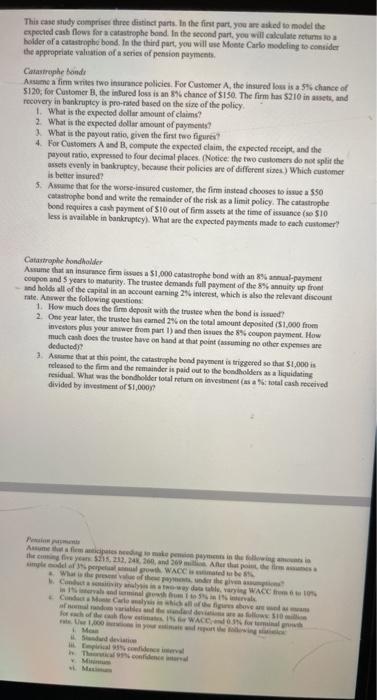

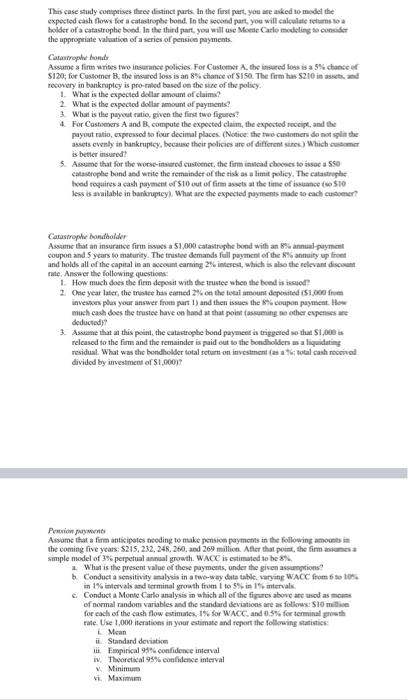

This case study comprise three distinct parts. In the first part, you are asked to model the expected cash flows for a catastrophe band. In the second part, you will calculate returns to holder of a catastrophe bond. In the third part, you will use Monte Carlo modeling to consider the appropriate valuation of a series of pension payments Catastrophe fondi Asume a fim writes two insurance policies For Customer A, the insured low is a chance of 5120 for Customer B, the intured loss is an 8% chance of $150. The firm has $210 in, and recovery in bankruptcy is pro-rated based on the size of the policy 1. What is the expected dollar amount of claims? 2 What is the expected dollar amount of payments 3. What is the payout ratio, given the first two figures 4 For Customers and compute the expected claim, the expected receipt and the payout ratio, expressed to four decimal places (Notice the two customers do not split the assetsevenly in bankruptcy, because their policies are of different sizes) Which customer is better insured 5. Aame that for the worse-insured customer, the firm instead chooses to issue a 550 catastrophe bond and write the remainder of the risk as a limit policy. The catastrophe bond requires a cuth payment of S10 out of firmassets at the time of issuance (so S10 less is wailable in bankruptcy) What are the expected payments made to each customer Catastrople bondholder Assume that an insurance firm issues a $1,000 catastrophe bond with an amal-payment coups and 5 years to maturity. The trustee demands full payment of the annuity up front and holds all of the capital in an account earning 2. Interest, which is also the relevant discount mate. Answer the following questions 1. How much does the fim deposit with the true when the bond is issued 2. One year later, the trustee bas came on the total amount deposited (51.000 from investors plus your answer from part 1) and then the coupon payment. How much cash does the trustee have on hand at that point assuming the expenses deducted 1. Assume that at this point, the catastrophe bond payment is triggered so that $1,000 released to the firm and the remainder is paid out to the beholders as a liquidating residual. What was the bondholder total return on investment (a las received divided by investment of 51.000 Amesem the year 2012 Alpe complex perpetua WACC Who the other Code WACC NI variables Forch Me Theo M M This case study comprises three distinct parts. In the first part, you wenked to model the expected cash flows for a catastrophe bond. In the second part, you will calculate returns to a holder of a catastrophe bood. In the third part, you will use Moede Carlo modeling to consider the appropriate valuation of a series of pension payments. Catastrophe honde Assume a fimm writes two insurance policies For Customer Athened loss is a 5% chance of $120; for Customer B, the insured loss is an 8% chance of S150. The firm has 210 instad recovery in bankruptcy is promoted based on the size of the policy 1. What is the expected dollar amount of claims? 2. What is the expected dollar amount of payments? 3. What is the payout ratio, given the first two figures 4 For Customers A and B compute the expected claim, the expected receipt, and the payout ratio, expressed to four decimal places. (Notice: the two customers do not split the asetsevenly in bankruptcy, because their policies are of different stres) Which comer is better insured? 5. Asume that for the worse-insured customct, the firmimitad choose to issue a se catastrophe bond and write the remainder of the risk as a limit policy. The catastrophe bond requires a cash payment of 10 out of fimm assets at the time of issuance (to 10 Jess is available in bankruptcy). What are the expected payments made to cach customer? Catastrophe bondholder Assume that an insurance firmsses a $1,000 catastrophe bond with an 8% annual payment coupon and 5 years to maturity. The trustee demands full payment of the annuity up front and holds all of the capital in an account earning interest, which is also the relevant discount rate. Answer the following questions 1. How much does the firm deposit with the trustee when the bond is issued 2. One year later, the trustee has earned on the total amount deposited ($1.000 from investors plus your answer from part 1) and then issues the coupon payment. How much cash does the trustee have on hand at that point ossoming no other expenses deducted? 3. Assume that at this point, the catastrophe bond payment is triggered so that $1,000 is released to the firm and the remainder is paid out to the bondholders as a liquidating residual. What was the bondholder total return on investment (as total cash received divided by investment of S1,00017 Assame that a firm anticipates needing to make pension payments in the following amounts in the coming five years. S215, 232, 248, 260, and 269 million. After that point, the firmama simple model of 3% perpetual annual growth. WACC is estimated to be 8% What is the present value of these payments under the given assumptions? b. Conduct a sensitivity analysis in a two-way data table varying WACC from 5 to 10 in 1% intervals and terminal growth from 1 to 5 in 1 intervals. Conduct a Monte Carlo analysis in which all of the figures above are used as mens of normal random variables and the standard deviations are as follows: $10 milice for cach of the cash flow estimates, 15. sor WACC and 0.5% for terminalruth rate. Use 1,000 iterations in your estimate and report the following statistics Mean Standard deviatic Empirical 95% confidence interval iv. Theoretical 95% confidence interval Minimum vi. Maximum This case study comprise three distinct parts. In the first part, you are asked to model the expected cash flows for a catastrophe band. In the second part, you will calculate returns to holder of a catastrophe bond. In the third part, you will use Monte Carlo modeling to consider the appropriate valuation of a series of pension payments Catastrophe fondi Asume a fim writes two insurance policies For Customer A, the insured low is a chance of 5120 for Customer B, the intured loss is an 8% chance of $150. The firm has $210 in, and recovery in bankruptcy is pro-rated based on the size of the policy 1. What is the expected dollar amount of claims? 