Question

This case study describes how beauty brand L'Oral conducted a very public content-led experiment to launch its Revitalift Laser X3 product in Australia. In 2015,

This case study describes how beauty brand L'Oral conducted a very public content-led experiment to launch its Revitalift Laser X3 product in Australia.

In 2015, Australia overtook the US as the biggest market for cosmetic surgery per capita, leading to brands such as L'Oral losing market share.

Research showed that Australians were skeptical about product claims and looked to procedures such as laser skin resurfacing to fight signs of ageing.

The campaign, Laser or L'Oral, took a test subject and treated one side of her face with laser skin resurfacing, and treated the other with new L'Oral Revitalift Laser X3, and filmed the four- week journey to make an online content series.

In four weeks, the campaign resulted in a 44% increase in L'Oral Revitalift Laser X3 sales, against an initial sales target of 20%.

Campaign details

Brand

: L'Oral Paris Revitalift Laser X3 Brand Owner: L'Oral Paris

Lead Agency

: McCann Melbourne Country: Australia

Industries

: Skin care, sun protection

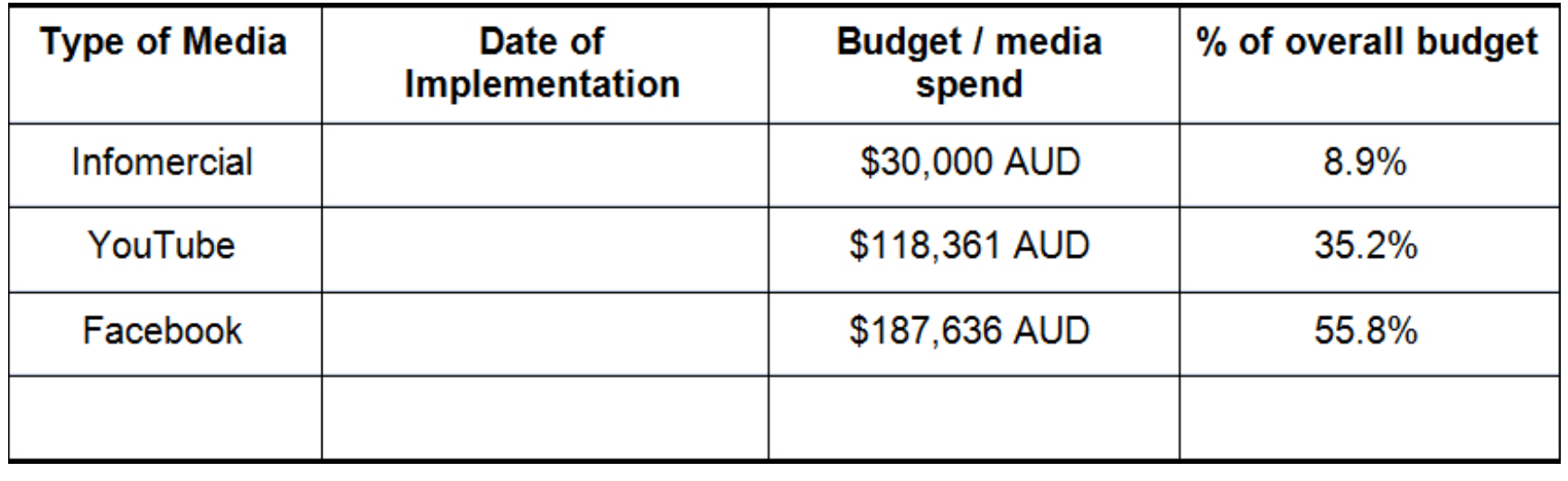

Media Channels

: Content marketing, Online video, Product sampling, Social media,Television Budget: Up to 500k

Executive summary

Australia is a country obsessed with cosmetic procedures. In 2015, it overtook the US as the biggest market for cosmetic surgery per capita, with over $1 billion dollars spent annually on procedures that can cause significant financial and physical pain.

For the launch of Revitalift Laser X3, L'Oral Paris set out to show Australian women that there are alternatives to painful, expensive and invasive cosmetic procedures. And to prove this, we conducted a very public content- led experiment.

Laser or L'Oral. A first-of-its-kind, side-by-side comparison, on the same face.

Over four weeks, Australian women watched as one very brave volunteer, Kate, underwent laser skin- resurfacing on the right side of her face, while she used L'Oral Revitalift Laser X3 on the left side of her face. After four weeks, the results were in, and they were astonishing.

