Answered step by step

Verified Expert Solution

Question

1 Approved Answer

This assignment will be used as an assessment to check your understanding of financial statements and ability to extract key information from reported financials. Each

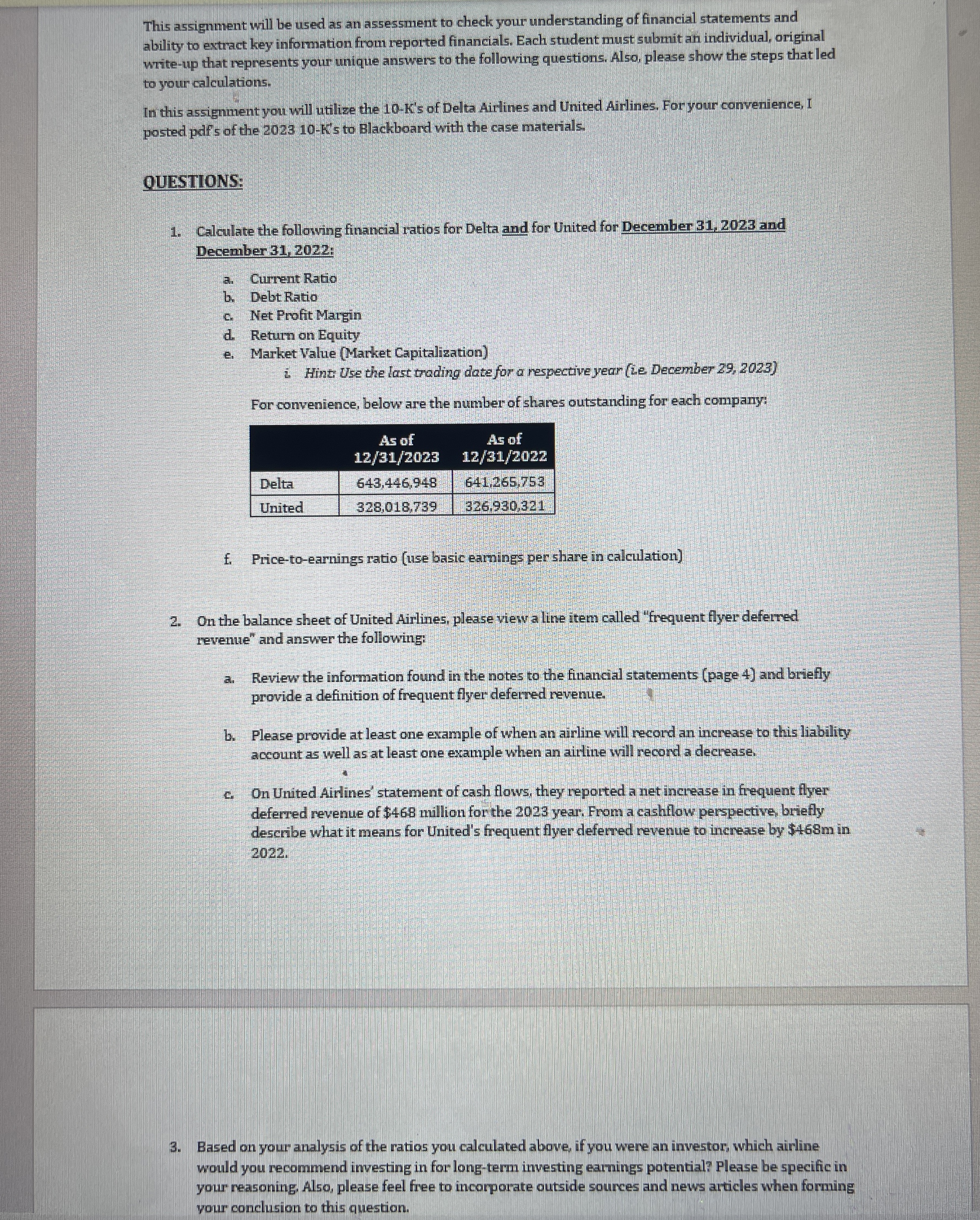

This assignment will be used as an assessment to check your understanding of financial statements and ability to extract key information from reported financials. Each student must submit an individual, original writeup that represents your unique answers to the following questions. Also, please show the steps that led to your calculations.In this assignment you will utilize the Ks of Delta Airlines and United Airlines. For your convenience, I posted pdfs of the Ks to Blackboard with the case materials.QUESTIONS: Calculate the following financial ratios for Delta and for United for December and December ;a Current Ratiob. Debt Ratioc. Net Profit Margind. Return on Equitye. Market Value Market Capitalization Hints Use the last trading date for a respective year Le December For convenience, below are the number of shares outstanding for each company:As of As of DeltaUnitedf Pricetoearnings ratio use basic earnings per share in calculation On the balance sheet of United Airlines, please view a line item called "frequent flyer deferred revenue" and answer the following:a Review the information found in the notes to the financial statements page and briefly provide a definition of frequent flyer deferred revenue. b Please provide at least one example of when an airline will record an increase to this liability account as well as at least one example when an airline will record a decrease.G On United Airlines' statement of cash flows, they reported a net increase in frequent flyer deferred revenue of $ million for the year. From a cashflow perspective, briefly describe what it means for United's frequent flyer deferred revenue to increase by $m in Based on your analysis of the ratios you calculated above, if you were an investor, which airline would you recommend investing in for longterm investing earnings potential? Please be specific in your reasoning. Also, please feel free to incorporate outside sources and news articles when forming your conclusion to this question.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started