2 What is the expected dollar amount of payments 3. What is the payout ratio, given the first two figures 4 For Customers and compute the expected claim, the expected receipt and the payout ratio, expressed to four decimal places (Notice the two customers do not split the assetsevenly in bankruptcy, because their policies are of different sizes) Which customer is better insured 5. Aame that for the worse-insured customer, the firm instead chooses to issue a 550 catastrophe bond and write the remainder of the risk as a limit policy. The catastrophe bond requires a cuth payment of S10 out of firmassets at the time of issuance (so S10 less is wailable in bankruptcy) What are the expected payments made to each customer Catastrople bondholder Assume that an insurance firm issues a $1,000 catastrophe bond with an amal-payment coups and 5 years to maturity. The trustee demands full payment of the annuity up front and holds all of the capital in an account earning 2. Interest, which is also the relevant discount mate. Answer the following questions 1. How much does the fim deposit with the true when the bond is issued 2. One year later, the trustee bas came on the total amount deposited (51.000 from investors plus your answer from part 1) and then the coupon payment. How much cash does the trustee have on hand at that point assuming the expenses deducted 1. Assume that at this point, the catastrophe bond payment is triggered so that $1,000 released to the firm and the remainder is paid out to the beholders as a liquidating residual. What was the bondholder total return on investment (a las received divided by investment of 51.000 Amesem the year 2012 Alpe complex perpetua WACC Who the other Code WACC NI variables Forch Me Theo M M This case study comprises three distinct parts. In the first part, you wenked to model the expected cash flows for a catastrophe bond. In the second part, you will calculate returns to a holder of a catastrophe bood. In the third part, you will use Moede Carlo modeling to consider the appropriate valuation of a series of pension payments. Catastrophe honde Assume a fimm writes two insurance policies For Customer Athened loss is a 5% chance of $120; for Customer B, the insured loss is an 8% chance of S150. The firm has 210 instad recovery in bankruptcy is promoted based on the size of the policy 1. What is the expected dollar amount of claims? 2. What is the expected dollar amount of payments? 3. What is the payout ratio, given the first two figures 4 For Customers A and B compute the expected claim, the expected receipt, and the payout ratio, expressed to four decimal places. (Notice: the two customers do not split the asetsevenly in bankruptcy, because their policies are of different stres) Which comer is better insured? 5. Asume that for the worse-insured customct, the firmimitad choose to issue a se catastrophe bond and write the remainder of the risk as a limit policy. The catastrophe bond requires a cash payment of 10 out of fimm assets at the time of issuance (to 10 Jess is available in bankruptcy). What are the expected payments made to cach customer? Catastrophe bondholder Assume that an insurance firmsses a $1,000 catastrophe bond with an 8% annual payment coupon and 5 years to maturity. The trustee demands full payment of the annuity up front and holds all of the capital in an account earning interest, which is also the relevant discount rate. Answer the following questions 1. How much does the firm deposit with the trustee when the bond is issued 2. One year later, the trustee has earned on the total amount deposited ($1.000 from investors plus your answer from part 1) and then issues the coupon payment. How much cash does the trustee have on hand at that point ossoming no other expenses deducted? 3. Assume that at this point, the catastrophe bond payment is triggered so that $1,000 is released to the firm and the remainder is paid out to the bondholders as a liquidating residual. What was the bondholder total return on investment (as total cash received divided by investment of S1,00017 Assame that a firm anticipates needing to make pension payments in the following amounts in the coming five years. S215, 232, 248, 260, and 269 million. After that point, the firmama simple model of 3% perpetual annual growth. WACC is estimated to be 8% What is the present value of these payments under the given assumptions? b. Conduct a sensitivity analysis in a two-way data table varying WACC from 5 to 10 in 1% intervals and terminal growth from 1 to 5 in 1 intervals. Conduct a Monte Carlo analysis in which all of the figures above are used as mens of normal random variables and the standard deviations are as follows: $10 milice for cach of the cash flow estimates, 15. sor WACC and 0.5% for terminalruth rate. Use 1,000 iterations in your estimate and report the following statistics Mean Standard deviatic Empirical 95% confidence interval iv. Theoretical 95% confidence interval Minimum vi. Maximum