L'Oral Revitalift increased its market share by 33% during the period, achieving record sales in a highly competitive category. And Kate showed that when it comes to a L'Oral cream vs. a laser, you'd only ever go one way.

Market background and objectives

A category in constant change

Over the past ten years, the cosmetics category in Australia has gone through significant transformation. For anti-ageing products, in particular, the route to market for these products, as well as the solutions being sought, have changed significantly:

The changing retail environment

Like so many FMCG categories, there is a widening gap between the top and the bottom of the market, as the cosmetics retail environment is beginning to diverge. The top of the market and the bottom of the market continue to grow at the expense of the retailers in the middle. Premium retailers, such as Mecca and Sephora, are leveraging their access to 'cult beauty' products and superior shopper experiences. At the bottom end, retailers such as Chemist Warehouse drastically discount, undercutting and own a very different version of value .

"Cosmeceuticals" on the rise

With the rise of a more knowledgeable, wealthy and beauty-conscious class of urban consumers, women are

looking for more evidence behind claims of efficacy, and proven biologically active ingredients are demanded in

products more than ever before .

As a result, "cosmeceuticals" and pharmaceutical brands have become one of the fastest-growing cosmetic

industries, globally. Today, there are over 500 suppliers and manufacturers of "cosmeceuticals" (a cosmetic

product that claims to have medical benefits), with an estimated CAGR of 7.7% between 2012 and 2016 .

With this trend rising, Australian women believe less in the offering provided by traditional cosmetics that claim to achieve the same results as a cosmeceutical can. Consequently, L'Oral Paris was losing potential customers who didn't believe their brands were capable of high-quality anti-ageing results.

Women looking for solutions beyond cosmetics

As women demand quicker, and more tangible, solutions to look younger, cosmetic procedures have also gained momentum. Every year, Australians are spending $1 billion on these procedures . Per capita, that's 40% more than Americans . Among these, non-invasive procedures, such as anti-wrinkle injections and dermal fillers, are the most sought-after methods for Australians to turn back the ageing clock.

These category truths highlight the huge challenge we faced. Not only did L'Oral need to grow Revitalift's market share within its own category, it also needed to grow volumes vs. the category disrupting Revitalift's traditional market - cosmetic procedures.

Compounding the challenge was a limited launch budget.

Our three key objectives were:

Sales objective:

Increase L'Oral Revitalift Laser X3 sales by 20% in the four-week campaign period.

Market share objective:

Increase market share of L'Oral Revitalift to 5% for the four-week campaign period.

Content reach objective:

Achieve 1,000,000 YouTube views, within the target market, for the short-form video and 500,000 YouTube views for the long-form version. Achieve a reach of 600,000 for the short-form video and 800,000 for the long-form video.

Insight and strategic thinking

This campaign is, in effect, the story of how two compelling human insights, a clear category problem and a belief in its own product allowed L'Oral to literally put its money where its mouth is, and take on two categories at once, and win.

It all started with two revealing human insights. Our primary target for the campaign was identified through an

initial research phase. Data found that Australian women, from 40 to 65 years old who had experienced the

initial signs of ageing (i.e., the first signs of wrinkles or lines), were the most active segment looking for a solution

These women were likely to be already using anti-ageing skin care products or "cosmeceuticals" from

competitors, or considering the need for a simple cosmetic procedure to improve the condition of their skin, turning back the clock on their ageing skin .

Importantly, the target market had significant life and category experience. They were likely to have tried a number of products and experiences that had made various claims over time. And they were likely to be actively dissatisfied with the results, and sceptical about new claims. Importantly, while they were realistic in their expectations about what a cream could do, this still didn't diminish their desire for a new breakthrough.

This is the first human insight we built our campaign around. While our audience had seen and heard everything, and were sceptical about any claims made one way or another, they still remained open to, and hopeful for, a treatment that actually worked.

"I can't turn back time. But I still hope to turn the tables on it." - Qualitative respondent.

Further qualitative work revealed a second important insight: that scepticism lay with the brands, not necessarily the products themselves. Research showed that sources of trust were less likely to be advertising and branded communications, and more likely to be their direct friendship circles and third-party online reviews .

"I'm more likely to trust my friends than an actress who's being paid to act." - Qualitative respondent.

This meant we needed to make an, essentially, non-partisan creative construct that would create the effect of an independent third-party voice.

