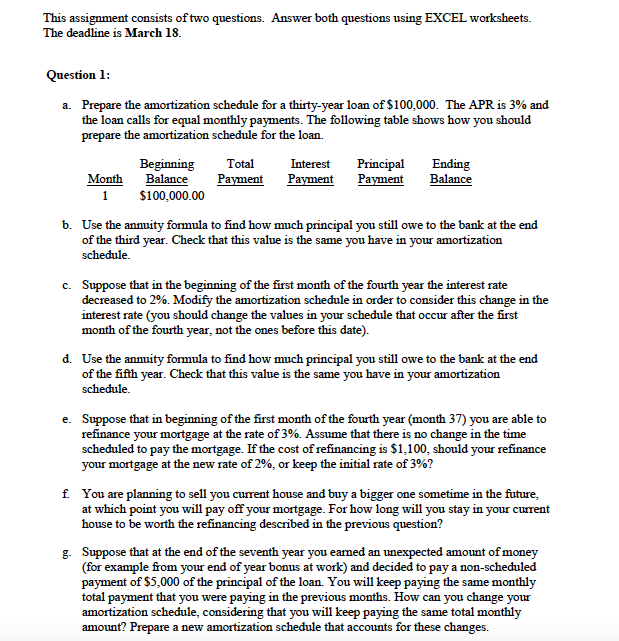

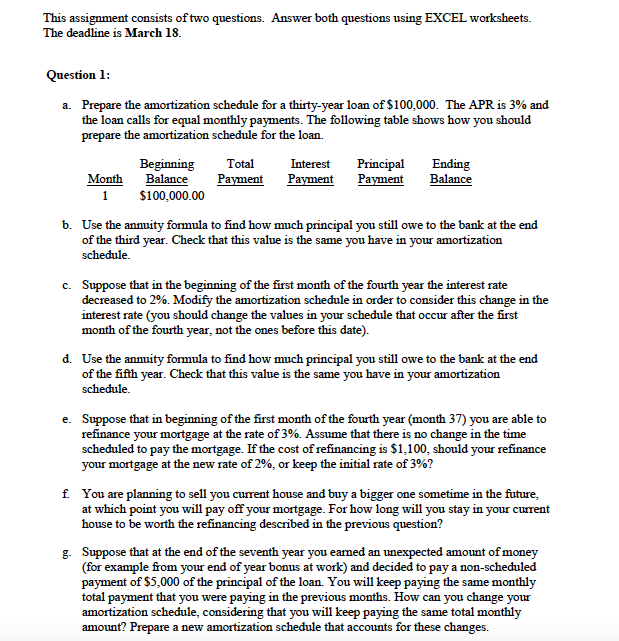

This assignment consists of two questions. Answer both questions using EXCEL worksheets. The deadline is March 18 Question 1 Prepare the amortization schedule for a thirty-year loan of $100,000. The APR is 3% and the loan calls for equal monthly payments. The following table shows how you should prepare the amortization schedule for the loan. a. Total Interest Principa Ending Month Balance Payment Paymet Payment Balance Beginning 1 $100,000.00 b. Use the annuity formula to find how much principal you stil1 owe to the bank at the end of the third year t Check that this value is the same vou have in vour Suppose that in the beginning of the first month of the fourth year the interest rate decreased to 2%. Modify the amortization schedule in order to consider this change in the interest rate (you should change the values in your schedule that occur after the first month of the fourth year, not the ones before this date) c. d. Use the annuity formula to find how uch principal you still owe to the bank at the end of the fifth year schedule . Check that this value is the same you have in your amortizatiorn Suppose that in beginning of the first month of the fourth year (month 37) you are able to refinance your mortgage at the rate of 3%. Assume that there is no change in the time scheduled to pay the mortgage. If the cost of refinancing is $1,100, should your refinance your mortgage at the new rate of 296, or keep the initial rate of 3%? e. f. You are planning to sell you current house and buy a bigger one sometime in the future, at which point you will pay off your mortgage. For how long will you stay in your curent house to be worth the refinancing described in the previous question? Suppose that at the end of the seventh year you earned an unexpected amount ofmoney (for example from your end of year bonus at work and decided to pay a non-scheduled payment of $5,000 of the principal of the loan. You will keep paying the same monthly total payment that you were paying in the previous months. How can you change your amortization schedule, considering that you will keep paying the same total monthly amount? Prepare a new amortization schedule that accounts for these changes. g