generic financial assets. We will label the high-risk asset as "stocks," and you may think of it as a well-diversified mutual fund that holds common stocks. We will label the low risk asset as "bonds," and you may think of it as a mutual fund that holds U.S. Treasury bonds with about five years to maturity Your career determines part of your risk profile. Two key questions in your asset allocation decision will be whether your human capital is high risk or low risk and, if high risk, whether it has a high correlation with stocks or low correlation. For our purposes in this project, you have three possible risk profiles: (a) high-risk human capital with a high correlation with stocks (ie.. your human capital is "stock-like" in terms of risk); high-risk human capital with a low correlation with stocks; low-risk human capital with a low correlation with stocks (ie, your human capital is "bond-like" in terms of risk). (b) (c) Please review the assigned readings for Unit 2 for information about how the risk characteristics of your human capital should influence your asset allocation decisions. Instructions for Unit 2 Analytical Project: Developing Your Life Cycle Plan (Fall 2017) Overview The purpose of this assignment is to give you an opportunity to step through the process of developing your own life cycle allocation. The Unit 2 readings describe this process in detail. This project is relatively high level. Technically, it is a bit challenging. To help you, I prepared an Excel workbook that already is structured for the process. Thus, you will be able to focus on the most important elements of the life cycle planning and avoid getting bogged down in setting up the necessary tables. The project also is high level in a fundamental sense. Financial planners often neglect this task. Yet a life cycle plan is an essential step for establishing an asset allocation plan for an investor's lifetime. Investor Characteristics A good life cycle plan is tailored to the individual investor. In this project, I assign each of you a role. Specifically, I assign you: (1) a career (2) a discount rate for your human capital (3) your annual real dollar wages We will have two generic financial assets. We will label the high-risk asset as "stocks," and you may think of it as a well-diversified mutual fund that holds common stocks. We will label the low risk asset as "bonds," and you may think of it as a mutual fund that holds U.S. Treasury bonds with about five years to maturity Your career determines part of your risk profile. Two key questions in your asset allocation decision will be whether your human capital is high risk or low risk and, if high risk, whether it has a high correlation with stocks or low correlation. For our purposes in this project, you have three possible risk profiles: (a) high-risk human capital with a high correlation with stocks (ie.. your human capital is "stock-like" in terms of risk); high-risk human capital with a low correlation with stocks; low-risk human capital with a low correlation with stocks (ie, your human capital is "bond-like" in terms of risk). (b) (c) Please review the assigned readings for Unit 2 for information about how the risk characteristics of your human capital should influence your asset allocation decisions