We identified two significant category challenges:

The challenge within our own category

The cosmetics category is not one built on trust. Hundreds of new products are launched every year, with each claiming a new kind of breakthrough. Research shows that Australian cosmetics consumers have been worn down by pseudo-scientific language and impossibly youthful celebrities and actors selling anti-ageing products . This has created a lack of resonance and credibility in category communications.

So, in order to force reappraisal for L'Oral and Revitalift within the category, we needed to break with well- established brand and category conventions.

The challenge of category disruption

The saying goes, "People don't want to buy a quarter-inch drill, they want a quarter-inch hole." While the cosmeceuticals category likes to shout about their newest products and their innovative ingredients, they often forget to give women what they really care about; genuine proof of results.

It is little wonder that many women believe less in the effectiveness of product claims and seek out more tangible and immediate results from cosmetic procedures such as laser skin resurfacing and Botox. Indeed, the extraordinary growth of the cosmetic procedure category in Australia poses a considerable threat to existing treatment methodologies and products, including Revitalift.

Creative strategy:

The answer to our brief lay in solving two key challenges.

Truth 1: Our audience don't trust messages from brands.

Implication 1: make an independent third-party voice and make it credible.

Truth 2: Our audience are looking outside of our category for the same solution.

Implication 2: Prove that they can achieve the results they want by staying with the category.

Therefore, we needed to prove that our Revitalift Laser X3 product not only worked, but that it worked better than the newer, more-immediate and more-tangible science of cosmetic procedures. And we had to prove this to an audience of highly sceptical people that had been (metaphorically) burnt before.

Implementation, including creative and media development

We set out to make a first-of-its-kind transformative type of testimonial; one that wasn't simply a before-and- after shot, that lacked emotive cues; but one that helped to prove that a cosmetic procedure wasn't the only way to achieve younger looking skin.

To achieve a convincing result, a convincing test scenario was needed. So, to diminish any scepticism, we created the most controlled setting for a facial skin cream vs. cosmetic procedure comparison: the same face.

Campaign idea: Laser or L'Oral. The side-by-side comparison on one face.

Laser or L'Oral was a four-week live experiment, where we took a brave test subject and treated one side of her face with laser skin resurfacing, and treated the other with new L'Oral Revitalift Laser X3. The test subject's four-week journey was filmed and used to make a content series, while the final efficacy of the product trial would, hopefully, prove that there was an alternative to painful and invasive cosmetic procedures.

This was brought to life through a four-part strategy:

1. Find the right subject.

The credibility of the campaign relied on the face of the campaign. The decision was made to not leverage the profile of L'Oral's international spokespeople and we, instead, started a process to find a woman more representative of our target audience.

Relying on the expertise of the consulting dermatologist, Dr. Nina Wines, Kate was found, a 44-year-old woman from New South Wales. Her main concerns were the fine lines and wrinkles around her nose/mouth, eyes and forehead and had considered (but not ever used) laser skin resurfacing to improve this.

2. Follow her journey.

To emotionally draw in the audience online, it was not enough to simply show a static "before-and-after" image. We set out to build a rapport with Kate and demonstrate, in the most real way, the painful and expensive journey through a laser procedure, and how that compared with using L'Oral Revitalift Laser x3 over time.

Targeted social videos were used to introduce women to Kate and her story, allowing Australian women to watch the experiment unfold week by week. Not only was it important to demonstrate the visual impact on Kate's skin over time, we also focused on her emotional journey and how she felt through the process.

Four weeks of content was shared via Facebook and YouTube that targeted women demographically, behaviourally and by interests. The YouTube content included both a short-form (15 seconds) and long- form (1 min 52 seconds) variants to better target particular individuals.

3. Reveal Kate's results.

The entire campaign was designed to capture hearts and minds through a powerful mix of truth, sincerity and transparency. So, when it came to revealing the final results of the experiment, it was only fitting to do so in a way that was impossible to hide: live television.

Through a televised infomercial on one of the nation's biggest breakfast programmes, The Morning Show, Kate was invited to talk about her experience and results, to which she confidentially revealed that "[she'd] expected a lot more from the laser skin-resurfacing and a lot less from the Revitalift Laser range."

This content was then leveraged online to generate further engagement.

4. Enable women to try it and see the results for themselves.

Alongside Kate's journey, women were enabled to conduct their own experiments with the Revitalift X3 Laser range. This was facilitated through a direct buying mechanic that was embedded at every step along the four-week journey.

Media used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started